Are you trying to save money but find yourself overwhelmed by all the decisions it takes to save even a little? If so, you might want to consider why round up transactions could be an effortless way to start.

This simple method helps you save small amounts automatically without overthinking your budget.

When I was a teenager, saving money was simple. Even though I didn’t earn much and often depended on my parents, I still managed to set aside some cash. Why? Because the financial decisions weren’t mine to make.

I handed my earnings to my parents, they handled the budgeting, and I saved whatever was left for myself. It was straightforward because I wasn’t responsible for the bigger, more complex financial decisions.

But adulthood changes everything. Suddenly, you’re responsible for paying rent, buying groceries, and managing all those “adulting” expenses. It’s easy to feel frustrated and overwhelmed by the constant decisions about where your money should go.

So, is there a way to make saving money less of a hassle? Yes, there is—and it’s a method that helped me improve my saving habits: rounding up transactions.

What’s that? Let me explain.

What Is Round Up

A round-up transaction is a banking feature that automatically rounds up your debit card purchases to the nearest dollar, which explains why round up transactions are an effortless way to save money with every purchase.

The difference between the purchase amount and the rounded-up total is transferred to a savings or separate checking account.

For example, if you buy a pizza for $12.75, your bank rounds the total to $13. The pizza place receives $12.75, and the extra $0.25 is deposited into your designated savings or checking account.

If you frequently shop or make purchases with your debit card, these small amounts can add up significantly over time. Plus, having rounded totals makes it easier to manage your bank balance without those pesky cents cluttering things up.

Keep in mind that banks may use different names for this feature. For example, Bank of America calls it “Keep the Change,” while Southeast Bank refers to it as “Round-Up Savings.”

How To Save More With Round Up Transactions

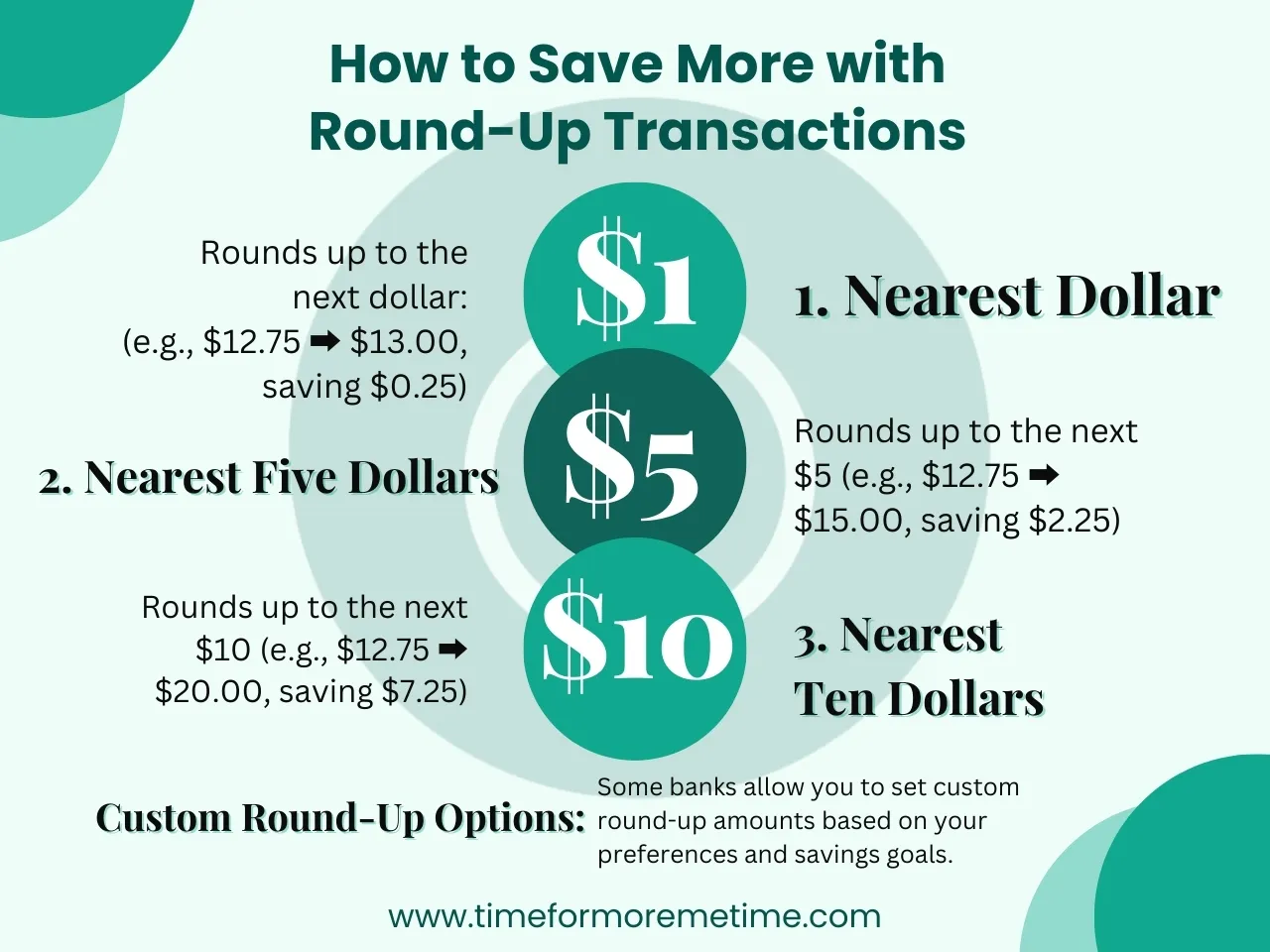

Many banks offering the round-up transaction feature provide three basic settings: round to the nearest dollar, round to the nearest five dollars, or round to the nearest ten dollars.

Some banks even allow you to specify a custom amount to round up your transactions.

Anyway, in the previous section, you saw how rounding to the nearest dollar works. For example, a $12.75 purchase would result in a deduction of $13.00 from your debit card, with $0.25 saved.

If you choose to round to the nearest five dollars, that same $12.75 purchase will result in a debit of $15.00. Instead of saving just $0.25, you’d save $2.25.

Finally, rounding to the nearest ten dollars would make that $12.75 purchase a $20 deduction.

This significantly increases your savings. If you use your card daily, you could potentially save up to $299 in a month by rounding up to the nearest ten dollars. That’s a substantial amount and can quickly build your savings.

However, note that if a transaction exactly matches the set round-up amount (e.g., $10 for the nearest ten-dollar round-up), no additional money will be saved since the difference is $0.

How Can You Limit This Feature

Knowing why round up transactions can be beneficial is a must, but it’s also best to understand the downside. As useful as the round-up feature is, it can quickly become overly aggressive in taking money from your account for savings.

Imagine buying three $1 coffees every day while rounding up to the nearest ten dollars. You’d be saving $18 a day. While this sounds great for your savings, it can quickly drain your spending account. Over a month, that adds up to $540!

To prevent this from happening, many banks allow you to set limits on your round-up transactions.

For example, you can cap the feature at $50 per month. Once the total amount saved through round-ups reaches $50, the feature will stop triggering for the rest of the month. It will automatically resume the following month.

This way, you can enjoy the benefits of automated savings without risking getting overdraft fees or stretching your budget too thin.

Who Can Benefit Greatly From Round Up Transactions

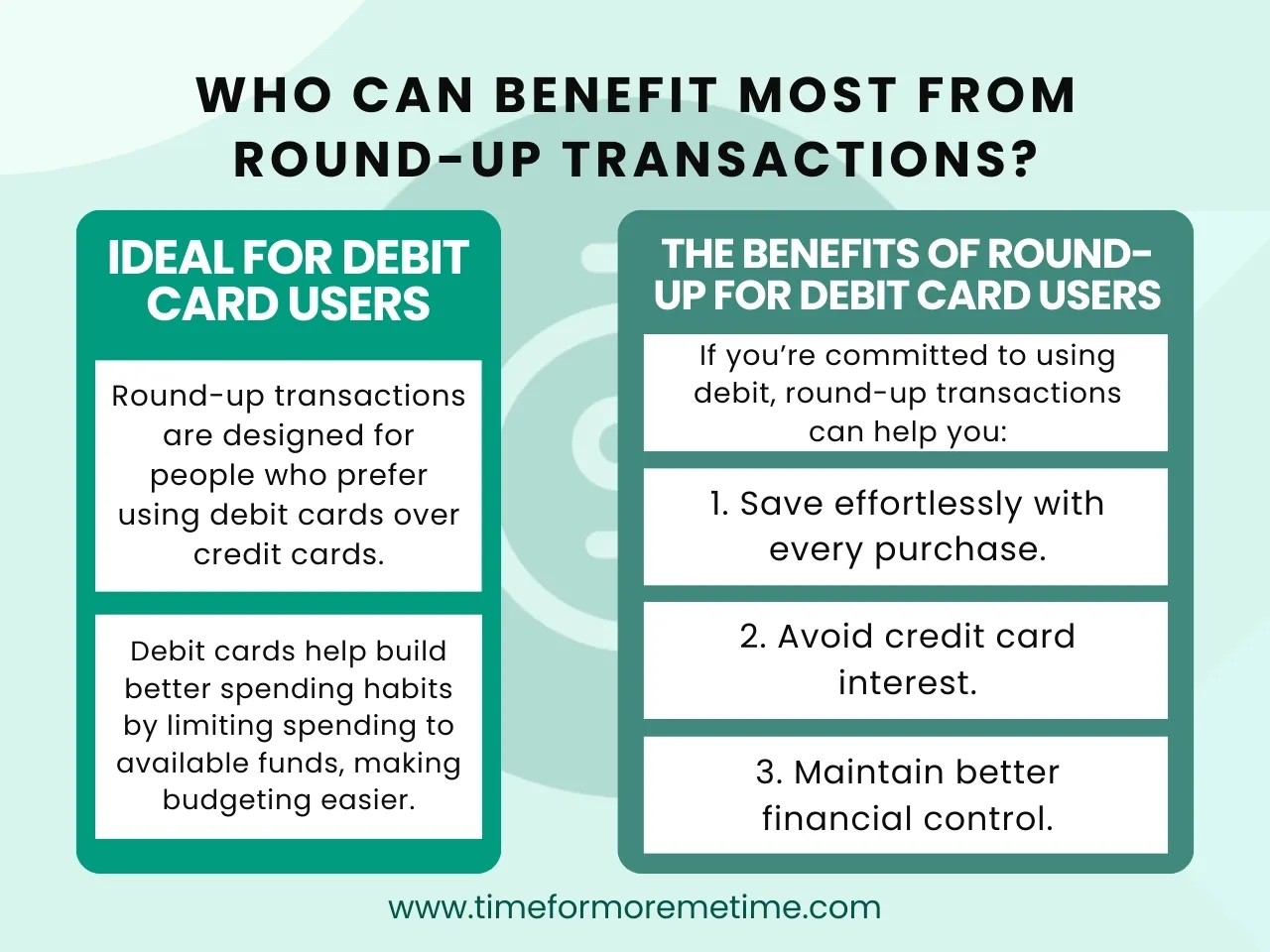

Understanding why round up transactions are beneficial starts with knowing that they are primarily designed for people who use debit cards.

Unfortunately, many prefer credit cards for their purchases due to the numerous benefits they offer, such as building a credit score, earning rewards, enjoying fraud protection, and accessing other perks.

However, if you prefer using debit over credit, round-up transactions can be a great tool for you.

Debit cards are excellent for helping you build better spending habits since you’re limited to the funds in your account. This makes you more mindful of your budget and can help you avoid accumulating debt.

That said, there are some risks. Round-up transactions can increase the likelihood of overdraft fees if your settings are too aggressive or your bank balance falls to $0.

To avoid this, it’s important to monitor your account regularly and, if possible, set limits on your round-up savings feature.

For those committed to using debit cards, round-up transactions are a simple and effective way to save money without much effort. They help you stay on top of your spending while avoiding credit card interest and maintaining better control over your finances.

Conclusion

Why round up transactions? They offer a simple, effective way to save money effortlessly, especially for those who use debit cards.

By automatically setting aside small amounts with each purchase, this feature turns everyday spending into an opportunity to grow your savings. It’s a method I used years ago to start building my savings, even with very little income.

The best part is that once it’s set up, you can forget about it. However, if you have a small paycheck going into your checking account, it’s wise to use this feature cautiously to avoid overdrafts.

It also helps curb spending habits and reduces impulse buying, giving you better control over your finances.

With a little planning, this simple trick can help you save more and spend smarter—without the hassle.

If you want to learn more strategies to save money, check out our other articles or follow our YouTube Channel to get notified of new videos. I’ve created these videos to guide you towards financial freedom!

Sources

- Photo: Unsplash: Cova Software