When people listen to financial news, they often hear a lot about the stock market. However, many people only see it as a place where money is traded. If you want to learn more about the stock market, you’re in the right spot! In this post, I’ll explain what it is and how it works. Let’s get started!

What Are Stock Exchanges

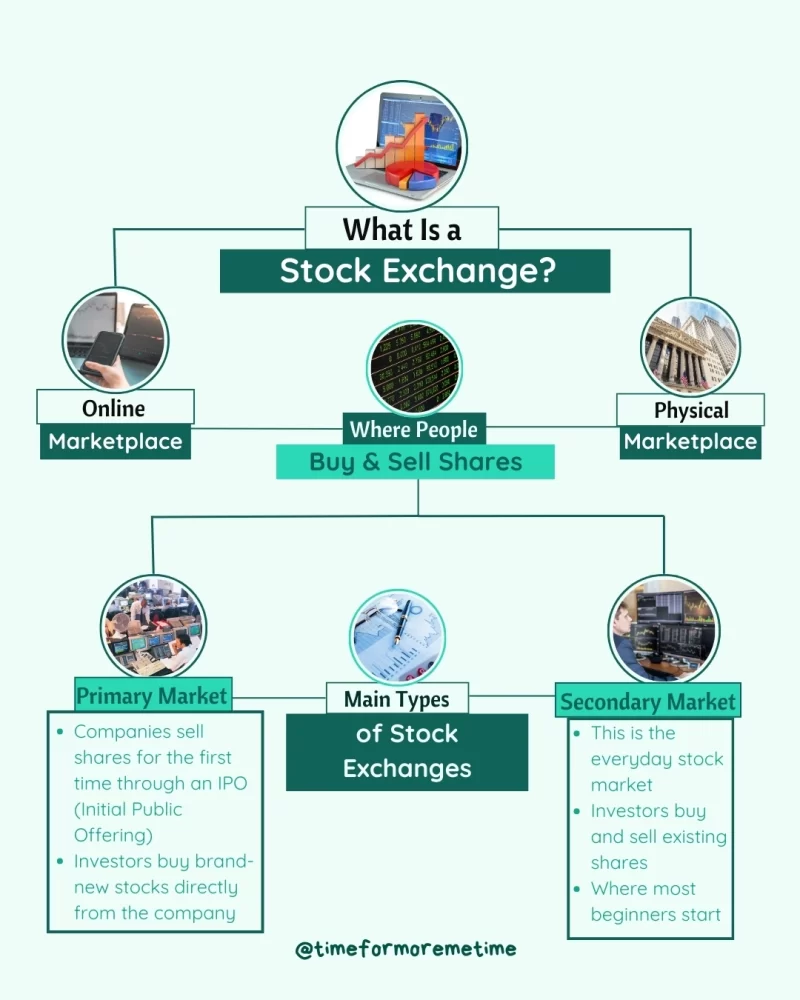

A stock exchange is a platform, either online or in a physical location, where people can buy and sell shares of companies. It establishes rules, verifies the legitimacy of companies, and ensures fair practices among buyers and sellers.

When you buy a share, you own a part of that company and can call yourself a stockholder or shareholder. If the company performs well, the value of your share may increase, and you might receive dividends, which are portions of the company’s profits. If you sell your share for more than you paid, you earn capital gains.

For a company to list its shares on an exchange, it must meet specific requirements and undergo a valuation process to assess its overall value. The company must demonstrate financial success, have a reliable history, and comply with governance standards and regulations.

Once these criteria are met, the company can go public through an Initial Public Offering (IPO) with the help of investment banks and regulatory bodies. It must also pay listing fees. After this process, the company can issue stocks for sale, with the number of shares and their price determined by the company’s valuation and input from investment banks.

Stock exchanges serve as a primary market, where investors can buy stocks that are being issued for the first time, typically through IPOs. However, they are more commonly known for their secondary market—often referred to as the stock market—where people buy, sell, and trade already owned stocks. This is where most trading activity occurs.

There are also third and fourth markets, which take place outside traditional stock exchanges on different platforms, but these are separate topics.

As a beginner, you will likely spend most of your time in the secondary market. Understanding how it works is crucial for developing your trading skills and making informed investment decisions. You will learn about market trends, price changes, and factors that influence stock prices, which will help you manage your investments more effectively.

What Can You Do In Stock Exchanges

There are two main ways to profit from stock exchanges: passive income through dividends and active income through capital gains. Most investors prefer the latter, focusing on buying and selling stocks for profit.

Profiting from trading is possible due to the dynamic nature of the stock market. Stock prices can change every second, influenced by factors such as a company’s performance, the economy, and various financial, economic, and political events.

To achieve capital gains, the basic strategy is simple: buy a stock when its price is low and sell it when the price is high. However, many investors use more advanced strategies that have developed over time to suit different trading styles. Here are some common trading methods:

- Day Trading: This strategy involves buying and selling stocks within the same trading day. Day traders aim to profit from short-term price movements and do not hold positions overnight.

- Swing Trading: Swing traders hold stocks for several days or weeks to take advantage of expected price changes, focusing on short- to medium-term trends.

- Position Trading: Position traders hold stocks for a longer period, often months or years, based on fundamental analysis and long-term trends, paying less attention to short-term price fluctuations.

- Scalping: This very short-term strategy involves making numerous small trades throughout the day to capture tiny price changes, with scalpers aiming for quick profits.

- Long and Short Trading: Long trading involves buying stocks with the expectation that their price will rise, while short trading involves selling borrowed stocks with the expectation that their price will fall, allowing the trader to buy them back at a lower price later.

The trading strategy a person chooses will depend on their capital, experience, behavior, risk tolerance, and market analysis.

How Can You Start Investing In Stock Exchanges

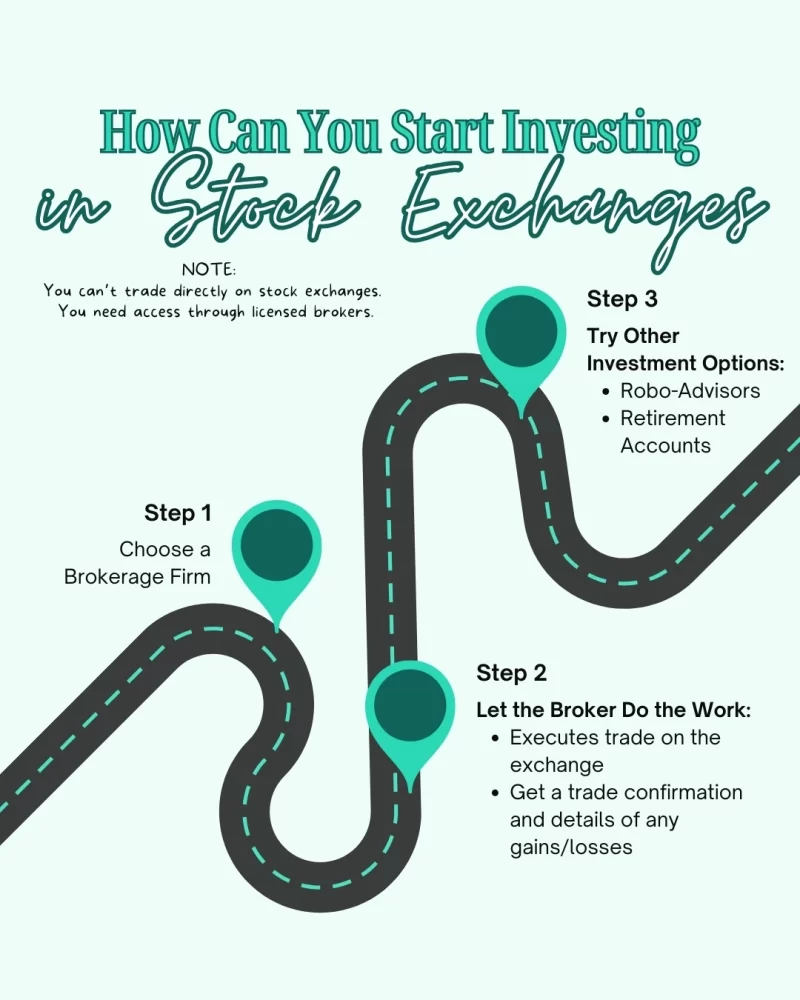

As a beginner, you can’t directly trade on stock exchanges or their online platforms. Instead, you’ll be classified as an individual retail investor, which means you can mainly participate in the secondary market. Direct trading on stock exchanges requires membership, which is typically reserved for brokerage firms, financial institutions, and high-net-worth individuals.

To trade stocks listed on stock exchanges, you need to become a client of a brokerage firm that is a member of the exchange you want to access. You can do this by signing up on the brokerage firm’s platform and placing your orders through your broker. Once your order is received, the brokerage will execute it on your behalf, and you’ll receive confirmation along with details of any gains or losses from your trade.

In addition to traditional brokerage firms, you also have other options for indirectly trading stocks on stock exchanges. These include using robo-advisors or investing through retirement accounts.

Conclusion

Stock exchanges serve as a link between companies seeking to raise capital and individuals looking to invest and make a profit. While you can’t have a seat on the stock exchanges’ trading floors, you can still invest through brokerage firms. With the right strategy and a good brokerage, you have the potential to earn money and build wealth over time.

Interested in learning more? Explore our other beginner-friendly guides and subscribe for more tips on building your financial future. You can also watch our videos on our YouTube channel, follow us on social media, and subscribe to our newsletter.

Source

- Photo: Unsplash: Marcus Reubenstein