Celebrities, top executives, and high-profile individuals always seem to grow their wealth effortlessly through investments. But let’s be honest—investing is anything but easy.

It takes time, effort, and knowledge. So how do these busy individuals manage their investments or even handle their money at all?

Here’s the secret: they don’t.

Take Oprah and Ellen, for example. Oprah once admitted she hadn’t stepped inside a bank in nearly three decades. As for Ellen? She doesn’t even know her ATM PIN. Classic “rich people problems,” right?

With that level of detachment, do you think they’re the ones managing their portfolios?

Of course not—they rely on money managers to handle it all.

Before we dive in, let’s clear up a common misunderstanding: money managers and wealth managers are not the same. While their duties may overlap, their focus is different.

Money managers specialize in handling investments like stocks, bonds, and portfolios. Wealth managers, however, take a broader approach, dealing with retirement planning, taxes, estate planning, and more.

Money managers might sound like something only the ultra-wealthy can afford, but they’re not exclusive to the rich.

If you’re new to investing or starting to accumulate wealth, a money manager can help you navigate the complexities of the market.

I don’t have a money manager yet, but I’ve consulted with a financial advisor who explained why they’re crucial and some financial habits for success. As your finances grow, managing them can quickly become overwhelming.

This realization sparked my curiosity, leading me to research how money managers work and how they could benefit people like you and me.

Now, let me share what I’ve learned—it might just change how you think about investing!

What Is A Money Manager

Money managers specialize in creating strategies to help you reach your financial goals. Their work focuses on careful planning, smart budget planning, and making informed investment decisions to grow and protect your wealth.

They do this by managing funds or investment portfolios on behalf of their clients. Their main objective is to maximize returns while minimizing risks, all tailored to each client’s preferences and financial goals.

You might hear them called money handlers, investment managers, or asset managers—different terms for the same role. Money managers can work independently or as part of a firm.

Managing investments effectively is no easy task. It involves staying on top of market trends, analyzing economic updates, and monitoring stock performance—tasks that can easily consume your time and energy.

That’s why many celebrities and high-profile individuals turn to money managers. These professionals take on the complexities of investing, allowing their clients to grow their wealth without the hassle of overseeing every detail themselves.

It’s easy to see why wealthy individuals hire money managers—but what about the rest of us? How can they be useful for everyday people? Let’s explore that next.

How Money Managers Can Help You

Let’s get to the part everyone’s curious about: How exactly can money managers help grow your money? While they’re often associated with celebrities or high-profile individuals managing millions, money managers can also bring value to regular folks like us.

Here’s what they can do to give your finances a boost:

- Craft Winning Investment Strategies: Money managers don’t just guess when it comes to investing—they develop tailored strategies based on your goals, comfort with risk, and timeline. They study market trends, analyze economic shifts, and find the best opportunities to grow your money efficiently.

- Allocate Asset Smartly: Deciding where to put your money is key, and money managers excel at this. They diversify your investments across different asset types like stocks, bonds, real estate, or even commodities. This balanced approach increases potential returns while minimizing risks—a crucial step in building a stable financial future.

- Oversee Portfolio Actively: A good money manager doesn’t just set up your investments and walk away. They keep an eye on your portfolio, tracking performance and market trends. This allows them to make necessary adjustments—buying, selling, or holding assets—to keep you on track toward your financial goals.

- Manage And Reduce Risks: It’s not just about growth; it’s about protecting what you have. Money managers work to shield your finances from risks like market volatility, credit problems, or cash flow issues. They’re always on the lookout for potential hurdles and take proactive steps to steer clear of trouble.

- Save You Time And Stress: Money managers don’t just manage finances—they manage your peace of mind. By handling the nitty-gritty of financial planning and decision-making, they free you up to focus on your career, personal life, or other priorities. They can even give you emergency fund tips as a bonus.

Aren’t these the same things money managers do for the rich? Absolutely! But you might be wondering, “How can this actually help me?”

Let’s take a step back and ask ourselves: How are we really different from wealthy actors? Are they working harder than us? Are they more financially savvy? The honest answer is no.

The real difference lies in what their jobs pay. Many of them earn significantly more than the average person, allowing them to afford money managers to grow their wealth even further.

That’s not to say their talents aren’t valuable—though, let’s be honest, some of them are coasting on good looks alone. But the point is, their income gives them access to tools that aren’t exclusive to the rich.

Hiring a money manager is an investment in itself. You’ll pay for their expertise and trust that they can grow your money, much like you trust a stock or mutual fund to deliver returns.

A good money manager can make the world of investing more accessible and level the playing field, whether you’re a millionaire or just someone with a bit of extra cash to put to work.

That said, not all money managers are created equal.

If you’re thinking about hiring one, it’s important to do your research and choose someone who aligns with your financial goals. Finding the right fit can make all the difference in securing your financial future.

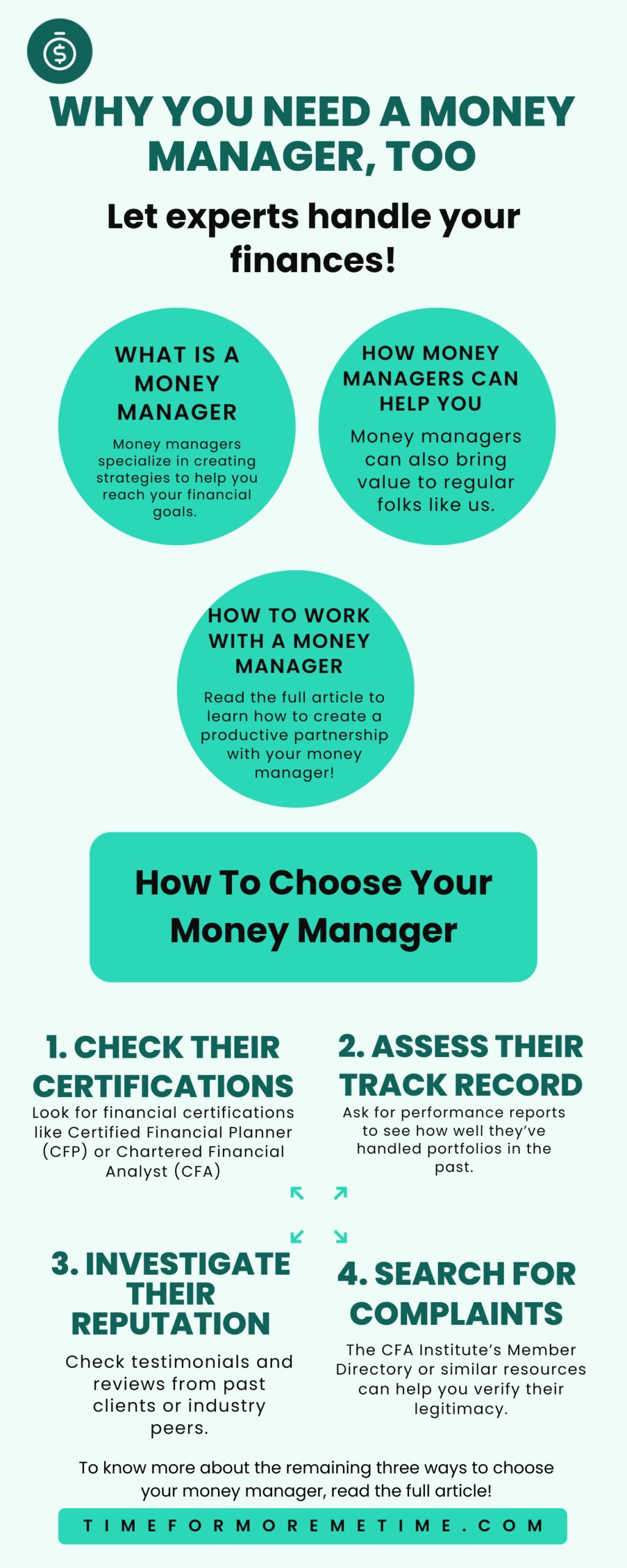

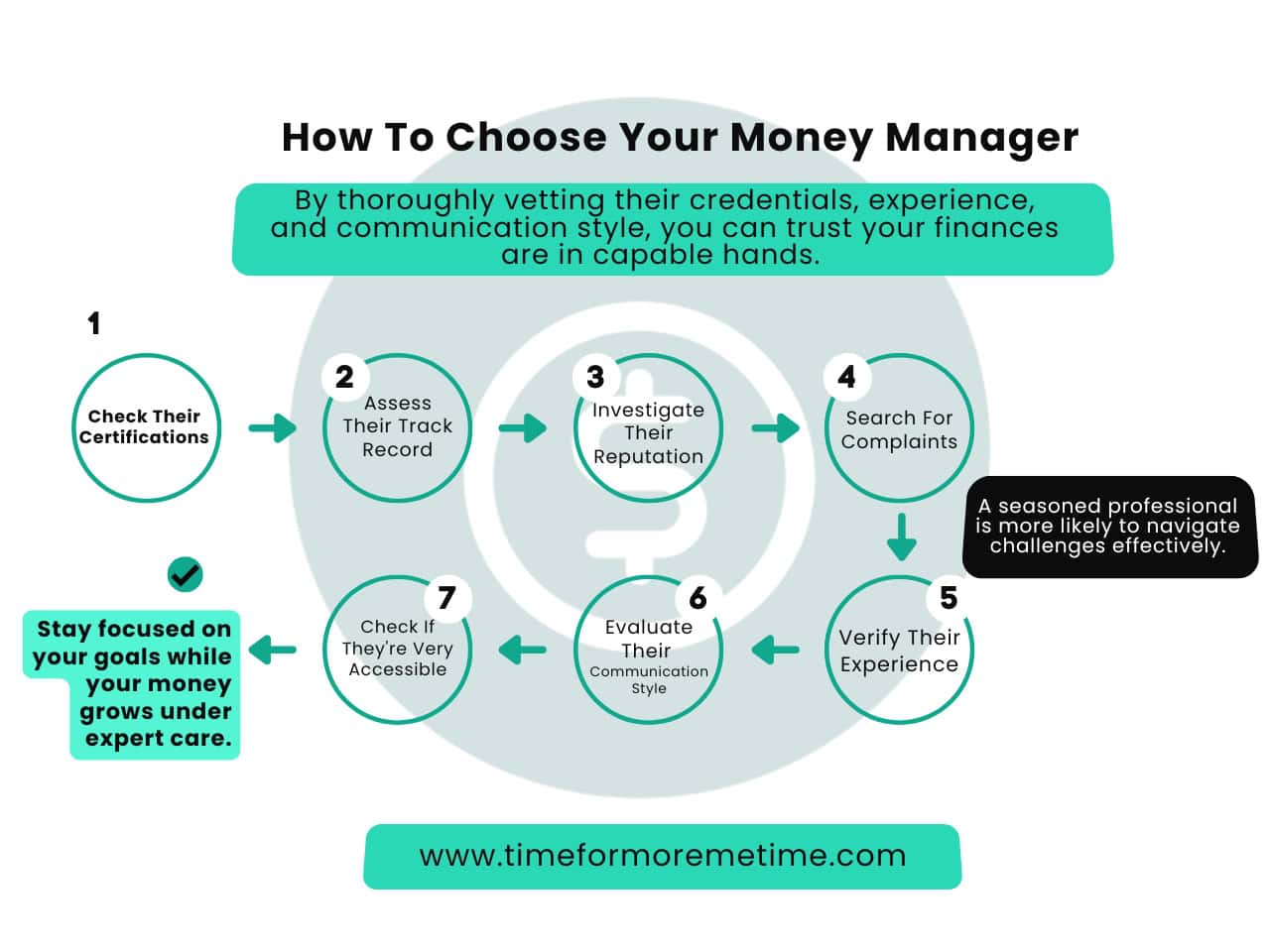

How To Choose Your Money Manager

When you’re ready to hire a money manager, it’s essential to choose the right one. After all, switching isn’t easy, and these professionals don’t come cheap. To make the best decision, consider these key factors during your selection process:

- Check Their Certifications: Start by verifying their credentials. Look for financial certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA)—both of which indicate a high level of expertise and ethical standards. These designations show they’ve undergone rigorous training and are equipped to guide you professionally.

- Assess Their Track Record: A solid history of managing investments is a must. Ask for performance reports to see how well they’ve handled portfolios in the past. Consistent, positive returns indicate strong investing skills.

- Investigate Their Reputation: Check testimonials and reviews from past clients or industry peers. Visit their website and social media profiles to see what others are saying. A good reputation speaks volumes about their reliability and trustworthiness.

- Search For Complaints: Ensure your candidate has a clean record. The CFA Institute’s Member Directory or similar resources can help you verify their legitimacy. Simply search their name to confirm they’re qualified and free from client complaints.

- Verify Their Experience: Experience matters. Look into how long they’ve been in the industry, the range of investment products they’ve managed, and their familiarity with varying market conditions. A seasoned professional is more likely to navigate challenges effectively.

- Evaluate Their Communication Style:

A money manager’s ability to communicate is just as important as their technical skills. Look for someone who can explain complex financial concepts in plain language, making it easy for you to understand your options and make informed decisions. - Check If They’re Very Accessible: Your money manager should be easy to reach. Whether through calls, emails, or even video chats, having multiple ways to contact them ensures smoother communication and quicker responses when needed.

Selecting the right money manager takes effort, but it’s worth it.

By thoroughly vetting their credentials, experience, and communication style, you can trust your finances are in capable hands. This way, you’ll stay focused on your goals while your money grows under expert care.

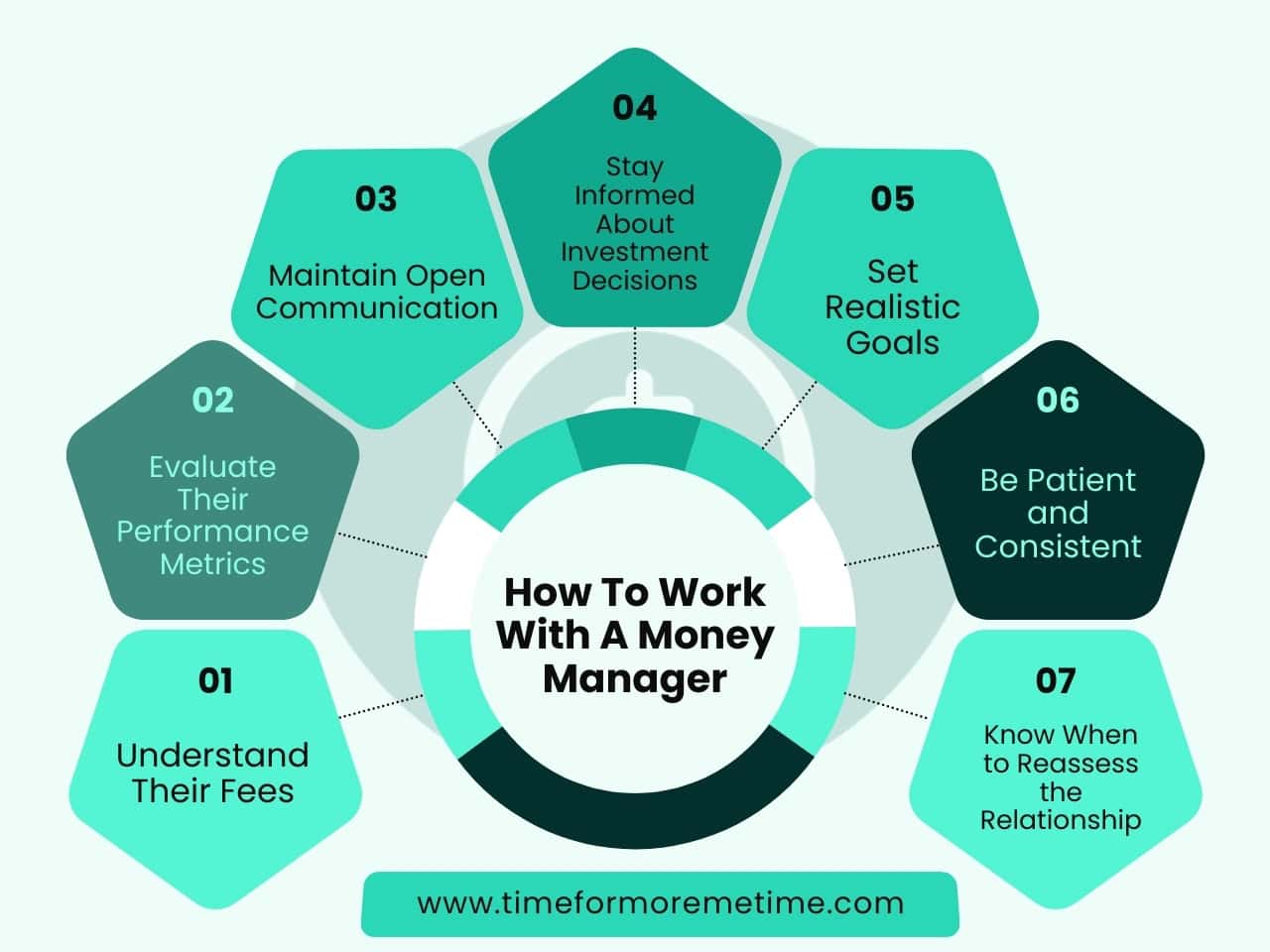

How To Work With A Money Manager

Now that you’ve hired a money manager, how do you ensure the partnership is effective? Here’s what you can expect and how to collaborate to make the most of their services:

- Understand Their Fees: Money managers charge for their expertise, usually as a percentage of the assets they manage. This fee can range from 0.5% to 2%, depending on your portfolio size. Larger portfolios may qualify for lower percentage rates, but the total amount paid will still be higher. For example, if you have $1 million under management and your manager charges 1%, that’s $10,000 annually. Make sure you fully understand their fee structure and ensure it aligns with the value they bring to your investments.

- Evaluate Their Performance Metrics: Set clear benchmarks to measure your money manager’s effectiveness. Compare your portfolio’s performance to appropriate market indices or benchmarks (e.g., S&P 500 or bond market indexes). Regularly review reports to see how their strategies are performing relative to these standards. Consistent underperformance may signal the need for adjustments or even a conversation about their approach.

- Maintain Open Communication: Keep the lines of communication clear and active. Schedule regular meetings to discuss updates on your investments, market trends, and any changes in your financial goals. Share any major life events—like buying a home or planning for retirement—as these may require adjustments to your strategy.

- Stay Informed About Investment Decisions:

While your money manager is the expert, you should still understand the basics of where and how your money is invested. Review their reports and don’t hesitate to ask questions about specific investments, risks, or fees. This transparency builds trust and ensures you’re on the same page about your financial goals. - Set Realistic Goals: Clearly communicate your financial objectives and risk tolerance. Whether you’re aiming for long-term growth, preparing for retirement, or saving for a big purchase, your manager needs to know your priorities. Be realistic about returns and timelines, as this will help them craft a strategy that meets your expectations.

- Be Patient and Consistent: Investing is a long-term game. Trust the process, and avoid making impulsive decisions based on short-term market fluctuations. Give your money manager the time and space to execute their strategies while holding them accountable through regular reviews.

- Know When to Reassess the Relationship: If your manager consistently underperforms, fails to communicate effectively, or seems out of sync with your goals, it may be time to reevaluate the partnership. Don’t hesitate to seek a second opinion or consider other professionals if needed.

By staying informed, maintaining regular communication, and setting clear expectations, you’ll create a productive partnership with your money manager—ensuring your investments are working toward your financial success.

Conclusion

I hope this post has given you some valuable insights and maybe even got you thinking about hiring a money manager. I’ll admit—it was a bit challenging to write this without diving too deep into technical jargon.

But I hope the message is clear: money managers aren’t just for the wealthy. They can be a powerful tool for anyone looking to make smarter investment decisions and grow their finances.

If you found this helpful, I encourage you to explore the other posts on this site.

There’s plenty more to learn about managing your finances and reaching your financial goals. Don’t forget to stick around and follow us for more tips and insights.

Or better yet, subscribe to our YouTube Channel and be notified for videos on how you can achieve financial freedom!

Happy investing!