Investing in stocks can be daunting for many people. The complicated nature of the stock market and the fear of losing money can discourage potential investors. However, learning about stocks and their advantages can help you make better investment decisions. Let’s break down what stocks are and get started!

What Are Stocks

Stocks are financial instruments that show you own a part of a company. By the way, financial instruments are valuable contracts that can be bought and sold. They include stocks, bonds, and other types of investments.

Stocks are a type of equity security, which means they represent a share of ownership in a company. When you own stocks, you have a claim on some of the company’s assets and profits. This allows investors to own a piece of a company and possibly benefit from its growth.

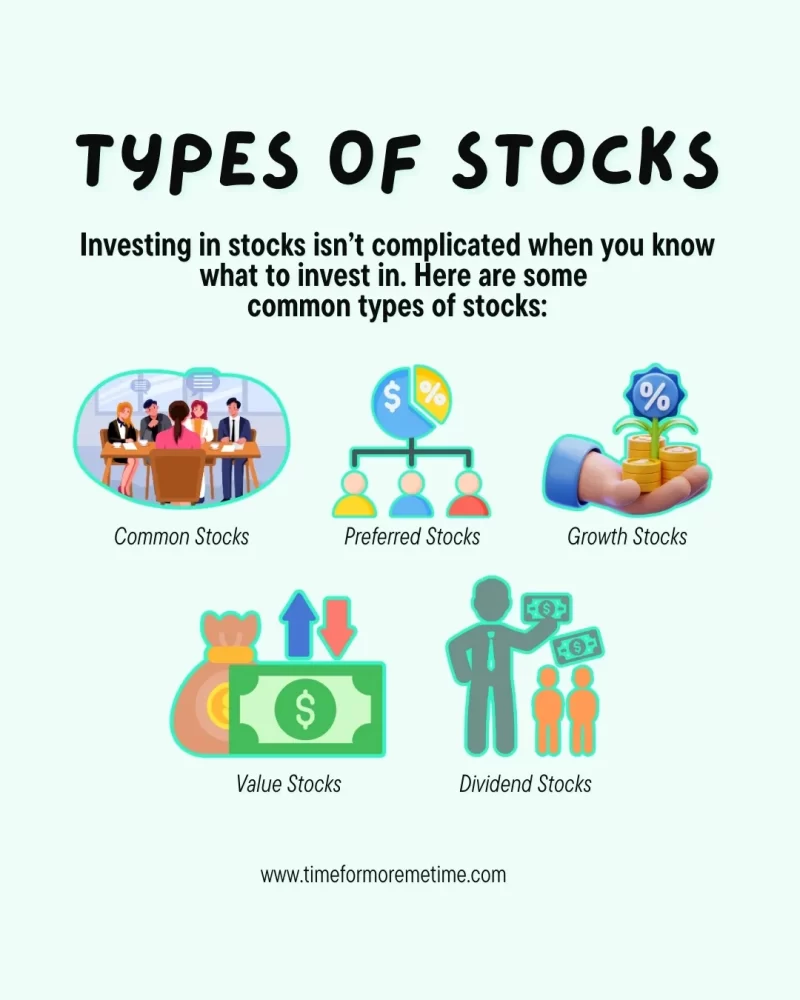

Different types of stocks include:

- Common Stocks: These shares represent ownership in a company and typically grant voting rights for decisions like electing the board of directors. However, not all common stocks have voting rights, as some companies issue different classes with varying voting powers. Investors should review the specific terms of each stock to understand its voting rights.

- Preferred Stocks: These shares give investors a fixed payment (dividend) and priority over common stockholders if the company is sold or goes bankrupt, but they usually don’t have voting rights.

- Growth Stocks: These are shares in companies expected to grow faster than others in their industry or the overall market. These companies often reinvest their profits to keep growing instead of paying dividends.

- Value Stocks: These stocks are seen as being priced lower than their true worth based on things like earnings or dividends. Investors often look for these as good deals.

- Dividend Stocks: These are shares in companies that regularly pay a portion of their earnings to shareholders, providing a steady income.

Stocks are a key part of the equity market, giving investors a way to share in the financial growth of companies. And as a beginner, you’ll mainly work with common stocks as it will be the most accessible type of stocks for you.

Where Can You Buy Stocks

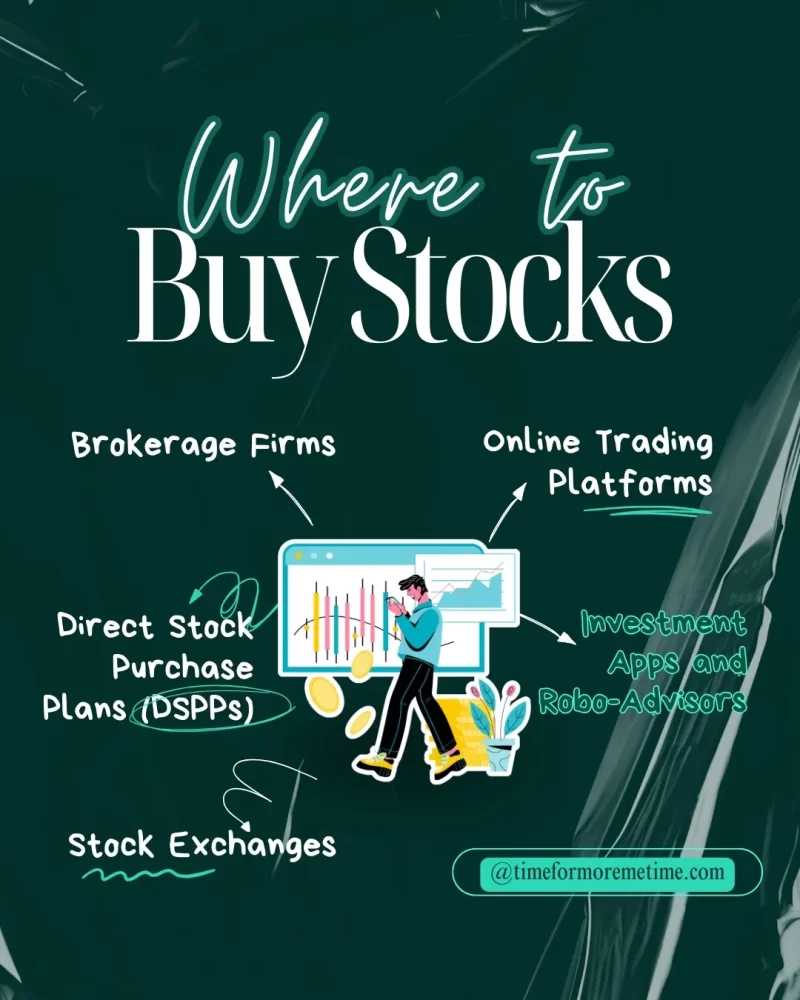

You can buy stocks through several platforms:

- Brokerage Firms: Traditional brokerage firms provide personalized services and advice for buying stocks. In these firms, a financial advisor can help you choose stocks based on your investment goals.

- Online Trading Platforms: These platforms let you buy stocks directly from your computer or mobile device, often with lower fees than traditional brokers. With them, you can create an account, deposit money, and easily purchase stocks with just a few clicks.

- Stock Exchanges: Stocks are traded on stock exchanges like the New York Stock Exchange (NYSE) or NASDAQ. To buy stocks on these exchanges, you typically need a brokerage account to place your orders.

- Investment Apps and Robo-Advisors: Many mobile apps provide a simple way to buy stocks and often include educational resources for beginners. Some robo-advisors, like Acorns, can help you invest and manage your stock portfolio based on your preferences.

- Direct Stock Purchase Plans (DSPPs): Some companies offer DSPPs that allow you to buy shares directly from them without a broker. For example, you can invest in Coca-Cola through their DSPP, which may let you purchase shares at a lower cost and without brokerage fees.

There are many convenient options for buying stocks, each suited to different preferences and investment strategies.

Why Should You Invest In Stocks

Investing in stocks can be a great way to build wealth over time and reach your financial goals. Historically, the stock market has offered higher returns than other investment options like bonds or savings accounts. However, it’s important to remember that investing in stocks comes with risks, including the possibility of losing money.

One major benefit of investing in stocks is the chance for compound growth. This means your investment can earn returns not just on the initial amount you invested, but also on the earnings you accumulate. For example, if you invest in a stock that increases in value and pays dividends, you can reinvest those dividends to buy more shares, which can boost your overall returns.

In short, investing in stocks has the potential for significant financial growth, making it a valuable option for anyone looking to improve their investment portfolio.

When Is The Best Time To Invest In Stocks

The best time to invest in stocks is usually when the market is down or correcting. During these times, stock prices are often lower, allowing you to buy shares at a discount.

However, trying to perfectly time the market can be risky and may lead to missed opportunities and unnecessary stress. Investing when the market is high can result in significant losses if prices drop afterward.

To avoid these pitfalls, consider using a dollar-cost averaging strategy. This means investing a fixed amount of money at regular intervals, no matter what the market is doing. This approach can help reduce the impact of market ups and downs and lower the risk of making poor investment choices based on short-term changes.

A good tip is to focus on long-term trends instead of short-term market movements. By keeping a long-term perspective, you can better handle market fluctuations and take advantage of the overall growth of the stock market.

Investing during market downturns and using strategies like dollar-cost averaging can improve your chances of achieving good returns over time.

Conclusion

Understanding stocks is important for anyone who wants to build wealth and secure their financial future. Investing in stocks can lead to significant returns and help grow your investment portfolio over time. Compared to other investment options, stocks usually offer greater growth potential, making them a great choice for long-term investors.

If you found this helpful, please subscribe to our blog, follow us on social media, and check out our YouTube channel for more money tips and insights!

Sources

- Photo: Unsplash: Dimitri Karastelev