Looking for a simple way to start investing and earn passive income? Fixed income mutual funds could be a good option for you. To find out if they are the right fit, read my post that explains what they are and how to get started. Let’s get started!

What Are Fixed Income Mutual Funds

Fixed income mutual funds are a type of mutual fund. Mutual funds are investment options that gather money from many investors. This pooled money is then invested in different financial instruments, such as bonds and stocks. The goal is to help the investment grow and provide returns to investors.

Fixed income mutual funds mainly focus on investing in debt securities, mostly bonds, because they provide fixed income through interest payments. Debt securities are agreements where the issuer owes money to the investor.

The issuer is often a company or the government. When the issuer creates a debt security or a bond, investors can buy them. When they do, it means the investor is lending the money they paid for the bonds. In return, the issuer agrees to pay back the money on a specific date, called the maturity date, and to make interest payments regularly.

What makes fixed income mutual funds different from other types is that they usually pay regular interest to investors, often monthly or quarterly.

These payments can continue even if the underlying bonds don’t generate profits. However, if the bonds in the fund fail to pay or default, the payments may be reduced. Also, payments can be affected if bond prices go down.

How Do Fixed Income Mutual Funds Work

Fixed income mutual funds are managed by a small team of professionals. This team uses the pooled money from investors to buy various bonds. These investments generate income through interest payments, which are then distributed to all the investors in the fund.

This team carefully chooses which bonds to include in the portfolio based on important factors, such as:

- Credit Quality: This refers to the bond issuer’s reputation for paying interest and repaying the full amount by the maturity date.

- Duration: This indicates how long it will take for the bond to reach its maturity date and how often the issuer will make interest payments.

- Yield: This is the amount of interest earned over time.

By analyzing these factors, the management team aims to create a diversified portfolio or collection of bonds that can provide steady income to investors while minimizing risk. The goal is to achieve a balance between generating returns and protecting the investors’ capital.

What Are The Types Of Fixed Income Mutual Funds

Fixed income mutual funds come in several forms, each with its own mix of risk, return, and tax features. The type of fund is primarily based on the kinds of bonds they invest in:

- Government Bond Funds: These funds primarily invest in bonds issued by the federal government. They are considered low-risk investments and provide steady returns, making them a safe choice for conservative investors.

- Corporate Bond Funds: These funds focus on bonds issued by companies. They usually offer higher yields than government bonds but come with increased credit risk, as the financial health of the issuing company can affect its ability to pay interest.

- High-Yield Bond Funds: Also known as junk bond funds, these invest in lower-rated bonds that pay higher interest rates. They are best suited for investors willing to take on more risk in exchange for the potential for greater income.

- Short-Term Bond Funds: These funds invest in bonds with short maturities, typically ranging from 1 to 3 years. They offer more stability and are less sensitive to changes in interest rates, making them a conservative option.

- Long-Term Bond Funds: These funds focus on bonds with longer maturities, usually 10 years or more. While they may offer higher yields, they are more affected by shifts in interest rates, which can lead to greater price volatility.

In addition to these types, there are other fixed income mutual funds that may invest in a mix of different bond types. These are often called diversified, multi-sector, or balanced funds, each with its own goals and strategies.

Where To Invest In Fixed Income Mutual Funds

You can invest in fixed income mutual funds through several reliable channels, each offering different levels of control, assistance, and fees. Your choice depends on how hands-on you want to be and whether you value lower fees or personalized advice.

- Brokerage Firms: This is a popular option that provides access to a wide range of bond funds from various providers. Brokerage firms offer tools for screening funds, risk ratings, historical performance data, and analyst insights to help you select funds that align with your investment goals.

- Fund Providers: Investing directly through fund providers often results in lower fees since there are no brokerage costs involved. These companies offer detailed information and tools to help you understand fund performance, yield, and investment strategies.

- Financial Advisor: Financial advisors provide personalized assistance, which can be especially helpful if you have a complex financial situation or a diverse investment portfolio. They can recommend fixed income funds based on your risk tolerance, investment time frame, and income needs.

If you decide to work with a financial advisor, be sure to ask about how they are compensated. Some advisors charge fees for their services, while others may earn commissions from the funds they recommend. Understanding their compensation structure is important to ensure transparency and to know how it may affect your investment choices.

Why Invest In Fixed Income Mutual Funds

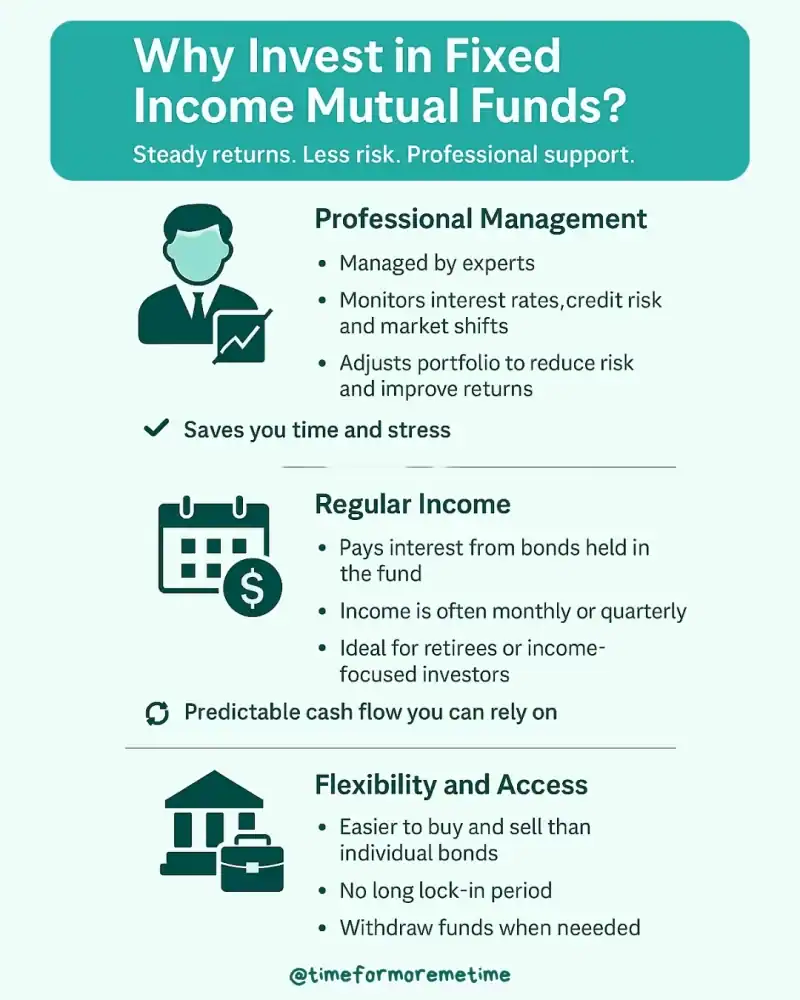

Fixed income mutual funds are a popular choice for investors looking for steady returns, lower risk, and professional management—all in one package.

One of the main advantages of investing in these funds is the professional management they offer. Experienced fund managers keep a close eye on interest rates, credit ratings, and market changes. They adjust the portfolio as needed to maintain strong performance and manage risk, which saves you time and effort.

For those who rely on investment income, these funds provide regular income through interest payments from bonds. They are particularly suitable for retirees or anyone seeking a predictable cash flow.

Additionally, it is easy to withdraw your money from a fixed income mutual fund, unlike managing multiple individual bond investments. This flexibility makes fixed income mutual funds accessible for investors who want income and stability without tying up their cash for an extended period.

When Is The Best Time To Invest In Fixed Income Mutual Funds

The best time to invest in fixed income mutual funds depends on market conditions and your financial goals. Consider investing when interest rates are expected to decrease, as this can increase the value of the bonds in these funds, leading to regular interest payments and potential gains.

Investing when bond yields—the return an investor earns based on a bond’s current price—are high can also provide more income. Many people prefer bond funds for their stable returns compared to the stock market’s volatility.

However, predicting interest and yield changes can be challenging. The ideal time to invest is whenever you have the funds available. While fixed income mutual funds generally carry lower risk than stock funds and other financial instruments, they can still lose value, especially if interest rates rise or credit conditions worsen. Choosing a well-managed fund can help mitigate risk, but it won’t eliminate it.

Conclusion

Fixed income mutual funds are a flexible and reliable way to generate income, manage risk, and add stability to your investments. They are ideal for retirement planning, diversification, or offsetting portfolio volatility. Just ensure your fund choice aligns with your financial goals, timeline, and risk tolerance.

Want to learn more about getting started with investing? Subscribe to our blog, follow us on social media, and check out our YouTube channel for beginner-friendly tips and insights!

Sources

- Photos: Unsplash: Ash Cook