When you live with family, managing finances can easily become overwhelming. Understanding the top ways to manage household finances is crucial, as handling your finances alone is a different ballgame compared to managing them with others.

There’s a lot to consider, and you need to be smart about your spending.

Every expense must be tracked, every income accounted for, and you should be prepared for emergencies. It’s natural to feel like giving up on saving money or even the idea of retiring early at times.

While living with family and managing finances can be challenging, it’s part of the human experience. Managing a household’s finances can be nerve-wracking, but ensuring that everyone in the family is taken care of is incredibly rewarding.

So, instead of giving up on the chance to achieve financial freedom while living with family, it’s better to learn effective ways to manage household finances.

In this short guide, I’ll share the top strategies that helped me manage my household finances while living with my parents. Plus, I’ll add some methods I still use now that I’m living alone.

These tips can be applied whether you’re on your own or with your family. Let’s get started!

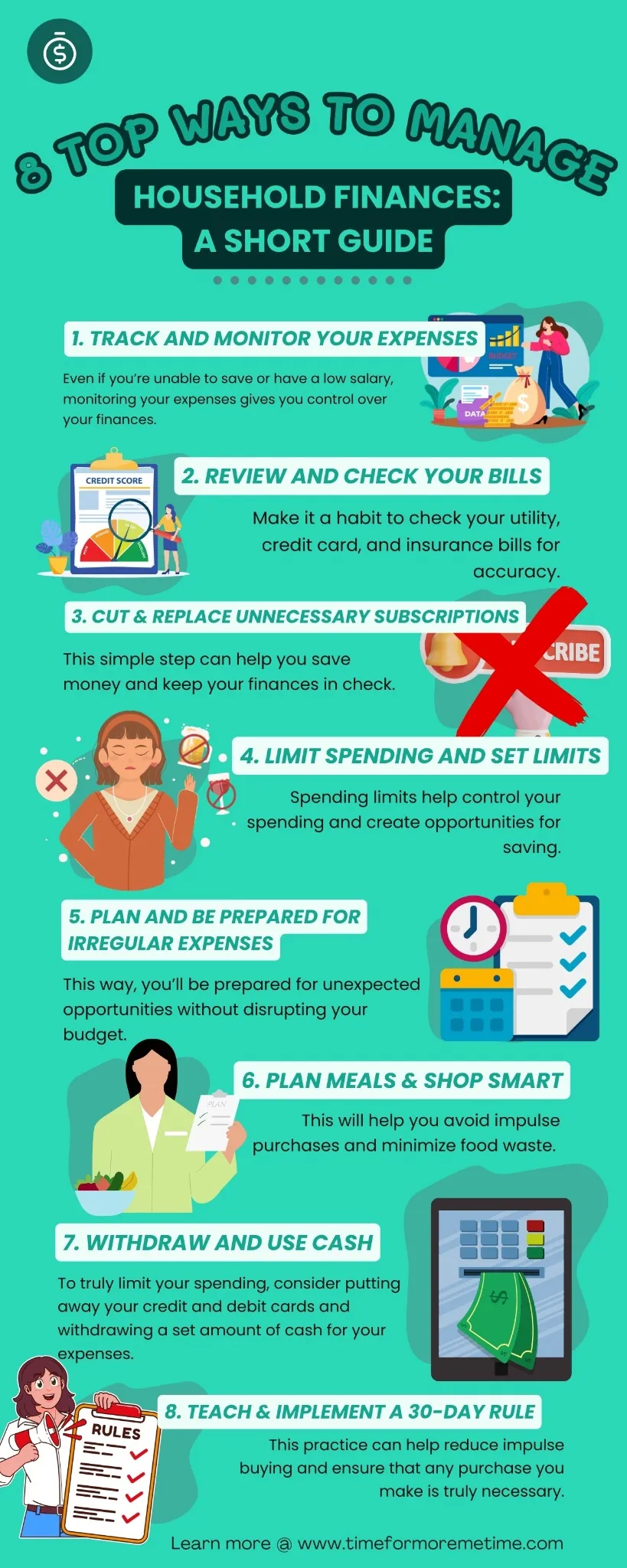

1. Track And Monitor Your Expenses

I can’t emphasize enough that tracking your expenses is the first step toward financial freedom. Even if you’re unable to save or have a low salary, monitoring your expenses gives you control over your finances.

There are several ways to track your expenses:

- Use expense tracking and budgeting apps for convenience.

- Manually track them using spreadsheets if you spend a lot of time on your computer.

- If you prefer a more traditional approach, pen and paper can work just as well.

Tracking your expenses provides an overview of how you manage your household finances. It helps you identify spending patterns and areas where you can improve, ultimately leading to better financial management.

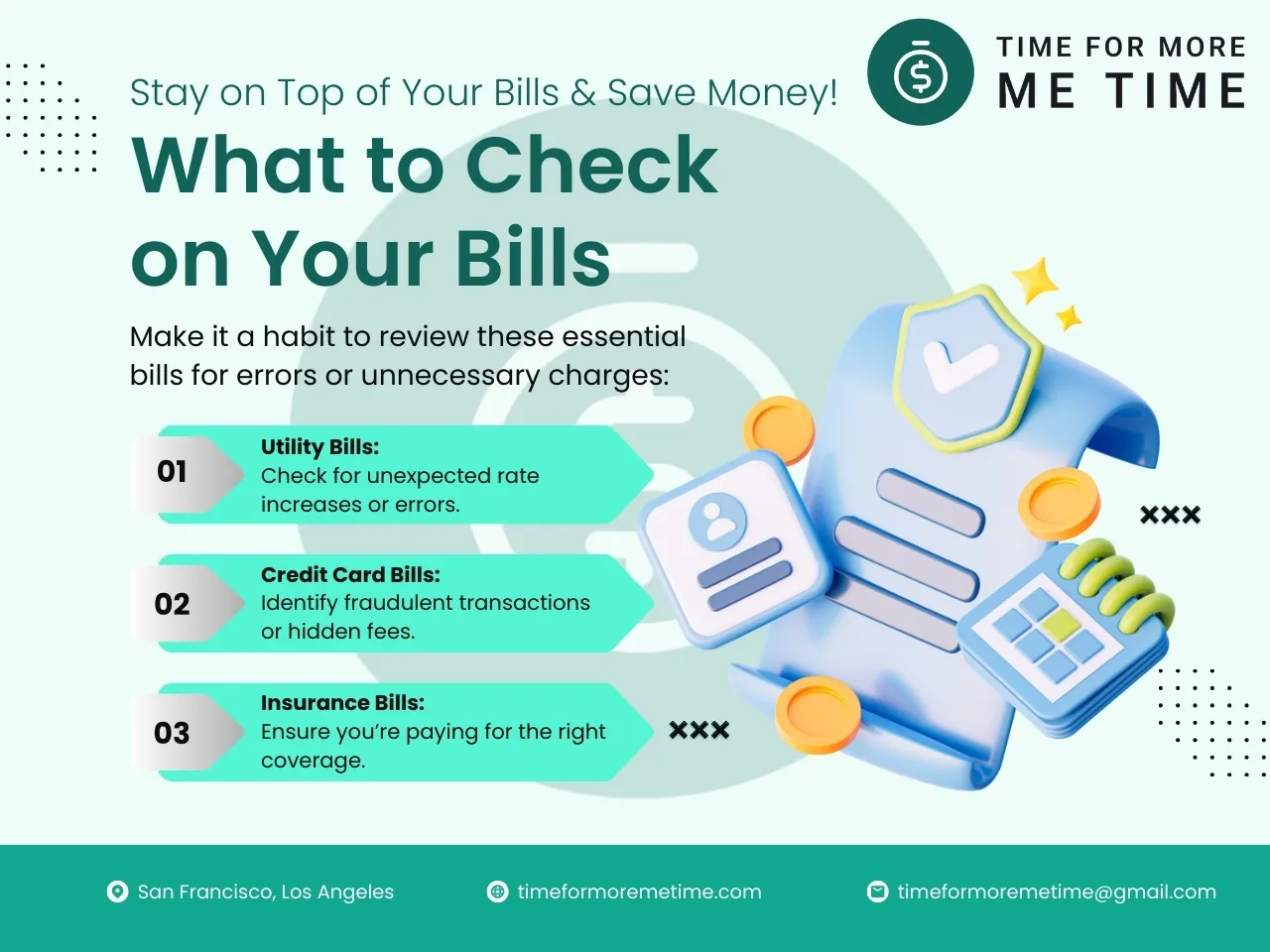

2. Review And Check Your Bills

While reviewing bills regularly is an important part of using expense tracking tools, it deserves its own section. Unlike many other expenses, bills are typically stable and consistent. However, that doesn’t mean you should take them for granted.

Make it a habit to check your utility, credit card, and insurance bills for accuracy. Ensure that your providers aren’t charging you extra and that you’re getting the most out of the services you’re paying for.

Additionally, look for opportunities to negotiate lower rates or consider switching providers for better deals. Regularly reviewing your bills can lead to significant savings and better financial management.

3. Cut And Replace Unnecessary Subscriptions

In addition to your utilities and insurance, take the time to review your recurring subscriptions and memberships. While you might think these should fall under bills, the landscape has changed significantly in recent years.

Today, many services can easily lure you into subscriptions that you may forget about. These charges often appear alongside your credit card bill, and if you’re on autopay, it’s easy to overlook subscriptions you’re not using.

Stay vigilant about all your subscriptions. Cancel any that you no longer use or need, and consider replacing them with more affordable options if possible. This simple step can help you save money and keep your finances in check.

4. Limit Spending And Set Limits

Once you’ve tracked your expenses for a week or a month, you’ll gain insight into how much money is leaking from your wallet.

The next step is to curb those expenses by setting spending limits, and this applies not only to you but also to your family members.

Spending limits help control your spending and create opportunities for saving. There are several effective ways to establish these limits:

- Set a Maximum Amount: Determine the maximum amount of money you can spend on non-essential items each month.

- Implement a No-Spend Period: Choose a specific time frame during which you won’t spend any money, allowing you to reset your spending habits.

- Limit Types of Purchases: Decide on specific categories of items or services that you will restrict your spending on, such as dining out or entertainment.

By setting clear spending limits, you can take control of your finances and work towards your savings goals.

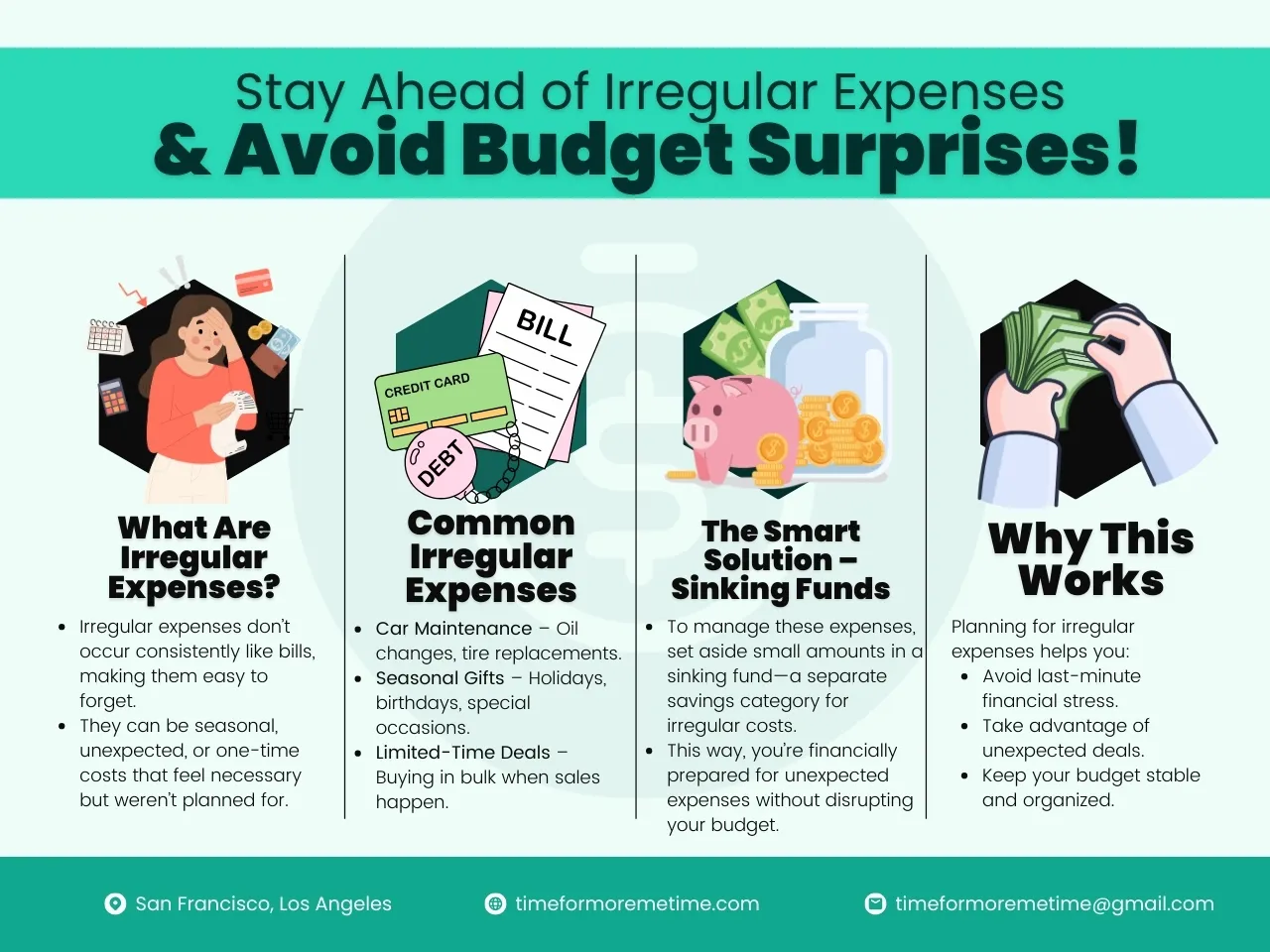

5. Plan And Be Prepared For Irregular Expenses

There are various types of expenses: needs, wants, and emergency expenses. In between these categories are irregular or seasonal expenses.

Irregular expenses are those that are not consistent with your regular bills. They may be seasonal or recurring costs that occur after an odd number of weeks or months, making them easy to forget.

Sometimes, irregular expenses can arise unexpectedly. While they may not be emergencies, they can feel somewhat necessary and often appear out of nowhere.

Common examples include car maintenance and seasonal gifts. Another example is when a tray of eggs suddenly goes on sale. While it’s a good deal, and you may already have eggs at home, it presents a sudden opportunity.

It’s a need, but it can also be seen as a want because of the bargain.

To manage these irregular expenses, set aside a small amount of money specifically for them, also known as sinking funds. This way, you’ll be prepared for unexpected opportunities without disrupting your budget.

6. Plan Meals And Shop Smart

In addition to bills, rent, and mortgage, meals are another significant expense in your household.

To reduce costs in this area, create a weekly meal plan and shopping list. This will help you avoid impulse purchases and minimize food waste. Consider buying non-perishable items in bulk to save even more.

If dining out is a tradition in your home, set a monthly limit for restaurant expenses. Alternatively, learn how to cook your favorite dishes at home to satisfy your cravings without the added cost.

If you find that you need specific tools or equipment to prepare these meals, consider investing in them, such as an espresso machine or other kitchen gadgets.

Additionally, instead of budgeting for your kids’ meals at school or your partner’s meals at work, consider preparing homemade lunches when possible. Not only is it a thoughtful gesture, but it can also save you a significant amount of money.

7. Withdraw And Use Cash

This is a personal favorite of mine and one of the top ways to manage household finances effectively.

While setting spending limits and writing them down works for most people, it doesn’t work for everyone. To truly limit your spending, consider putting away your credit and debit cards and withdrawing a set amount of cash for your expenses.

The best part about using cash is that it encourages you to think carefully about your purchases.

It also provides a hard limit on what you can spend. Unlike with a credit card, if the cash you have is less than the cost of an item, you simply can’t buy it, which helps prevent overspending.

If I have kids, I would also give them a set amount of cash as an allowance.

Unfortunately, many kids today have access to prepaid and credit cards, which I believe can be problematic. This often leads to parents facing headaches when their children make impulsive online purchases for games or other items.

When I was younger, my parents gave us allowances to teach us how to budget our money and learn from the mistakes of overspending. Using cash can instill valuable financial lessons that last a lifetime.

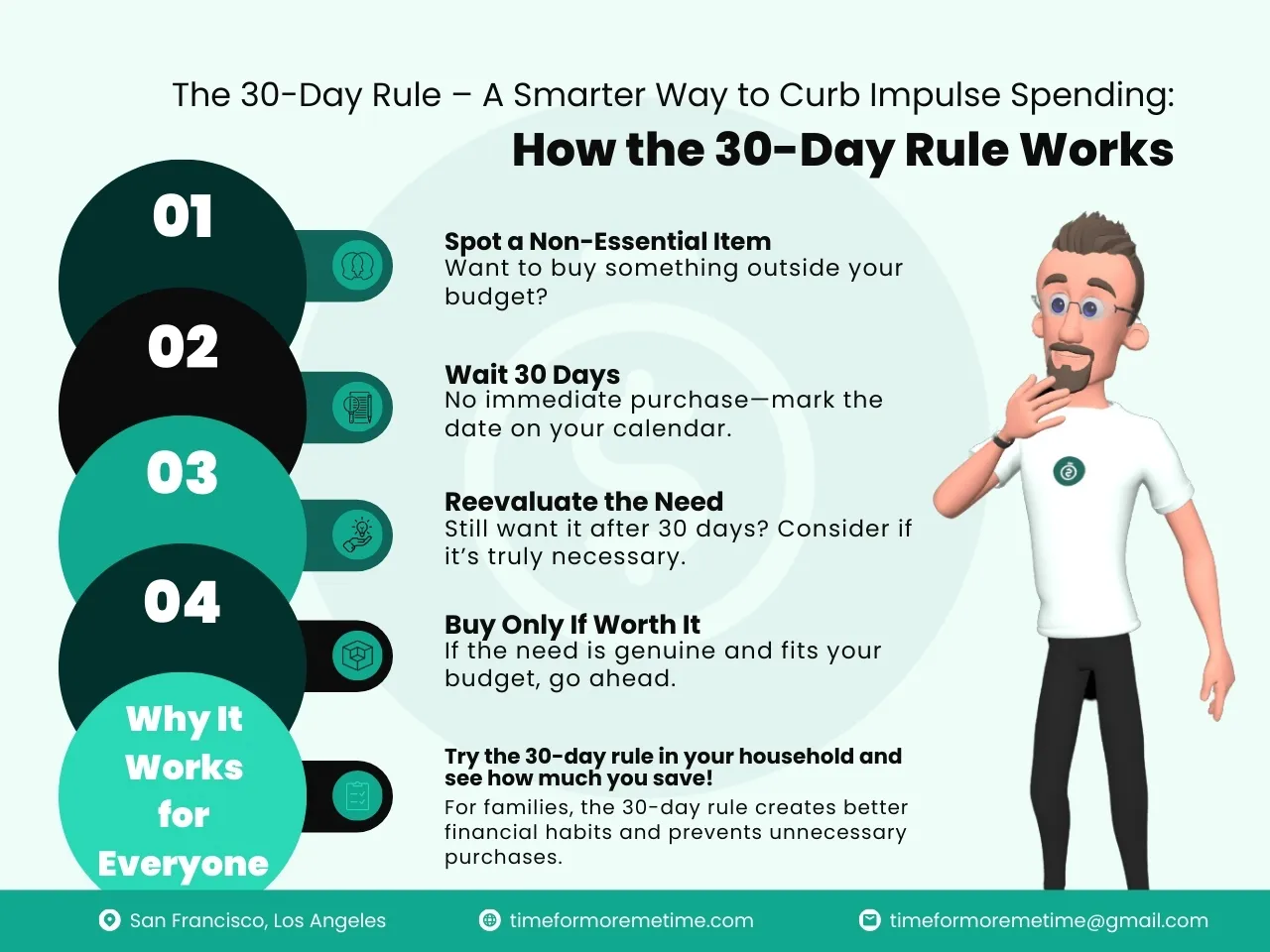

8. Teach And Implement A 30-Day Rule

I usually recommend the 24-hour rule for preventing impulse spending, but when you’re in a household with kids, I suggest teaching and implementing a 30-day rule. If you’re not familiar with it, let me explain.

The 24-hour rule is a technique that helps people avoid impulsive purchases.

When someone wants to buy something not included in the budget, they wait 24 hours before making a decision. Often, they forget about the item and end up not spending the money. This method works well for single individuals.

However, when you have kids, they won’t just forget about something in 24 hours; they’ll keep asking for it.

To address this, extend the waiting period to 30 days. While they may pester you for the first week, by the second week, they often forget about it. If they still want the item after a month, then it’s time to reconsider the purchase.

This rule isn’t just for the kids; it applies to adults as well.

When you’re single, you might feel free to use the 24-hour rule without much thought. But when you’re with family, it’s a different situation.

So, for non-essential purchases, wait 30 days before buying. This practice can help reduce impulse buying and ensure that any purchase you make is truly necessary.

FAQs

Here are some frequently asked questions and their respective answers that may further help you manage your household’s finances!

What are some common financial mistakes families make?

Unfortunately, there are many common financial mistakes that families make, and I’ve experienced several of them firsthand with my parents.

Some of these include not having an emergency fund, overspending on non-essentials, and failing to track expenses. In our case, my mother assigned me the task of tracking our expenses to help us recover financially.

For a long time, we didn’t have an emergency fund, which had serious consequences. This lack of financial cushion ultimately led to my siblings and me being taken away from our parents due to a sudden financial crisis.

Other common financial mistakes families make include not setting clear financial goals, failing to review insurance coverage regularly, and ignoring debt management.

Addressing these issues can help families achieve better financial stability and security.

How can I avoid lifestyle inflation as my income increases?

Lifestyle inflation, or lifestyle creep, occurs when your income increases and your spending on lifestyle upgrades rises as well. This can lead to significant financial problems.

Fortunately, I never experienced this issue, perhaps because I was raised in a strict environment of poverty.

The only change in my lifestyle when I earned more was taking on another job and working on building this site. My lifestyle remained largely the same.

If you find yourself facing lifestyle inflation, there are several strategies to tackle it.

First, maintain your current lifestyle by sticking to your budget and continuing to save. Consider allocating a portion of any income increase to savings or investments instead of increasing your spending.

This approach can help you build wealth over time while keeping your financial goals on track.

How can I involve my family in budgeting discussions?

The key is to hold regular family meetings to discuss finances, set goals together, and encourage everyone to share their thoughts on spending and saving. This approach helped my parents, my siblings, and me when we were facing financial difficulties.

While these discussions didn’t completely shield us from the impact of our financial struggles, they helped my brother and me understand our situation better.

This understanding likely contributed to the fact that we never held any resentment towards our parents for our struggles with poverty.

Conclusion

And there you have it! These are the top ways to manage your household finances and expenses. They’re quite simple, really. The challenge lies in sticking to them consistently.

Take meal planning and cooking homemade lunches, for example. Many people may commit to this for a month or two, but once things improve, they often revert to eating out.

I challenge you not to fall into this pattern. Make sure you and your family stay disciplined in following these practices.

If you do, you’ll create a more comfortable life for your family. And don’t forget to read the other articles that can help you save more and earn extra income! Subscribe to my YouTube channel to get notified for more finance-related tips.