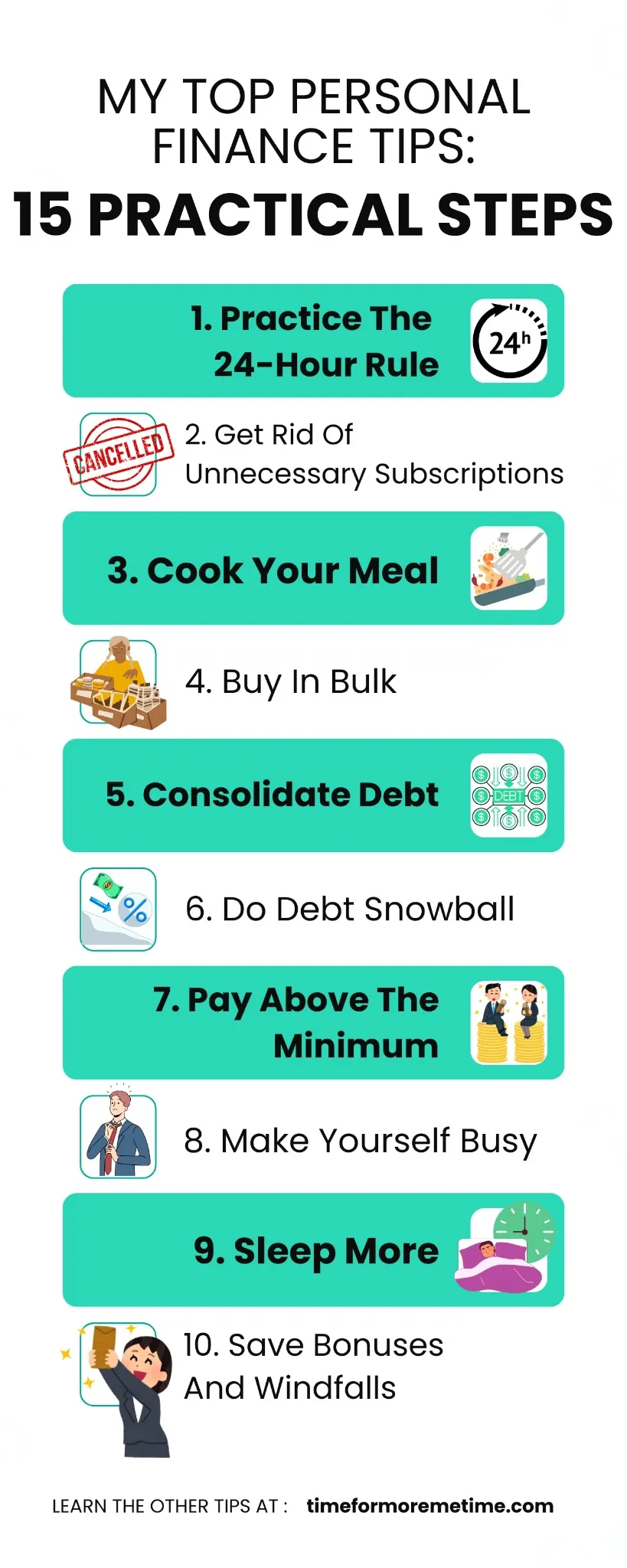

These days, it feels like so many things drain our money, which is why I’m always looking for ways to manage it better. Over time, I’ve picked up my top personal finance tips that have helped me stay on track.

If you think back to centuries ago, most people were just working to afford food, shelter, and basic necessities—no impulse buys, no endless entertainment subscriptions.

Sure, life was harder in many ways, but there’s something about that simpler, more focused lifestyle that feels richer and more fulfilling.

Ironically, we now earn more than they ever did despite doing far less physically demanding work. Think about how much farmers earn while toiling in the fields compared to what we earn sitting comfortably in office chairs.

Yet, even with higher wages, many of us still feel unfulfilled and unhappy and struggle to save money.

As I’ve written countless blog posts on finances, I’ve shared tips here and there. But today, I wanted to compile some of my favorites—my top personal finance tips that have worked well for me.

Honestly, these tips aren’t just about how to save money; they’re more like guidelines on how not to spend it foolishly. But you get the idea, right?

Let’s get started!

1. Practice The 24-Hour Rule

The best way to combat impulse buying is to apply the 24-hour rule. If you’re tempted to purchase something that isn’t part of your budget or basic needs (like food, rent, or utilities), wait 24 hours before deciding.

In most cases, you’ll forget about it, which is a good sign that you didn’t truly need or want it that much. That’s what I do, and it works—especially if you’re a busy person. It’s easy to forget things that don’t matter in your life.

However, this approach might not work for everyone, particularly if you struggle with severe impulse-buying habits. In such cases, additional strategies, like limiting access to funds or seeking support, may be helpful.

2. Get Rid Of Unnecessary Subscriptions

In today’s world, subscriptions seem to be everywhere, and they add up quickly. From streaming services to repair plans, companies often bundle products with recurring charges, sometimes for things you don’t truly need.

Got a new phone? You might be offered a repair subscription—but shouldn’t modern phones be built to last without needing constant repairs?

These subscriptions, while convenient, can quietly drain your paycheck or savings over time. And it doesn’t help that subscription traps have become rampant.

Take a close look at your bank statements and identify subscriptions you don’t use or genuinely need. Cancel them. If you find you actually need one later, you can always resubscribe.

By trimming unnecessary subscriptions, you can free up extra money for more important financial goals.

3. Cook Your Meal

Cooking your own meals may feel optional, but it can be a game-changer for your budget. I do it myself, even though juggling two jobs and side hustles makes it challenging.

If you have more manageable hours or just one job, cooking at home is well worth the effort.

While grocery prices are high, it’s still significantly cheaper to buy ingredients and cook than to eat out or order takeout. Sure, fast food might seem like a convenient alternative, but sacrificing your health for savings isn’t worth it.

Cooking at home allows you to eat healthier, save money, and often enjoy better-quality meals.

If time is an issue, consider meal prepping: cook in bulk on your days off and portion meals for the week. It’s a practical way to save time and money.

4. Buy In Bulk

With rising grocery prices, there are many ways to save money on groceries. One of my personal finance tips here, which is also the smartest move you can make, is buying in bulk.

Stores like Costco, Sam’s Club, and BJ’s Wholesale Club specialize in bulk purchasing, often offering significant savings.

Don’t limit yourself to just one retailer.

Explore options like Dollar Tree or other discount stores, which might offer bulk deals that suit your needs. Be mindful, though—bulk buying is only cost-effective if you’re purchasing items you’ll actually use before they expire.

If you’re unsure where to start, look for non-perishable items (like rice, pasta, and canned goods) or household essentials (like paper towels and cleaning supplies). Stocking up on these can lower your per-unit cost and reduce the frequency of shopping trips.

For those without access to big-box stores nearby, check local grocers or community co-ops for bulk discounts. It’s all about finding what works best for your situation.

5. Consolidate Debt

I’ve done this a few times, and debt consolidation has been a lifesaver. While it might slightly increase your total debt due to fees or interest, it simplifies payments and can even improve your credit score.

If you’re juggling multiple debts—especially long standing ones—consolidating them is worth considering. It combines your debts into a single loan with one monthly payment, which can reduce stress and make it easier to manage.

In some cases, consolidation may even lower your interest rate, saving you money in the long run. Just be sure to shop around for the best terms and avoid taking on new debt while you pay it down.

6. Do Debt Snowball

If debt consolidation isn’t an option or doesn’t appeal to you, the debt snowball method is another effective strategy. Here’s how it works:

- List all your debts by amount, starting with the smallest.

- Focus on paying off the smallest debt first while making minimum payments on the others.

- Once the smallest debt is paid, roll that payment into the next smallest debt.

This approach helps build momentum as you eliminate smaller debts quickly, giving you a sense of accomplishment and motivation to tackle larger ones.

While it may not save as much money in interest as other methods, it simplifies debt repayment and makes the process feel more manageable.

7. Pay Above The Minimum

Paying off debt as quickly as possible has clear advantages. It frees you from the stress of carrying debt, reduces the amount you pay in interest over time, and can even improve your credit score.

If your lender allows you to pay more than the minimum required, take advantage of it whenever possible. By paying extra, you’ll chip away at the principal faster, shortening the repayment period and saving money in the long run.

When combined with strategies like the debt snowball method or debt consolidation, paying above the minimum can help you achieve financial freedom more quickly and efficiently.

Even small additional payments can make a big difference over time.

8. Make Yourself Busy

Boredom often makes us unhappy, and when we’re unhappy and bored, we tend to seek instant gratification. Unfortunately, most forms of instant gratification come with a price tag.

To avoid falling into this money trap, stay busy. Take on extra work, start a hobby that doesn’t require much spending (like writing, drawing, or exercising), or spend more time with friends and family.

Staying occupied not only keeps your mind off unnecessary spending but also helps you feel more fulfilled and productive.

9. Sleep More

Sometimes, the best thing you can do is rest. Boredom can tempt you into spending, but instead of shopping, try sleeping it off. Your body and mind will thank you.

If you see something you want to buy but aren’t sure about, take a nap instead of making a quick decision. You don’t need to wait 24 hours—sometimes, just a short rest can recharge your mind and help you forget unnecessary desires.

After sleeping, you’ll likely feel refreshed and ready to focus on more important things.

10. Save Bonuses And Windfalls

Whenever you receive money outside your regular income—like a bonus, tax refund, or unexpected windfall—resist the urge to spend it. Instead, deposit it into your savings account and leave it untouched.

While it’s tempting to reward yourself, think about the bigger picture. Building a larger savings account is a far more satisfying and lasting reward than spending on something impulsive.

By prioritizing your future financial security, you set yourself up for greater opportunities and peace of mind—one of my top personal finance tips that has helped me save more and stay financially prepared.

11. Track Your Typical Expenses

Maintain a detailed list of your regular weekly or monthly expenses. Include everything you typically buy—like groceries, bills, and other recurring costs. This list serves as a straightforward budget to help you manage your spending and stay on track.

Here’s the key: if something isn’t on the list, you probably don’t need it. Use this as a guide to identify unnecessary expenses and prioritize your financial goals.

Stick to your list, and you’ll automatically reduce impulse purchases while keeping your spending focused on what truly matters.

12. Use Cash

Leave your credit cards at home and rely on cash instead. Set a daily allowance for how much you can spend and stick to it. Having cash-only limits your spending and makes you more mindful of every purchase.

If leaving your card behind completely feels impractical, you can keep it in your car—but make sure it’s securely hidden. This creates a small barrier that forces you to think twice about overspending.

For example, if you’re tempted to buy something over your cash budget, ask yourself: “Is it worth walking all the way back to the car for this?” Chances are, it’s not.

13. Buy Off-Brands And Secondhand Items

Branded items aren’t a necessity. Don’t let others’ opinions sway you—buying off-brand or secondhand is a smart way to stretch your money.

Whether it’s sneakers, clothes, or even appliances, off-brand and secondhand options can offer the same functionality or style without the hefty price tag.

This rule applies to many things. From furniture to electronics, you’d be surprised how much you can save by choosing alternatives over name-brand or brand-new items.

Plus, you’re reducing waste by giving secondhand items a new life, which is a win-win. Speaking of reducing waste, consignment stores offer a great way to declutter your home and earn extra cash for things you no longer need.

Then, you can use your earnings from consignment to invest in new items that better suit your lifestyle.

14. Make Yourself Scarce

Socializing with friends can sometimes come with hefty price tags. They might invite you to bar hop, take vacations, or stay at fancy hotels. Most of us have friends like that.

While this can strain your budget, it doesn’t mean you need to cut ties with them. After all, you value them for who they are, not for the costs associated with spending time together.

The solution? Make yourself scarce. Instead of dodging invites or ignoring messages—which can come off as rude—be honest with your friends about your financial goals.

Let them know you’re cutting back on spending. It takes self-control, and while it’s tempting to join in on the fun, staying true to your financial priorities is smarter in the long run.

Real friends will understand and respect your decision.

15. Embrace Frugality

For many, adopting a frugal lifestyle feels challenging. But for those of us who’ve experienced financial struggles, frugality often comes naturally—it’s a survival mechanism.

If you’ve had to pinch pennies in the past, don’t feel pressured to let go of that mindset now.

It’s okay to embrace frugality as a long-term lifestyle. What matters is that you’re prioritizing your comfort, securing your future, and ensuring you can meet your financial needs without taking on debt.

Living simply isn’t about deprivation; it’s about making thoughtful choices that give you peace of mind and stability.

FAQs

But before I wrap up, I want to address some common questions about managing personal finances.

1. How much money is enough to consider your financial health good?

There isn’t a one-size-fits-all answer because it depends on your income, expenses, lifestyle, and financial goals.

However, a good benchmark is having an emergency fund of three to six months’ worth of living expenses, no high-interest debt, and assets that are steadily growing through savings or investments.

This setup creates a solid foundation for financial health.

2. Can you ever get rid of debt?

Yes, you can eliminate debt by sticking to a repayment strategy, such as debt consolidation or the debt snowball method. I personally cleared most of my significant debts, leaving only loans I took for essential reasons.

While debts like student loans or mortgages may take longer to pay off, with consistent budgeting and payments, it’s entirely possible to get rid of most types of debt.

3. Saving after clearing debt or not?

It’s usually a good idea to start saving while you’re still paying off debt, especially for emergencies. After clearing high-interest debt, focus on building savings and investments, as they act as a financial buffer to prevent you from taking on more debt in the future and improve long-term stability.

For me, I started saving only after clearing most of my debt. I believe you can’t save money you don’t have. If I saw my bank balance with debt subtracted and it was negative, saving would take a back seat.

But that’s just my approach—it doesn’t work for everyone.

Conclusion

And there you have it! These are my top personal finance tips, the steps that have helped me effectively manage my money, particularly when it comes to controlling spending.

I know, some of these may require sacrifices. But remember, always keep your eye on the future—and the bigger picture. Even if you can’t see the full impact today, think about where you’ll be in a year.

These steps may push you to make short-term sacrifices, but in just a year, you’ll likely realize how much more financially free you’ve become. And if that’s not the case, it might be time to reassess.

Perhaps your income isn’t enough, or maybe your lifestyle is outpacing your means.

Either way, if you need more tips or guidance, feel free to check our articles and YouTube Channel! We have a lot of tips about managing your money wisely and making extra income.

Source

- Photos: Unsplash: Vitaly Gariev