Tracking expenses is a fundamental step toward achieving financial freedom—or, at the very least, avoiding debt. In fact, learning the best ways to track personal expenses has helped me develop healthy spending habits and budget effectively.

My mother instilled this habit in me when I was a child by encouraging me to write down all my expenses, a simple but powerful strategy that laid the foundation for better financial management.

I hope you can adopt this practice in your own life, as it can be incredibly beneficial. However, I understand that tracking expenses can feel tedious and boring.

You may have already tried some of the methods I’ll discuss, as everyone has different preferences when it comes to integrating new habits. I certainly faced challenges with other aspects of personal finance.

But here’s the good news—there’s no single correct way to track expenses. Some methods work better than others, depending on your lifestyle, preferences, and financial goals. The key is to experiment and find the system that suits you best.

Anyway, with that said, let’s get to the point and get started!

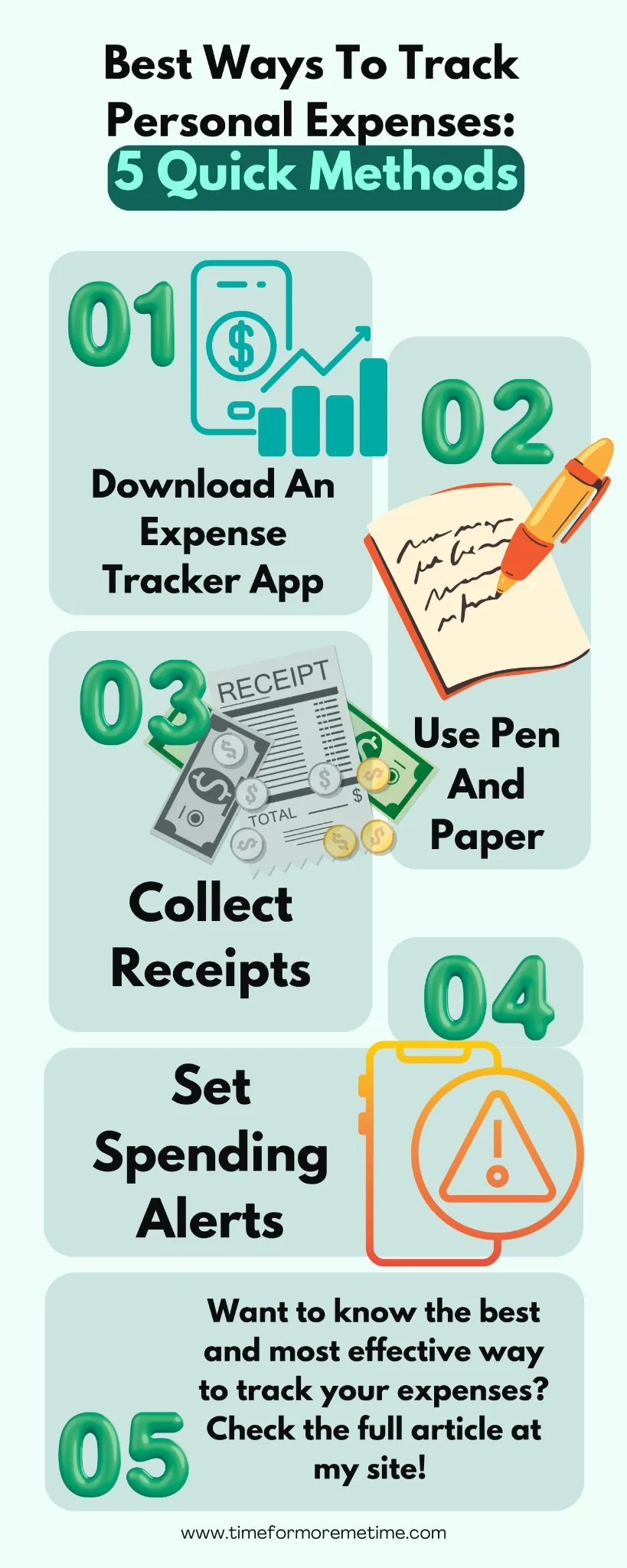

1. Download An Expense Tracker App

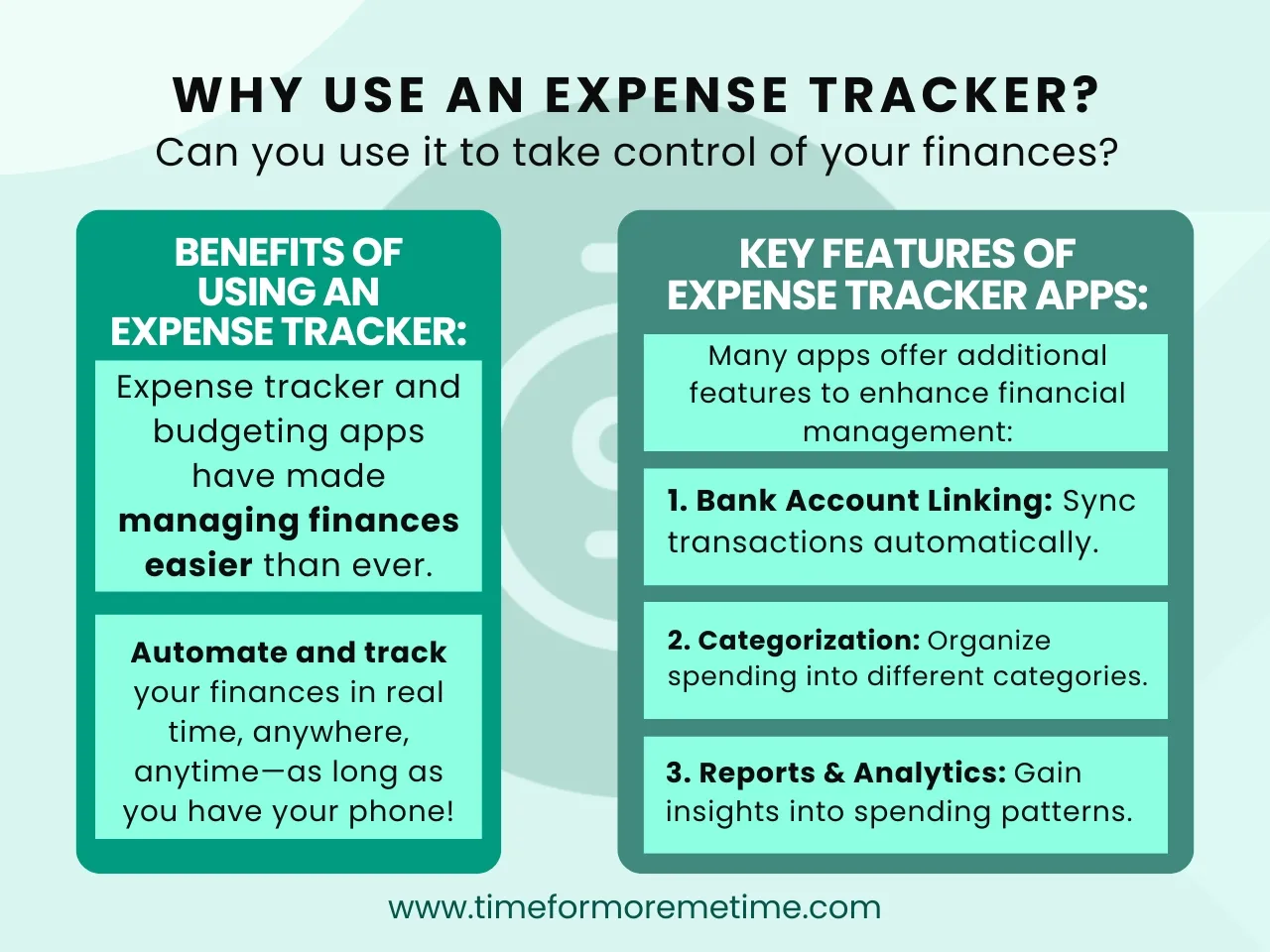

Well, what can I say? Expense tracker and budgeting apps have already conquered this simple financial task.

Fortunately, there are many apps out there that can help you track your personal expenses. Some are free, while others have premium or paid features. Regardless, if you just want to track your personal expenses, you can use one that doesn’t have all the bells and whistles.

What do I recommend?

Well, MyMoney is the one I use. It’s a simple budgeting app that can help track personal expenses. For me, it’s enough. However, it doesn’t mean that this is the only option for you, and you only need to stick to expense tracking.

Many apps also allow you to link your bank accounts, categorize transactions automatically, and generate reports to help analyze spending patterns.

If you’re someone who prefers automation and real-time tracking, using an expense tracker and budgeting app can make financial management much more convenient.

2. Use Pen And Paper

This is where I started—just a simple pen and paper. I began tracking my expenses at a young age because money was limited, and every dollar spent had to be accounted for—not to mention that my mom told me to do so.

Thankfully, it wasn’t difficult then since I had only a few purchases to track. I even kept records of my family’s expenses, especially those of my parents.

Why did I take on this responsibility so early? Because when money is scarce, you become more mindful of where it goes. I believe everyone should take expense tracking seriously.

Developing this habit early leads to a healthier relationship with money.

The process is simple: take a few sheets of paper and list every expense. Include the item name, date, and price. If possible, write down the reason for the purchase.

Over time, you’ll notice spending trends, which can help you make smarter financial choices.

This habit gives you a clear record of your spending, helping you make better financial decisions over time. Sadly, I don’t write and track my expenses using pen and paper anymore. But I’m sure some of you would love to do that.

If you want to learn more money-saving tips, subscribe to my YouTube channel or read my other articles.

3. Collect Receipts

I know it’s exhausting to write on paper nowadays. After all, just admit it—when was the last time you held a pen and wrote with it? Me? Well, most of the time, it’s because of work, but I know a lot of people who don’t write anymore.

Anyway, collect your receipts and stick them on a clipboard or an onion board. However, be reminded that most receipts fade after a few weeks—some in just days. So, if you can, you might as well take pictures.

Another tip: organize your receipts by category—groceries, dining, utilities, and entertainment—so that reviewing your expenses becomes easier. If you want to digitize everything, use apps that scan and store receipts electronically.

4. Set Spending Alerts

Another effective way to manage your finances is by spending or banking alerts, which is one of the best ways to track personal expenses and stay in control of your budget.

Many banks and financial institutions allow you to set notifications for transactions above a certain amount.

You can receive alerts via email or text whenever a purchase is made, helping you stay aware of your spending habits in real time.

If you use a budgeting app, you can also set custom notifications to warn you when you’re nearing your budget limit in different categories. This can prevent overspending and encourage better financial discipline.

5. Plan Your Budget

Are you tired of writing down receipts or fiddling with your phone to add another expense to your tracker every time you make a purchase? If so, it might be time to plan your budget more effectively.

Instead of waiting to input your latest expense, try writing down or entering future expenses in your tracker before you actually spend the money. This proactive approach not only helps you plan your budget but also reduces the tedious work involved in tracking your expenses.

There are many benefits to this method.

- First, it allows you to allocate your income wisely before you even spend it.

- Second, it helps prevent impulsive spending because your money already has a designated purpose.

- Lastly, pre-planning expenses ensure that you stay within budget and meet your savings goals.

As a bonus, you only need to cross out “predicted expense” if you didn’t go through it.

Conclusion

And there you have it! There’s no one-size-fits-all approach, but these are some of the best ways to track personal expenses effectively. No matter which method you choose, the key to success is consistency in tracking and managing your finances.

Find a method that works best for you and stick with it. Over time, you’ll develop a clearer understanding of your financial habits, making it easier to manage money, avoid unnecessary spending, and save for future goals.

The ultimate goal of tracking expenses isn’t just to record where your money goes—it’s to take control of your finances.

By keeping a close eye on your spending, you empower yourself to make informed decisions, build financial stability, and work toward greater financial freedom. Sounds great, right? So get at it!