The new generation is fortunate to live in the age of the internet. With just a few clicks, they can access all the knowledge they need—whether it’s finding a financial advisor for seniors, learning new skills, or exploring topics they’re curious about.

No trips to the library, no waiting for school lessons—everything is right there in their pocket, lap, or desk.

For my generation and older ones, it wasn’t that easy—and I’m not even that old, mind you! Accessing information meant relying on traditional methods, like books or classes. If those weren’t available, ignorance was often the default. When we needed help, we had to hire someone to teach or assist us.

Even now, though the internet is available to us too, time and privilege are not always on our side. Take me, for instance—I work two jobs. I’d love to learn website design and development, but it’s just not feasible. I’ve accepted that and sought outside help instead.

The same applies to managing finances. While I understand the basics, I often consult professionals. Now, imagine being 65 or older, possibly retired (though that’s not a given in today’s economy). With Social Security hopefully providing some support, keeping a tight grip on your finances becomes even more important.

Becoming a retiree or senior brings unique financial challenges and opportunities. Retirement planning shifts into high gear, and unexpected expenses—particularly healthcare costs—can quickly eat into your budget. According to Fidelity Investments, a reputable multinational financial services corporation, healthcare expenses consume around 15% of a senior’s budget.

This is where a financial advisor can make a world of difference. They offer strategies to maximize retirement income, protect your assets, and plan for surprises. The need for expert advice is clear: a report from the Insured Retirement Institute (IRI) reveals that only 25% of baby boomers feel confident their savings will last through retirement.

If this sounds familiar, now might be the time to take action. Keep reading to learn how a financial advisor can help you navigate this crucial stage of life.

Financial Advisors: What Do They Do

If you’re here, you’re probably wondering what financial advisors actually do. Maybe you picture them as smooth-talking professionals, but in reality, they’re just people focused on helping you create personalized plans. These plans tackle key areas of retirement, like estate planning, managing risks, and making your taxes work more efficiently.

Personally, I know I’ll need their help someday. Unlike you, who might already be building wealth, I’m still working on getting there.

As more Americans reach retirement age, demand for personalized financial advice is growing. Most of them increasingly seek expert help to make smart choices about their money and healthcare. At this stage of life, earning opportunities often shrink, making it essential to spend and manage assets wisely for a comfortable retirement.

So, how exactly do financial advisors help? Here’s a quick overview of their key services:

- Estate planning: Helping manage the transfer of your assets while protecting your legacy.

- Tax optimization: Crafting strategies to reduce your tax burden and save more.

- Risk management: Diversifying your investments to protect against big losses.

- Income management: Ensuring a steady flow of income to support your lifestyle throughout retirement.

- Goal setting and tracking: Assisting you in defining financial goals and providing ongoing guidance to stay on track.

Most of these key services are available in most robo-advisors. One of them is Acorns. With Acorns, you can start investing with as little as $5 a week and allow your money to grow through compound returns. You can even receive money tips and tricks from their top experts.

If you want to explore how this service works by using it yourself, I recommend getting started with this through my link: join Acorns. If you do, you’ll receive a $5 bonus. It’s not much, but it’s still money! If you need more information, continue reading!

Now that you have an idea of what robo-advisors offer, you’re probably asking, “How do they make this work for me?” Don’t worry—I’ll break it all down in the next section.

Financial Advisors: What Benefits They Bring

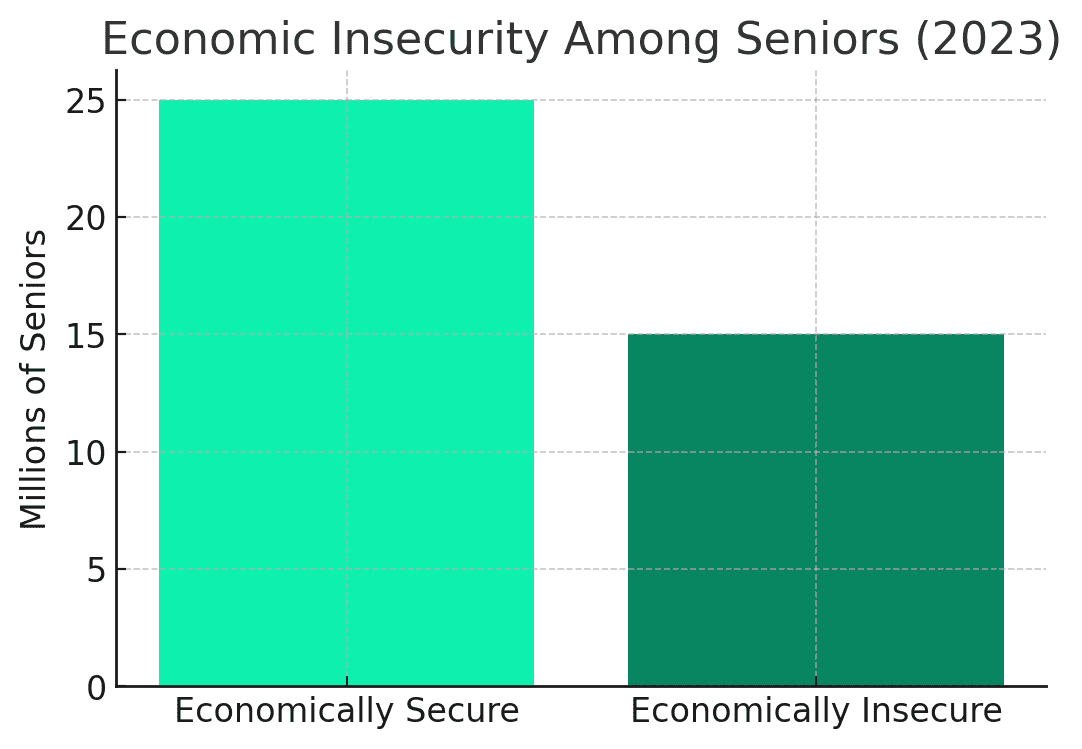

The economy isn’t doing anyone any favors right now. Inflation is high, and even basic groceries feel like luxuries. For low-income seniors, this reality is even harsher. Many are living in economic insecurity, with limited access to quality healthcare. According to the National Council on Aging (NCOA), more than 17 million seniors in the U.S. are economically insecure.

Seniors also face additional challenges, including high housing costs, poor nutrition, limited transportation, dwindling savings, and job loss. It’s heartbreaking to think that, at an age when people should be enjoying retirement, many are forced to consider employment just to make ends meet. One of the core ideals of the American dream is retiring comfortably—not working until the very end just to survive.

This is why seniors, especially those facing financial struggles at 65 and beyond, should seek assistance. Financial advisors can step in to craft strategies that make limited resources stretch further, easing the burden and making life more manageable.

But financial advisors don’t just help with immediate concerns. They offer a wide range of services, such as:

- Customized Plans: Advisors create a financial roadmap based on your goals and risk tolerance, helping you adjust investments to meet retirement needs.

- Tax Strategies: By using tax-efficient withdrawals and strategic planning, advisors can minimize the taxes you owe during retirement.

- Estate Planning: Advisors assist in creating wills and trusts to protect your assets and ensure your wishes are honored.

- Healthcare Cost Management: They help you plan for Medicare premiums, long-term care, and other medical expenses.

- Budget Optimization: Advisors can develop a budget that prioritizes essential expenses, reduces waste, and makes the most of your resources.

- Access to Government Programs: Many seniors are unaware of programs like Medicaid, Supplemental Security Income (SSI), and Low Income Home Energy Assistance Program (LIHEAP). Advisors guide them through the application process.

- Debt Management: They can help you reduce or eliminate debt, freeing up funds for daily living costs.

In tough times, having a trusted financial advisor can make all the difference, helping seniors navigate challenges and achieve a more secure and dignified retirement.

Financial Advisors: What Are The Traditional Alternative

If financial advisors are so helpful, why doesn’t everyone use them? The simple answer is cost. For many, spending money to save money feels counterintuitive. This is especially true for retirees on a tight budget since financial advisors aren’t always affordable.

I get it. And there are some who are like the old me. Like many young people, I thought, I can do what they do. I can handle my finances on my own. I don’t need to give them my hard-earned money!

And sure, it’s possible not to get help. But here’s something to consider: if you could do it all on your own, why haven’t you already set yourself up for financial success? The answer likely isn’t laziness or lack of effort—life has a way of pulling our focus elsewhere. Whether it’s family, friends, or community obligations, we often put others first and leave our financial well-being on the back burner.

That said, not being able to afford a financial advisor doesn’t mean you’re out of options. There are alternatives that can provide valuable guidance, many of which are free or budget-friendly. Here are some options:

- Banks and Credit Unions: Many institutions offer free workshops and one-on-one advisory sessions for members. These often cover retirement planning, debt management, and saving strategies.

- Employer-Based Programs: Some retirees still have access to financial counseling through former employers’ benefit programs or 401(k) providers

- Community-Based Organizations and Nonprofits: Many nonprofits and local government programs provide free workshops and seminars on topics like Social Security benefits and Medicare. These events often include step-by-step guidance on complex financial decisions.

You can start by reaching out to your bank or credit union to see if they provide advisory services or workshops. If you’re employed, ask your employer about available financial counseling services. While these programs may not be common, you might also find a community organization willing to provide the guidance you need.

With some research and effort, these alternatives can help you take practical steps toward financial security without spending a lot. They can also give you a clearer understanding of whether you need a financial advisor and when it might be the right time to get one.

Financial Advisor: What Are The Modern Alternative

If you’re in a tight spot or just want to explore other options, online platforms could be the way to go. I completely understand, as this was my first step when I started focusing on improving my finances. There’s something empowering about doing things on your own and having access to resources right from the comfort of your home.

It’s great that financial advice is now more accessible than ever, and many of these platforms are run by professionals. The more you use them, you might even consider paying for a financial advisor and find the one who’s a good fit for you.

Once you dive deeper, you’ll also discover various ways to earn income and find investment options that work for you. Some platforms even offer guidance on building personalized financial plans.

While I strongly recommend working with a financial advisor, getting started online has its own advantages and might be a good fit for your situation. For one, it’s a cost-effective option. Some platforms provide reliable advice for free or for a small fee. Also, even if you don’t exactly plan to get advice, you can use the resources these platforms have to improve your financial literacy—like webinars and articles.

And, of course, you can do all of this without leaving your home. For seniors with mobility challenges or those who prefer remote communication, this is especially useful.

To help you get started, here are three platforms worth checking out:

- SmartAsset: This platform connects you with financial advisors who are a good match for your needs. It provides personalized recommendations to help you find an advisor who understands your unique goals and challenges.

- NerdWallet: A trusted resource for financial education, NerdWallet offers articles, tools, and calculators to help seniors make informed financial decisions. From budgeting tips to investment guides, it’s packed with useful resources.

- Betterment: This is a robo-advisor that offers automated investment management at a lower cost than traditional advisors. It’s ideal for seniors who want to simplify their investments and cut down on fees.

If you want to stay updated on trusted sites and tools to improve your finances, feel free to follow us. Just a heads-up—I’m not legally able to provide financial advice, but I can share what I’ve learned from my own experience and research!

Financial Advisors: What They Can Specifically Do For Retirees

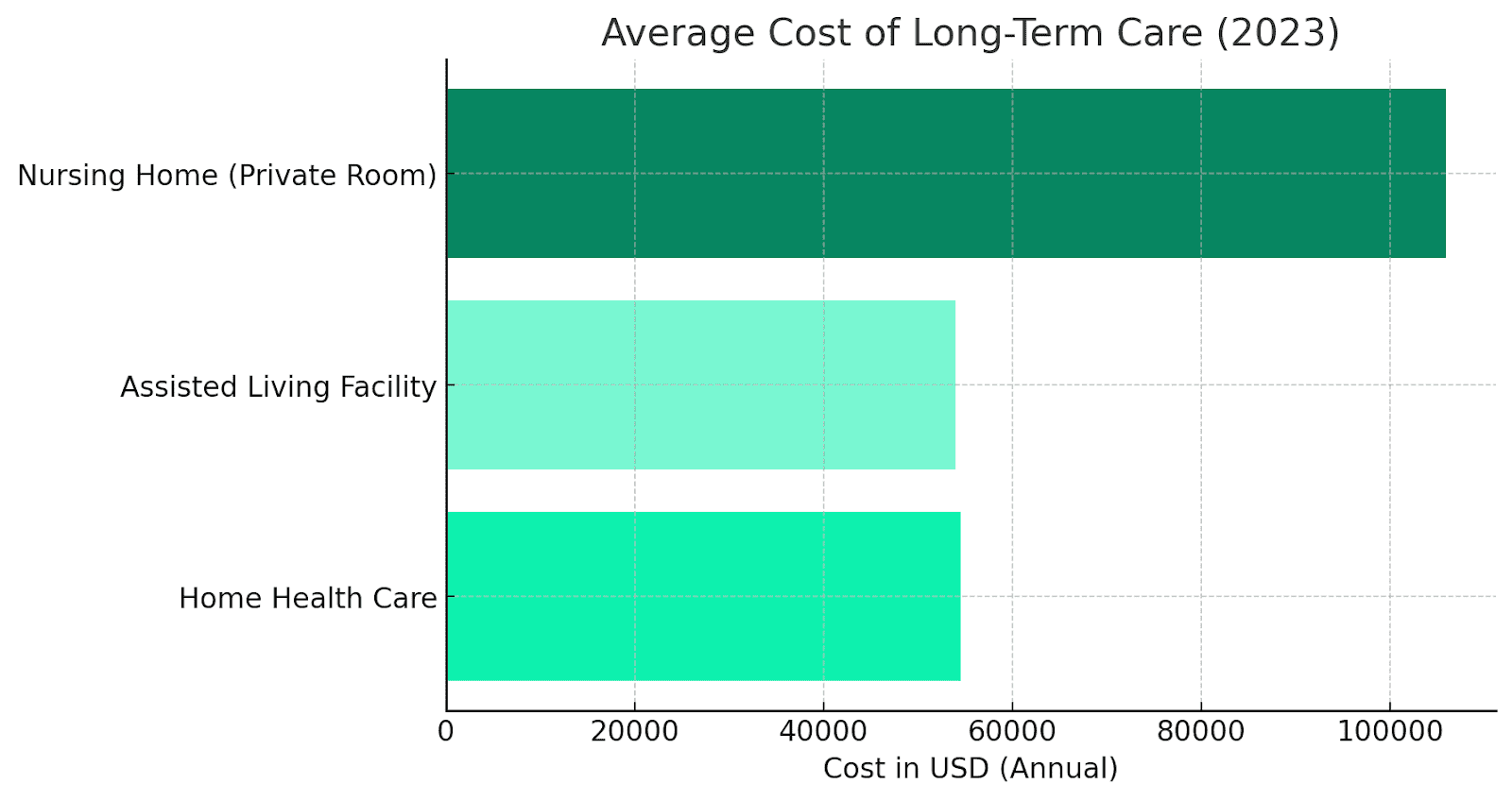

When retirees hire financial advisors, the main focus is often elder care planning. This involves preparing for long-term care, securing adequate healthcare coverage, and protecting assets from unexpected medical costs. It’s not just about managing day-to-day expenses but ensuring a stable financial future.

Under the umbrella of elder care planning, advisors typically address:

- Long-Term Care Insurance: Advisors help determine if a long-term care policy is suitable for you. These policies can cover expenses like in-home care or assisted living facilities.

- Healthcare Cost Management: They create plans to manage out-of-pocket expenses, ensuring you have sufficient coverage through Medicare or supplemental insurance.

- Asset Protection: Tools like trusts safeguard your assets from being depleted by long-term care costs. They also ensure your wealth is passed on according to your wishes.

- Trust and Estate Planning: Advisors offer strategies to minimize tax burdens while protecting and distributing your assets effectively.

- Medicaid Planning: Navigating Medicaid eligibility rules can be tricky. Advisors guide you through the process to ensure you can access necessary care without exhausting your savings.

This focus makes sense. For someone like me, still years away from retirement, financial advisors might concentrate more on wealth growth and building assets. However, as clients age, the advisor’s focus often shifts to preserving assets and planning for elder care.

This shift is critical because elder care costs can be staggering. According to the Genworth Cost of Care Survey 2023, the average annual cost of a private room in a nursing home is $116,800. Without proper planning, these expenses can drain even substantial savings.

Good financial planning for elder care not only helps seniors meet their needs but also reduces stress and enhances their quality of life in retirement. Having a financial advisor can be key to navigating these challenges and securing a stable future.

Financial Advisors: What To Ask

So, let’s say I’ve convinced you to look for a financial advisor. What’s the next step? You need to ask the right questions.

After you retire at 65, new challenges will come up—healthcare expenses, changes in income sources, and more. That’s why you need to ask your potential financial advisor, and even yourself, some important questions about your retirement and finances.

Based on the advisor’s answers, you can decide if they’re the right fit for you. But what should you ask them? I’m glad you asked—here are a few key questions:

- How will you help me plan for healthcare costs? Healthcare expenses can be unpredictable, and they’re a major concern for retirees. According to Fidelity, couples retiring at 65 may need around $315,000 to cover healthcare costs in retirement. Make sure your advisor can help you create a healthcare budget that puts you in the best financial position.

- What’s your tax strategy for me? Taxes don’t go away in retirement. You need to understand how your retirement income—like pensions, Social Security, and withdrawals from retirement accounts—will be taxed. A good advisor will help you create a tax-efficient strategy to minimize your tax burden and maximize your income.

- How can I maximize my Social Security benefits? Claiming Social Security at the right time can have a huge impact on your lifetime benefits. A skilled advisor can model different claiming scenarios to help you choose the most beneficial option based on your needs and life expectancy.

Of course, there are other questions to ask as well—like how to protect yourself from inflation or whether converting your IRA to a Roth IRA is a good idea. The questions you ask should focus on your specific situation and concerns.

It’s not just about asking how to budget your expenses. You should dig deeper—like understanding the best asset allocation for you or how to ensure your spouse will be financially secure after you pass.

The answers to these questions will help you determine if the financial advisor truly has your best interests in mind and if they align with your goals. Remember, they might know more than you—after all, that’s their job, and that’s why you’re seeking help.

So, don’t hesitate. Interview potential financial advisors and see if you can find the one that’s the best fit for you.

FAQs

And we wouldn’t want to end this post with our beloved FAQs sections! Here are some of the common burning questions about this topic!

1. Can I do without a financial advisor?

While it’s possible to manage your finances without a financial advisor, doing so can be challenging, especially as you reach retirement age. Many people, particularly seniors, benefit from the expertise of financial advisors who help with planning for retirement, managing healthcare costs, and making tax-efficient decisions.

If you’re confident in your financial knowledge and have the time to dedicate to managing your finances, you might not need an advisor. However, seeking expert help can make complex financial decisions much easier and offer peace of mind.

2. Are financial advisors needed for life?

Financial advisors may not be needed for life, but they can be particularly valuable during key life stages, such as retirement. As your financial situation evolves, especially with concerns like healthcare, taxes, and estate planning, a financial advisor can provide personalized strategies to meet your goals.

Once you’re more financially stable, you might find that you no longer need regular guidance. The need for an advisor depends on your specific circumstances and how comfortable you are managing your finances on your own.

3. Can a financial advisor help me with my debt?

Yes, financial advisors can help with debt management. They can create strategies to reduce or eliminate debt, which frees up more funds for your daily living expenses, especially in retirement.

By offering personalized advice on budgeting, prioritizing high-interest debts, and making smart financial decisions, they can help you manage your debts more effectively, making it easier to live within your means.

Conclusion

Considering getting help from a financial advisor at 65? I sure would! I believe it’s one of the best steps toward achieving financial stability and peace of mind in retirement. But I also understand that it’s not the right choice for everyone.

Remember, you have options, and you have the time to research what works best for you. That said, financial advisors are experts at what they do.

Hiring a financial advisor can be a game-changer if you’re looking for comprehensive estate planning, advice on Social Security, or help with maximizing your savings. Take control of your financial future and enjoy the retirement you deserve.

Anyway, do you want more tips on financial planning and tools for seniors? Follow or subscribe to stay updated on our latest reviews and informative posts!

Sources

- Photos: Unsplash: Amy Hirschi