For many people, banks are simply a place to store money, receive their salaries, and manage credit cards and loans. However, banks offer much more than these basic services. To learn more about what banks can do, read this post. Let’s get started!

What Is A Bank

A bank is a financial institution that helps people store their money. While this was its original purpose, banks have expanded their services over time. Today, they offer much more than just a safe place to keep your money.

You can use banks to access credit for purchases, grow your savings, and manage your investments. Thanks to technology, banks can also facilitate money transfers, schedule payments, and notify you of any activities related to your account.

Before learning how to earn money from banks, it’s important to understand how they make money. Here are the main ways:

- Loans: Banks use the funds deposited by customers to issue loans, earning money through the interest charged to borrowers.

- Investments: Banks invest in financial instruments like government and corporate bonds to earn returns and maintain liquidity—the ability to quickly convert assets into cash when needed.

- Merchant Services: Modern banks offer a range of financial services, including payment processing for businesses, which come with associated fees and charges.

- Foreign Exchange: Banks facilitate foreign exchange transactions, allowing for the sending and receiving of money globally. They earn profits through the difference between buying and selling rates.

- Account Fees: Many banks charge fees for maintaining accounts, overdrafts, and other services. These fees contribute significantly to their overall revenue.

With this information, you now have a better understanding of what banks are and how they sustain themselves while providing interest to their savers. Now, let’s explore how you can use banks to earn money.

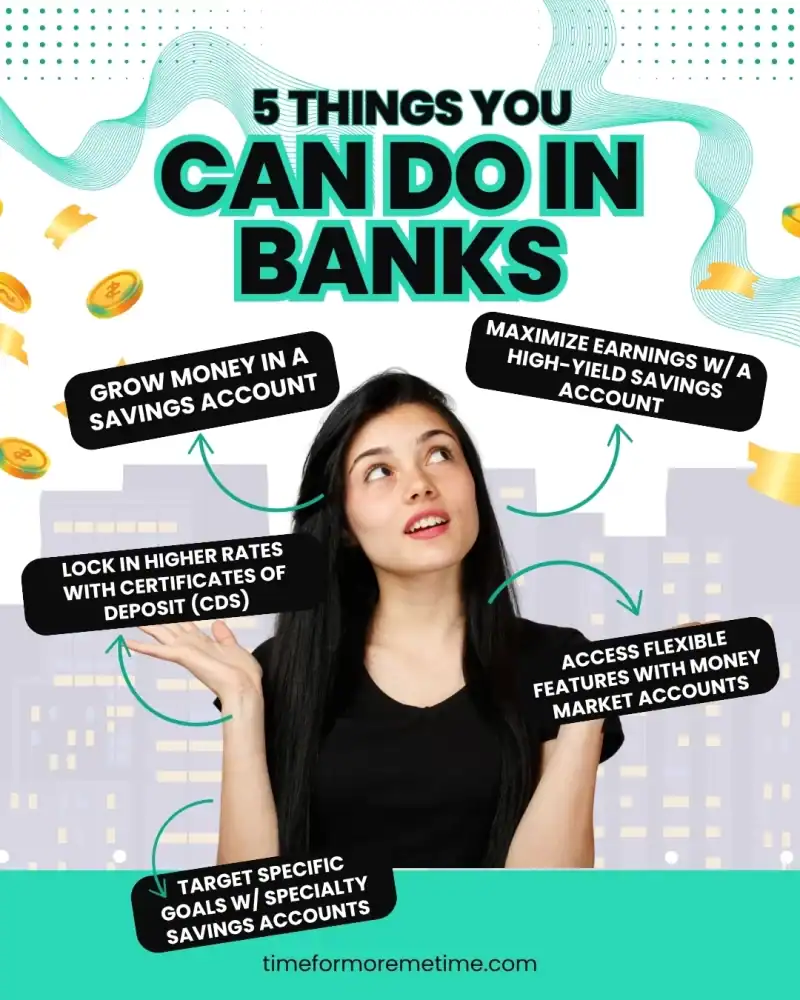

What Can You Do In Banks

A bank is no longer just a place to store money; it offers a variety of modern services to help improve your financial well-being. Here are some of the things you can do at a bank:

- Savings Accounts: When you deposit money in a savings account, the bank uses those funds to make investments. Since they are essentially borrowing your money to invest and grow it, they share the earnings with you through interest payments.

- High-Yield Accounts: Traditional savings accounts typically offer lower interest rates, while high-yield savings accounts—often provided by online banks or credit unions—usually offer better returns. However, these accounts may require you to maintain a minimum balance or limit the number of monthly withdrawals.

- Certificates of Deposit (CDs): Banks offer CDs, which are time deposits. In exchange for keeping your money locked in for a fixed term, you typically earn a higher interest rate than with a standard savings account.

- Money Market Accounts: These accounts often offer competitive interest rates and may include features like check-writing privileges and debit card access. However, they typically require a higher minimum balance than standard savings accounts.

- Specialty Savings Accounts: Some banks offer accounts designed for specific purposes, such as holiday savings or health-related expenses. These accounts may come with usage restrictions and may or may not earn interest, as they are primarily meant for saving rather than earning.

Most of these options are passive, conservative, and low-risk investment methods. If you’re looking for higher earning potential, let’s move on to the next section.

How Can You Start Investing In Banks

The first step to investing through a bank is to open an account. Before you do that, it’s important to gather some information. Here are a few key options to check if the bank offers:

- Investment Accounts: Many traditional banks partner with affiliated brokerage firms, allowing customers to open investment accounts to trade various securities, including stocks, bonds, mutual funds, and ETFs.

- Real Estate Investment Trusts (REITs): You can invest in Real Estate Investment Trusts (REITs) through a bank’s affiliated brokerage account. REITs offer a way to earn income from real estate investments without owning physical property, typically through dividends and potential capital growth.

- Retirement Accounts: Many banks offer Individual Retirement Accounts (IRAs), including Traditional and Roth options, either directly or through affiliated investment services. These accounts provide tax advantages and can help you grow your retirement savings through interest and investment returns.

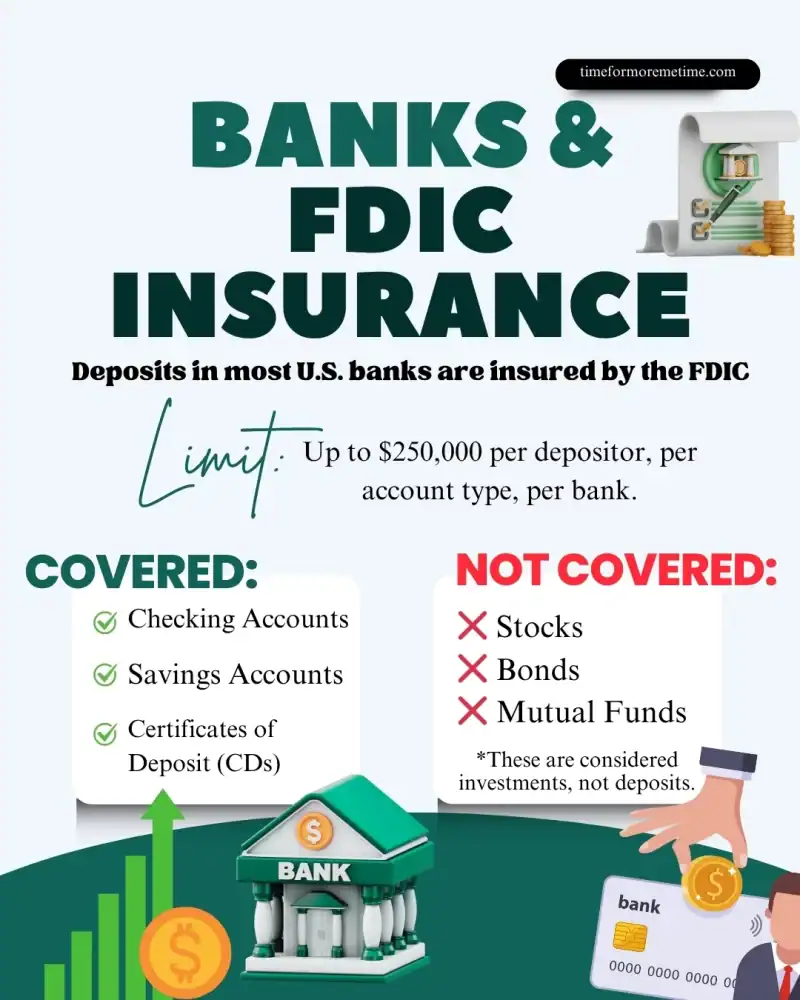

By utilizing these accounts, you can turn your bank into an investment partner. However, note that deposits in most U.S. banks are insured by the FDIC up to $250,000 per depositor, per account type, per bank. FDIC insurance only covers deposit accounts like checking, savings, and CDs—it does not protect investments such as stocks, bonds, or mutual funds.

In the past, banks typically provided direct guidance to clients regarding these types of accounts. Nowadays, you may primarily find written articles to educate you about investments. If you seek more personalized assistance, consider using the bank’s wealth management services.

These services include tailored investment strategies, financial planning, and portfolio management to help you grow your investments. While these services have traditionally been aimed at high-net-worth clients, many banks now offer scaled-down wealth management options for moderate investors.

Conclusion

Banks are one of the simplest and most accessible financial tools and institutions to help you grow, protect, and manage your money. With a better understanding of how they work, you’re now better equipped to use them to your advantage.

Want to learn more about smart money moves? Check out our other beginner-friendly guides, follow us on social media, and watch our videos on our YouTube channel for more easy-to-understand tips.

Source

- Photo: Unsplash: Miquel Parera