Frugality is about being careful with your resources and making the most of what you have without sacrificing happiness. It encourages meaningful choices, allowing you to spend less on things that don’t matter and focus on what truly counts.

By living frugally, you can stretch your dollars further, reduce financial stress, and enjoy life’s simple pleasures. If you find yourself in a tight financial situation, frugality may become your default lifestyle, as I experienced years ago.

But even if you’re not struggling financially, you might wonder why you should consider living frugally. With the current economy, simply saving money isn’t enough. Year after year, inflation decreases the value of our money, so we need to save more than ever.

If you’re ready to embrace a frugal lifestyle, I have some tips that will help you save without feeling like you’re living cheaply. You might find them quite helpful. Let’s get started!

1. Master Smart Grocery Shopping

Grocery shopping is a great chance to be frugal, especially for larger families or regular shoppers. Here are some simple tips to save money without losing quality or nutrition:

- Plan Meals Wisely: Meal planning helps cut down on food waste and control spending. By planning meals, you’re less likely to make impulse buys and more likely to buy only what you need, saving money and reducing waste.

- Buy Seasonal and Local: Choosing seasonal, local produce can save you money. Seasonal items are often cheaper and taste fresher. Shopping at farmer’s markets or co-ops can give you good ingredients at lower prices while helping the local economy.

- Use Cashback Apps: Cashback apps and discount sites are easy ways to save on everyday purchases. They offer cashback and discounts on essentials like groceries, toiletries, and gas. Trying different apps can help you find the best deals.

These grocery shopping tips can help you stretch your budget while managing your expenses effectively.

2. Enjoy Affordable Entertainment

Rising costs can put pressure on your entertainment budget, but there are many ways to enjoy your free time without overspending. If you don’t have any idea about affordable entertainment, here’s a quick list:

- Free Local Events: Many communities have free events throughout the year, like parades, craft fairs, concerts, and classes. Checking local listings and social media can show you a variety of free or low-cost options, especially during holidays. These events provide fun outings and help you connect with your community.

- DIY Fun: At-home activities can be just as enjoyable as a night out. Host a board game night, movie marathon, or themed party with friends or family. Potluck gatherings are another great idea, where each guest brings a dish, creating a fun atmosphere without high costs.

- Nature: Enjoying the outdoors is a great way to have fun without spending much. Go for a hike, have a picnic in the park, or explore local trails. Nature offers many chances for relaxation and adventure at little to no cost.

These options won’t even cost you a dime. Of course, some activities may require a few bucks, like visiting a park, but it’s much cheaper than typical entertainment options.

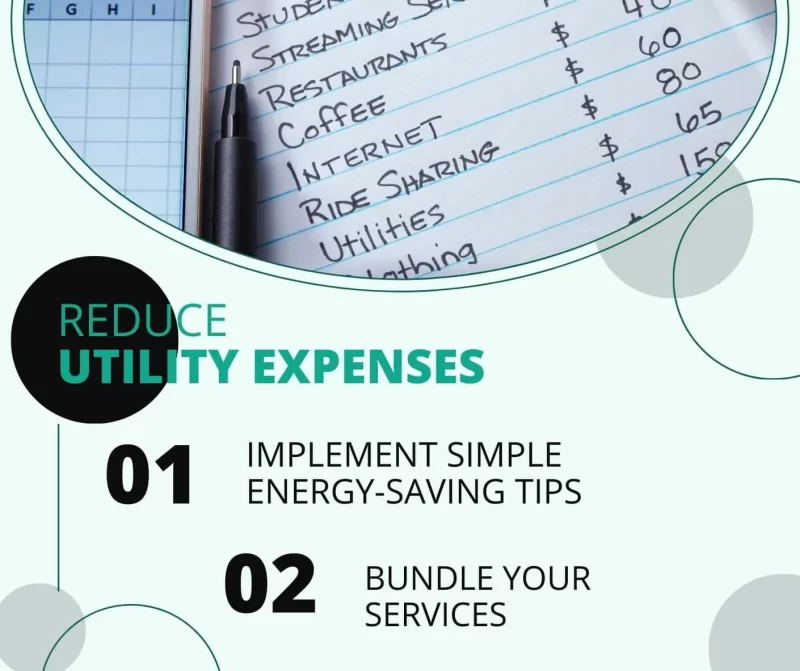

3. Reduce Utility Expenses

With utility prices rising, adopting smart habits can help reduce expenses and free up money for other priorities. Here are some practical tips, including time-tested practices from the Great Depression, to cut utility costs:

- Implement Simple Energy-Saving Tactics: Small changes at home can lead to big savings. Start by using LED light bulbs, which use less energy and last longer. Unplug electronics when not in use to avoid “phantom energy” draw, and remember to turn off lights when leaving a room.

- Bundle Your Services: Bundling services like cable, internet, and phone can lower your monthly bills. Assess what you really need, as many households pay for extras—like expanded phone packages or premium channels—that they rarely use. By cutting down to the essentials, you can keep your bills manageable while still enjoying the services you rely on.

- Adjust Your Thermostat: Lowering your thermostat in winter and raising it in summer can save a lot on heating and cooling costs. Even a small change of a few degrees can make a difference. Consider using a programmable thermostat to automatically adjust the temperature when you’re not home, helping you save energy without much effort.

Doing these is a quick way to keep your bills manageable while still enjoying the core services your household relies on. Of course, if it’s too cold or hot—or if you’re getting too inconvenienced—give yourself a break and relax a few of these rules.

4. Maximize Discounts And Coupons

We talked about using cashback and discount apps, but you shouldn’t stop at regular coupons; many stores and online sites offer more ways to get discounts. These small steps can greatly affect your overall budget, especially with larger retailers.

- Sign Up for Loyalty Programs: Loyalty programs at grocery stores, pharmacies, and gas stations are easy to join and can lead to big savings over time. They often work with sales and sometimes offer special deals on bulk items. Even small discounts on regular purchases add up, helping to keep costs down with little effort.

- Use Online Discount Codes: If you like online shopping, join sites that offer discounts. These sites can give you discount codes, cashback, and reward points that you can use for future purchases. Some sites even let you earn points by watching ads or doing small tasks, making it easier to save without changing how you shop.

- Check for Price Matching: Many stores offer price matching, which means they will match a lower price from a competitor. Before you buy something, check if the store has a price matching policy. This can help you save money without having to shop around, making sure you get the best deal.

To be honest, these steps can be a bit tiring to follow, but what can you do if you really want to save some cash? So, grit your teeth and get it done!

5. Embrace Second-Hand Shopping

Buying used items, from clothes to furniture, saves money and reduces waste. This habit was common in past generations and is just as effective today.

By buying high-quality, second-hand goods, you can avoid retail prices while still finding great items that last. Here are some ways to make the most of second-hand shopping:

- Visit Thrift Stores and Consignment Shops: These places are great for finding affordable, gently used items. You can often discover unique pieces that you won’t find in regular stores.

Check Online Marketplaces: Websites like Facebook Marketplace and Craigslist offer a wide range of items at low prices. You can often negotiate prices and find good deals.

Join Local Item Swaps: Get involved in local Buy Nothing groups or Freecycle networks to find useful items for free. These communities let you give away things you no longer need and get items you want without spending money.

So, as soon as possible, check out the nearest stores and groups to save some cash and enjoy the thrill of thrifting!

6. Cook At Home

Cooking at home is healthier and saves money compared to eating out. With rising restaurant costs, making meals in your kitchen can help stretch your budget while still enjoying good food.

On average, Americans spend $166 monthly per person on restaurants. If you eat three meals a day, that can add up to about $329 a week. In contrast, cooking at home may only cost around $112 a week, saving you about $217 each week.

By cutting back on eating out, you can use those savings for other important needs, leading to better financial health and more control over your diet. Here are some tips to make cooking at home easier:

- Try Simple Recipes: Look for easy recipes that need few ingredients. This can make cooking less stressful and more fun, encouraging you to keep it up.

Plan Your Meals: Create a weekly meal plan to avoid last-minute takeout. This helps you buy only what you need and cuts down on food waste.

Cook in Batches: Make larger portions and store leftovers for future meals. This saves time and ensures you have ready-to-eat meals on busy days.

I’m sure you’ll love doing these. I did, especially when I started living alone. You can’t deny that cooking your own meals and finding them delicious boosts your confidence and brings joy!

7. Apply The 30-Day Rule

In today’s consumer-driven world, careful spending is key to achieving financial freedom. Making smart buying decisions is important for staying on budget. Here are some money-saving tips to help you make better choices:

- Implement a 30-Day Waiting Period: Before making any non-essential purchases, wait 30 days. This helps you decide if an item is a real need or just a passing want. Also, avoid temptations. Unsubscribe from marketing emails and limit your time on shopping websites to cut down on impulse buys.

Use a Checking Account with Notifications: Choose a checking account that offers direct deposit and instant alerts. This lets you track your spending in real time. And if you can, set spending limits. Create limits for different categories, like groceries and entertainment. This helps you stay within your budget and focus on important purchases.

Review Your Expenses: At the end of each month, look over your spending to see if it matches your goals. This can help you make better choices in the future.

I always apply the 30-day rule to everything I want to buy. Often, after a week or a few days, I forget about them. If I forget, it means I don’t really need them or want them badly.

8. Create A Wish List

A practical way to manage your spending is to keep a wish list. Honestly, it can be a bit tricky to have a wish list when you follow the 30-day rule. To work around this, I only add items to my wish list if they are things I truly need but can’t afford right now.

For those who may not follow the same approach, here are some tips:

- List Desired Items: Write down everything you want, including prices. This helps you see what you really want and plan your purchases.

Track Sales: Keep an eye on sales and discounts for items on your wish list. This way, you can decide if it’s the right time to buy.

Evaluate Each Item: Consider how each item will benefit your household and fit into your daily life. This encourages thoughtful spending and helps you prioritize what’s truly needed.

Also, it would help if you discuss this with your family. Share your wish list with family members to agree on what’s essential. This can reduce impulse buys and ensure everyone is on the same page.

9. Evaluate Your Subscriptions

With many subscriptions for streaming services, phone plans, and other entertainment options, it’s easy to lose track of your spending. Make it a habit to review and optimize your subscriptions regularly.

So, do the following:

- List All Subscriptions: Write down all your subscriptions and their costs. This helps you see where your money is going.

Identify Unused Services: Check which subscriptions you rarely use. If you have multiple streaming services but only watch one, consider canceling the others.

Explore Sharing Options: Look into sharing accounts with family or friends to cut costs. This can help you enjoy the services you love without paying full price.

Once you eliminate all the excess subscriptions, reallocate the money you saved. Use the money saved from canceled subscriptions to invest in experiences that matter to you, like a family vacation or a new hobby.

FAQs

Here’s the FAQ section for more information!

How do you live extremely frugally?

Extreme frugality means becoming a minimalist, focusing on what you really need, and even adopting a stoic lifestyle. It includes careful buying, reusing items, making things yourself, and cutting back on non-essential spending. And in most cases, forgetting about entertainment and any form of luxury, regardless if said luxury is cheap.

For example, you might choose a cast iron skillet that lasts for years or use glass jars for pantry storage. You can also make your own cleaning products with vinegar and baking soda, and save money on coffee shop drinks by brewing your own at home. And instead of watching a movie you want, you would rather not.

Is it possible to be frugal and still enjoy life?

Yes, you can be frugal and still enjoy life! Being frugal doesn’t mean you have to give up fun experiences. Look for free or low-cost activities in your community, such as local events, parks, or free classes. You can also find affordable hobbies that bring you joy without breaking the bank.

How can I involve my family in frugal living?

Involving your family in frugal living can make it easier and more fun. Have open discussions about your budget and savings goals. Plan meals together, go grocery shopping as a family, and find fun, low-cost activities to do together. Teaching kids about money management and the value of saving can help them develop good habits for the future.

Conclusion

Hopefully, these frugal living tips can help you save money without feeling cheap, allowing you to live a happy and enjoyable life. To be honest, these are still tame compared to some extreme frugal living strategies. Thankfully, we don’t need to go that far to save money.

Anyway, for more tips on living a smart financial lifestyle, be sure to subscribe to our blog, follow our social media accounts, and watch our content in our YouTube channel.

Source

- Photo: Unsplash: Dan Counsell