Many people struggle to manage their money, leading to stress, overspending, and difficulty saving for important goals. Budgeting apps offer a simple solution. So, this post will talk about them to help you out. Let’s get started!

What Are Budgeting Apps

Budgeting apps are digital tools designed to help individuals manage their finances by tracking income and expenses. They fall under the category of personal finance management tools, which are resources that assist people in making informed decisions about their money.

Budgeting apps serve as a specific type of personal finance management tool that focuses on helping users create and maintain a budget.

How Do Budgeting Apps Work

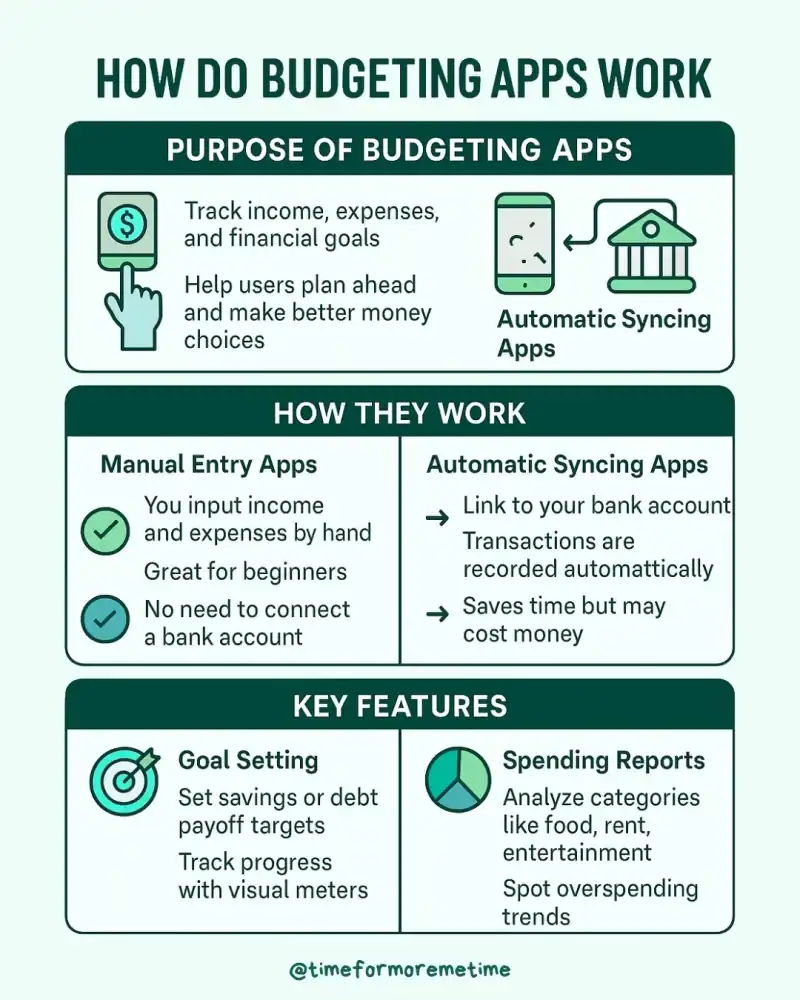

Budgeting apps are designed to give users a clear view of their income and expenses while allowing them to set aside money for future costs and prepare for upcoming income. Different budgeting apps offer various features that can change how users use the app and the information they can get.

For example, some apps have automatic syncing features that connect to your bank account, recording transactions, withdrawals, and income automatically. While the most common ones require manual entry, meaning you need to type in all your financial data yourself.

Additionally, some apps include goal-setting features that help users set specific money goals and track their progress toward reaching them. Meanwhile, other apps focus on creating reports, providing detailed pictures of spending habits to help users understand their financial behavior.

Most budgeting apps available in app stores are manual entry apps, making them a simple way to start tracking your finances without needing to connect bank accounts. Many of these apps are free and often include extra features at no additional cost.

However, the most popular budgeting apps usually require payment to access additional features, such as automatic syncing with bank accounts, which can simplify budgeting. Some apps follow a freemium model, allowing you to use basic features for free while charging for advanced features.

Additionally, some apps may offer free trials. Once the trial period ends, you will need to purchase the app to keep using it. Some freemium apps also provide access to certain paid features during the free trial, so be sure to pay attention to these options.

What Are The Types Of Budgeting Apps

Budgeting apps can be grouped based on their purpose and what they specialize in. Here are some common types:

- Expense Trackers: These apps help users record and categorize their daily spending, making it easier to see where their money goes.

- Zero-Based Budgeting Apps: These apps encourage users to assign every dollar they earn to specific expenses or savings, ensuring that no money is left unallocated.

- Envelope Budgeting Apps: These apps use a digital version of the envelope system, allowing users to set aside funds for different categories and track their spending within those limits.

- Goal-Oriented Budgeting Apps: These apps help users set and achieve specific financial goals, such as saving for a vacation or paying off debt.

- Subscription Management Apps: These apps help users keep track of their recurring subscriptions, like streaming services or gym memberships, to ensure they stay within their budget.

Depending on your financial goals, there is a specific app that can meet your needs.

Where To Find Budgeting Apps

You can easily find budgeting apps in the following places:

- App Stores: Budgeting apps are available for download on platforms like the Apple App Store and Google Play Store. Simply search for “budgeting apps,” and these platforms will show you a list of options you can download.

- Online Websites: Many budgeting apps have their own websites where you can sign up and use their services directly from your computer. You can find these websites by using search engines.

- Financial Institutions: Some banks and credit unions offer their own budgeting tools as part of their online banking services. If you have an account with a bank that provides budgeting features, you can log into your online banking portal to access these tools and track your spending.

As mentioned a while ago, most budgeting apps are free, including those offered by your bank. While some apps may have advanced features that make budgeting easier, it’s a good idea to start with the free options, as many of them are effective for managing your budget.

Why You Should Use Budgeting Apps

Using budgeting apps is important for anyone who wants to take control of their finances and improve their money management skills. These apps make budgeting easier by helping you track your spending and identify areas where you can save money.

One major benefit of budgeting apps is that they provide real-time insights into your spending habits, allowing you to make informed decisions. For example, if you see that you are spending too much on dining out, you can adjust your budget to save more or cover essential expenses.

However, it’s worth noting that not everyone prefers managing their budget digitally. Some people still enjoy using traditional methods like spreadsheets, budgeting notebooks, or journals. If you’re unsure about which method works best for you, consider downloading a budgeting app to see if it fits your needs.

When Is the Best Time To Use Budgeting Apps

The best time to download a budgeting app is now, or whenever you have time to explore your options. Since most apps are free, you can try them out to see how they work and how they can benefit you.

Once you recognize their usefulness, the best time to start using the app regularly is at the beginning of each month when you plan your expenses. This timing allows you to create a clear budget based on your income and upcoming bills.

Conclusion

Budgeting apps can be valuable tools for individuals seeking to enhance their financial management, offering features that simplify tracking expenses and setting financial goals. By using these apps, you can gain better control over your spending, save more effectively, and make informed financial decisions.

To stay updated on more financial tips and strategies, be sure to subscribe to our blog, follow us on social media, and watch our YouTube channel for helpful content!

Sources

- Photo: Unsplash: Live Richer