The first step to achieving financial stability and freedom is learning how to assess your personal finances. Think of financial stability and freedom as destinations, and like any journey, you need a map to get there.

This map represents the advice you follow and the strategies successful people use to reach their goals. But even the best map won’t help if you don’t know your starting point. To figure that out, you need to assess your personal finances.

Doing so helps you understand where you stand, how far you are from your goals, and what it will take to reach them. On this page, I’ll tell you the process I used to achieve this.

Anyway, I’ll keep this post short, straightforward, and packed with useful information—so let’s dive into this quick guide!

1. Evaluate Your Income

Let’s start with the most satisfying part: evaluating your income. This means identifying where your money comes from.

Are you working one or two jobs? Do you get remittances from your family? Are you receiving government assistance or rental income? If it brings money to you, it counts as an income source—let’s keep it simple.

Next, assess how stable these income sources are.

Can you count on them to provide money over the next year? Is the amount consistent, or does it vary? What’s the minimum and maximum amount you can realistically expect from each source?

2. Examine Your Expenses

Now that you’ve looked at the positives let’s move on to the negatives: your expenses.

Depending on your current habits, this might take a day if you’re already keeping track of your expenses, or it could involve using an app or writing everything down for a month.

Start by listing all your expenses from the last month. Use a spreadsheet, app, or journal—whatever works best for you. Keep recording until you’ve identified everything you spent money on during that time.

Once you have a clear picture, categorize your expenses.

Are they fixed, like rent or bills? Were they impulse buys? Could they be considered splurges? Or are they necessary expenses beyond your basic needs?

3. Analyze Your Debts

Let’s tackle debts—another key part of your financial picture.

Start by listing all the debts you currently owe. This might be stressful—trust me, just hearing the word “debt” makes my heart sink—but it’s crucial to include everything. Yes, even that $10 your friend spotted you.

Once you’ve listed all your debts, categorize them by who you owe. Are they student loans? Borrowed money from family or friends? Bank loans? Credit card balances?

Next, note the due dates for repayment.

When does the lender expect you to pay them back? Also, record the interest rates for each debt—it’s important to know how much extra you’ll need to pay over time.

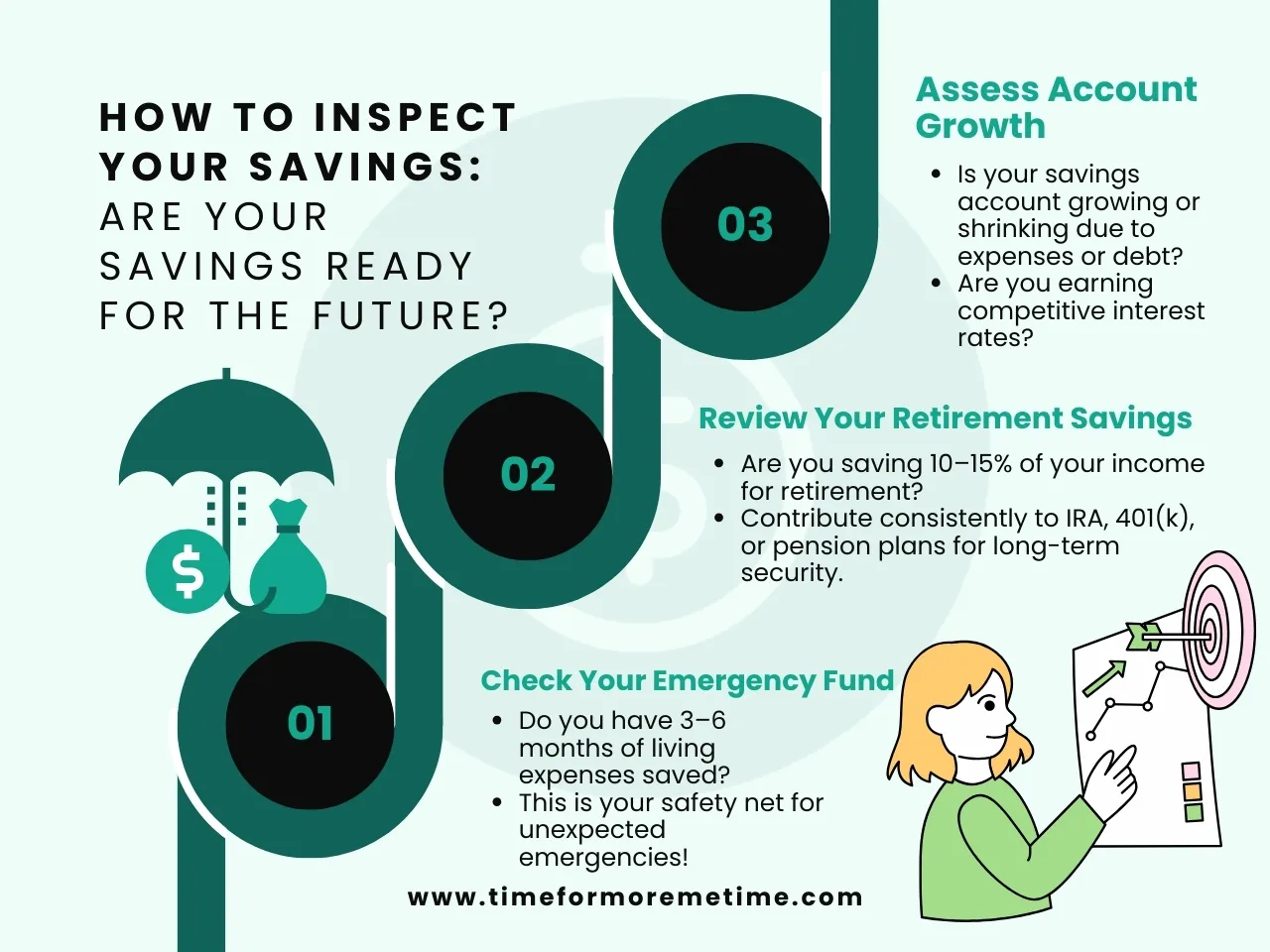

4. Inspect Your Savings

After understanding your income and debts, it’s time to take a good look at your savings. Start by checking your bank accounts.

Do you have an emergency fund? Ideally, it should cover at least three to six months’ worth of living expenses.

What about your retirement savings? Are you contributing consistently to accounts like an IRA, 401(k), or other pension plans? Ideally, 10–15% of your income should have been going toward retirement since you started working.

Finally, ask yourself a few more questions.

Is your savings account being depleted by your expenses or debt payments? Are you earning decent interest on your savings?

Understanding the state of your savings will help you prepare for future goals and unexpected challenges.

5. Evaluate Insurance

Your insurance is another important part of your personal finances. It acts as a safety net, protecting you from unexpected expenses while helping preserve your emergency fund and savings.

Start by reviewing your insurance policies.

Check how much money you could potentially cash out if needed and the maximum amount you could withdraw. While taking loans or cashing out your insurance isn’t always ideal, knowing your options is valuable for emergencies.

Lastly, ensure your insurance premiums are included in your list of expenses. Tracking these payments will give you a more accurate picture of your financial obligations.

Additionally, consider exploring strategies to lower your insurance premiums, such as bundling policies, maintaining a good credit score, or raising your deductible. These steps can help reduce costs and free up more room in your budget.

6. Analyze Your Finances And Debt To Income Ratio

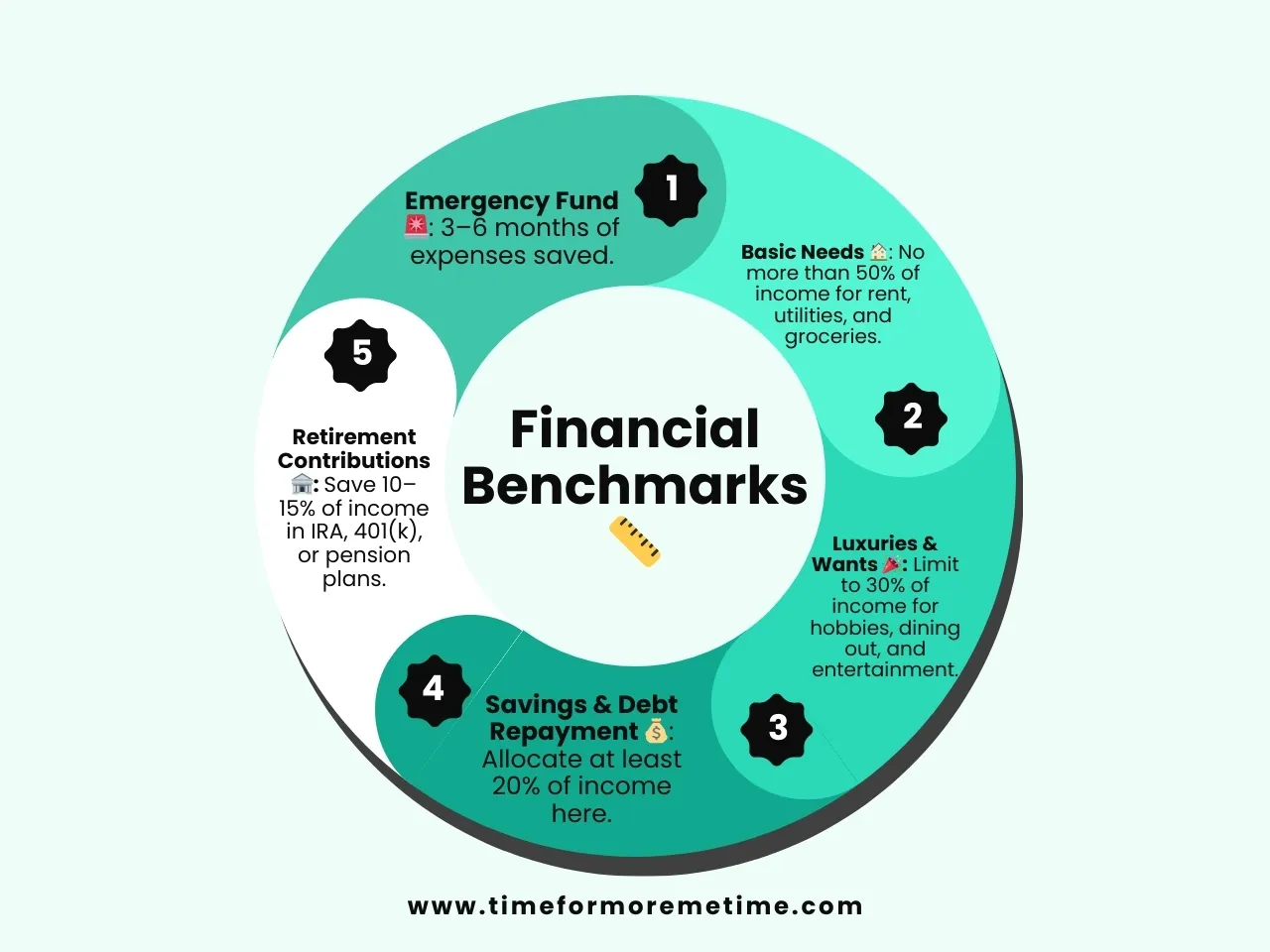

Now that you’ve gathered all the data, it’s time to crunch the numbers and set your goals. To help you get started, here are some common benchmarks for managing personal finances:

- Emergency Fund: Aim to have a safety net that covers at least three to six months of expenses.

- Basic Needs: Your essential expenses (e.g., mortgage, rent, utilities, groceries) should ideally take up no more than 50% of your income.

- Luxuries and Wants: Non-essential spending (e.g., hobbies, dining out, entertainment) should stay within 30% of your income.

- Savings and Debt Repayment: Set aside at least 20% of your income for these purposes whenever possible.

- Retirement Contributions: Aim to contribute 10–15% of your income toward retirement savings, such as an IRA, 401(k), or other pension plans.

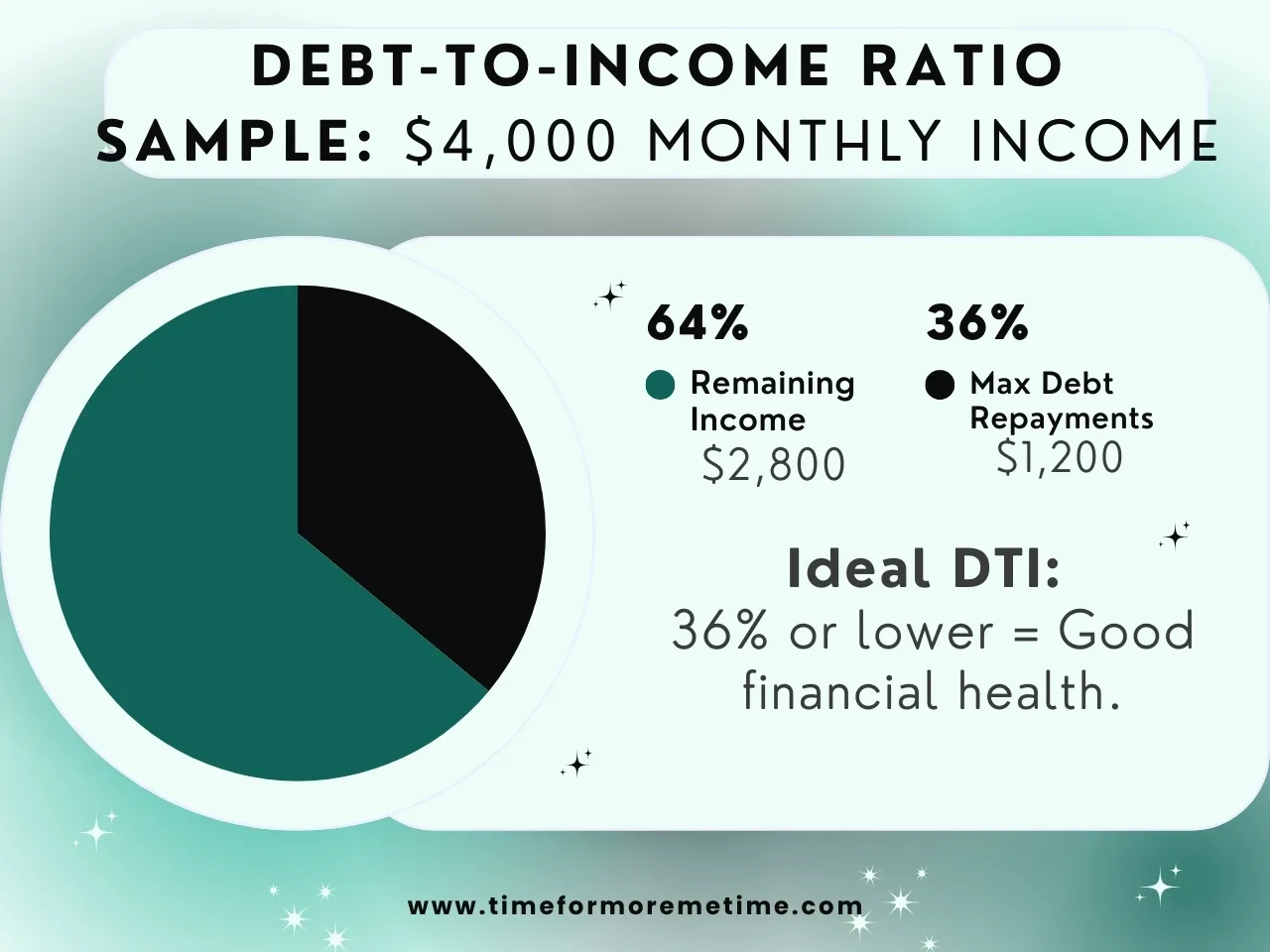

If you’re carrying a significant amount of debt, focus on your debt-to-income (DTI) ratio. The ideal DTI ratio is 36%. For example, if you have a monthly income of $4,000, then $1,200 (36% of your income) should be the maximum amount allocated for debt repayment.

A lower DTI means you’re in a good financial position, while a higher DTI suggests trouble. If your DTI is high, you may need to tighten your budget and focus on reducing debt.

Your DTI ratio can also guide you in making other financial decisions.

A lower DTI might signal that it’s time to explore investments, while a higher DTI could mean you need to reevaluate your insurance policies or make adjustments to your budget.

Conclusion

This process is what worked for me. I’d love to say it’s entirely my own creation, but it’s not. It’s the result of my research and personal experience applying what I’ve learned.

While it worked for me, I can’t promise it will work for everyone. It’s perfectly fine to be skeptical and think carefully about what you read online.

That said, I hope this short and simple guide has given you some useful ideas and inspired you to learn how to assess your personal finances. With time and effort, you can work toward achieving your financial goals.

If you found this helpful, be sure to check out my other articles for more tips on managing your money and reaching financial freedom. Don’t forget to subscribe to my YouTube channel, Time for More Me Time, for even more insights and inspiration!

Sources

- Photo: Unsplash: Alexander Mils