Investing can be overwhelming due to the many options available, and one of the first things you might want to learn about is Treasury securities. If you’re not familiar with them, it can be confusing. In this post, I’ll explain what Treasury securities are and how they work. Let’s get started!

What Are Treasury Securities

Treasury securities are a type of bond. A bond is essentially a loan agreement where an investor lends money to the issuer in exchange for regular interest payments and the return of the original amount when the bond matures. “Maturity” refers to the specific time when the issuer must pay back the loan in full.

What sets Treasury securities apart from most other bonds is that they are issued only by the US government, specifically by the Department of the Treasury. This makes Treasury securities a low-risk investment because they are backed by the trust and credit of the U.S. government.

Due to the nature of Treasury securities, you know exactly what to expect and when to expect it. This makes them a smart choice if you’re looking to protect your money and earn steady profits.

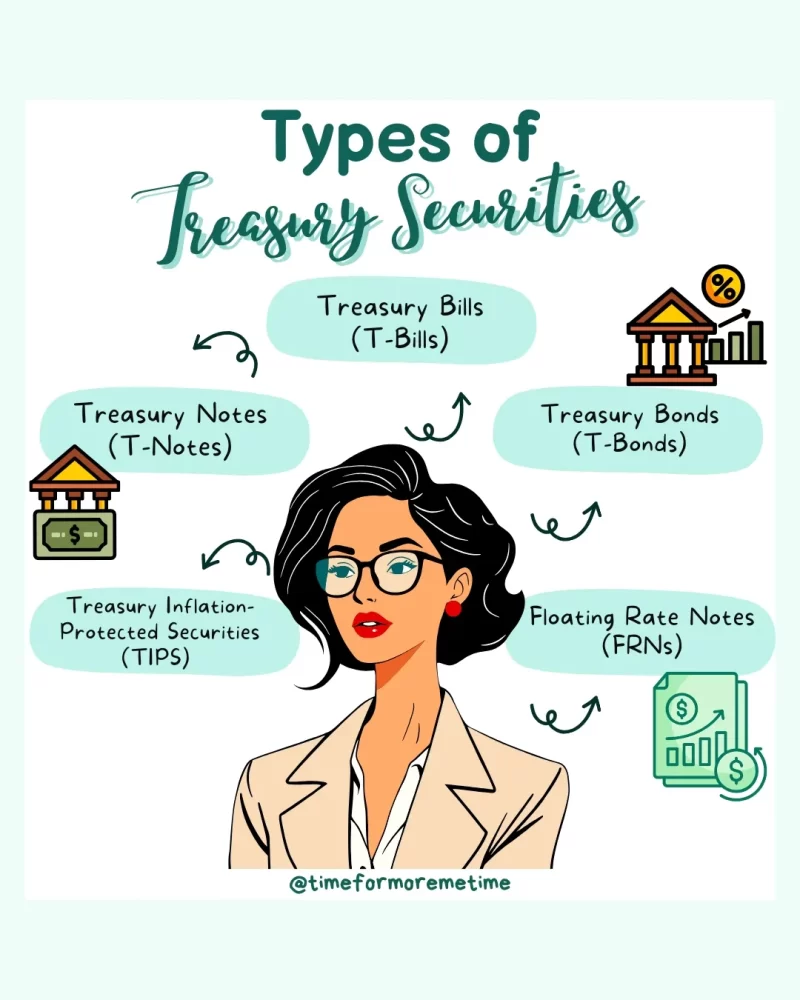

There are several types of Treasury securities, each with different timelines and interest features:

- Treasury Bills (T-Bills): Short-term investments that mature in one year or less. You buy them at a discount and get the full value at maturity.

- Treasury Notes (T-Notes): These mature in 2 to 10 years and pay interest every six months.

- Treasury Bonds (T-Bonds): Long-term securities that mature in 20 or 30 years. They also pay interest twice a year.

- Treasury Inflation-Protected Securities (TIPS): These adjust with inflation. Your interest payments rise if inflation goes up.

- Floating Rate Notes (FRNs): The interest rate changes every three months, based on short-term Treasury rates.

Each type offers a different way to match your goals, whether you’re saving short-term or building long-term security.

Where Can You Buy Treasury Securities

You can buy Treasury securities from several places, depending on how involved you want to be in your investing. The easiest way is through TreasuryDirect.gov, where you can buy them directly from the U.S. government without any fees.

If you prefer more flexibility or want help managing your investments, you can also buy Treasury securities through banks or brokers. Keep in mind that this option may come with extra services and access to the secondary market.

Another option is to invest in Treasury-focused exchange-traded funds (ETFs) or mutual funds.

- Treasury-focused ETFs: These are investment funds that you can buy on stock exchanges. When you invest in a Treasury-focused ETF, you are essentially buying shares in a fund that mainly holds US Treasury securities. This means you get exposure to a variety of Treasury securities without having to buy each one separately.

- Mutual Funds: These are similar to ETFs but are not traded on stock exchanges. Mutual funds are managed by private companies that pool money from many investors to buy a range of financial products, including Treasury securities. They act as investment vehicles that let you invest in a mix of securities.

You can access Treasury-focused ETFs and mutual funds through most brokerages—companies or individuals that help connect investors with the financial markets. This allows you to invest in different Treasury securities without having to manage each one on your own.

Why Should You Invest In Treasury Securities

Treasury securities are a solid choice if you want a dependable place to park and invest your money. Here’s why many investors include them in their financial plan:

- Safety: These are among the safest investments out there. They’re backed by the US government, so the risk of losing your money is very low. The government will definitely pay you back with interests.

- Predictable Income: Most Treasury securities pay interest on a set schedule, making it easier to plan for regular income.

- Liquidity: You can buy and sell them easily through brokers or directly from the government. You’re not locked in if you need access to your money.

- Tax Benefits: The interest you earn is exempt from state and local taxes, which can help boost your after-tax return.

- Diversification: Treasury securities can reduce overall risk in your portfolio, especially when stocks or other investments are unstable.

Investing on Treasury securities won’t make you rich overnight, but they can add stability, especially if you’re saving for something important or nearing retirement.

When Is The Best Time To Invest In Treasury Securities

Timing your investment in Treasury securities can greatly affect how much you earn and how safe your money is. These government-backed assets are generally seen as safe and dependable, but certain situations can make them even more profitable.

One of the best times to invest in Treasury securities is during times of economic uncertainty. When the stock market is unstable or there are worries about a recession, investors often look for safe places to keep their money. Treasuries provide stability and are backed by the U.S. government, which means they won’t go bankrupt and will always have the funds to pay back those who own Treasury securities.

Another good time to invest is when interest rates are high. When rates go up, newly issued Treasury securities offer better returns—meaning higher interest rates for the bonds being sold. This allows you to lock in better earnings, especially with longer-term options like Treasury notes or bonds. It’s a smart way to earn more while keeping risk low.

In short, Treasury securities work best when used wisely—during economic stress, inflation spikes, or rising rates, or as part of a long-term investment plan. However, if you just want a safe and steady income from interest, Treasury securities are always a strong choice, no matter when you invest.

Conclusion

Treasury securities are one of the easiest and safest ways to invest your money. Since they are issued by the US government, they are low-risk and dependable. This can be a great first step in your investment journey.

If you found this post helpful, please subscribe to our blog, follow us on social media, and check out our YouTube channel for informative videos!

Sources

- Photo: Unsplash: Vincent Yuan