Are you looking for tips on how to grow your money, like turning $50 into $5,000? Is that even possible? The answer is yes! However, it’s important to note that this won’t happen overnight. After all, get-rich-quick schemes rarely work. So, how did I come up with the idea of talking about turning $50 into $5,000?

To be honest, I was researching effective keywords for the site. It’s part of my brainstorming process, which also helps with my site’s SEO. During my research, I found it interesting that “turning $50 into $5,000” is a popular search term. But why are so many people interested in this concept?

This curiosity inspired me to write this post. I’ve successfully multiplied my money many times over, thanks to lessons I learned in business school and real-life experiences. And since there’s a seemingly strong demand for this kind of knowledge, I’m excited to share what I’ve learned with you. Let’s get started!

1. Real Estate Investing

Real estate has always been a reliable way to grow your money. While you typically need more than $50 to invest in real estate and see a profit, you can start with $50 to learn the basics.

There are many real estate courses available for under $50, and some are even free. This is a great place to begin.

If you truly only have $50 to invest and want to get into real estate, there are alternative ways to profit outside of traditional real estate investing.

One option is to invest in Real Estate Investment Trusts (REITs), in which I have a few bucks invested.

REITs are platforms that allow multiple investors to buy shares in real estate properties, similar to how stocks are traded on the stock exchange. Many REIT shares can start as low as $50, but keep in mind that prices may fluctuate over time.

Another option for investing in real estate with just $50 is through real estate crowdfunding. This involves pooling money with other investors to purchase real estate. A similar alternative is fractional real estate investment, which allows you to buy a fraction of a property.

When it comes to turning $50 into $5,000, real estate investment offers high-leverage opportunities that can lead to substantial returns over time.

2. High-Leverage Trading

High-leverage trading can be a way to double or even triple your $50, but it comes with significant challenges. You need to know what you’re doing, as it can be a high-risk method of earning money.

Instead of making $5,000, you could end up in debt, especially if you lack experience.

So, what is high-leverage trading? Essentially, it allows you to invest more money than you actually have by borrowing funds.

For example, let’s say you want to buy $1,000 worth of gold to resell at a higher price later, but you only have $500. To cover the difference, you might ask a friend or a broker to lend you the remaining amount.

After purchasing the gold, you sell it for a higher price, say $1,200. You then pay back your lender along with any agreed-upon interest.

Of course, this is a simplification. There are other factors that can affect profitability. In addition to the interest rate, you may face potential losses from transaction fees, market volatility, and other terms associated with the loan.

There are various forms of high-leverage trading, including margin trading, forex, futures, cryptocurrency, and Contracts for Difference (CFDs).

While they all fall under the umbrella of high-leverage trading, each has its own characteristics and may not be suitable for everyone, as they operate under different mechanisms and regulations.

While I initially intended to explain how to safely navigate these trading markets, I’ve decided to save that for another post. These topics are highly complex, and my strategies may not work for everyone.

3. Retail Arbitrage And Flipping

Want to make money in a fun way with as little as $50 as your initial investment? Retail arbitrage and flipping items are the answer!

Just to clarify flipping is essentially the practice of buying low and selling high. The core concept is to find items you can purchase at a low price and sell them later at market value or higher.

The difference between the two prices is your profit.

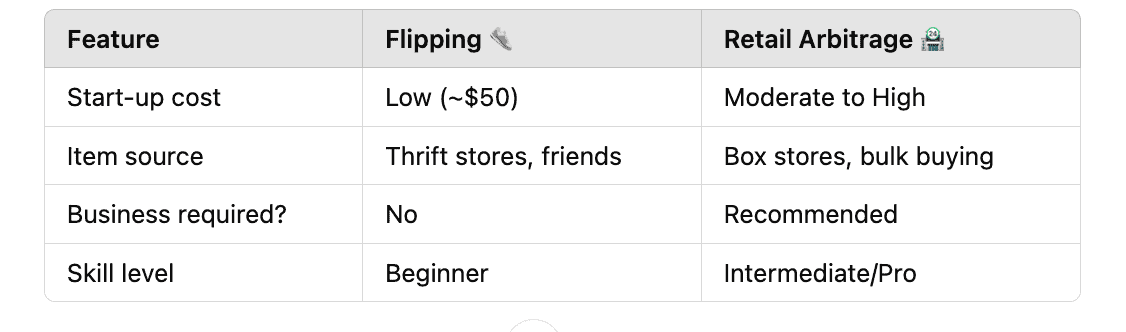

Meanwhile, retail arbitrage is the more intense and professional form of flipping. Instead of just going to thrift stores to get bargains or buying stuff from your friends at a low price, you deal with getting your stuff from box stores and other retailers to sell for your business.

If you’re truly only have 50 bucks to spare, it’s a good idea to start with flipping first. After all, you can do it on a small scale and you don’t need to have an officially registered business to get started.

You can operate within your social circles, treating it like a game of buying and selling at garage sales and thrift stores.

If you’re familiar with The Office, think of how Dwight started with a thumbtack and ended up with a telescope—which, unfortunately, was scammed from him by Jim through “magic” legumes.

If you do flipping right, you could turn your $50 into $5,000. Pretty neat, huh? Just a disclaimer: there’s a bit of luck and a lot of sales skills involved, so don’t get your expectations too high.

Anyway, typically, flipping and its more serious counterpart retail arbitrage involves hunting for deals at garage sales, clearance sections of retail stores, and even bulk buying.

If you have an eye for valuable items, this method can work really well for you. Essentially, you become a treasure hunter.

I flip during my free time, especially if there’s a garage sale nearby. I actively did this when I was a kid! However, I approach it with certain restrictions. Primarily, I avoid buying and selling items that could be subject to capital gains tax.

While I don’t have issues with taxes themselves, it’s an additional hassle I prefer to avoid.

Another important note: if you plan to engage in retail arbitrage, be aware that there are regulations, rules, and policies you need to follow and you need more than $50 to start.

For example, if you plan to sell your products on Amazon, you must adhere to its stringent rules for classifying your items, and you must have a stockpile of items to sell.

Additionally, ethical sourcing is crucial. To ensure you won’t get into trouble, make sure you don’t buy or resell stolen goods, bootlegs, or products that are gated or regulated.

4. Side Hustling

We live in a gig economy where what was once considered a ‘side hustle’ can now become a primary source of income. Use your skills and passions to make money!

Are you a wordsmith? Offer your writing services on platforms like Upwork. Got a knack for graphic design? There’s a whole world waiting for you on Fiverr. You can teach a language, tutor kids online, or become a pet sitter using apps like Rover or Wag.

Unlike the previous methods I mentioned, you can start this with almost no investment. However, a $50 investment would be beneficial.

This amount could cover basic marketing materials or essential tools to get you started, such as promoting your services on the platform you choose or building a website to advertise your offerings.

If you excel in the work you choose, turning your $50 investment into a $5,000 return is entirely possible! This is a fantastic opportunity to leverage your credit card or bank account to earn extra money online.

5. Establishing An Online Business

Starting an online business with just $50 may sound challenging, but with the right approach, it can be a smart way to learn how to turn that initial investment into $5,000. Just keep in mind that your returns may take some time to materialize!

Here are five examples of online businesses you can start with $50:

- Etsy: Etsy charges $0.20 per listing, so with $50, you can list up to 250 products! You can create digital products like printables, planners, or invitations using free design tools like Canva.

- Web Development: With $50, you can purchase a basic domain name (around $10) and a hosting plan (approximately $40 annually). Set up a portfolio showcasing your web design skills using free tools like WordPress and free themes. Then, start taking on small projects to earn and grow your business.

- Dropshipping: Platforms like Shopify offer free trials and plans starting around $1 for the first month, allowing you to use your $50 to cover the upcoming months. You can create an online store without holding inventory, making it a low-risk option.

- Affiliate Marketing: You can find a domain and hosting for under $50. Similar to a web designer’s portfolio, you can set up a blog using free themes and tools. By writing evergreen content, you can monetize your blog through affiliate marketing, earning commissions by promoting products.

- Print on Demand: With print-on-demand services like Printful or Teespring, you can create custom designs for apparel, mugs, and more without any upfront costs. Your $50 can be used for marketing your designs on social media or setting up a simple online store. You only pay for the products after you make a sale, allowing you to keep your initial investment low.

By exploring these options, you can find a business model that suits your skills and interests while maximizing your potential for growth!

FAQs

As usual, before I conclude this post, let’s address some frequently asked questions about this topic that you may find helpful!

How long does it typically take to see returns from these methods?

When it comes to returns, you can see some relatively quickly. However, if you’re aiming to multiply your investment from $50 to $5,000—basically a hundredfold—the timeline can vary significantly.

The amount of time required depends on your dedication, skills, and a bit of luck.

As a general rule of thumb, if you’re treating this as a side gig, expect it to take years. But if you’re making it your primary source of income, you might see results in about six months, based on the experience of people around me.

For instance, my editor earned $5,000 freelancing as a writer in less than six months, while my web developer reached that amount in three to four months.

In contrast, I took at least nine months to sell items worth over $5,000 through flipping, starting from a single toy—yes, they’re profitable to flip.

How do I stay motivated growing my money while doing these methods?

There isn’t a one-size-fits-all answer to this question. Personally, I engage in these activities for fun and to earn some extra cash. For my more serious investments, like my REIT, I simply let them grow and check in on them occasionally.

Some of my team members who are serious about their side hustles and online businesses treat these endeavors like jobs, which keeps them motivated to earn money without needing additional encouragement.

Are there risks involved in learning how to grow your money through these methods?

Like most ventures, there are inherent risks associated with these methods, especially those that require investments. However, if you’re starting with just $50, the risk is relatively low—unless you become aggressive in your approach.

For example, high-leverage trading can lead to significant debt if you don’t manage your trades wisely.

Additionally, you should consider the time investment involved. With flipping, for instance, you need to spend time hunting for goods and finding buyers, which can also be a risk if you’re not careful with your time management.

Conclusion

This was a fun post to write, and I hope you learned a few tricks to grow your money. I know some of you may have been expecting quick schemes to get rich, but unfortunately, there’s no guaranteed way to achieve that! If there were, I would be at the forefront of it!

While luck can play a role, the methods I discussed are honest and effective ways to earn your keep and allow a modest amount of money to grow into something substantial. However, don’t expect these methods to yield fast results.

Even a wild dandelion takes time before its flower blooms.

Anyway, be sure to explore our other articles for additional income ideas, money-saving tips, and time management strategies. And don’t miss out on our YouTube channel for finance-related vlogs you can listen to on the go!