When reviewing my budget, I often notice that insurance is one of my biggest recurring expenses. For a long time, I felt frustrated but didn’t take action—until I learned how to lower insurance premiums and started saving significantly.

That change gave me some relief, but I hadn’t realized just how much I’d benefited until a recent conversation at work.

A few days ago, while eating at work, one of my coworkers started venting about how high his insurance premiums were to another coworker. Upon hearing his complaints, it reignited my own frustration, and I joined the conversation.

It turned out to be an eye-opening moment. After sharing my experience, we discovered that my insurance premiums were actually the lowest among us.

I had always thought mine were expensive, but my coworkers’ premiums were far beyond anything I’d imagined. Honestly, I’d be outraged if I had to pay that much every month.

Naturally, my coworkers were curious about how I managed to keep my premiums so low. They asked me for advice, and I shared what I knew.

However, I gave them a disclaimer—I wasn’t entirely confident about everything I said and promised to do some research to provide them with accurate information.

Since I’ve already done the work, I figured I might as well write it down here and share these tips with anyone else who might find them helpful. While my premiums aren’t unmanageable, I know that many people feel overwhelmed by their insurance costs.

With that in mind, here are some practical strategies to help you lower your insurance premiums. A penny saved is a penny earned, and every dollar you save on insurance can be invested in a brighter future.

1. Shop Around And Compare Quotes

The biggest difference between me and my two coworkers is that I have a different insurance provider. It turns out my provider offered the best deal among us.

This made me realize how much insurance rates can vary between companies—sometimes by a surprising amount.

After doing some additional research online, I confirmed that rates can differ wildly from one provider to another. So, the obvious takeaway here is to take the time to get quotes from multiple companies to find the most competitive rate for your needs.

When shopping around, aim to check at least three to five providers.

It may take some time, but the effort is worth it for the potential savings. Be sure to ask about discounts or bundled policies when requesting quotes, as these can significantly reduce costs.

To make the process easier, consider using online comparison tools. These tools can quickly provide side-by-side comparisons, helping you figure out which option is the best fit for you.

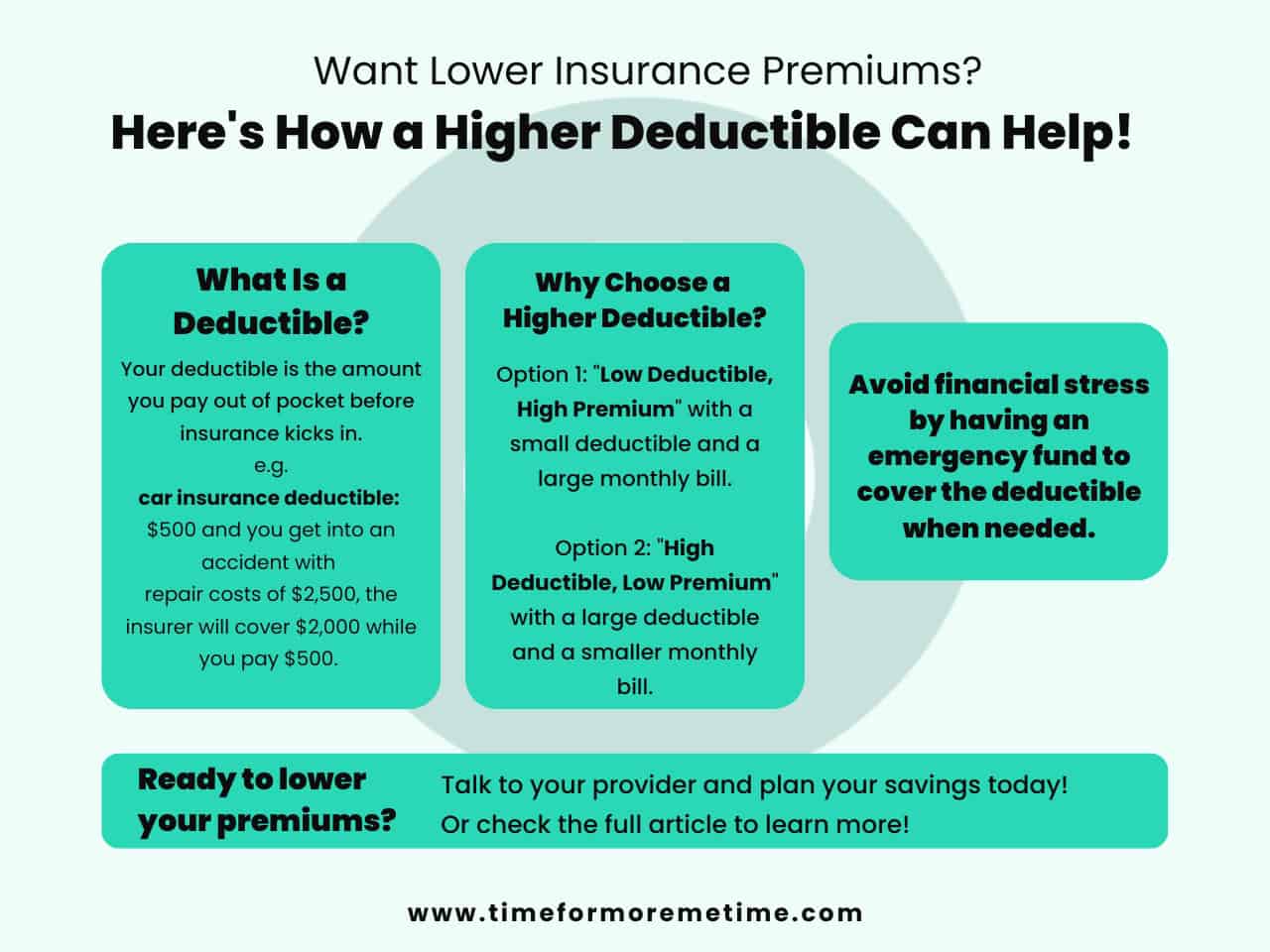

2. Increase Your Deductible

Another difference we noticed during our discussion about insurance policies and premiums was the deductibles. It turns out I have higher deductibles compared to my coworkers, and this significantly affects the cost of my premiums.

If you’re not familiar with the term, a deductible is the amount you agree to pay out of pocket before your insurance kicks in.

For example, if your car insurance deductible is $500 and you get into an accident with repair costs of $2,500, the insurer will cover $2,000 while you pay $500. Because you’re taking on more risk with a higher deductible, the insurer reduces your premium.

When I first got my insurance, I chose high deductibles because I couldn’t afford high monthly premiums at the time. To manage the risk, I made sure to build good habits and avoid situations where I might need to file a claim.

The takeaway here is that choosing a higher deductible can be a smart strategy in how to lower insurance premiums.

However, it’s essential to have savings or an emergency fund in place to cover the deductible if you ever need to make a claim. Planning ahead can help you balance affordability with preparedness.

3. Bundle Your Policies

Another way I’ve managed to save on insurance is by bundling my policies. Most of my insurance plans—like auto, home, and even life insurance—are with the same provider.

Initially, I chose this setup for convenience.

But I later realized it also helped reduce my premiums. In contrast, my coworkers have different insurers for various aspects of their lives. If I had gotten my insurance more recently, I might have ended up like them.

However, my provider is one of the older, more established options, and bundling was a natural choice given the limited options back then.

In addition to bundling, discounts can also help lower premiums.

While I don’t have specific discounts on my account, some of my coworkers do. They opted for separate insurers to take advantage of targeted discounts, thinking this would offset their costs.

However, bundling often provides greater savings overall, especially when combined with loyalty perks from a single provider.

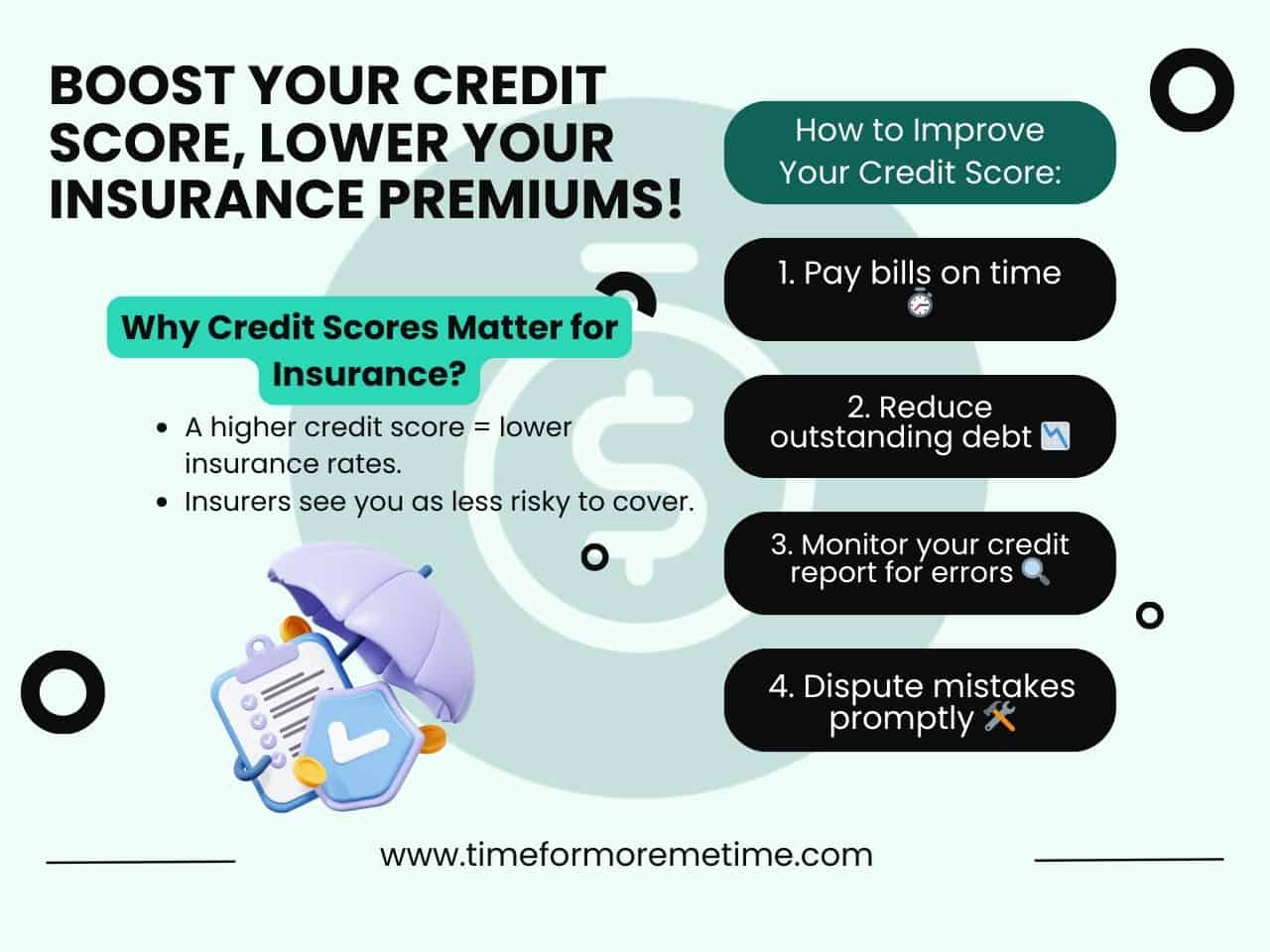

4. Maintain A Good Credit Score

This one seems obvious to me since credit scores were a big deal when I first started managing my finances.

I’ve always had a good credit score, but I didn’t realize how much it could impact insurance rates until one of my coworkers brought it up. That got me curious, so I did some research to learn more about the connection.

It turns out that credit scores play a significant role in determining your insurance premiums. A higher score often leads to lower rates because insurers see you as less of a risk.

The basic steps to improve your credit score are to pay your bills on time and reduce any outstanding debt.

Also, don’t forget to regularly monitor your credit report for errors. And if you spot any mistakes on your credit report, be sure to dispute them.

Staying on top of your credit score not only helps with insurance but can also save you money in other areas of your financial life.

5. Drive Safely And Avoid Accidents

We—my coworkers and I—all agreed that our car insurance premiums are relatively low. Most of us are decent drivers, and we take good care of our vehicles. We believe these factors play a big role in keeping our premiums down.

However, if your car insurance costs as much as or more than your homeowners or renters insurance, it might mean your insurer sees you as a high-risk driver.

To change your insurer’s perception of you being a high-risk driver, take steps to prove you’re a low-risk driver. Start by practicing safe driving habits and avoiding traffic violations.

A clean driving record can help you avoid surcharges after an accident and may even qualify you for safe driver discounts.

If you’ve had an accident in the past, consider taking a defensive driving course. This not only demonstrates your commitment to safety but can also potentially lower your premium.

Additionally, my research revealed that other factors can affect the cost of your car insurance. While some of these are beyond your control, like age, others, like the type of vehicle you drive and the coverage level you choose, can be adjusted to better suit your budget.

6. Choose Usage-Based Or Pay-Per-Mile Insurance

Another way to reduce your car insurance costs is to switch to a usage-based or pay-per-mile policy if you don’t drive your vehicle often. This type of insurance adjusts your premiums based on how much you use your vehicle or how far you travel.

Though, I have the default plan because I drive to work nearly every day. However, if you work from home or don’t drive as much, a pay-per-mile policy could be a better fit for you.

Pay-per-mile insurance works by offering a low base rate premium, with additional charges added based on the number of miles you drive.

Insurers have different methods for tracking your driving. Many will use a telematics device installed in your vehicle’s diagnostic port to monitor your mileage and sometimes even your driving habits.

Some insurers now use smartphone apps with GPS to track your driving, which can be convenient and non-intrusive.

For those with vehicles that don’t have a diagnostic port or for those who are concerned about privacy, insurers may also track mileage based on your car’s odometer readings.

This flexibility makes it easier to find a plan that suits your driving habits.

7. Leverage Discounts

Going back to discounts, it’s always a smart idea to look out for programs or offers that can help lower your premium. Discounts can add up and make a noticeable difference over time.

Before shopping around for a new insurer, check with your current provider to see if there are any discounts you might qualify for. Some common ones include multi-policy or bundled discounts or even a good student discount if you’re still in school.

Also, ask your insurer about specific actions you can take to qualify for additional discounts.

For example, homeowners insurance often offers reduced premiums for installing safety features like alarms or anti-theft devices. Taking the time to explore these options can help you save money without switching providers.

However, don’t focus on discounts alone. Don’t get into the same situation as my coworkers. Prioritizing discounts led them to find deals that seemed better but left them juggling multiple individual insurance policies.

Before jumping into any discount, be diligent and thoroughly evaluate your options to ensure it’s genuinely beneficial.

8. Consider Professional Associations Or Group Plans

A simple way to save on insurance is by using professional associations or group plans. Many alumni groups, professional organizations, and trade associations offer discounted insurance rates to their members.

If you’re looking to switch or learn how to lower insurance premiums, it’s a good idea to check with any professional or alumni groups you belong to.

These organizations often work with insurance companies to provide members with special deals or better rates, which can help you save money. Do remember that the size of the group can influence the price of your premium.

If you’re not already a member of one of these groups, it’s worth looking into others that might offer these benefits. Many professional networks or industry-specific groups have partnerships with insurance companies that can lead to significant savings.

Keep in mind that some groups may have specific eligibility requirements, so be sure to check the details and see what kinds of policies they offer. Some might focus on specific types of insurance, like health, auto, or home insurance.

If you can’t find a suitable group, you might also consider starting your own.

By forming a group, you and others can have more power to negotiate better rates with insurance providers. The larger your group, the more bargaining power you’ll have, which can result in lower premiums.

While organizing a group may take some effort, the potential savings on your insurance premiums could make it worth the time.

9. Stay Healthy

As someone in the health industry, I can’t stress enough how important it is to stay healthy—or work on getting healthier.

You may already know how much money flows through hospitals, and the amount I see being processed in my workplace is truly mind-blowing.

Remember, no matter how much you pay in premiums, they won’t protect you from diseases or health issues.

In our line of work, we aim to help you avoid reaching a point where you need to contact your health insurer, except for something simple like claiming your dental coverage.

That being said, maintaining good health and reducing your risk factors can play a significant role in lowering your premiums. Health insurance companies often base their premiums on your overall health, so the healthier you are, the less you may have to pay.

Also, if your insurer offers wellness programs, be sure to take advantage of them. These programs can help you improve your health, and some insurers even offer discounts or rewards for participating.

Staying healthy not only benefits you in the long run but can also lead to substantial savings on your insurance premiums.

10. Review Your Coverage Regularly

By reading this, you’re already taking the first step. Learning about ways to reduce your premiums can be a huge help when reviewing your coverage. Over time, your insurance needs may change, so it’s important to stay on top of this.

Don’t just evaluate your policies once. Make it a habit to review your coverage every year to ensure you’re not paying for things you no longer need. This can help you identify unnecessary costs and adjust your plan accordingly.

It also helps to talk to friends, family, and even coworkers about their insurance plans. I can personally say this approach worked well for me.

It allowed me to better understand my own coverage and discover additional ways to lower my premiums. Sharing experiences with others can offer new insights and help you make more informed decisions about your insurance.

FAQs

Before we end this post, you might want to check some of the frequently asked questions about lowering insurance premiums.

What should I do if my premiums increase even though my situation hasn’t changed?

If your premiums increase despite no significant changes in your situation, the first step is to review your policy details carefully. Look for any reasons listed by your insurer for the increase, such as rising repair costs, changes in state regulations, or changes in the provider’s pricing structure.

Sometimes, insurers adjust their rates due to broader economic factors or claims within your area.

Contact your insurance company to ask for clarification on the reasons behind the increase. It’s possible that they can offer discounts or adjust your policy to keep your premiums affordable.

How do insurance companies decide how much to raise premiums each year?

Insurance companies typically raise premiums based on several factors that reflect the overall risk involved with insuring a policyholder. One of the primary factors is claims history, both on an individual and collective level.

If you or other policyholders in your area have made frequent claims, it signals a higher risk to the insurer, prompting them to raise rates to cover potential future claims.

Insurance providers also consider the rising costs of repairs, medical expenses, or replacements due to inflation, which directly impacts the cost of covering claims.

In some cases, insurers might also adjust premiums based on overall market conditions or changes in the legal or regulatory landscape, such as changes in state laws or health insurance mandates.

Can I reduce my premiums by reducing my coverage limits?

Yes, reducing your coverage limits can lower your insurance premiums. Coverage limits refer to the maximum amount an insurer will pay for a covered loss, such as property damage or medical expenses.

By lowering these limits, you’re taking on more financial risk in exchange for a reduced premium.

For example, if you lower your liability coverage or reduce the personal injury protection limit, your insurer will charge you less since they’re covering a smaller portion of the potential costs.

However, it’s important to evaluate how much risk you’re comfortable with before making any reductions.

You should ensure that your coverage still meets legal requirements and that you can comfortably cover any out-of-pocket expenses should something go wrong.

Conclusion

I’m really glad I had the chance to discuss my concerns about insurance premiums with my coworkers. It helped me better understand my own situation and gave me a chance to educate myself further on the topic.

I’m also happy that I can now share the insights I’ve gained with all of you. It’s great to know that the things I’ve learned can be helpful to others.

To wrap things up, remember that being proactive and informed is key to lowering your premiums effectively. By following the tips I’ve shared, you might be able to save some money that could add up over time.

Every dollar saved on premiums is a dollar that can be redirected toward your long-term financial goals, helping to build a more secure and promising future. So, take control, explore your options, and make informed choices to start saving today!

If you want to further enhance your financial well-being, check our other articles or follow our YouTube Channel to get notified for new videos helping your learn more about financial freedom!

Sources

- Photo: Unsplash: Vlad Deep