Derivatives can be a complex subject for beginners. It’s important to have some familiarity with basic investment terms before you start learning about or investing in derivatives. However, this post aims to explain what they are without requiring any prior knowledge. With that in mind, let’s get started!

What Are Derivatives

To understand derivatives, you first need to know about financial instruments. These are contracts that represent a financial asset for one party and a financial obligation for another. In simple terms, one party provides money or protection against risks, while the other party gains access to funds, ownership of an asset or company, or protection against bad investment outcomes.

For example:

- Debt Instruments: A bond is a type of debt instrument. It’s a contract between a lender (the bondholder) and a borrower (the issuer of the bond). The borrower promises to pay back the loan amount with interest.

Equity Instruments: A stock is an equity instrument. It represents partial ownership in a company and may allow the investor to receive dividends and voting rights, depending on the type of stock.- Foreign Exchange Instruments: These involve trading currencies. For example, currency pairs show the value of one currency compared to another, and forex options give the holder the right to exchange one currency for another at a specific rate.

Derivatives are another type of financial instrument, and they are unique because their value is based on something else. While most financial instruments get their value from the terms of the contract—typically based on the asset or terms specified in the contract—derivatives get their value from the price or performance of an underlying asset, index, or even an event.

A derivative is a contract between an investor and a counterparty, which can be another investor, a financial institution, or a market maker (like a brokerage firm).

How Do Derivatives Work

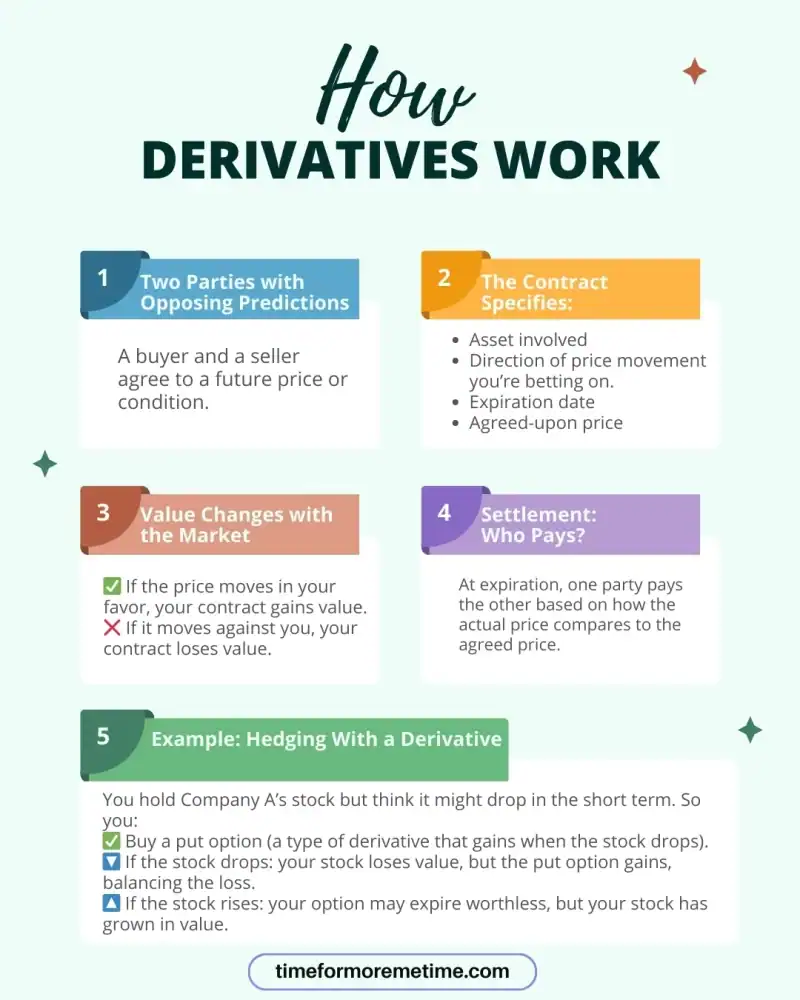

In speculative situations, derivatives can act like bets on future price movements, but their main purpose is to protect against financial risks. For example, if you invest in a derivative that predicts a certain asset’s price will rise and it does, the counterparty who bet against you will pay you. Conversely, if the price falls, you will have to pay the counterparty.

However, derivatives are mainly used for hedging rather than for making large profits, as one might do by speculating or gambling on future outcomes. Hedging is an investment strategy that involves taking steps to protect yourself from potential losses in your investments.

So, how do derivatives actually reduce risk and protect profits? Let’s look at an example:

Imagine you’ve invested in Company A’s stocks and believe that its stock price will decline, but you want to keep your investment because you think the company will do well in the long run. To minimize the impact of a potential price drop on the value of your investment, you can hedge using derivatives.

You could buy derivatives that predict Company A’s stock price will go down. If the stock price does drop, you’ll earn from the derivatives, which can offset the loss in the stock’s value, even if you continue holding it to benefit from dividends in the future. Depending on how much you invested, you might even profit from this strategy.

If, on the other hand, Company A’s stock price rises, you may lose money on the derivatives, but you will benefit from higher dividends due to the company’s strong performance.

In this way, derivatives can help investors manage potential risks and losses by providing a safety net against unfavorable price changes.

What Are The Types Of Derivatives

Here are the most common types of derivatives. While the ways to profit from each type may vary, they all operate under the same basic principles and processes described earlier:

- Futures: This is an agreement to buy or sell something later at a set price. Both sides agree on the price today, even though the exchange will happen in the future.

- Options: This is a deal that gives you the choice (but not the requirement) to buy or sell something at a certain price before a deadline. You can choose not to use the option if the deal doesn’t benefit you.

- Swaps: This is a contract where two people agree to trade money in different ways—for example, swapping fixed interest payments for variable ones, or vice versa. Swaps are primarily used by institutions to manage financial risks, such as fluctuations in interest rates or currency values, by exchanging one set of cash flows for another.

- Forwards: Forwards are like futures, but more flexible. The deal is made directly between the two parties and doesn’t go through a public market. That means they can customize the terms, but it also means there are fewer rules.

- Credit Derivatives: These are financial instruments used to manage exposure to credit risk. The most common type is a Credit Default Swap (CDS), which allows one party to transfer the credit risk of a borrower to another party in exchange for periodic payments.

While each derivative functions differently, they all rely on expectations about future market movements. People use derivatives to reduce risk, protect profits, or potentially earn more from price changes.

With this knowledge, you can identify which derivatives to invest in and conduct thorough research to capitalize on opportunities. Staying informed about market trends and the specific circumstances of the assets you are considering will enable you to make more strategic investment decisions.

Where You Can Invest In Derivatives

To invest in derivatives, you need to use specific platforms that facilitate these types of trades. Here are the most common ways to get started:

- Brokerage Accounts:

These are online accounts that let you buy and sell various investments. Many reputable brokers allow retail investors to trade common derivatives like options and futures, usually requiring account approval based on your experience and financial situation. Some also offer educational resources for beginners. - Futures Exchanges:

Certain derivatives, like futures and options, are traded on futures exchanges. These exchanges are regulated to ensure transparency and reduce risk, but trading futures still carries high risk and the potential for large losses. - Over-the-Counter (OTC) Markets: OTC markets operate outside of futures exchanges and involve direct transactions between investors. OTC derivatives are not standardized or traded on public exchanges, which can increase the risk of default and reduce pricing transparency. While they offer customization, they often come with higher counterparty risk.

Before you start trading derivatives, be sure to research and identify the platforms that will make it easier for you to invest in them.

Why You Should Invest In Derivatives

Derivatives serve various purposes in investment strategies, with risk management, or hedging, being one of the most important. Additionally, derivatives offer flexibility, allowing adjustments to meet different investment goals and take advantage of various market conditions.

Investors also use derivatives purely to make money. With proper analysis and planning, they can provide profit opportunities, but they come with significant risk and complexity, often leading to losses.

For those who can handle high risk and have sufficient capital, derivatives can offer chances for big returns, but they can also lead to large losses quickly. Due to their complexity and leverage, derivatives are best suited for experienced investors who understand the risks and have strategies to manage them.

When Is the Best Time to Invest in Derivatives

The best time to invest in derivatives depends on your financial goals, market conditions, and risk tolerance. Consider the following:

- Market Volatility: Derivatives can help hedge against potential losses in volatile markets, though higher volatility also increases the cost of some strategies and the overall risk for speculative positions.

- Interest Rate Changes: If you expect interest rates to rise or fall, certain derivatives can help manage the impact on your investments.

- Currency Fluctuations: For international investments, derivatives can protect against unfavorable currency movements.

Always ensure you’re financially prepared and have a clear understanding of the derivatives you’re considering.

Conclusion

Derivatives can be a smart way to manage risk or take advantage of market changes—if you know how to use them. They may seem complex at first, but with the right knowledge, they can become a useful part of your investing toolbox.

If you found this guide helpful, be sure to subscribe to our blog for more easy-to-follow finance tips. You can also follow us on social media and visit our YouTube channel for more videos that make money topics simple to understand.

Source

- Photo: Unsplash: Celyn Kang