What are P2P platforms? They have been gaining attention in investment discussions lately, and they present an intriguing concept. In this post, you will discover how they operate and how you can leverage them for your benefit. Let’s get started!

What Are P2P Platforms

P2P platforms, or peer-to-peer platforms, are online services that allow individuals to lend and borrow money directly from one another. Basically, they facilitate P2P lending. They aim to make borrowing more accessible and potentially profitable.

Here’s how it works: When someone needs a loan—for purposes like paying off debt, home repairs, or starting a small business—they can apply on a P2P platform instead of going to a bank. The platform reviews their application and shares the loan request with potential lenders.

Lenders can browse various loan requests and choose which borrowers they want to support. Once a loan is fully funded, the borrower receives the money and agrees to repay it with interest over time. As borrowers make their payments, lenders earn a profit.

The platform handles all aspects of the process, including applications, approvals, and monthly payments. This setup allows borrowers to access funds quickly, while lenders can earn more than they would by simply keeping their money in a savings account.

It’s important to note that most loans on P2P platforms are unsecured and not insured. This means that if a borrower defaults, you could lose your money permanently. In such cases, the platform typically can only remove the borrower from the site. As a lender, you need to accept this risk.

Some platforms may try to recover funds through third-party collections, but the success of these efforts can vary, and lenders are not guaranteed reimbursement.

The term “peer-to-peer” highlights the direct connection between individuals, removing the need for traditional middlemen like banks and financial institutions. Instead, P2P platforms serve as the intermediary. This approach reduces bureaucracy and increases the chances of loan approval.

What Can You Do In P2P Platforms

P2P platforms let you do two things: borrow money if you need it, or lend money if you want to grow your savings.

As a borrower, you can apply for a loan to help with expenses such as medical bills, school fees, home repairs, or other personal needs. The application process involves filling out a short form, and if your request is approved, it will be posted for potential lenders to see. Keep in mind that P2P lending platforms typically limit lending and borrowing to individuals within the same country to simplify the process and avoid regulatory complications. Lenders from across the country can then contribute small amounts to help fully fund your loan.

If you’re a lender, you can use your extra money to help others while earning from it. You look at different loan requests, decide who to support, and choose how much to lend. You’re not giving money away—each borrower agrees to pay back the amount they borrowed, plus a little more. That extra is your earnings—similar to interest.

The platform does all the hard work: collecting payments, sending reminders, and making sure everything runs smoothly. Over time, as borrowers repay their loans, you get your money back little by little—along with any interest you earn—assuming the borrower repays in full.

How Can You Start Investing In P2P Platforms

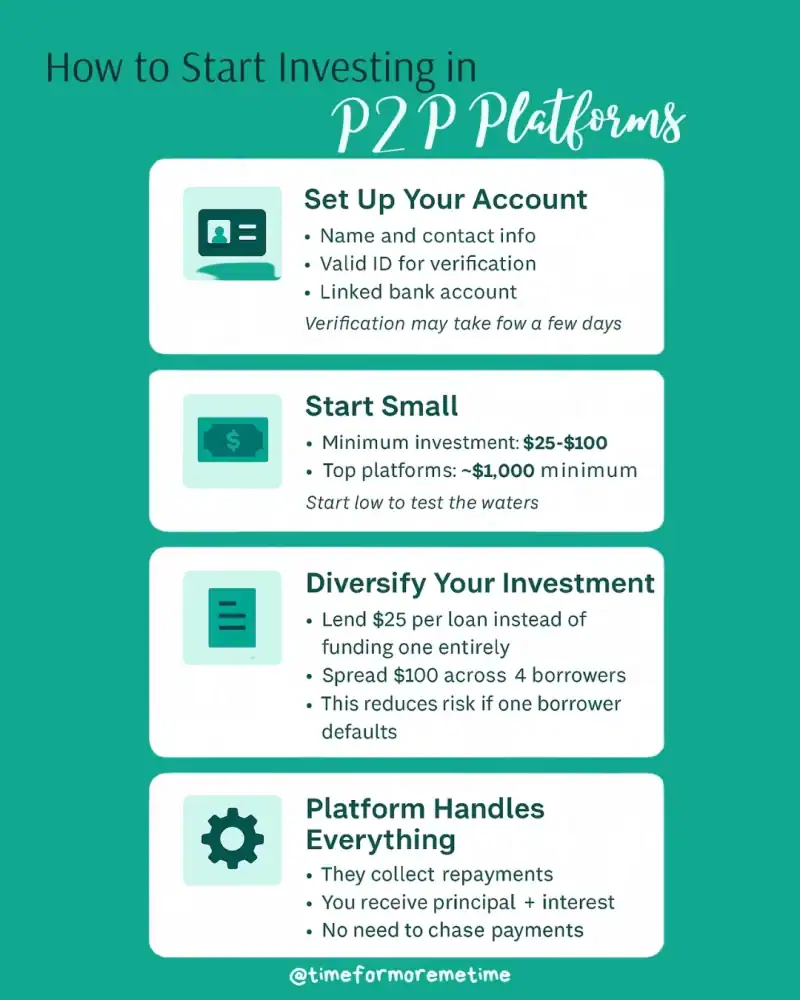

Joining a P2P platform is usually streamlined, but there are a few important things to know before you start.

Most platforms let you create an account online in just a few minutes. You’ll need to provide your name, contact details, and verify your identity with a valid ID. You also need to link a bank account so you can deposit and withdraw funds. This verification process can take several days.

The minimum amount required to start investing or lending money on most platforms is relatively low, with some allowing you to begin with as little as $25 to $100. However, if you want to use more reputable platforms, it’s advisable to have at least $1,000, as they often set this as their minimum requirement. This low entry point makes it easy to explore P2P lending without committing a large sum of money upfront.

Once your account is ready, you’ll see a list of loan requests—these are from people who need money for things like home repairs, medical bills, or paying off debt. Each request includes how much they want to borrow, why they need it, and how long they’ll take to repay it.

You don’t need to fund an entire loan on your own. You can choose to lend a small amount, often as little as $25 per loan. This allows you to spread your investment across multiple loans instead of putting all your money into one. For instance, if you have $100, you could lend $25 to four different borrowers. This strategy helps minimize your risk—if one borrower fails to repay, you still have the other loans to rely on. The remaining amount is covered by other lenders.

The platform collects the payments from borrowers and sends you your share over time, along with the interest you earn. Everything is managed automatically by the platform.

If you’re a borrower, the platform may periodically check your credit profile to ensure continued eligibility. Therefore, it’s important to avoid engaging in poor financial behavior if you want to keep your P2P platform account in good standing.

Conclusion

P2P platforms create a direct connection between people who need to borrow money and those who want to grow their savings. While you may not be a bank, you can still lend and potentially earn returns through these platforms—but it’s important to understand the risks and diversify your investments.

Interested in learning more ways to grow your money? Explore our other beginner-friendly guides and subscribe for more tips on building your financial future. You can also watch our videos on our YouTube channel, follow us on social media, and subscribe to our newsletter.

Source

- Photo: Unsplash: Frederick Warren