Certificates of deposit (CDs) are a widely used savings option that many people choose for their security and reliability. If you’re here, you’re likely interested in learning what CDs are and how you can invest in them to earn interest. So, without further ado, let’s get started!

What Are Certificates Of Deposit

A certificate of deposit (CD) is a type of savings account offered by banks and credit unions, but it has distinct characteristics that differentiate it from traditional savings accounts.

With a CD, you enter into an agreement with the financial institution. You deposit a specific amount of money for a predetermined period, known as the term, and in return, the institution pays you a fixed interest rate.

The term for a CD can range from as short as one month to as long as five years or more. During this time, your money remains in the account and earns interest. Early withdrawal is not allowed without incurring a penalty, which typically costs you a few months’ worth of interest.

The main difference between CDs and traditional savings accounts is the interest rate. CDs typically offer higher rates because you commit to leaving your money untouched for a set term, allowing banks to use those funds for investments and loans without the risk of early withdrawal.

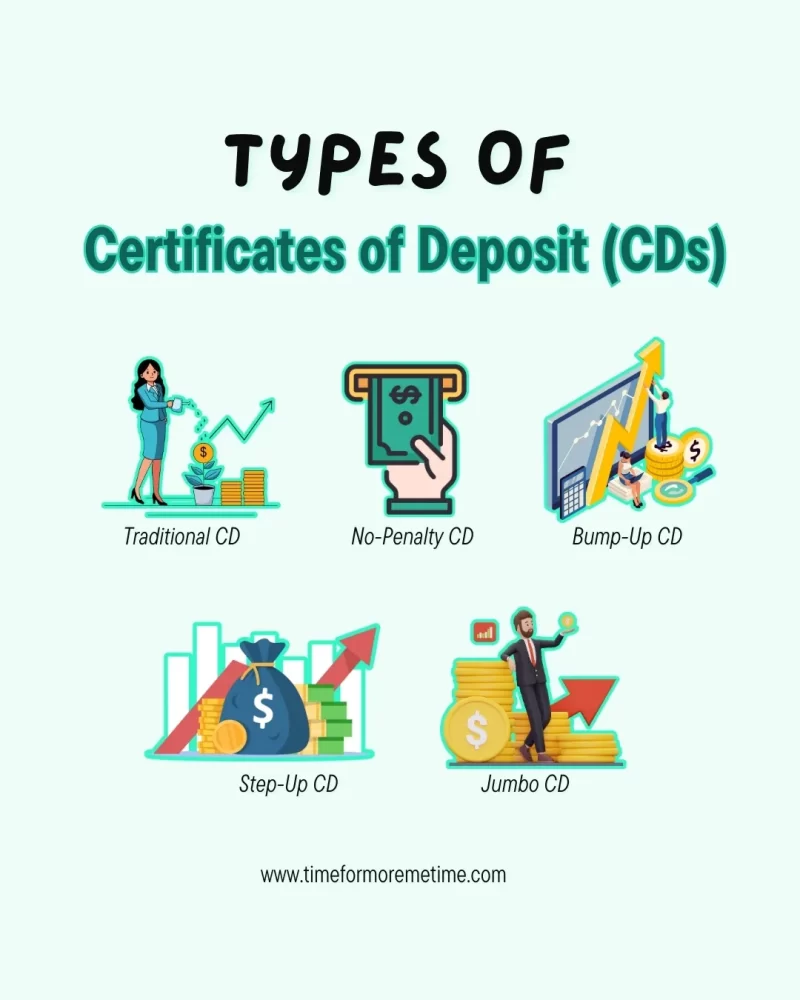

However, not all CDs are the same. Depending on your financial needs, you can choose from several types of CDs, each with different features and levels of flexibility. Here are some of the most common options:

- Traditional CD: Fixed interest rate and term, and the most common type.

- No-Penalty CD: Lets you withdraw your money early without a penalty. The trade-off is usually a lower rate.

- Bump-Up CD: Allows you to “bump up” to a higher rate if market rates increase during your term.

- Step-Up CD: Interest rate increases at scheduled intervals, regardless of market changes.

- Jumbo CD: Requires a large minimum deposit (usually $100,000 or more) but offers higher returns.

CDs are great for short- to medium-term savings goals for those who value security and predictability. For example, if you invest $5,000 in a 12-month CD with a 4.50% APY, you’ll earn $225 in interest by the end of the term. APY represents the total interest earned in a year, including compounding, which is the process of earning interest on both the original amount and the interest already added.

Where Can You Get Certificates Of Deposit

Once you’ve decided that a certificate of deposit fits your investment or savings goals, the next step is knowing where to get one. CDs are widely available, but the rates, terms, and flexibility can vary depending on where you shop. Choosing the right provider can help you earn more interest and avoid unnecessary fees.

Here are the main places where you can get CDs:

- Banks and Credit Unions:

Traditional financial institutions offer a range of CD options, often with the convenience of in-person service. For example, US Bank provides fixed-rate CDs that you can open online or at a local branch. Credit unions may also offer competitive rates, though they typically require membership. - Online Banks:

Digital-only banks often offer some of the highest CD rates in the market. With lower overhead costs, they pass the savings on to you. Many financial institutions let you open a CD in minutes and manage everything online—making them a good choice for hands-off savers and investors. - Brokerages:

For those looking to compare multiple CD options in one place, brokerages offer brokered CDs. These give you access to CDs from different banks across the country, often with higher interest rates and flexible terms.

Always compare rates and terms before committing. A small difference in interest rates can mean more money in your pocket.

Why Should You Invest In Certificates Of Deposit

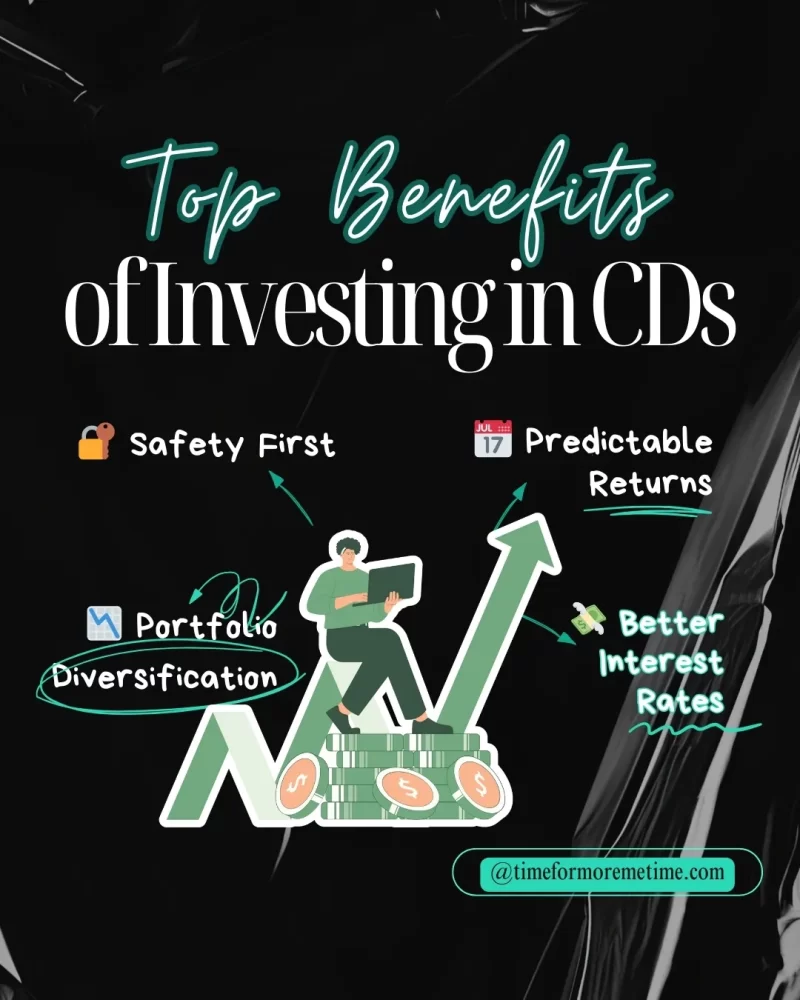

Certificates of deposit (CDs) provide several advantages that make them a dependable option for conservative savers and income-focused investors. One of the main benefits is their safety, as CDs issued by banks are insured by the Federal Deposit Insurance Corporation (FDIC). The FDIC is a U.S. government agency that protects depositors by insuring their funds up to $250,000 per depositor, per insured bank.

For credit unions, the National Credit Union Administration (NCUA) offers similar protection as the FDIC, but it specifically oversees federal credit unions. This government backing makes CDs one of the safest options for storing your money.

Another advantage is predictability. CDs come with fixed interest rates, so you know exactly how much you’ll earn over the term. This makes them ideal for financial planning, especially when you’re working toward short- to medium-term goals.

In addition, CDs often offer higher interest rates than regular savings accounts—especially for longer terms. Committing your funds for a longer period usually comes with a better interests, making CDs a smarter option if you don’t need immediate access to your cash.

Finally, CDs play a valuable role in portfolio diversification. Adding low-risk, fixed-return assets like CDs can help reduce volatility and preserve capital during uncertain market conditions. For investors looking to balance risk and reward, CDs offer a dependable layer of financial security.

A fixed return is a guaranteed interest rate that an investment will earn over a set period. Volatility refers to the fluctuations in prices and interest rates in the market. Capital is the initial amount of money you invested.

When Is The Best Time To Invest In Certificates Of Deposit

The best time to invest in certificates of deposit is when interest rates are high. Higher rates mean you can lock in better returns or interests for the entire term of the CD, making it a more rewarding savings option.

If you believe interest rates might drop in the near future, opening a long-term CD now can be a smart move. It allows you to preserve today’s higher yields before new CDs offer lower returns. This strategy is especially useful if you prefer guaranteed earnings without having to monitor the market.

CDs are also ideal when you have extra funds that you won’t need to touch for a while. Whether you’re setting aside money for a down payment, vacation, or just building your emergency fund, a CD can grow your savings safely and steadily.

Conclusion

Certificates of deposit (CDs) are a great way to start investing. They combine elements of saving and investing, and they are easy to understand. It’s the perfect gateway for anyone who wants to start investing and generating passive income.

If this information helps answer your questions, be sure to subscribe to our blog, follow us on social media, and check out our YouTube channel for informative videos.

Sources

- Photo: Unsplash: Brock Wegner