Knowing how to find ways to increase income is essential, especially when financial security feels uncertain. It’s difficult to focus on the world’s problems when we’re struggling with our own.

Even if we’re living comfortably now, the unpredictable nature of the future makes it necessary to take proactive steps to improve our situation.

One obvious solution is to increase your income. I’ve taken this path myself. While I’m in a better financial position now, I aspire to step back eventually and reclaim more time for myself.

But enough about me—let’s focus on you. If you’re looking to boost your income or grow your savings, here are five basic but effective strategies to get started:

1. Ask For A Raise

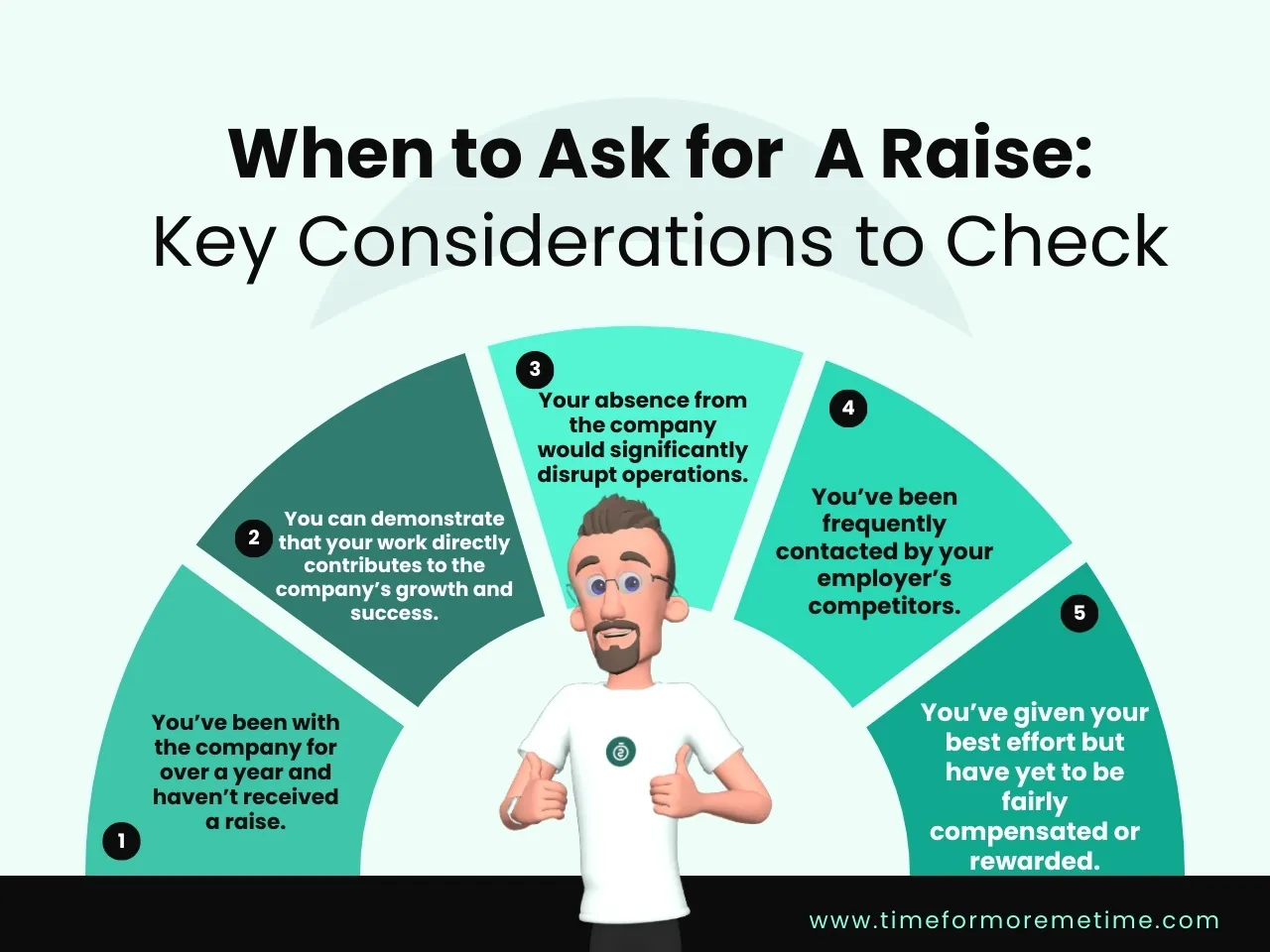

It’s true—asking for a raise can be uncomfortable. But if you believe you deserve one, why not ask? The key question is: How can you know if you truly deserve a raise? Here are some considerations:

- You’ve been with the company for over a year and haven’t received a raise.

- You can demonstrate that your work directly contributes to the company’s growth and success.

- Your absence from the company would significantly disrupt operations.

- You’ve been frequently contacted by your employer’s competitors.

- You’ve given your best effort but have yet to be fairly compensated or rewarded.

If you find yourself in one of these situations, it’s worth having a conversation with your boss or superior about the possibility of a raise.

There are many ways to approach this conversation, so you can choose the method that feels most comfortable and likely to lead to a positive outcome.

2. Sell And Lease

Over time, we accumulate a lot of stuff—much of which ends up unused. Why? Because we’re busy with work and forget that many of the items we purchased are gathering dust instead of being used.

Rather than letting them sit unused and depreciate, why not sell or lease them to earn some extra income? Here are some common items you can sell or lease:

- Vehicles: If you have an extra car, consider leasing or selling them. There are online platforms that make it easy to lease out your car.

- Electronics: We often upgrade our gadgets, leaving old ones forgotten in cabinets. If you’re not planning to use them again, sell them.

- Clothing: New clothes pile up quickly, whether through purchases or gifts. Take a look in your closet—you’re likely to find clothes you can sell.

- Home Goods: Got furniture that no one ever uses? If you rarely entertain or don’t sit on certain pieces, consider selling them.

- Tools: If you own tools or appliances that are collecting dust, why not rent them out to neighbors or advertise them on an app?

These are just a few examples, and they’re a great starting point for learning how to find ways to increase income by decluttering items and generate some extra cash.

And remember, if you sell things, you can always buy them back if you’re in a better financial state.

3. Invest

If you have spare money sitting in your savings account or wallet, it might be a good idea to consider investing.

Of course, we’re not talking about making risky, high-stakes investments—we’re aiming for smaller, low-risk investment options with modest returns.

The goal is to increase your income, not become a millionaire overnight.

Here are some low-risk investment options you can consider:

- High-Yield Savings Accounts: Simply place your extra money in a savings account that offers a higher interest rate. The returns may be small, but it’s still a way to grow your money over time.

- Fixed Deposits: If you have a stable income, you can choose a fixed deposit. The key difference from a regular savings account is that you can’t withdraw the money for a set period, but you’ll earn better returns.

- Government Bonds: This involves lending money to the government. The government will pay you back with interest, making it a safe investment. It’s also easy to get started.

- Municipal Bonds: Similar to government bonds, but issued by local governments. These also offer guaranteed returns with interest.

- Cash Management Accounts (CMAs): Unlike a traditional savings account or fixed deposit, a CMA involves trusting a company to manage your funds. Since these companies don’t have the overhead expenses of banks, they tend to offer better interest rates in an effort to attract more investors.

These are some of the most basic and low-risk options for increasing your income through investment. Keep in mind that, as with any investment, you’ll need some spare cash to get started.

Additionally, it takes time to see returns from these investments, so patience is key. Remember that when planning your strategy.

4. Get A Side Gig

As much as possible, I don’t encourage everyone to take on a side gig.

While I often mention it, it somewhat contradicts what I’m ultimately trying to promote: helping people create more time for themselves. I’ll admit, I’m guilty of having a side gig too.

That said, a side gig can be an investment in your future.

We work hard now with the goal of a better retirement and more free time down the line. So, let’s look at some low-commitment side gigs that can still leave you with time for yourself.

- Ridesharing: You can earn extra cash by driving after work or on weekends, perhaps while heading home or after running errands.

- Podcasting: This isn’t a fast way to earn money, but it offers the chance to work while socializing with friends or others in the podcasting community.

- Delivery and Shopping: If ridesharing isn’t for you, consider delivering or shopping for groceries and food. It doesn’t require much social interaction or long trips.

- Tutoring: If you have a talent for teaching, tutoring online could be a great option. The main challenge here is scheduling, but it’s worth exploring.

- Blogging or Vlogging: If you want to share your life or experiences with others while earning a little on the side, blogging or vlogging could be the right fit for you.

These are some of the least commitment-heavy side gigs I can think of. I’ve tried four of these myself, and they’re fun—well, except podcasting. I’m not there yet!

5. Change Career

Ultimately, if the basic options I’ve mentioned don’t work for you or aren’t enough, it might be time to reconsider your career. Your current job may not be providing the financial stability you need.

Of course, this is a big decision, so approach it wisely. But remember, changing your career is always an option to consider.

Conclusion

Many of us are struggling to make the most of our time while learning how to find ways to increase income. However, increasing your income doesn’t always require drastic changes.

There are safe and practical options that can still significantly boost your finances. The key takeaway is that there are many strategies you can explore.

The most important thing is to take small, consistent steps that align with your goals, while staying patient and strategic.

Achieving financial security and creating more time for yourself is a gradual process, but with the right approach, it’s entirely within reach.

Don’t forget to subscribe to our YouTube channel @timeformoremetime to be updated on finance-related and time-saving tips! Or check our articles if you want to know more about ways to earn extra money!

Sources

- Photo: Unsplash: Alexander Grey