Saving money can be tough. Many people find it hard to set aside even a little each month. This can lead to stress and confusion about what to do next. You are not alone, and there are easier ways to save.

I understand this struggle. I remember when I was in San Francisco and intended to save money but ended up spending most of it on food and errands. I followed this pattern for years until I found a better way. Now I can show you a method that works even when life is busy.

In this post, you will learn how to automate your savings. This makes saving simple and stress-free. Let’s get started!

1. Request Your Employer To Split Your Paycheck

Making saving easier starts with having part of your paycheck go directly into your savings account. This keeps your money separate and helps you stay on track. Your employer can send a portion of your pay to your main account and the rest to a savings account.

Many people do this because it reduces the pressure of deciding how much to save each month. When you don’t see the money in your main account, saving feels more natural and less forced.

To begin, ask your employer if they offer split direct deposits. Consider using a high-yield savings account for the second account, so your money can grow faster. This simple change can help you make steady progress.

2. Dedicate Certain Sources Of Income To One Account

A straightforward way to boost your savings is to put all your extra income into one account. This keeps your main paycheck available for bills, food, and rent while giving your extra income a clear purpose. I started doing this when I earned small amounts from my old online stores.

By doing this, you’ll see steady growth because the money goes straight into a fixed deposit or savings account before you can spend it. This helps you avoid any guilt from spending since you aren’t touching your regular budget. It feels easier to save when the money goes into a separate account each time, helping you build strong habits over time.

Have you ever used passive income without much thought? If so, this method can be useful. You can direct all your side income into a savings account so it can grow. You can also set aside part of your tax refund for this account since the IRS allows you to split refunds into different accounts. This approach makes saving feel simple and automatic.

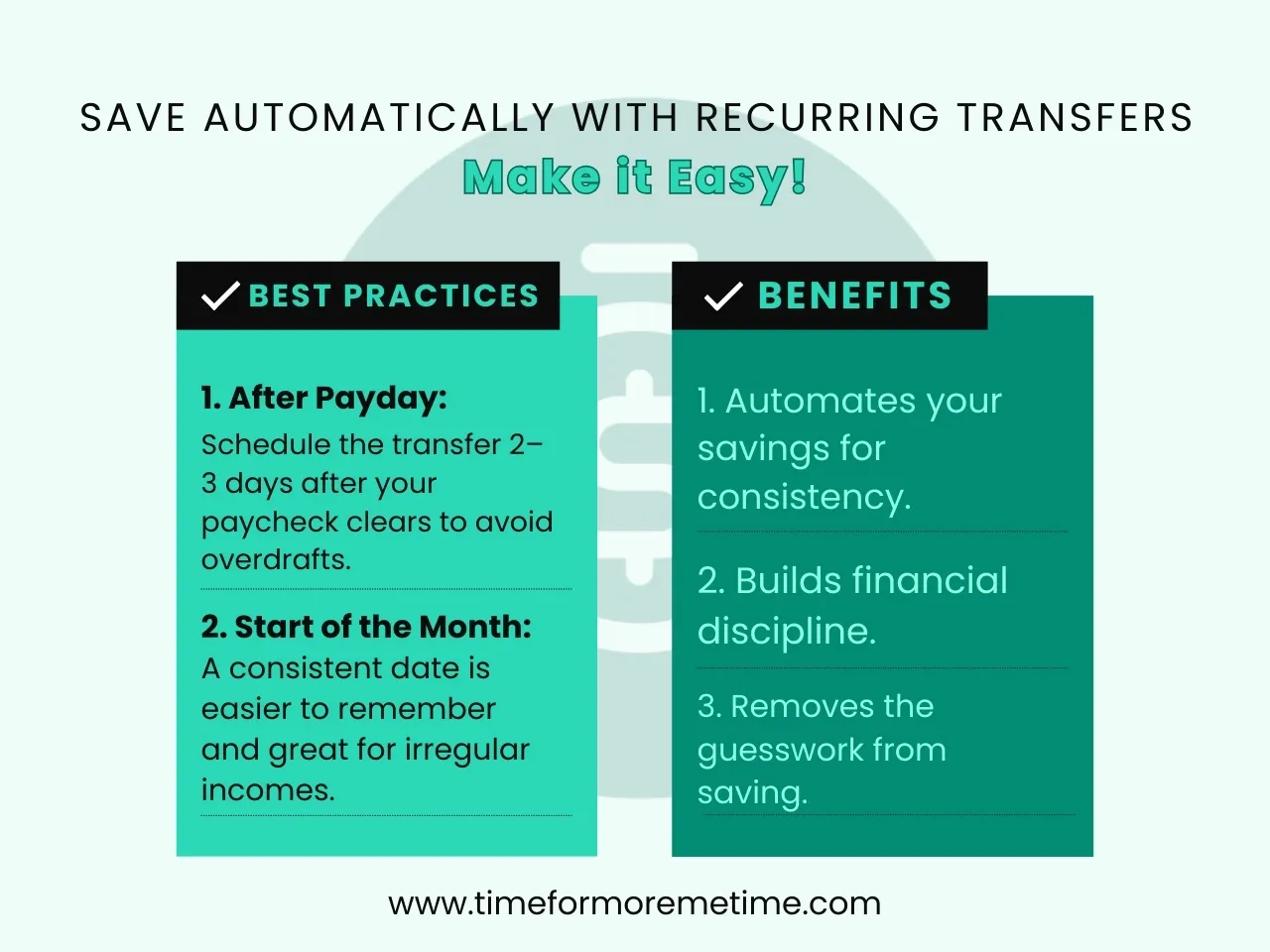

3. Set Up Recurring Transfers

A simple way to save money each month is to have your bank automatically move funds for you. This means a set amount from your checking account goes to your savings account on a regular schedule. It works in the background, so you don’t have to think about it. I set up recurring transfers when I was working long shifts at UCSF, which made saving easy.

This method reduces stress and keeps things consistent. It also stops the habit of spending money before saving it. As a result, saving feels steady and predictable, keeping your finances on track, especially during busy times.

You can schedule the transfer a few days after payday to ensure you have enough money in your account. If your income varies, you might choose the first day of the month instead. This simple habit helps your savings grow.

4. Enroll In A 401(k) Account

A great way to save for the future is to use a 401(k) account. This account automatically takes money from your paycheck and puts it into savings before you can spend it, helping you build retirement savings over time. I started using my 401(k) when I first worked full time in Buffalo, and it made saving feel easier.

With a 401(k), money is pulled directly from your pay. An added benefit is that some employers match your contributions, which helps your savings grow faster. Since the money moves before reaching your checking account, it encourages you to stick to your savings plan.

You have two options: a traditional 401(k), which can lower your taxable income, or a Roth 401(k), which allows tax-free withdrawals later on. Both keeps your money safe until you reach retirement age, making it a solid and automatic path to a secure future.

5. Get A Piggy Bank

A straightforward way to save money is by using a piggy bank at home. This works well, even in a world where many people use cards and apps. It gives your spare cash a designated space. I started using one when I was looking for an easy way to save without overthinking it.

Many people forget how quickly coins and small bills can add up when they mainly use card payments. This approach turns loose change into steady savings and helps you build a habit that feels natural after a few weeks. It’s simple and stress-free.

Each time you come home, place your coins and small bills into the piggy bank—I actually use a fish bowl as a piggy bank though. I drop every coin and dollar into mine. It may seem small at first, but it grows quickly with daily contributions. This makes saving feel easy and automatic.

6. Do The Spend And Save Pair Method

A helpful way to grow your savings is to pair every planned purchase with a small savings amount. For each item you buy, you also move a set amount into a special savings account. It turns spending moments into saving moments.

In my experience, about seven out of ten things I bought each month were expected purchases. This showed me that pairing these buys with small savings could create a strong financial habit. It made me feel more in control, knowing that each choice was benefiting my future. And it feels reassuring, as even small purchases contribute to long-term goals.

Choose a small savings amount for every planned purchase, like one or five dollars. You can even use a set percentage. This method is effective because it turns your regular spending into steady progress. It is simple and refreshing compared to other savings advice you often see.

Conclusion

While these strategies can teach you how to automate savings effectively, it’s important to proceed with caution. Automating your savings is a powerful tool, but being too aggressive can leave you strapped for cash.

So, be mindful. Take the time to calculate how much you can realistically set aside without compromising your day-to-day needs. While building a solid financial future is essential, don’t forget to take care of your present self.

Most importantly, don’t forget to subscribe to our YouTube channel @timeformoremetime to be updated on finance-related and time-saving tips! Or check our articles if you want to know more about ways to earn extra money!