Lately, I’ve been exploring different ways to make money online from home. If you’ve been following this site, you’ve probably come across posts about earning money through games, surveys, and other opportunities.

If you’ve read those articles, you’ve likely noticed me urging caution more than once. Why? Because the internet is full of scammers who prey on people eager to earn money.

These fake opportunities may seem too good to pass up, but they’re designed to steal your money or personal information.

While I’d love to try every online earning method myself, I simply can’t. My plate is already full, and I prioritize spending time with my family and taking care of myself.

On this site, my goal is to introduce you to potential opportunities, but I always encourage you to do your own research. Don’t rely solely on advice from someone random—like me—on the internet.

That said, I want to help you avoid online job scams. Knowing how to spot a scam is crucial because some scammers go to great lengths to appear legitimate.

This post is all about protecting yourself. Below are some common red flags to watch out for when applying for online jobs:

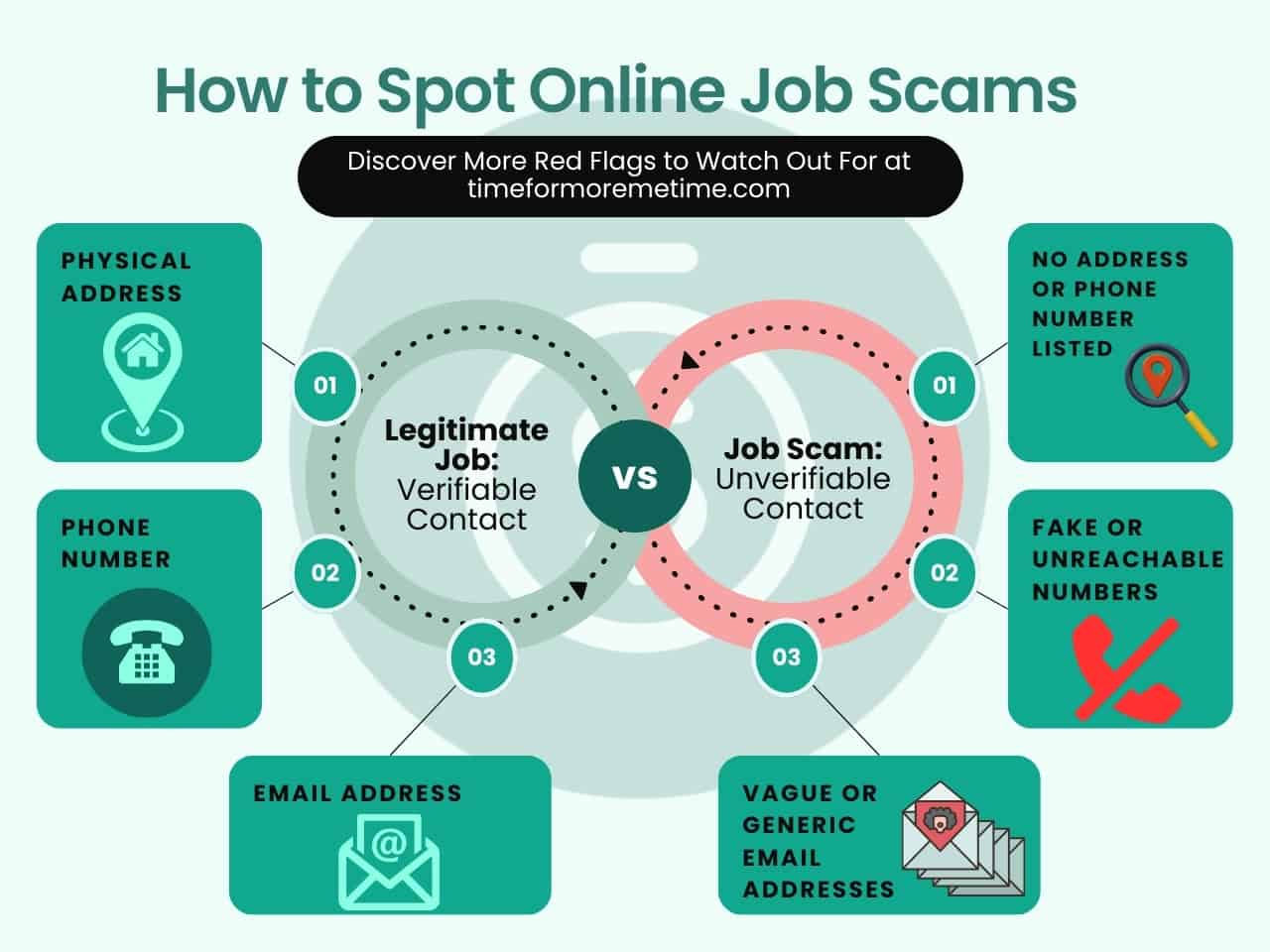

1. Unverifiable Contact Information

The first thing I check when researching a company or organization is their contact information. Legitimate businesses usually list their physical address prominently, followed by a phone number and an email address.

After all, basic transparency is one of the ways to make a business look legit.

If a company or website doesn’t make this information public, it’s a red flag. Of course, not every website needs to follow this standard. For example, I don’t share my contact information on my site because I’m not running a traditional business.

I’ve hired people for web work and post-editing, but they don’t need my personal contact details because they already have access to something far more valuable—my website itself.

Trust me, if I didn’t pay them, they’d have the power to take the whole site offline, and that’s the last thing I want!

That said, businesses offering jobs or services must make it easy for people to reach them. If a company’s address, phone number, or email is missing or cannot be verified, consider it a major warning sign.

Legitimate companies prioritize accessibility—scammers, on the other hand, do not.

However, if these jobs are posted on reputable and verified remote job sites like Upwork, Fiverr, etc., don’t expect to find personal email or phone numbers of these potential employers or clients.

That’s because these sites don’t operate that way. From my experience, legitimate communication happens through their built-in messaging systems, ensuring transparency and security for both parties.

Sharing personal contact information is often against their terms of service, but it helps protect you from scams. If you’re curious about the best remote job sites and how they work, I’ve written a blog post on this topic—you can check it out for more insights!

2. Requests For Upfront Payments

Let’s be real—no one hands out free money except scammers hoping to trick you.

Legitimate online jobs and gigs won’t ask you to pay anything upfront. Remember, employers pay you, not the other way around! The only “investment” you should make for a job is your time and effort.

Think about it—being an unpaid intern is hard enough. Why would anyone dream of being a paying intern or trainee? If a company or individual asks for a fee to access a job, join a platform, or “unlock” training, it’s a huge red flag.

Legitimate opportunities don’t require you to spend money before you start earning. Unfortunately, this is one of the most common online job scams people fall for.

A recent example that caught attention was when the CEO of Zomato, a popular Indian company, announced a job opening for a Social Media Chief of Staff.

The catch? Applicants had to pay $23,000 upfront and agree to work without a salary for the first year. While this turned out to be a publicity stunt, it’s a perfect example of how ridiculous and exploitative upfront payment demands can be.

Unlike stunts, real scammers use similar tactics to take advantage of people every day. Always steer clear of opportunities that require you to pay to work—it’s likely a scam.

Stay cautious and protect yourself! Value yourself, and don’t be desperate!

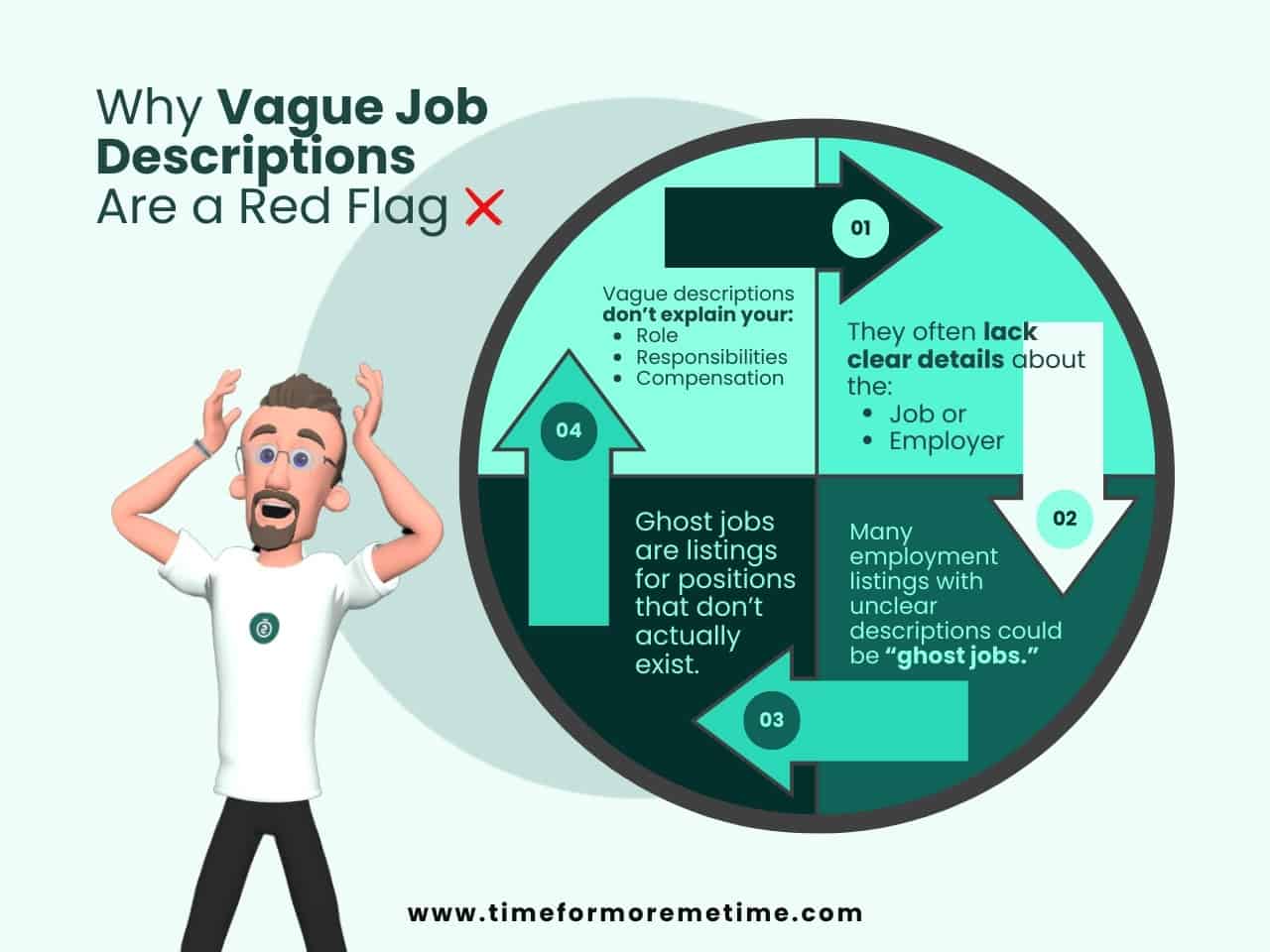

3. Vague Job Descriptions

If a job description is unclear or doesn’t explain what you’ll actually be doing, it’s a reason to be cautious. Legitimate employers and platforms provide clear details about the work, responsibilities, and compensation.

When a job post is vague, it often means there’s something suspicious going on.

While not always outright online job scams, many employment listings with unclear descriptions could be “ghost jobs.” These aren’t ghostwriting gigs or remote positions—they’re jobs that don’t actually exist.

Unfortunately, these fake listings are becoming more common. My SEO guy even fell victim to one of these situations.

A recent survey revealed that 68% of 1,000 hiring managers admitted to leaving job posts active for over a month—despite already being filled, with 10% keeping them open for more than six months.

Why? Some companies are hunting for the top 1% of talent, while others want to remind employees they’re replaceable or create the illusion that the business is growing. Aren’t they too greedy?

While ghost jobs don’t necessarily ask for money, they can waste your time and energy.

In some cases, companies will let you proceed through the entire application process—filling out forms, attending interviews, and completing tasks—only to leave you waiting indefinitely for a response.

This waiting game can mess with your mental health. You might feel anxious or start questioning your worth.

“Was I not good enough? Did I do something wrong?” All this self-doubt stems from applying for a job that wasn’t even real in the first place.

To protect yourself, always research the company and look for reviews from past applicants. If the process feels strange or overly drawn out, it might be better to move on and focus your energy on more promising opportunities.

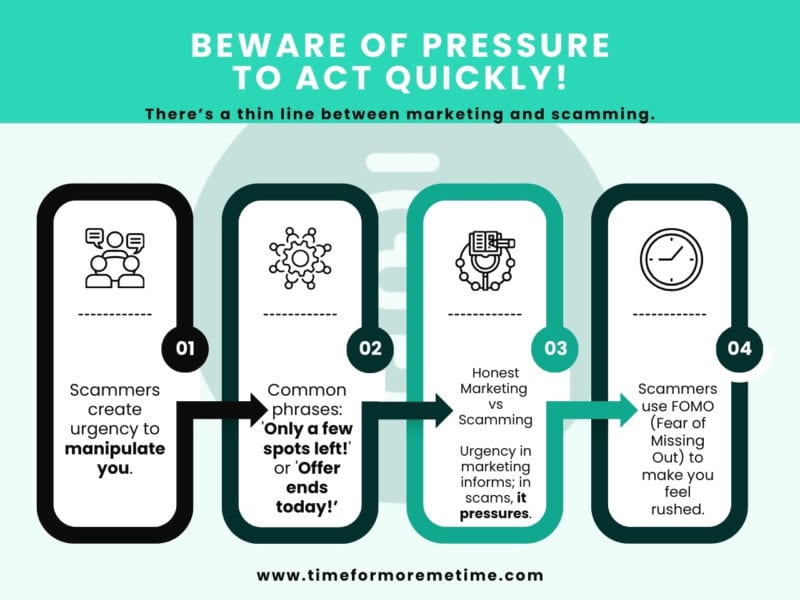

4. Pressure To Act Quickly

One of the sneaky things about scams is how much they mimic marketing strategies—scamming and marketing have a thin line. And that thin line is intent: marketers sell products or services honestly, while scammers aim to deceive you.

If someone is pushing you hard to act immediately, chances are there’s something fishy going on.

Scammers thrive on creating urgency. They’ll say things like, “Sign up now—only a few spots left!” or “This offer ends today!” These tactics are designed to rush you into making decisions without giving you the chance to think.

It’s crucial to slow down and research any opportunity before committing to it.

Having a clear mind and staying calm is key. The pressure to act quickly isn’t always obvious—it can be subtle and manipulative. Scammers use tactics like the “fear of missing out” (FOMO) to make you feel that delaying your decision will cost you a rare opportunity.

For example, they may call an offer “exclusive” or “time-sensitive,” making you feel like it’s now or never.

But remember: real opportunities don’t rely on pressuring people. If someone is pushing you to act fast, take a step back, evaluate the situation, and trust your instincts.

Don’t let urgency cloud your judgment.

Take your time, think it through, and always verify the legitimacy of the opportunity before making a move.

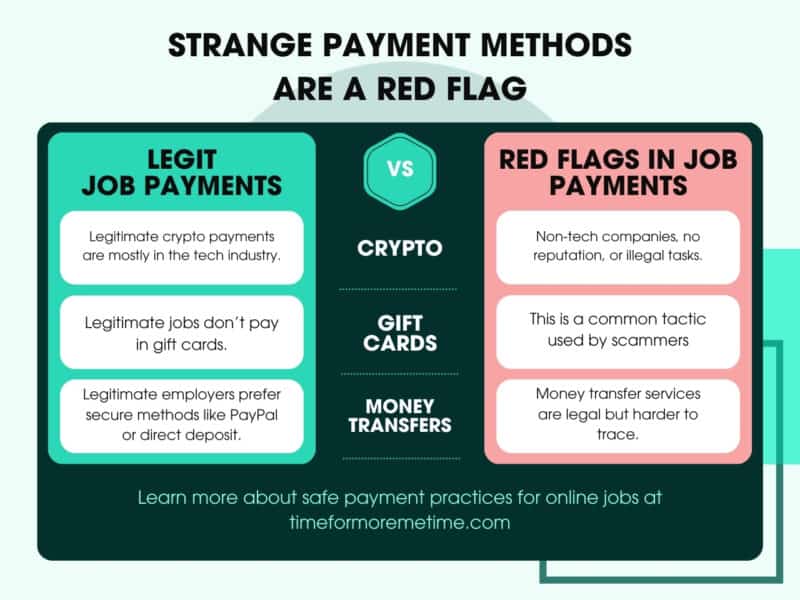

5. Strange Payment Methods

I’m no crypto expert, but if a job you’re applying for offers to pay you in cryptocurrency, my first instinct is to tell you to be cautious—even if it’s a side hustle.

While not all crypto-based jobs are scams, it can be tricky to determine whether one is legitimate or not. On top of that, crypto salaries come with their own set of risks.

Jobs that pay in crypto could be run by early adopters, generous employers, scammers, or even black market operators—it’s often hard to tell the difference.

So, how can you figure out which is which?

Here’s a simple rule: legitimate companies that pay in crypto are usually in the tech industry.

If the company isn’t tech-focused, lacks a solid reputation, or is brand new, it’s more likely to be a scam. Of course, if the job also involves illegal tasks, that’s a definite red flag. Always trust your instincts and proceed with caution when dealing with crypto payments.

Beyond crypto, some shady employers might offer payment in gift cards. This is another red flag. Legitimate jobs don’t pay in gift cards—period.

If you want to earn free gift cards, I’ve got you covered. You may want to consider joining reward platforms, turning online activities into rewards, or even using apps and websites to earn rewards!

In the U.S., some scammers also use money transfer services as a payment method.

While these services are legal and commonly used, they’re harder to trace, which makes them a favorite for scammers. On the other hand, legitimate employers tend to stick to well-known, secure methods like PayPal or direct deposits.

If the payment method seems unusual or feels off, take a closer look. Research the company and ask questions before agreeing to anything. When in doubt, walk away. Your time and effort are worth more than the risk of falling for a scam.

6. Suspicious Websites Or Emails

One of the biggest problems with scammers is that they invest their time in all the wrong places. If they put the same effort into polishing their websites and materials as they do in their scams, they could easily fool more victims!

But honestly, if they did that, they might as well get a regular job—at least then they’d be getting paid for their efforts, right?

Scammers are lazy. Laziness is often one of their biggest downfalls. When you encounter a website or email that looks unprofessional or poorly designed, it’s usually a sign of a scam.

Look out for spelling mistakes, broken links, or inconsistent branding. Scammers rarely invest the time or money to make their platforms look credible or trustworthy.

A legitimate company, on the other hand, usually has a well-designed website that reflects its professionalism. If the site looks outdated, full of errors, or feels like it was hastily thrown together, proceed with caution.

Trustworthy businesses understand the importance of a polished online presence and take care to ensure their websites look professional and are easy to navigate. Don’t be fooled by a messy site—it’s a clear red flag!

7. Unrealistic Offers

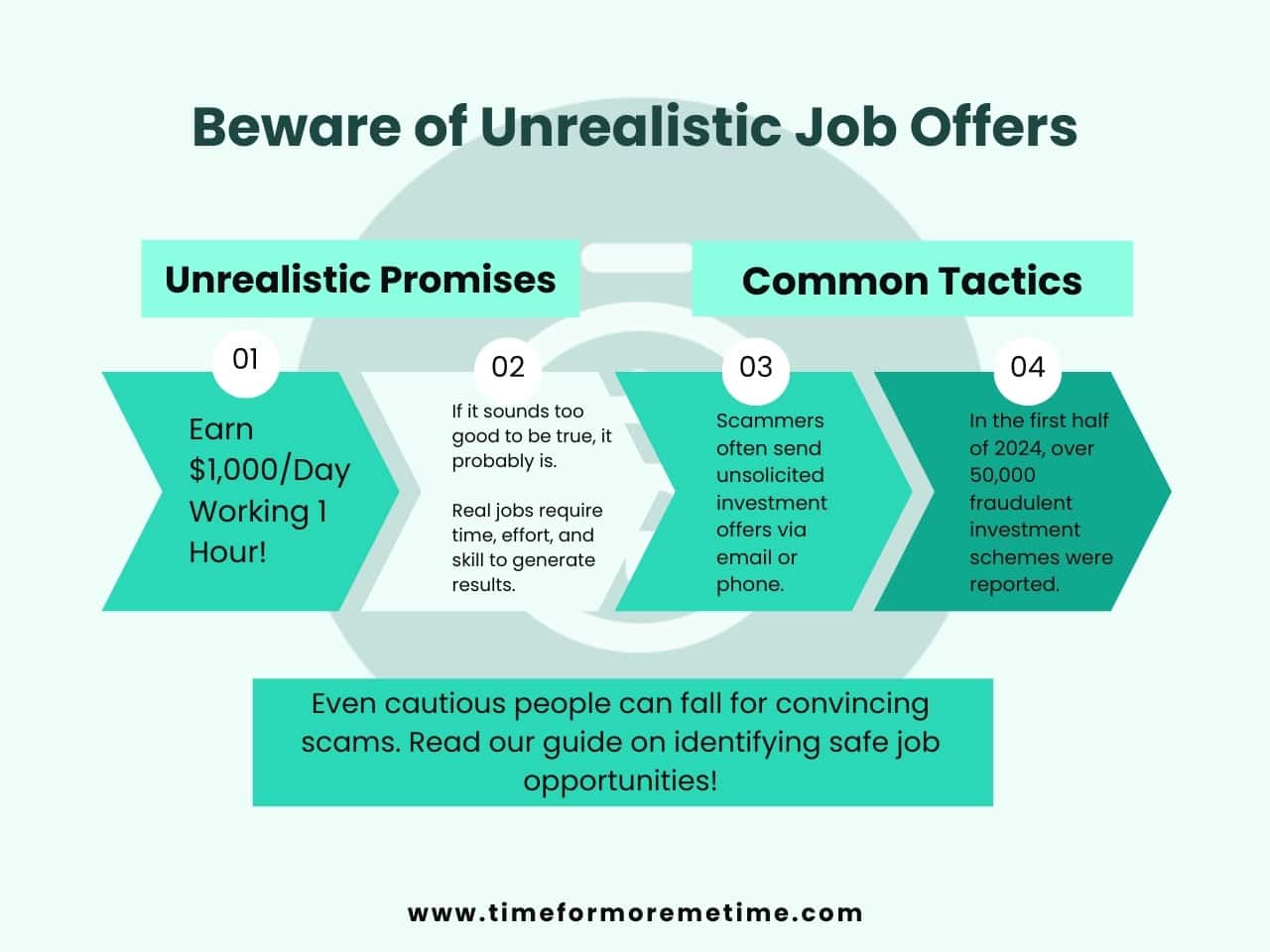

A major warning sign is when a job or platform promises you unrealistically high earnings with little to no effort.

Claims like “Make $1,000 a day working just one hour!” are designed to grab your attention and lure you in. Real opportunities take time, effort, and skill to produce consistent results.

This type of scam has become especially common in the form of unsolicited investment offers sent via email or phone calls. In the first half of 2024 alone, over 50,000 instances of fraudulent investment schemes have been reported.

If you ever receive an investment offer together with a job from a stranger through email or over the phone, delete the message or hang up immediately.

Don’t engage with it.

While you might feel confident in your ability to resist scammers, never underestimate their ability to persuade. Even the most cautious person can be talked into a convincing scam.

It’s always better to avoid these offers altogether than to risk falling for one.

FAQs

Need more information? You might find what you’re looking here!

What kinds of legitimate online jobs require upfront payments?

None. Legitimate online jobs don’t ask for upfront payments. Jobs that require you to pay for training and access to a platform or software before starting are often online job scams. Common examples include “data entry” or “affiliate marketing” jobs.

Remember, if an employer is asking you for money, you’re not an employee—you’re their customer, and at worst, you could become a victim.

Are high-paying online job offers too good to be true?

Not necessarily. There are high-paying online jobs that are legitimate! The key is to consider the job’s responsibilities and requirements. However, if a job offers a high salary for minimal work or experience, be cautious—it could be a scam.

Do all online job scams have vague job descriptions?

Not all jobs with vague descriptions are scams, but they should raise concerns. Some legitimate companies may post unclear listings, especially when they’re seeking general skills or don’t want to give too much away about the role.

It’s also possible that small business owners may be unsure about what they need and what they’re doing, which can lead to unclear job descriptions. Just be cautious and do your research before applying.

Conclusion

Remember one thing: don’t be desperate. I know that people looking for employment can be vulnerable, but unfortunately, some dishonest individuals take advantage of those seeking a better life or trying to put food on the table.

Keep these seven red flags of online job scams in mind when you start job hunting. And remember, it’s not just about protecting your money—it’s also about saving your time from being wasted.

If you’re looking for more guidance, be sure to check out our articles on the best remote job sites, how to find the right remote job, and other finance-related tips.

You can also follow us on YouTube and our social media pages for more insights, updates, and resources to help you achieve financial freedom. Good luck, and may you land the perfect, legitimate online job!