Binary options may seem like a simple way to invest, but they are extremely risky—and that’s putting it lightly. Before you even consider getting into it, it’s important to learn more about them. This post will give you basic information to help you understand binary options better and why you should avoid them if you’re new to investing. Let’s get started!

What Are Binary Options

Binary options are a type of financial instrument known as derivatives. Financial instruments are assets and contracts that have value and can be bought, sold, or traded. With derivatives, you can make a profit by predicting how the prices or performance of other financial assets, like stocks or bonds, will change.

However, binary options are different from other derivatives. In instruments like futures, your potential profit or loss depends on the actual performance of the underlying asset. In contrast, with binary options, you receive a fixed payout—which is also limited—regardless of how much the financial asset moves.

When you trade binary options, if you predict correctly, you earn a profit. If you’re wrong, you lose the money you invested. As the name suggests, there are only two possible outcomes with binary options.

Because there are only two outcomes and two choices, trading binary options is very risky. You always face the possibility of losing your investment, but if you make the right call, you can earn a significant reward quickly.

Due to its gambling-like nature, binary options are widely banned in many countries and face strict limitations in the United States. Some of the countries and regions where binary options are completely banned or have stringent restrictions include Israel, the European Union, Australia, the United Kingdom, and Canada.

How Do Binary Options Work

To trade binary options, you first need to select an asset and check its current price and the expiration date of the option. For example, if gold is priced at $3,000 and an option indicates that its price will be above $3,000 in one hour, you must decide whether you believe this prediction will come true—a yes or no proposition.

If you predict correctly and choose to invest $20, you could receive a payout of 60% to 90% of your investment. For a $20 trade, this means you could earn a profit of $12 to $18, in addition to your initial $20 stake, resulting in a total payout of $32 to $38 if you win. However, if your prediction is incorrect, you will lose the entire $20 you invested, resulting in a 100% loss.

Keep in mind that the payout rate for binary options varies depending on the platform and market volatility. Do not expect a consistent payout rate.

Now, let’s illustrate the potential outcomes with a larger investment. Imagine you invest $1,000 in binary options over 100 trades. If you win 50% of the time and earn 90% of your stake back plus your initial money, you would make $950 from those winning trades. Conversely, if you lose the other 50% of the trades, you would lose $500. Based on these optimistic assumptions, your initial $1,000 investment could decrease to $450 by the end of the trading period.

To break even and earn back your original investment, you need to win at least 69 trades out of 100. With 69 wins, you would receive $1,311 back. After accounting for 31 losses, which would cost you $310, you would ultimately recover your $1,000 and make a profit of $11. However, if you are trading on exchanges with a lower payout rate of 60%, you would need to achieve a win rate of 77% to break even.

Having a win rate of 69% is almost an impossibility, especially for beginners. Even seasoned traders struggle to maintain win rates high enough to break even consistently.

What Are The Types Of Binary Options

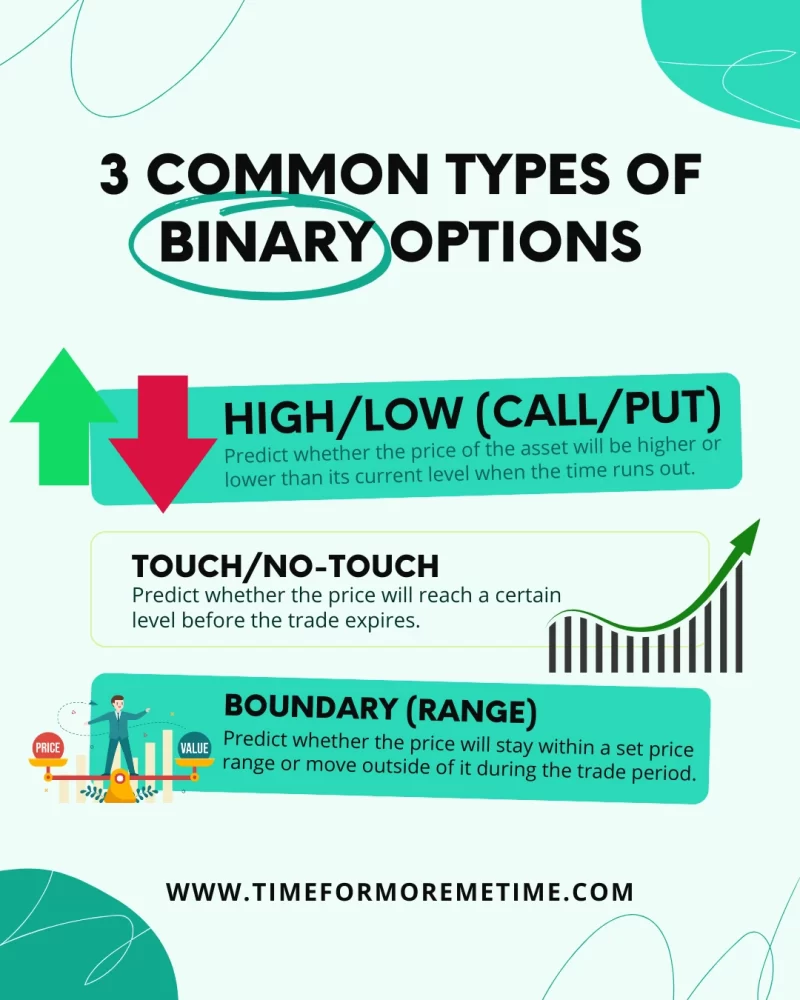

All binary options offer a binary result and focus on the performance of a derived financial instrument. However, there are more specific types of predictions you can make which offers you more options or results to predict on, which allow for different ways to structure your prediction and provide more variety in trading strategies.. Here are three common types:

- High/Low (Call/Put):

Predict whether the asset’s price will be higher or lower than the current price when the trade ends. - Touch/No-Touch:

Predict if the price will hit a certain level before expiration. If it “touches,” you win. - Boundary (Range):

Predict if the price stays within or moves outside a given range during the trade.

Most beginners in binary options—not beginners in investing—start with High/Low trades because they’re straightforward and easier to manage.

Where To Start Trading Binary Options

You can trade binary options on regulated exchanges overseen by the CFTC (Commodity Futures Trading Commission), primarily Nadex (North American Derivatives Exchange) and Cboe (Chicago Board Options Exchange). However, there are restrictions and limits on binary options trading on these exchanges.

Be careful, as there are many fraudulent platforms—often located offshore—that can jeopardize your money. With these, there have been cases of fraud where platforms refuse to allow withdrawals of funds and manipulate losses, further putting your investment at risk.

On a positive note, many unregulated platforms offer demo accounts. These demo accounts allow you to practice and learn how binary options work without risking real money. They provide real-time—a bit inaccurate—data on popular financial instruments, helping you develop your analysis and prediction skills.

However, be aware that demo accounts can create a false sense of security and may not provide you with comprehensive experience. Many unregulated platforms aim to get you to sign up and start trading quickly—they are not there to train you. The less experienced and knowledgeable you are, the better for them. So, consider this a warning.

Additionally, exercise caution. If a platform requests your personal information just to access their demo account, it’s best to walk away and not look back.

Why You Should Trade Binary Options

One of the main features of binary options is their high risk and high reward potential, which suggests significant earning opportunities in a short time. However, this perception can be misleading. As discussed in the previous section, binary options often have a negative profit expectancy, meaning you are unlikely to win against the house.

Because of that, many investors discourage beginners to start in binary options, especially if it’s their first time investing. While some advocates claim that binary options are easy and straightforward, this is only partly true. Accurately predicting price movements within a limited time frame can be very difficult for newcomers.

Some people suggest that binary options are simply a yes or no decision, implying that you don’t need to analyze charts or monitor events. This is misleading. In reality, having a solid understanding of investing and financial analysis is essential for increasing your chances of making a profit in binary options trading.

Additionally, trading binary options can be fun and challenging. However, this type of fun and challenge is only suitable for those who can afford to take risks and have the money to do so. If you’re looking for a reliable way to make money or make serious investments, it’s best to avoid binary options altogether, as they may not be the right choice for you.

Conclusion

Binary options are something new investors should study—but not trade. There are solid reasons this has been banned and heavily restricted in most parts of the world.

Ready to know more about finances? Explore more of our beginner guides, follow us on social media, and watch our videos on our YouTube channel.

Source

- Photo: Unsplash: Daniel Dan