Learning how to use your money wisely can be tricky when everything sounds so complex. If you’ve ever felt lost hearing words like “stocks” or “bonds,” you’re not alone. In this post, I’ll break down financial instruments in the simplest way possible—so you know exactly what they are, where to find them, why they matter, and when to start. Let’s get started!

What Are Financial Instruments

Financial instruments are contracts between two parties that can be created, traded, modified, and settled. These contracts represent an asset for one party and a liability for the other. While they were once paper-based, most financial instruments are now digital.

A common example of a financial instrument is a bond. A bond is a contract that shows one party is loaning money to another. This contract typically specifies a date for when the loan will be fully repaid and the interest that must be paid for borrowing the money.

For the issuer of the bond, it is a liability because they must pay interest in addition to repaying the loan amount. For the buyer of the bond, it is an asset because they earn money from the interest payments.

Bonds can be issued, bought, sold, and traded. When a bond is sold, the seller receives the full loan amount, and the new owner of the bond becomes the lender, receiving interest payments from the issuer.

Most financial instruments work in a similar way, and because they can be traded, they help people grow, save, or protect their money. They are often used to build wealth or save for the future.

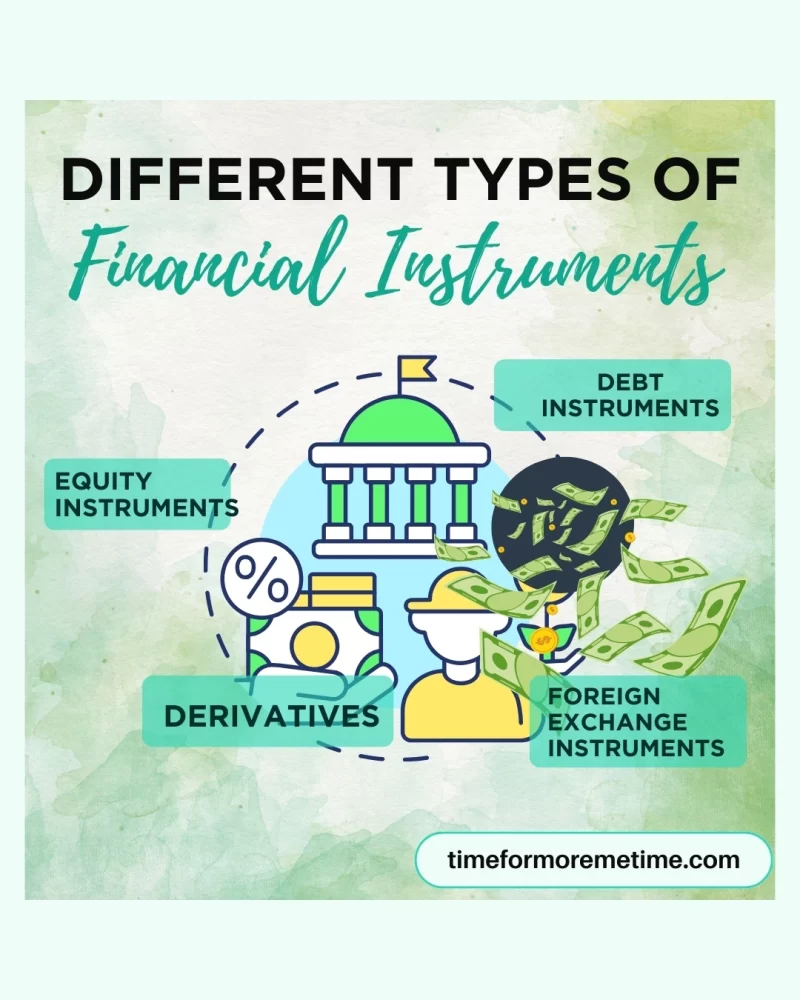

Financial instruments can be classified by asset class. An asset class is a category of financial instruments that have similar features and are governed by the same laws and regulations. Here are four key asset classes:

- Equity Instruments: These represent ownership in a company, usually a corporation. A common example is stocks, which allow you to buy a small piece of the company. If the company profits, you may earn money as well, and you can sell your stocks later for a higher price than what you paid.

- Debt Instruments: These represent a loan from an investor to an issuer (the borrower), who agrees to repay the loan amount (principal) along with interest over time. A common example of this type is bonds.

- Foreign Exchange Instruments: These involve transactions between different currencies, commonly known as Forex (Foreign Exchange). In this market, people trade currencies.

- Derivatives: Often considered a fourth asset class, derivatives derive their value primarily from the other three asset classes. These financial instruments gain value based on the price movement of an underlying asset or another financial instrument in the future. A common example of a derivative is a futures contract, which is a standardized agreement traded on exchanges to buy or sell an asset at a specific price on a future date.

People can earn money from trading financial instruments in two main ways.

The first way is through periodic income, which is money received at regular intervals. Common sources of periodic income include fixed income from interest on loans or bonds, and equity income from dividends paid by stocks based on the company’s earnings.

The second way is through trading and capital gains. The basic principle for making a profit is to buy low and sell high. The value of financial instruments can go up (appreciate) or down (depreciate). Their prices fluctuate based on factors such as the economy, the parties involved in the transactions, and movements in the financial market.

These are the common and basic ways to earn money, but there are other methods as well. The specific approach will depend on the type of financial instrument you are investing in and trading..

Where You Can Invest In Financial Instruments

You don’t need a lot of money or experience to start investing. Today, there are many accessible ways to begin, even from your phone:

- Online Brokers: These platforms allow you to buy and sell financial instruments like stocks and bonds on your own, often with lower fees compared to traditional brokers.

- Full-Service Brokers: These firms provide personalized investment advice and management services. They typically charge higher fees but offer comprehensive support, including financial planning and research.

- Robo-Advisors: These are automated services that use algorithms to manage your investments based on your risk tolerance and financial goals. They usually charge lower fees than traditional financial advisors.

- Retirement Accounts: These are long-term savings plans designed to help you prepare for retirement. Many retirement accounts offer tax advantages, allowing you to keep more of your earnings.

- Financial Advisors: If you want expert assistance, you can hire a financial advisor. They will help you select investments that align with your financial needs, risk tolerance, and investment timeline.

Each option offers a distinct way to begin—choose the one that works best for you. You can always start small and grow from there.

Why You Should Invest In Financial Instruments

Investing your money in financial instruments can help it grow instead of just sitting idle. Here are some reasons why investing is a smart choice:

- Grow Your Savings: Investments usually earn more than a regular savings account, helping your money grow over time.

- Earn Extra Income: Some investments, like stocks and bonds, can give you regular money through dividends or interest payments.

- Keep Up with Inflation: Smart investing can help your money grow faster than inflation, which helps you maintain and increase what you can buy over time.

- Easy to Buy and Sell: Many financial instruments, especially those traded on well-known exchanges, can be bought and sold quickly and easily at current market prices.

- Many Choices: The market has a wide variety of financial instruments with different features and benefits. features, risks, and returns, catering to diverse investor profiles and needs.

Investing in financial instruments is one of the best ways to grow your money over time. Even if you start with a small amount, the benefits can add up. Investing allows you to earn more, create financial security, and get ready for the future.

When Is The Best Time To Invest In Financial Instruments

The best time to start investing in financial instruments is when you’re financially ready and have a clear plan in place. You don’t need to time the market perfectly. What matters more is starting with what you have and building from there.

Starting early gives your money more time to grow through compounding—this means the money you earn from your investments starts earning its own money over time. Even small amounts, invested regularly, can make a big difference.

Market ups and downs are normal, so try not to wait for the “perfect” time. What’s more important is staying consistent and committed. Just make sure you have emergency savings set aside first, so you’re not forced to pull out your investments in a tough spot.

As life changes—like getting a new job, getting married, or having kids—your goals might shift. That’s completely normal. The key is to review your plan and adjust when needed.

Conclusion

Financial instruments are simply tools to help you grow, protect, and manage your money. Now that you understand the basics, you’re in a better position to make smart choices with your finances. The key is to start small, stay consistent, and adjust as your life changes. You don’t have to get everything right on day one—just keep moving forward.

Ready to know more about finances? Explore more of our beginner guides, follow us in social media, and watch our videos on our YouTube channel.

Sources

- Photo: Unsplash: Sortter