If you’re here, chances are you’re wondering how to choose the right savings account to fit your financial goals. On average, an American has at least five bank accounts. I’ll admit—I have a few myself. Each of these accounts serves a specific purpose, and there’s a good reason behind why I opened them.

Many people think of a savings account as just a place to store money, but it can be much more than that.

Choosing the right one can make a real difference in how you manage and grow your savings. That’s why it’s worth taking a little time to figure out which account best suits your needs.

Not sure what to look for in a savings account? Don’t worry—I’ve got you covered! Here are some important factors to consider:

1. Interest Rates

First and foremost, when learning how to choose the right savings account, a high-interest rate should be one of your top priorities.

Why? Because the interest rate is what sets a savings account apart from a piggy bank. While your money sits in the account, it earns a small amount of interest over time, helping your savings grow without any extra effort on your part.

High interest rates are especially important if the account is meant for long-term savings, like an emergency fund or a sinking fund. Over time, even a slightly higher rate can make a noticeable difference in how much you save.

On the other hand, if the account is meant for frequent use—such as paying bills or covering daily expenses—you don’t need to focus too much on the interest rate. In these cases, accessibility and low fees might be more important.

2. Minimum Balance Requirements

A minimum balance requirement might seem like a small hurdle when opening an account, but it’s something you should seriously consider. Choosing a savings account with the right minimum balance requirement can save you from unnecessary stress and fees down the road.

If you’re just starting to save or often find your balance running low, an account with no minimum balance requirement is ideal.

This way, you won’t have to worry about accidentally incurring penalties or, worse, having your account closed because you didn’t meet the required balance.

For those who can comfortably maintain a higher balance, accounts with minimum balance requirements might offer perks like better interest rates or waived fees.

Just make sure the minimum is realistic for your current financial situation.

Bottom line: pick an account that aligns with how you manage your money today, not just what you hope to achieve in the future. This will help you avoid unnecessary fees and keep your savings journey on track.

3. Initial Deposit

Just like minimum balance requirements, the initial deposit is something to keep in mind when opening a savings account. This is the amount of money you’ll need to put in upfront to get started, and it can sometimes influence the features or benefits of your account.

For example, some accounts with higher initial deposit requirements may offer better interest rates or other perks, such as waived fees or bonus rewards. If you’re in a position to make a larger initial deposit, these accounts could provide added value.

However, if your budget is tight, look for accounts with low or no initial deposit requirements. These options make it easier to get started, especially if you’re working on building your savings from scratch.

In short, choose an account with an initial deposit requirement that works for your current financial situation. This way, you can start saving without unnecessary stress while still enjoying the benefits your account offers.

4. Fees

Another important factor to keep in mind when learning how to choose the right savings account is the fees.

In a perfect world, banks would reward you for trusting them with your money. After all, they use your savings for their investments. However, many banks charge fees, and some of these can be hidden or unexpected.

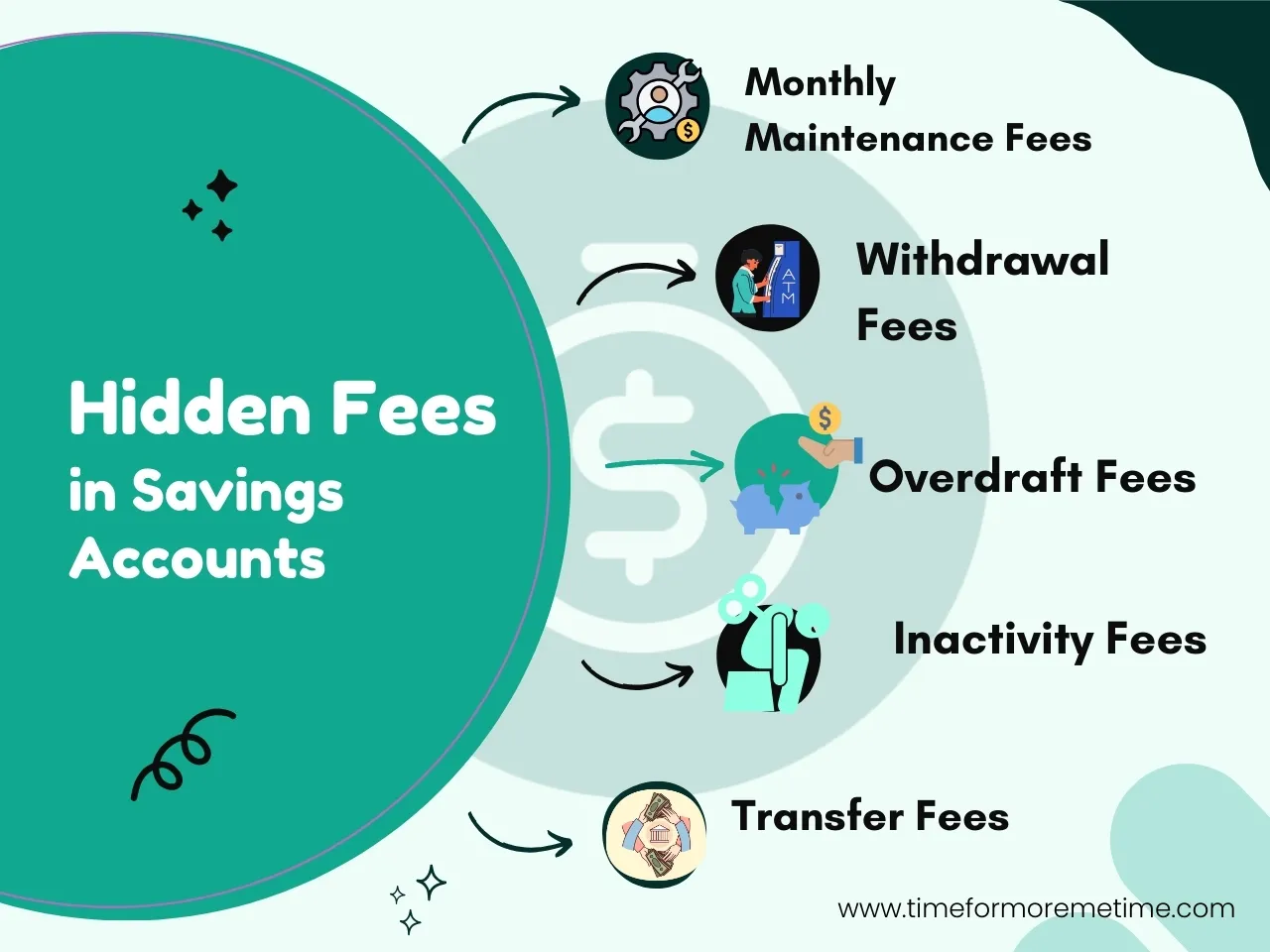

Common fees to watch out for include:

- Monthly Maintenance Fees: Charged just for keeping the account open.

- Withdrawal Fees: Applied if you exceed a certain number of transactions per month.

- Overdraft Fees: If your account goes negative.

- Inactivity Fees: Charged when there’s no activity in the account for an extended period.

- Transfer Fees: Charged when moving money between accounts, especially if they’re at different banks.

To avoid surprises, always read the fine print and ask questions about fees before opening an account. Also, if there are fees, ask if it is possible to waive them.

The best savings accounts have low or no fees, which is especially helpful if you’re just starting to build your savings. However, if some fees are unavoidable, adapt your account usage to minimize them. For example, limit unnecessary withdrawals or meet the conditions to waive fees.

5. Features And Additional Banking Services

Besides earning interest, one of the main things that sets a savings account apart from a simple piggy bank is the extra features and services it offers. These can make managing your money easier and more efficient.

When learning how to choose the right savings account, consider your financial situation and how you plan to use the account. Look for features and services that align with your needs. Some common and helpful options include:

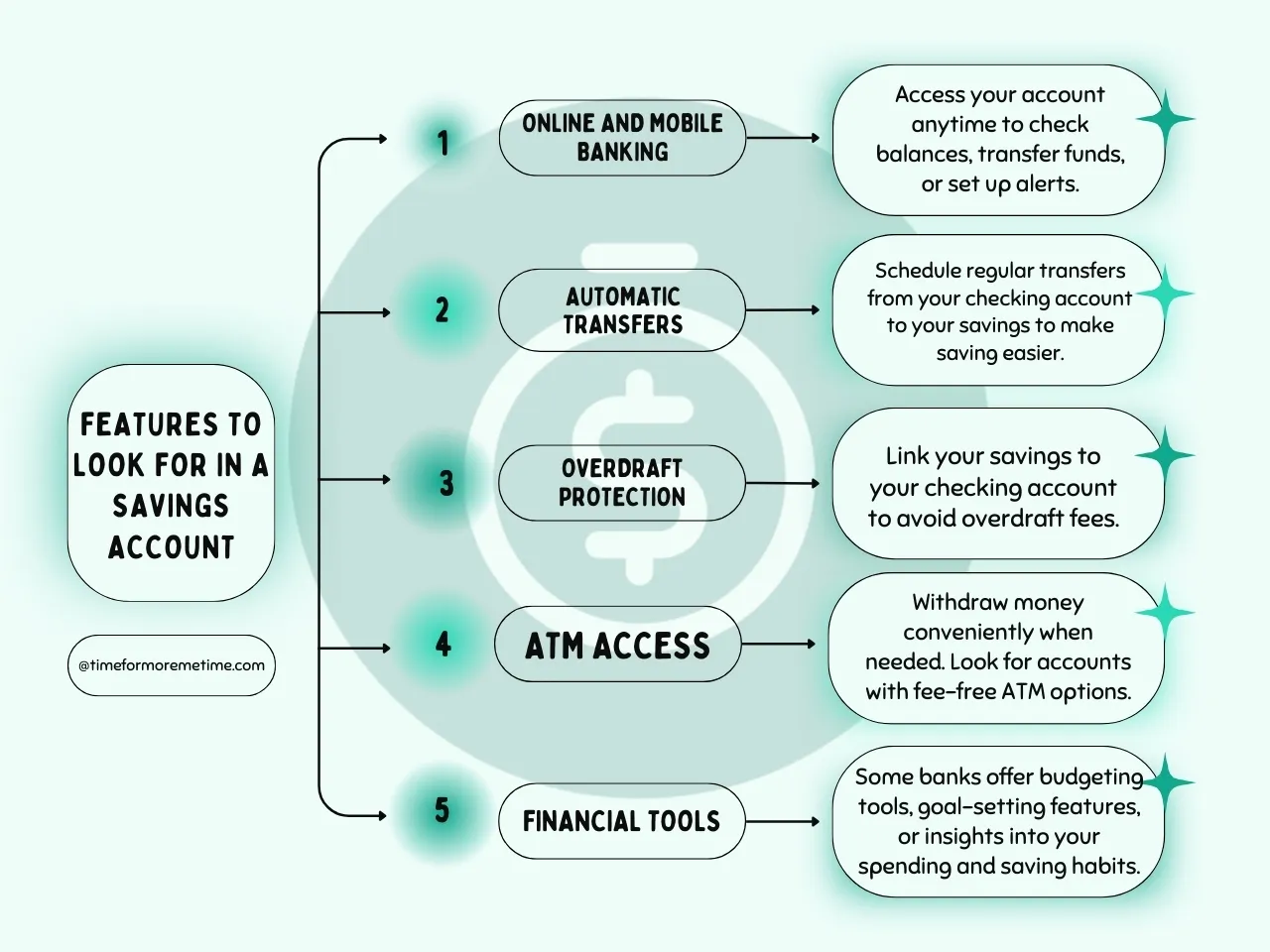

- Online and Mobile Banking: Access your account anytime to check balances, transfer funds, or set up alerts.

- Automatic Transfers: Schedule regular transfers from your checking account to your savings to make saving easier.

- Overdraft Protection: Link your savings to your checking account to avoid overdraft fees.

- ATM Access: Withdraw money conveniently when needed. Look for accounts with fee-free ATM options.

- Financial Tools: Some banks offer budgeting tools, goal-setting features, or insights into your spending and saving habits.

Thankfully, many of these features are standard with most savings accounts today. However, some services, like overdraft protection or advanced financial tools, might not be included by default. It’s always a good idea to ask your bank about the unique features they offer and whether they align with your needs.

Conclusion

By keeping these factors in mind, you’ll be able to choose a savings account that fits your needs and current financial situation. Although these considerations might seem simple, many people overlook them, leading to unpleasant surprises and regret later on.

Take the time to evaluate your options carefully. A little effort now can save you from potential headaches in the future and ensure your savings account works for you, not against you. Good luck!

If you want to learn more about boosting your finances, check our other articles or follow our YouTube Channel to get notified for new videos. Subscribe now, and let me guide you toward financial freedom!

Sources

- Photo: Unsplash: Andre Taissin