If you’re ready to learn the best ways to earn residual income, you’re in the right place. I’ve gone from being $90,000 in debt to earning $270,000 a year, so I know firsthand how powerful residual income can be in transforming your financial future.

Residual income can be a game-changer for your finances. In my case, it helped me pay off student loans and credit card debt while also funding the remodeling of my parents’ house. This type of income can pave the way to financial freedom, providing stability and growth when your regular paycheck isn’t enough.

By the way, don’t confuse residual income with passive income. Here’s a simple breakdown: residual income is the extra money left after paying debts and expenses. Passive income, on the other hand, is money earned with minimal active effort. Residual income can come from both active efforts, like having a job, and passive sources, such as investments or rental properties.

Life is unpredictable, and relying on just one source of income can be risky. Residual income acts as a safety net, offering financial security and peace of mind. Whether you’re planning for early retirement, saving for emergencies, or chasing your dreams, a steady stream of residual income gives you more control over your future.

I’ve learned this the hard way: living paycheck to paycheck isn’t sustainable. Life isn’t just about paying bills—it’s about creating the lifestyle you want. Residual income can help you achieve that.

If you’re serious about building wealth, understanding how to generate residual income is essential. It’s not just about earning extra money; it’s about creating lasting financial freedom.

In this guide, I’ll share proven strategies and practical tips to help you start your journey toward earning residual income. So, grab your favorite drink, and let’s dive in!

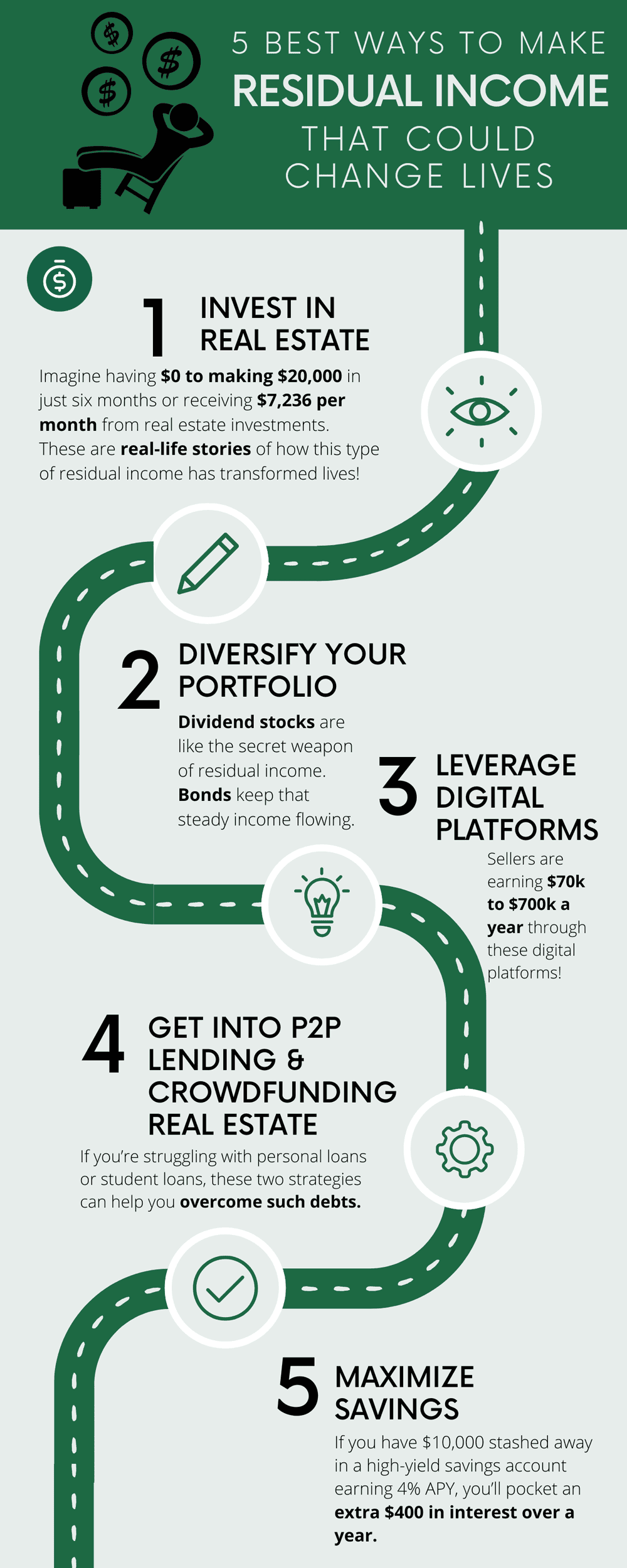

1. Invest In Rental Real Estate

Want to enjoy life without the worries of financial constraints? Well, you can achieve that if you’re collecting rent checks every month.

This may sound like a dream, but that’s the power of rental income—one of the best ways to make residual income. Investing in rental real estate has helped a lot of people turn things around, and it could be your breakthrough, too.

Even Robert Kiyosaki said, “Investing in real estate, even on a small scale, has been a proven way to build wealth and create lasting financial stability.”

Imagine having $0 to making $20,000 in just six months or receiving $7,236 per month from real estate investments. These are real-life stories of how this type of residual income has transformed lives!

The idea is simple: buy a property, turn it into a rental property, and watch your income grow.

But let’s be real—being a landlord isn’t always easy. From dealing with tenants to unexpected repairs, there are challenges. Yet, if you’re willing to put in the work, real estate can offer a steady income stream that grows over time.

Not to mention that having a rental property is a massive investment. You need a lot of money. However, if you have the money to burn, then you can try this avenue. But if you don’t have that money, there are other alternatives with beginner investing tips I’ll talk about here.

2. Invest On Dividend Stocks And Portfolio

Dividend stocks are often the go-to option for generating semi-stable residual income. If you’re unfamiliar, a dividend stock represents a publicly available share of a company. By purchasing these shares, you earn a portion of the company’s profits. These profits are distributed to you through regular dividend payments, making this one of the best income streams.

The key is to find companies with a solid history of paying dividends. Some well-known companies offering dividend stocks include Coca-Cola, Johnson & Johnson, and Procter & Gamble. These companies might not be flashy, but they are known for their reliability.

On the other hand, bonds might not be as exciting as stocks, but they play a vital role in stabilizing your investment portfolio. When you purchase a bond, you’re essentially lending money to a company or government in exchange for consistent interest payments.

Even when the stock market experiences downturns, bonds ensure a steady flow of income, offering a sense of security when you need it most.

3. Affiliate Marketing And Online Selling

Technology has made it easier for us to enjoy many things, including the ability to earn residual income. Two of the most popular ways to do this today are affiliate marketing and online selling.

Affiliate marketing is like a partnership where you recommend products or services to people.

For example, if you run a popular blog, you can add links or suggestions for products that people can buy from your affiliate partners. If a reader clicks the link and buys the product, you earn a commission.

Earning through affiliate marketing might not be a huge payout per sale, but it can add up quickly if hundreds or even thousands of people buy the product. Plus, if your blog or marketing efforts are successful, this can become a reliable source of passive income over time.

If marketing or persuading people to buy products isn’t your strength, why not sell your own products instead? After all, it’s much easier to convince people to buy something you’ve created and truly believe in.

Some of the most popular items to sell are digital products like ebooks, online courses, and design templates. Platforms like Etsy, Creative Market, or Udemy make it simple to sell these products online.

Top earners on Etsy are proof that selling online can be very profitable. For example, some sellers make between $70k and $700k a year by creating and selling digital products.

The best part? These sellers enjoy residual income without the stress of managing inventory or handling shipping.

4. Get Into Peer-to-Peer Lending And Crowdfunding Real Estate

If digital platforms aren’t your thing, there are still plenty of proven ways to generate passive income and take control of your finances. If you’re struggling with personal or student loans—like I did before—these two passive income strategies can help you manage and overcome such debts.

Let’s start with peer-to-peer (P2P) lending. In simple terms, you become a lender. You lend money to individuals, but in a business-like way, with interest. The key here is to charge interest, as you’re lending money not just to help others, but to earn income.

To take this idea further, you can join a P2P lending network or platform. These platforms act as marketplaces where you can find people in need of loans. As a lender, you get to choose who you want to lend money to. You then earn income from the interest on the loan.

It’s similar to how banks operate, but with more control in your hands. You decide who receives your money and set the terms for the interest. However, keep in mind that each lending platform has different rules and policies. Be sure to research these platforms thoroughly before diving in.

Next is crowdfunding real estate. This is where you invest in real estate or real estate projects alongside other people. A platform or group facilitates the process of pooling funds from several investors to fund a property purchase or development project. As an investor, you get to share the profits generated by the real estate venture.

Crowdfunding real estate allows you to get involved in property investments without having to put up the entire amount of money by yourself. It’s a great way to diversify your investments and participate in lucrative real estate projects with a lower initial investment than traditional methods.

Just like with P2P lending, it’s important to thoroughly understand the rules and terms of any real estate crowdfunding platform you join. It’s essential to evaluate the risks, understand the potential returns, and ensure the platform is reputable before making any residual or passive income investments.

5. Maximize Savings with High-Yield Accounts and CDs

As you might have noticed, most of the previous methods listed here come with some inherent risks. If you’re risk-averse, you can choose to go with high-yield accounts and certificates of deposits (CDs).

A high-yield account is basically a savings account with high-interest rates. Meaning, the longer and bigger your money stays in the savings account, the more additional money you can get from the bank every year. For example, with a 4% APY high-yield account, your $10,000 in the bank can let you earn $400 from interest rate every year.

Now, let’s talk about Certificates of Deposit (CDs)—another way to protect and grow your savings after recovering from debt.

With CDs, you lock in your money for a fixed term—ranging from months to years—and get a guaranteed interest rate in return. Basically, it’s like another form of a high-yield account and it’s a type of time deposit. The only difference is that you can’t withdraw your money early in order to benefit from the interest.

FAQs

Here are some frequently asked questions about residual income that I may not have covered in the post. Enjoy!

Are there any tax implications for earning residual income?

Yes, income from residual sources like investments or rental properties may be subject to taxes. It’s important to consult with a tax professional to understand your specific tax situation. Tax rates can vary depending on the type of income, so getting advice tailored to your circumstances is always a good idea.

How can I ensure the sustainability of my residual income?

To ensure your residual income is sustainable, it’s important to diversify your income streams. Don’t put all your money in one basket—spread it out across different investments or income sources.

Diversifying helps reduce risk, so if one source isn’t performing well, others can make up for it. Keep an eye on market trends and adjust your strategy as needed. Reinvesting your profits will also help grow your income over time, allowing you to maintain and even increase your earnings.

What’s the most important factor in successfully earning residual income?

Consistency and patience are key. Building substantial residual income takes time, so it’s important to stay committed. Focus on long-term, reliable strategies rather than looking for quick fixes.

In the early stages, you may need to put in more effort, but as your income streams grow, they will start to generate more passive returns. Stay focused, and with persistence, you’ll see the results over time.

Remember, residual income isn’t entirely passive. Especially in the beginning, you’ll need to work hard and be proactive to set everything up before it starts generating substantial returns. The initial effort is what lays the foundation for future growth.

Conclusion

As you can see, the potential of the best ways to make residual income is enormous. Personally, I’ve enjoyed several of these methods, as they provide me with extra income on the side.

If you’re ready to take control of your financial future, start exploring these strategies today. And don’t stop here—be sure to check out my other articles on earning money, saving money, and saving time. Let’s work together toward achieving your financial goals!

Sources

- Photo: Unsplash: Katie Harp