Learning how to monitor your finances is an essential skill that everyone should practice. It’s the foundation for managing your money effectively, helping you save more and make better financial decisions.

In this post, I’ll share the steps I’ve taken to keep track of my finances. Some of these methods might seem old-fashioned, but they’ve worked well in giving me a clear picture of my financial situation.

I’ll also mention a few modern, tech-savvy approaches that leverage apps and tools for convenience.

Anyway, no need to wait any longer—let’s dive into the steps you can take to monitor your finances:

Collect And Keep Receipts And Statements

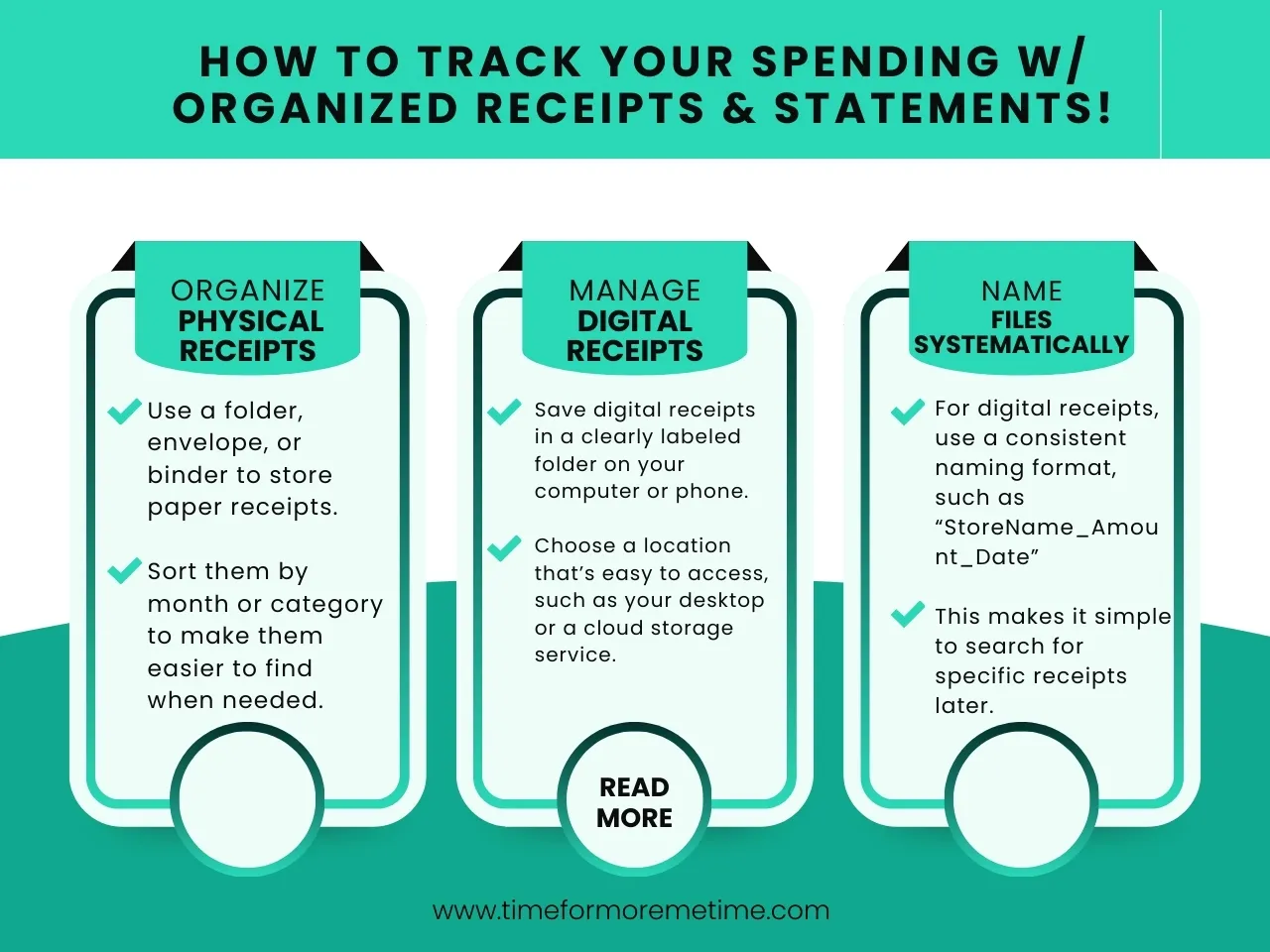

The first step in monitoring your finances is to collect and organize your receipts and billing statements. These records are crucial for gaining a clear picture of your spending habits and making it easier to review your purchases later.

Whether you’re dealing with physical copies or digital files, learning how to monitor your finances starts with keeping these documents well-organized to track where your money goes. Here’s how to do it effectively:

- Organize Physical Receipts: Use a folder, envelope, or binder to store paper receipts. Sort them by month or category to make them easier to find when needed.

- Manage Digital Receipts: Save digital receipts in a clearly labeled folder on your computer or phone. Choose a location that’s easy to access, such as your desktop or a cloud storage service.

- Name Files Systematically: For digital receipts, use a consistent naming format, such as “StoreName_Amount_Date” (e.g., “GroceryStore_45.60_2025-01-10”). This makes it simple to search for specific receipts later.

Beyond helping you track and monitor your finances, these records can also simplify tax preparation. Keep receipts for deductible expenses to ensure you have proof when filing taxes.

Also, it can help you resolve disputes in your purchases. The receipts can provide documentation in case of billing errors, faulty products, or disputes over payments.

Make Your Own Receipts

If a seller doesn’t provide a receipt for your purchase, it’s a good idea to create one yourself. Start by buying a small notebook to keep track of these transactions. Simply write down the following details for each purchase:

- The seller’s name or business name

- The item or service you bought

- The price you paid

- The date of the transaction

- Any additional information or notes you want to take

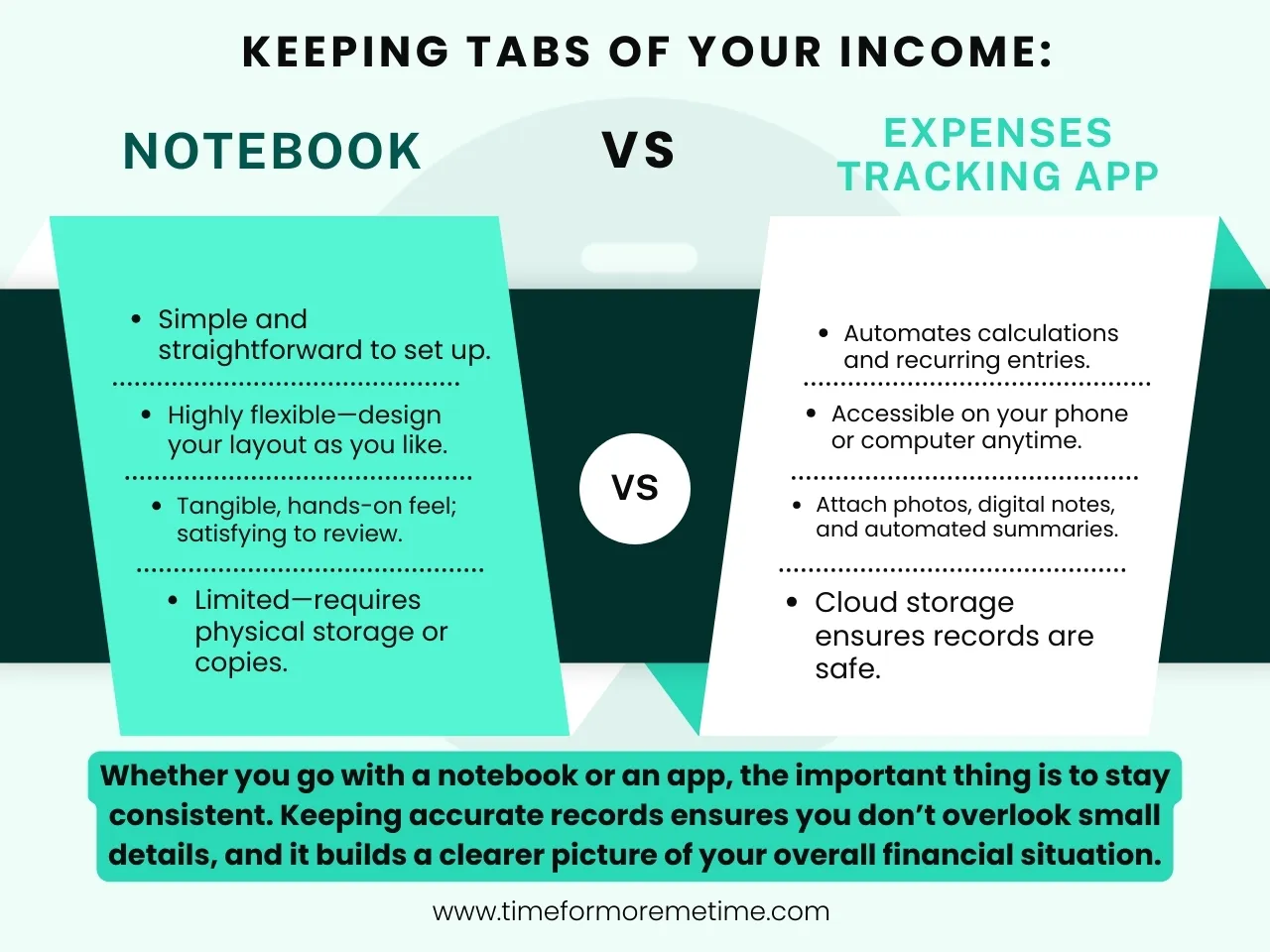

Learning how to monitor your finances isn’t just about tracking spending—it’s also useful for keeping tabs on your income.

Whenever you receive cash, record it in your notebook with the date, the source, and the amount. This practice helps you remember where your money comes from and ensures your records stay complete.

If you prefer, you can use an expenses tracking app instead of a notebook. Many apps allow you to quickly log transactions and even attach digital notes or photos for reference.

Personally, I like using a notebook because there’s something satisfying about writing things down and reviewing them on paper. It makes auditing my finances feel more tangible and keeps me focused.

Whether you go with a notebook or an app, the important thing is to stay consistent. Keeping accurate records ensures you don’t overlook small details, and it builds a clearer picture of your overall financial situation.

Install Mobile Banking Apps

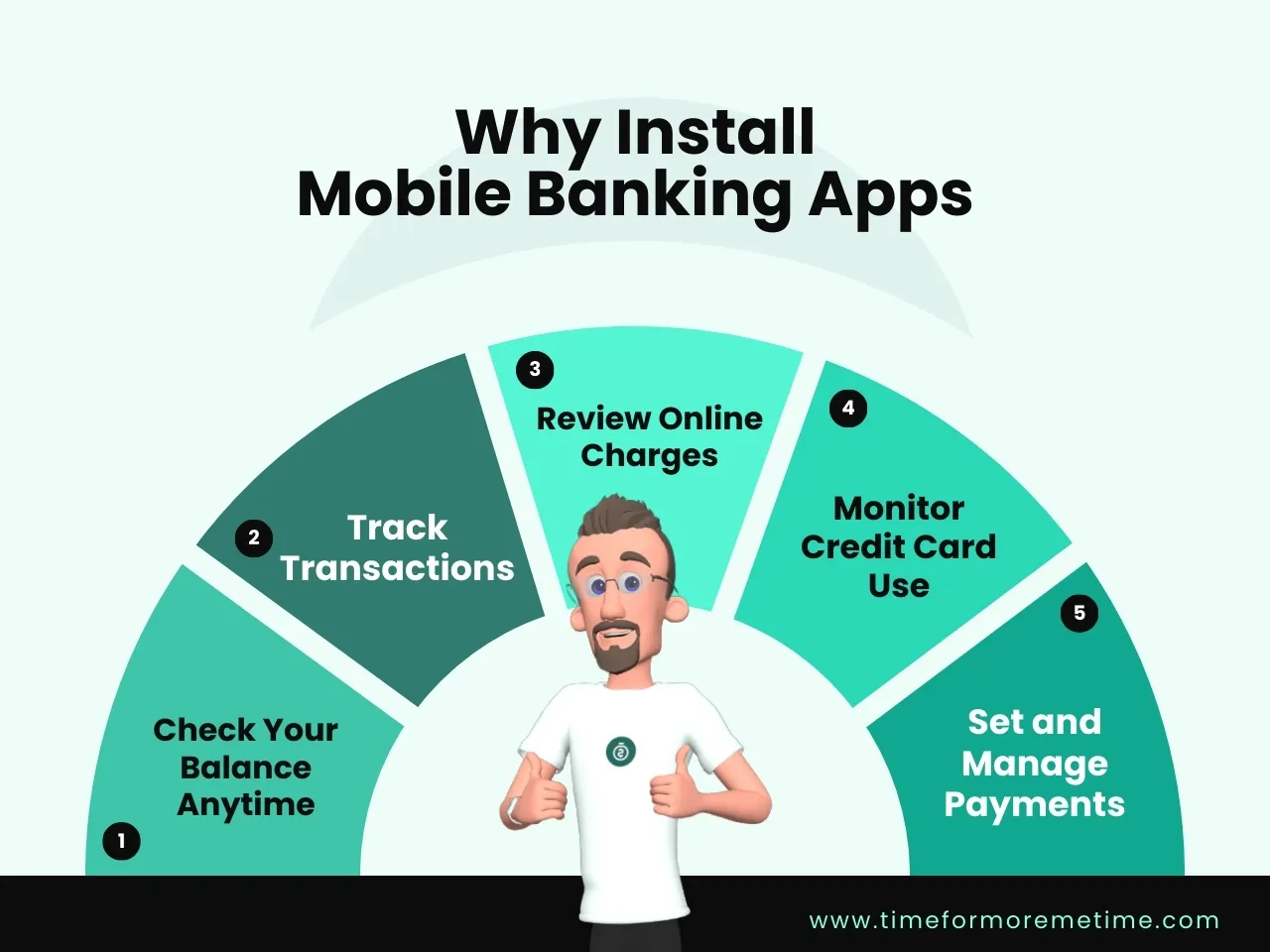

Be sure to download and install your bank’s mobile app. These apps are powerful tools that make it easy to monitor and manage your finances from anywhere.

With a mobile banking app, you can:

- Check Your Balance Anytime: Quickly see your current account balance without needing to visit a bank or ATM. You can also view your monthly statement there.

- Track Transactions: Most apps automatically record all account activity, including deposits, withdrawals, and money transfers.

- Review Online Charges: Keep an eye on online purchases, subscription fees, and other electronic transactions.

- Monitor Credit Card Use: If you have a credit card linked to your account, the app will show charges and payments, giving you a full picture of your spending.

- Set and Manage Payments: Schedule bill payments or transfer money to other accounts with just a few taps, helping you stay on top of due dates and avoid late fees.

Be sure to enable notifications on these apps to instantly be informed of any activities involving your account or any offers that your bank may have. Anyway, these features provide complete oversight of your account activity, helping you stay informed and avoid overspending.

Predict And Anticipate Expenses

When monitoring your finances, it’s important to not only track your current spending but also predict and plan for future expenses. This is expense forecasting.

Focus specifically on your expenses rather than your income—this helps you prepare and manage your money more effectively.

For instance, think ahead about costs like buying gifts for friends and family during holidays or special occasions. By anticipating these expenses, you can set aside money in advance—known as sinking funds, reducing the risk of overspending or dipping into savings.

Audit Weekly Or Monthly

Once you’ve collected all your financial data, it’s time to audit your finances and perform a financial checkup on yourself.

Regular audits—whether weekly or monthly—help you understand your spending patterns, identify areas to cut back, and ensure your financial goals stay on track.

Collect all your receipts, makeshift receipts, billing statements, payslips, and digital transaction logs.

Having everything in one place makes it easier to review your spending. You can log it in a physical spreadsheet, or you can use a spreadsheet app.

If spreadsheets aren’t for you, you may want to get gamified financial apps. They make auditing fun by incorporating game-like elements. These apps can turn tracking expenses into an engaging and rewarding experience, helping you stay motivated to monitor your finances.

Once everything’s logged or digitized, look for trends in your spending.

Are you overspending in certain areas? Can you cut back on non-essential expenses? Identify where adjustments are needed.

Conclusion

To be honest, learning how to monitor your finances and regularly auditing them can feel like a chore. However, it’s one of the most important habits you can develop to take control of your money.

By consistently tracking your expenses and reviewing your financial activities, you set the foundation for better money management.

This simple yet essential practice not only helps you stay organized but also allows you to identify opportunities to save, avoid unnecessary spending, and make smarter financial decisions.

Over time, these small efforts add up, leading to greater financial stability and peace of mind.

Remember, the key is consistency.

Start with small steps, use tools that work for you, and make monitoring your finances a part of your routine. The rewards of better financial control will far outweigh the effort it takes.

Ready to take charge of your finances and save more?

Check out our articles for expert strategies and subscribe to our YouTube Channel for fresh, actionable tips. Every video is designed to help you on your journey to financial freedom—don’t miss out!