Millennials have grown up. They’re not exactly young anymore, but they’re not old yet either. They’ve outgrown the “young adult” label, and with that comes a price—navigating life independently while ensuring a secure financial future.

That’s where millennial investment strategies come into play. These are tailored approaches that reflect their values, tech-savvy nature, and desire for financial freedom.

One major advantage they have? Technology. Most millennials grew up with the internet at their fingertips, witnessing rapid advancements firsthand. They’re not just familiar with innovation; they embrace it.

That’s why their approach to investing looks different from mine. I’ll admit—I’m no tech expert. I rely on my team for anything that requires serious time in front of a computer.

But millennials? They adapt quickly to modern investment strategies. You could even say today’s investment landscape was built for them.

Meanwhile, I’ve had to put in extra effort to understand and incorporate these strategies. If you’re a millennial or part of Gen Y, you’re probably already familiar with many of them. And if you’re Gen X or Gen Z, these strategies could be worth adding to your financial playbook.

So, what exactly are millennial investment strategies? How do they work? And why should you care? Let’s get started!

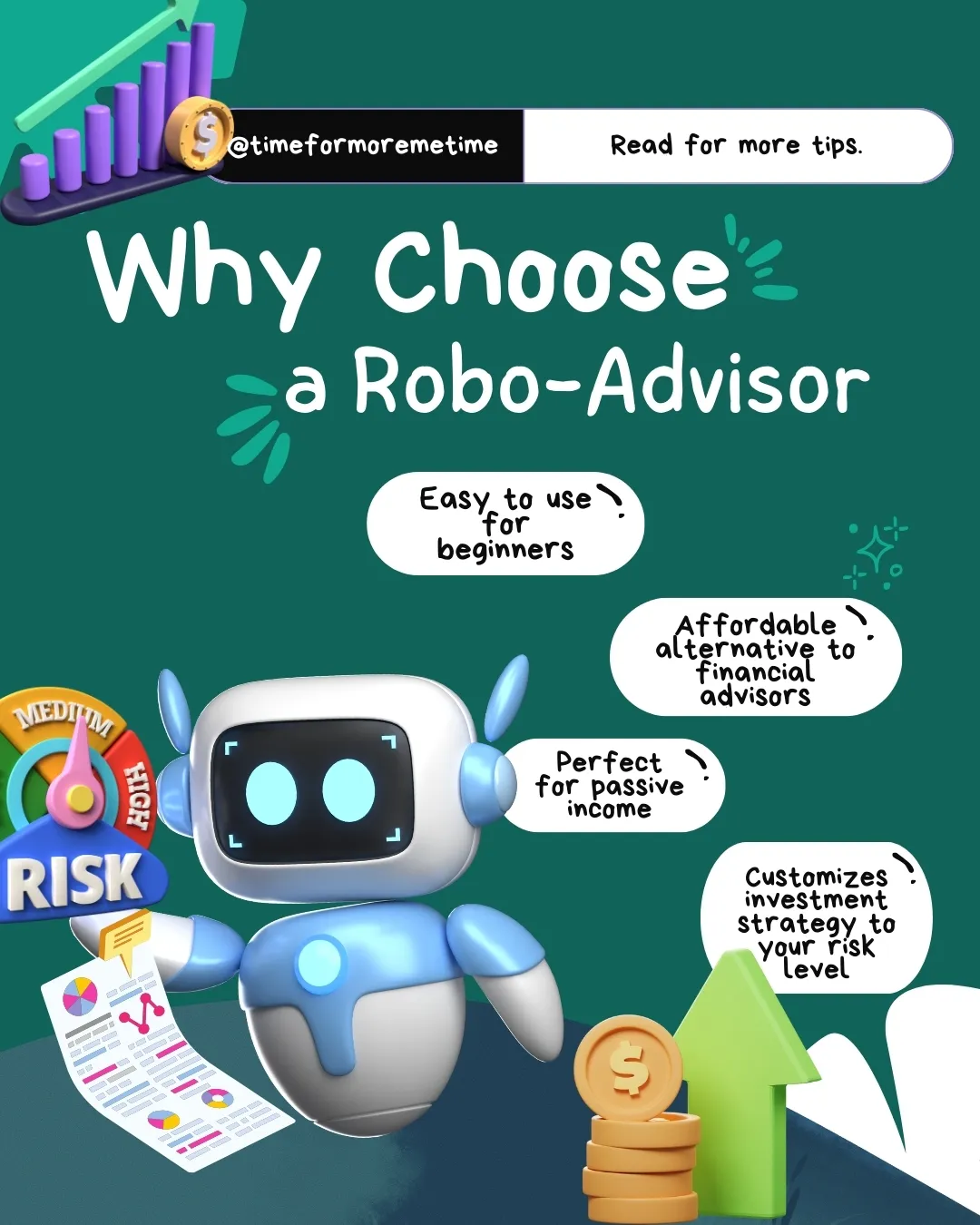

1. Robo-Advisors

Let’s start with robo-advisors—automated investment services that help users effortlessly build and manage their portfolios. All you need to do is download an app or sign up for a platform, set your investment preferences, and let the robo-advisor handle the rest.

These smart financial tools eliminate many of the traditional hurdles of investing. As long as you have capital and a trusted robo-advisor, your chances of growing your money—with minimal effort—are significantly higher than diving into the stock market without a clue.

Robo-advisors, like Acorns, are perfect for those who want to expand their portfolios without actively managing investments, making them a great option for passive income.

In many ways, they’re replacing traditional financial advisors. And their biggest advantage is that they’re far more affordable than hiring a human expert to oversee your investments.

2. AI Trading Bots

AI trading bots are automated trading systems that execute trades on your behalf based on market conditions and algorithms. They’re widely used in stocks, forex, and cryptocurrencies, which I’ll discuss next.

Do AI trading bots sound similar to robo-advisors? In some ways, yes—but they serve very different purposes.

While robo-advisors manage your long-term investments based on your preferences and risk tolerance, AI trading bots operate in real time. With them, you can make rapid buy/sell decisions based on technical analysis and platform algorithms.

Unlike robo-advisors, which focus on steady, passive growth, AI trading bots are designed for aggressive, high-frequency trading. They analyze market trends, price movements, and trading signals instantly, allowing them to respond faster than any human trader ever could.

So, which one is right for you? And which do millennials prefer? The answer is both—it all depends on their goals and risk tolerance.

If you’re looking for a hands-off, low-risk, long-term investment approach, robo-advisors are the way to go. But if you’re experienced, prefer active trading, and can handle higher risk, AI trading bots might be the perfect tool to maximize profits and take advantage of market fluctuations.

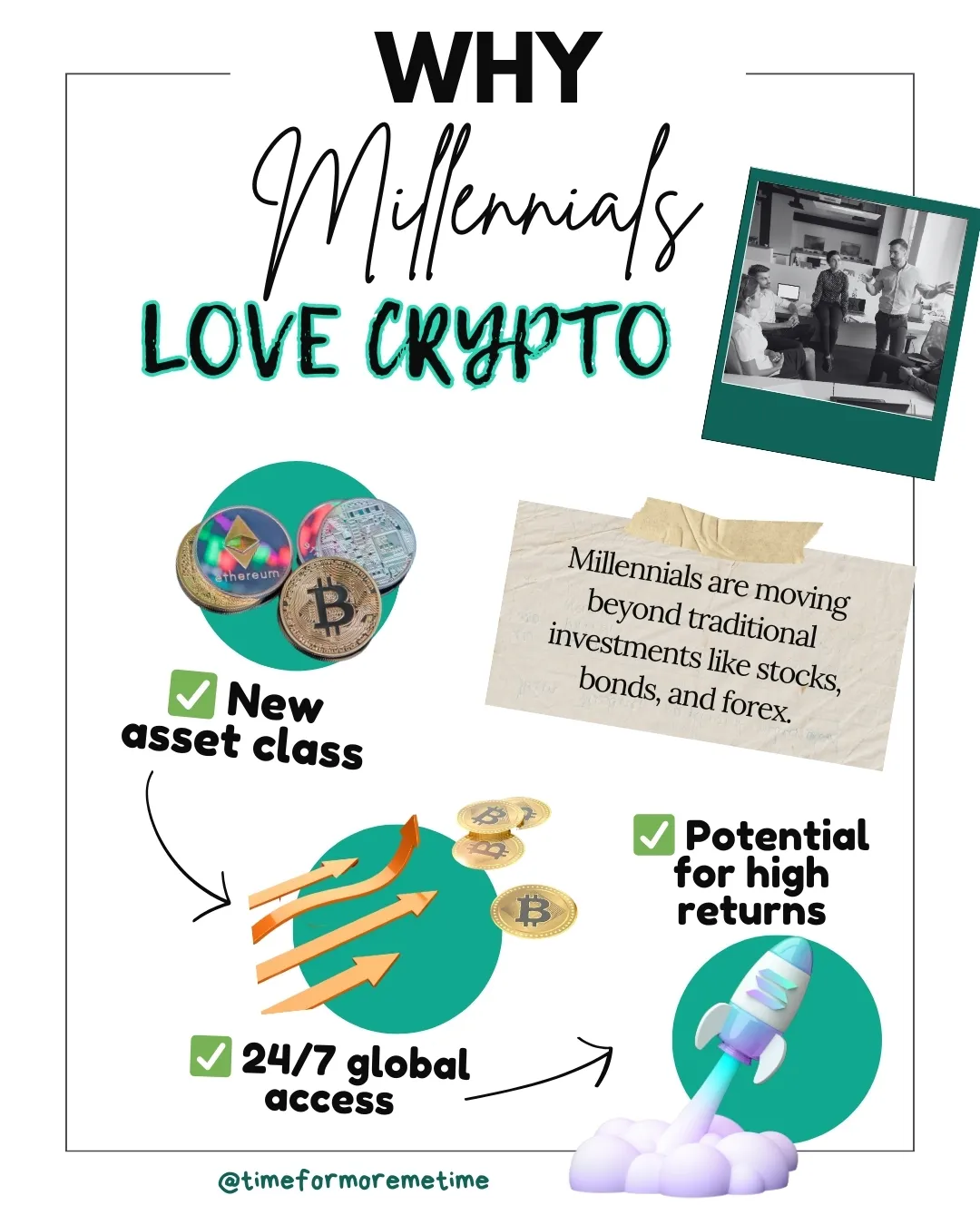

3. Cryptocurrency Investments

Millennials have witnessed the rise—and continued growth—of cryptocurrency. If you’re unfamiliar, cryptocurrency is essentially digital money, but unlike traditional currencies, it isn’t tied to any country or central authority—making it decentralized. It basically money without its physical aspects.

Anyway, because it’s decentralized, its exchange rate isn’t influenced by a nation’s economy or policies. Instead, cryptocurrency values are primarily driven by supply and demand.

When more people buy in, prices rise as real money flows into the market, increasing its value. On the other hand, when investors sell off their holdings, money exits the system, causing prices to drop.

Of course, that’s just the basics of how crypto works. But the point here is that millennials aren’t limited to traditional investments like forex, stocks, and bonds anymore—they have access to this highly dynamic digital asset class. And with the right timing and strategy, cryptocurrency can offer lucrative returns.

However, high rewards come with high risks. Many people have already lost significant money in crypto due to volatility, scams, and poor investment decisions. If you’re considering stepping into this space, thorough research and risk management are essential.

4. Decentralized Finance (DeFi) Investing

Decentralized Finance (DeFi) investing is a subset of crypto investing that removes the need for banks or financial institutions.

If crypto trading is like forex, then DeFi investing is similar to putting money in a bank and earning interest from loans—except, in this case, there’s no bank. Instead, lending and borrowing happen peer-to-peer, and as an investor, you help power the system while earning interest directly from borrowers.

There are multiple ways to invest in DeFi, including:

- Staking: Similar to a digital savings account, where you lock up your crypto to support a blockchain network and earn interest.

- Yield Farming: A more aggressive version of staking, where you move funds between platforms to chase the highest possible returns.

- Liquidity Pools: Instead of holding your crypto, you deposit it into trading pools to help facilitate transactions on DeFi exchanges—and in return, you earn a share of the trading fees.

DeFi investing offers high-reward opportunities, but it also comes with risks, such as market volatility, smart contract vulnerabilities, and platform security. Do your research before diving in—this is not for the faint of heart!

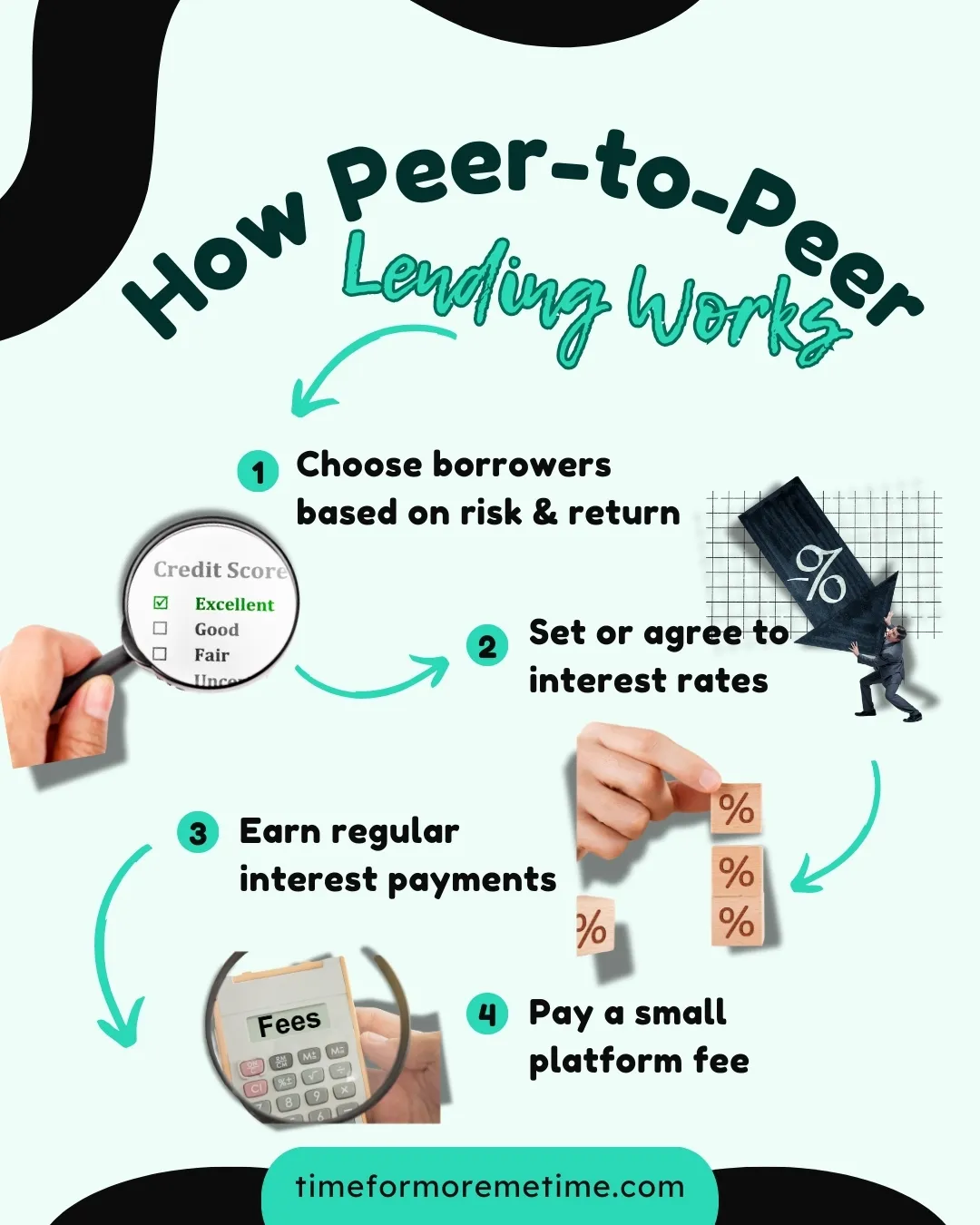

5. Peer-to-Peer Lending

Explaining DeFi investing was a bit of a headache, so let’s switch to something simpler, yet still modern, and many millennials do—peer-to-peer (P2P) lending.

P2P lending is a system where you lend money directly to individuals or organizations of your choice. Instead of dealing with a bank, you act as the lender, and in return, you earn interest on the loan.

However, there’s still an intermediary—the platform that facilitates these transactions. These platforms are backed by financial institutions to ensure secure lending and borrowing. In return, they take a small cut of the interest you earn.

Traditionally, banks use customer deposits to lend money. That’s no wonder since they’re keeping most of the interest for themselves while distributing only a fraction back to account holders.

P2P lending cuts out the middleman. This means you can earn higher returns since you don’t have to split profits with a bank—just pay a small platform fee.

Also, with P2P lending, you have control over whom you lend to and can set interest rates based on the borrower’s risk profile. While it comes with risks (borrower defaults, platform reliability, etc.), it’s a great way to diversify your investments and boost your passive income.

6. Fractional Share Investing

In the past, investing—especially in stocks—required significant capital. If you didn’t have enough money, you were out of luck. But today? You can invest in stocks even with a small budget.

How? Robo-advisors help, but so does fractional share investing. This method allows investors to pool their money to buy shares of high-value stocks.

While group investing was possible before, it was complicated and inconvenient. Now, thanks to modern investment platforms, it’s quick, seamless, and accessible to everyone.

With fractional share investing, you can own a portion of expensive stocks like Amazon and Tesla, which are known for strong long-term growth. This means you don’t need thousands of dollars to start investing—you just need a few extra bucks from your savings.

Millennials are in a great position because investing has never been easier, even for those with little financial experience. Of course, some basic financial literacy is still necessary, but let’s be real—it’s never been this simple to start building wealth.

7. Real Estate Crowdfunding

Just like fractional share investing, you can now crowdfund and invest in real estate without needing massive capital. In the past, getting into real estate investing required a fortune, making it nearly impossible for the average person. Most people’s only entry point was buying a home and selling it later for a profit.

But today? Real estate crowdfunding allows investors to pool their money to finance real estate projects—without the burden of property management. That’s just one of the many ways you can invest in real estate. And let’s be honest here, the real estate industry is booming simply because housing and rental prices are skyrocketing.

And since you’re just a fractional investor, you have zero responsibilities when it comes to managing the property. No maintenance, no tenants, no stress—just passive income.

FAQs

And as always, here’s the FAQ section to cover our bases before we wrap up!

How do young investors approach risk when it comes to millennial investment strategies?

Millennials take a cautious yet opportunistic approach to risk. Many grew up during the 2008 financial crisis, making them more risk-averse than previous generations. However, they’re also willing to take calculated risks—especially in areas like tech stocks, cryptocurrencies, and socially responsible investing.

To balance risk, they prioritize diversification and favor low-cost investment options like ETFs and robo-advisors, which offer automated and data-driven portfolio management.

What is the significance of financial literacy for millennials in their investment strategies?

Financial literacy is essential for millennials because it helps them navigate an increasingly complex investment landscape. With countless platforms and products available, understanding key concepts—like compound interest, risk management, and asset allocation—enables them to make smarter, more informed decisions.

Since millennials tend to prefer self-directed investing and digital finance tools, financial literacy also helps them avoid common pitfalls, such as high fees, emotional investing, and short-term thinking.

What challenges do millennials face in their investment strategies?

Millennials encounter several significant challenges when it comes to investing. Key issues include high levels of debt, a rising cost of living, and stagnant wages. These factors make it difficult for them to enter the investment landscape or even consider investing at all.

Additionally, millennials grapple with market volatility and a lack of trust in traditional financial institutions. Even when they have the funds available, many are hesitant to risk their hard-earned money on investments due to fear of loss.

On the other hand, the abundance of tech-backed investment strategies can also pose a challenge. While these digital tools offer convenience, they can lead to over-reliance on technology, which may encourage impulsive decisions.

This reliance can expose millennials to high-risk assets, such as meme stocks and cryptocurrencies, which can be particularly volatile.

Conclusion

While I may have made it seem like millennial investment strategies are easy, the truth is—they’re not. Sure, millennials have better access to modern, tech-driven investment strategies and an easier time understanding them. However, they still face one major hurdle: they need money to get started.

And that’s where the challenge lies—because, for many in this generation, money has been tight. So, if you want to learn more ways to earn extra income, check out my other articles.

That said, I believe most millennials will find a way. With smart financial decisions and their natural ability to adapt to new investment opportunities, I have no doubt they’ll navigate their way to financial success.

And if you’re not a millennial, don’t worry—you can still take advantage of these strategies. Investing is evolving, and there’s always room to learn, adapt, and grow.

If you want to level up your financial and investment knowledge, stay tuned for my future posts here—and don’t forget to check out my YouTube channel for more insights!

Sources

- Photo: Unsplash: Helena Lopes