There are many types of stocks, which can make it hard to know which ones to invest in. In this post, I will explain what preferred stocks are and answer any questions you might have about them. Let’s get started!

What Are Preferred Stocks

To understand preferred stocks, it’s important to know about stocks and bonds first.

- Stocks represent ownership in a company, allowing shareholders to claim part of the company’s assets and earnings.

Bonds are loans made by investors to companies or governments, which pay regular interest and return the principal when they mature.

Preferred stocks are a type of investment that combines features of both stocks and bonds. They pay fixed dividends like bonds and have a higher claim on a company’s assets than common stocks if the company goes bankrupt.

When you own preferred stocks, you receive steady dividend payments—similar to interest from bonds—and you are paid before common stockholders if the company fails. This offers more stability and less risk than common stocks.

However, preferred stockholders typically do not have voting rights in company decisions, unlike common stockholders. While the price of preferred stocks can fluctuate, they usually do not increase in value as much as common stocks—the most common type of stocks as the name implies. They are mainly suited for investors seeking reliable income rather than significant growth or control.

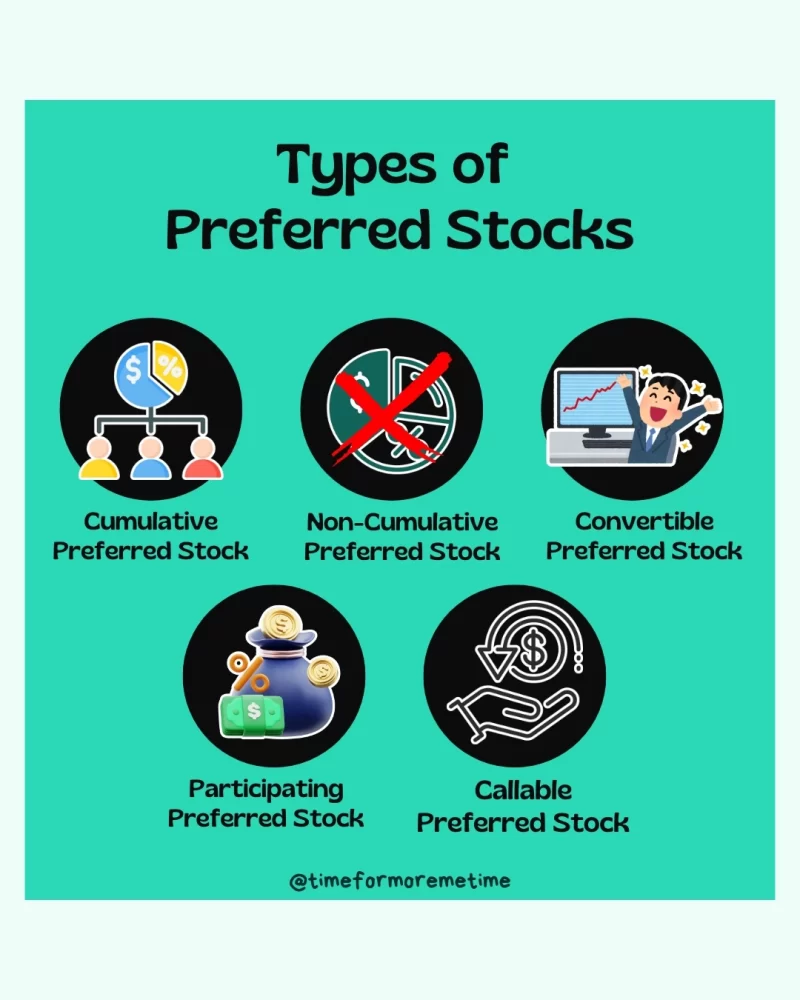

There are several types of preferred stocks, each with its own features:

- Cumulative Preferred Stock: If the company skips a dividend payment, it still owes you that money. You’ll get paid before common shareholders.

- Non-Cumulative Preferred Stock: Missed dividend payments are gone for good. You won’t be repaid later.

- Convertible Preferred Stock: You can choose to turn this into common stock if the company does well and the price goes up.

- Participating Preferred Stock: You get your fixed dividend, plus more if the company earns extra profits.

- Callable Preferred Stock: The company can buy these back from you at a set price after a certain date.

Many beginners and investors prefer cumulative preferred stock because it is usually less risky and easier to understand than other types of preferred stocks. However, it’s important to note that preferred stocks may not be suitable for everyone. If you are looking for steady income with less risk than common stocks, they could be a good option to consider.

Why Invest In Preferred Stocks

Preferred stocks are a good option if you’re looking for steady income without taking big risks. They usually pay higher dividends than regular stocks or savings accounts, which means you can earn more money on a regular basis—often every quarter.

One big advantage is that preferred stockholders get paid first. If the company pays dividends or runs into financial trouble, you’ll be ahead of common shareholders when it comes to getting your money. That makes preferred stocks safer than regular stocks, though not as safe as government bonds or savings accounts.

Another benefit is that the payments are predictable. You’ll know how much money you’re going to get and when. That’s great for budgeting, especially if you’re retired or just want reliable extra income.

Preferred stocks can also lose value if interest rates go up, because other investments may start offering better returns. And some preferred stocks can be “called,” which means the company can buy them back early—cutting off your future income from that investment.

If you want something more stable than regular stocks but with better returns than a savings account, preferred stocks can be a smart way to earn passive income with less stress.

Where Can You Buy Preferred Stocks

Buying preferred stocks is easier than you might think. You can get them through online brokerage accounts. These platforms let you search for individual preferred stocks, just like you would with regular stocks.

Some investors also buy preferred stocks directly from the companies that issue them, but that’s less common and usually requires a bit more effort and research.

If you don’t want to pick individual preferred stocks, another great option is to invest through ETFs (exchange-traded funds). These are special funds that include lots of different preferred stocks in one package.

It’s a simple way to get exposure to the whole category without needing to do deep research on each company. ETFs are especially useful if you’re new to preferred stocks or want someone else to manage the mix for you.

Whichever option you choose, make sure to look at things like dividend rates, company strength, and whether the stock can be called or converted. This will help you make smarter decisions with your money.

When Is The Best Time To Invest In Preferred Stocks

Preferred stocks can be a smart choice when interest rates are low. That’s because they often pay more than savings accounts or even some bonds. If you’re looking for better returns without jumping into risky stocks, preferred stocks can fill that gap.

They’re also useful if you want to diversify your investments. In simple terms, that means not putting all your money in one type of asset. Adding preferred stocks to your mix can give you a good balance between steady income and moderate risk.

But timing matters. If interest rates start rising, the value of preferred stocks can drop—since new investments might offer better returns. So, it’s best to be cautious during periods of rising interest rates.

Conclusion

Preferred stocks offer regular income like bonds and ownership in a company like stocks, making them suitable for those seeking reliable payments with lower risk than common stocks. However, it’s important to understand how they work, the associated risks, and their role in your financial plan.

For more simple, helpful guides, subscribe to our website, follow us on social media, and watch our videos on our YouTube channel.

Sources

- Photo: Unsplash: Vincent Yuan