Budgeting and managing my financial health were things I mostly handled on my own. After graduating college, I felt confident in controlling my expenses. Over time, I realized the next step I needed to take was investing.

I knew that succeeding in investments was key to achieving financial freedom and early retirement. So, I started investing whatever money I had.

At first, it was exciting, but after a year—and especially after taking on a second job—it started to feel exhausting. The returns weren’t great (though I was still making money), and the way I was managing it felt inefficient and not worth the effort.

That got me thinking: How can I automate my investments or, at the very least, avoid constantly monitoring the news and other market updates? I’m okay with small wins, but I want to free up more time for myself.

And if I do spend more time on it, I want to see bigger returns that justify the effort.

During my research, I came across the idea of working with a financial advisor. So one day, I asked myself: Can my budget accommodate a financial advisor to help me build my portfolio and take away some of the “pain?”

That idea didn’t last long. They were expensive! My finances were in good shape, but not that good. Plus, I already knew what I was doing—I just dreaded the process and wanted to free up some time for myself.

Paying a premium for something I could handle on my own, no matter how tedious didn’t sit right with me. So, I looked for an alternative. That’s when I learned how to invest using my bank’s robo advisor.

And I found out that they’re a heck of a lot cheaper than hiring someone—they’re basically “free” at some point.

Once I started using a robo-advisor, I felt a huge weight lifted off my shoulders. Even though I was checking my portfolio less often, I felt reassured knowing everything was running smoothly.

Before, being successful in investing meant constantly gathering information and keeping a close watch on the markets.

With robo-advisors, I could finally step back. The time I used to spend an hour or two every week managing my portfolio? Now, I just check my phone and see what’s next on my agenda.

Anyway, I’m sure you’re here to learn about what exactly these robo-advisors are and how exactly it can help you out. So, let’s get started!

What Are Robo-Advisors

Simply put, a robo-advisor is an online service that uses smart technology to manage investments automatically—and sometimes even provides investment advice.

These platforms assess your financial goals, risk tolerance, and timeline through online forms. Based on your answers, they create and manage a mix of investments tailored to your needs.

Robo-advisors explained simply: they are automated investment platforms that manage your portfolio based on algorithms and financial goals.

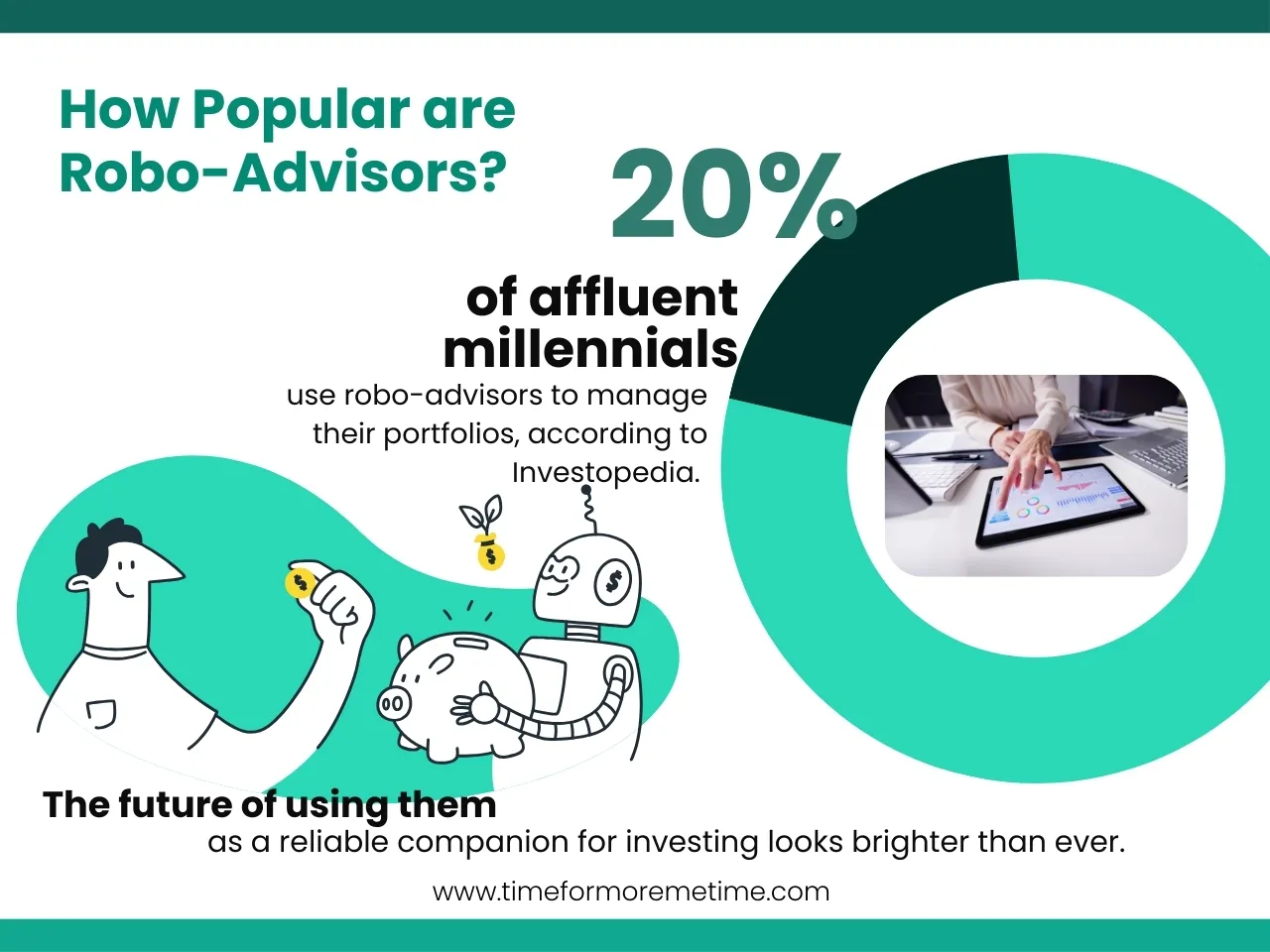

As this technology continues to evolve—especially with the rise of AI—robo-advisors are becoming even more advanced and popular.

In fact, a growing number of investors are already embracing this shift, with 20% of affluent millennials using robo-advisors to manage their portfolios. The future of using them as a reliable companion for investing looks brighter than ever.

Currently, the robo-advisor I’m using is Acorns. It’s a cute—not really a description you will use for this kind of service but it’s apt—and simple app. It also let you start as small as $5 and can help you navigate the investment world with ease.

If you want to get to know robo-advisors first hand, you can try to join Acorns yourself. By going through that link, you’ll receive a $5 bonus and get started with an excellent robo-advisor. Also, I get to have a small commission, which can help me continue to produce more content in this website.

Anyway, if you’re not ready yet, let’s continue what robo-advisors are and how you can use them.

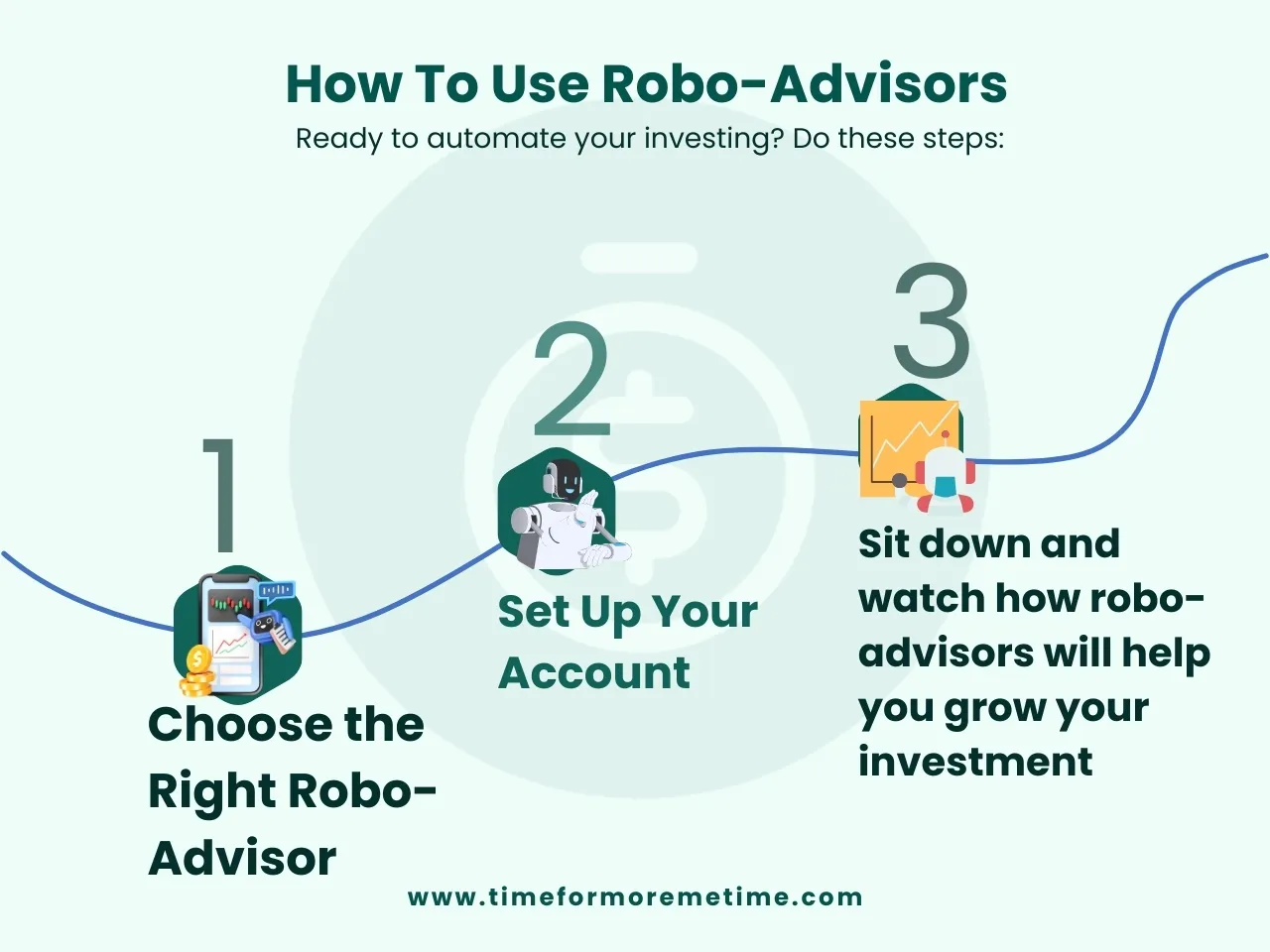

How To Use Robo-Advisors

The first step is to know which banks provide real-time investment advisors that fit your needs and budget. While robo-advisors are generally more affordable than financial advisors, some can still be on the pricier side.

Most operate on a subscription basis rather than a commission model, while others charge fees based on a percentage of assets under management (AUM). It’s important to compare these costs across different platforms to ensure you’re getting the best value.

Once you’ve chosen one of the best robo-advisors for investing, you can start setting up your account.

During this process, you’ll provide details about your financial situation and goals. This usually involves answering questions about your income, savings, investment objectives, and risk tolerance.

From there, how your robo-advisor works will depend on the type of investment support it offers, the features available, and the type of account you signed up for.

For example, some robo-advisors help you earn interest on your cash, others focus on high-growth investments, and some even offer tax-efficient strategies.

Keep in mind that the kind of investment assistance you receive will vary based on these factors, so it’s important to choose a robo-advisor that aligns with your financial goals.

How Does Robo-Advisors Work

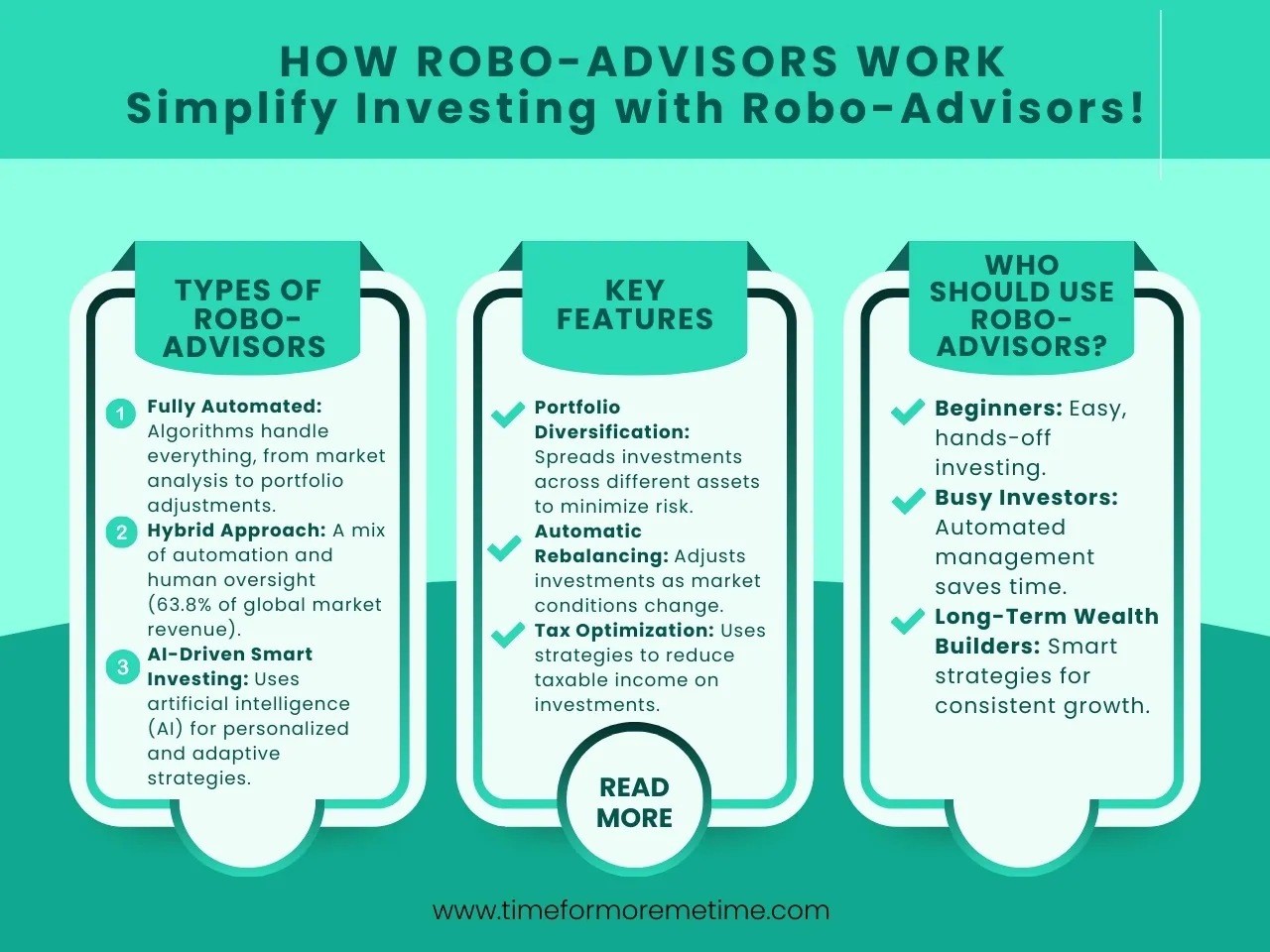

Robo-advisors use technology to automate investing, but how they operate can vary depending on the service.

Some top bank robo-advisor services rely entirely on algorithms to manage your investments, analyze market trends, and optimize your portfolio without human involvement.

Others take a hybrid approach, which makes up 63.8% of global robo-advisor market revenue. This approach blends automated services with human oversight, where financial experts oversee the algorithms.

That way, they can ensure your investments align with market conditions and your financial goals.

More advanced robo-advisors are now integrating artificial intelligence (AI) to refine their decision-making. AI-driven platforms can adapt to market fluctuations more efficiently, personalize investment strategies, and even predict potential risks with greater accuracy.

Regardless of the approach, robo-advisors aim to simplify investing by handling key tasks like portfolio diversification, automatic rebalancing, and tax optimization.

This makes them an excellent option for both beginners and experienced investors who want a more hands-off way to grow their wealth.

What Are The Advantages Of Robo-Advisors

For me, the biggest selling points of robo-advisors were the time they saved me, the way they removed the tedious aspects of investing, and the confidence they gave me that my money was working efficiently.

And, of course, as I mentioned earlier, they’re significantly cheaper than hiring a financial advisor.

To make these benefits clearer, here’s a breakdown of what makes robo-advisors so valuable:

- Lower fees: Compared to traditional financial advisors, robo-advisors charge much lower management fees—often a fraction of the cost. Many platforms have no commission fees, meaning more of my money stays invested and grows over time. This made it easier for me to start small without worrying about fees eating into my returns.

- Low minimum investments: With traditional investing, you often need thousands of dollars to get started. But with some robo-advisors, you can begin with as little as $100.

- Automated portfolio management: Before using a robo-advisor, I felt overwhelmed by the idea of picking investments, monitoring the market, and rebalancing my portfolio. But these platforms handle all of that for you. They automatically adjust your investments, rebalance your portfolio, and even apply tax strategies like tax-loss harvesting—all without requiring constant attention.

- Data-driven investment strategies: Unlike human advisors who might rely on personal opinions or market speculation, robo-advisors use cold, hard data and algorithms to make investment decisions. This takes the emotion out of investing and ensures that decisions are based on logic, market trends, and risk assessments.

- Accessibility and simplicity: Even though I have a business degree and had some investment experience before using a robo-advisor, I immediately noticed how much simpler they made investing. The interfaces are user-friendly, the terminology is easier to understand, and the entire process is streamlined for beginners.

For anyone who has ever felt confused or intimidated by investing, I can confidently say that a robo-advisor is one of the easiest ways to get started.

This is particularly important given that stats on personal finance shows only 54% of U.S. adults feel they have a strong or moderate understanding of personal finances.

Meanwhile, 33% say they have limited knowledge, and 13% admit to knowing little to nothing about managing their money.

With the help of robo-advisors, we can take away the guesswork, help us invest wisely, and makes growing money something anyone can do—even if we’re starting with little knowledge or funds.

To maximize convenience, look for the best robo-advisor integration with banks, as this allows for seamless transfers, automated savings, and better financial management all in one place.

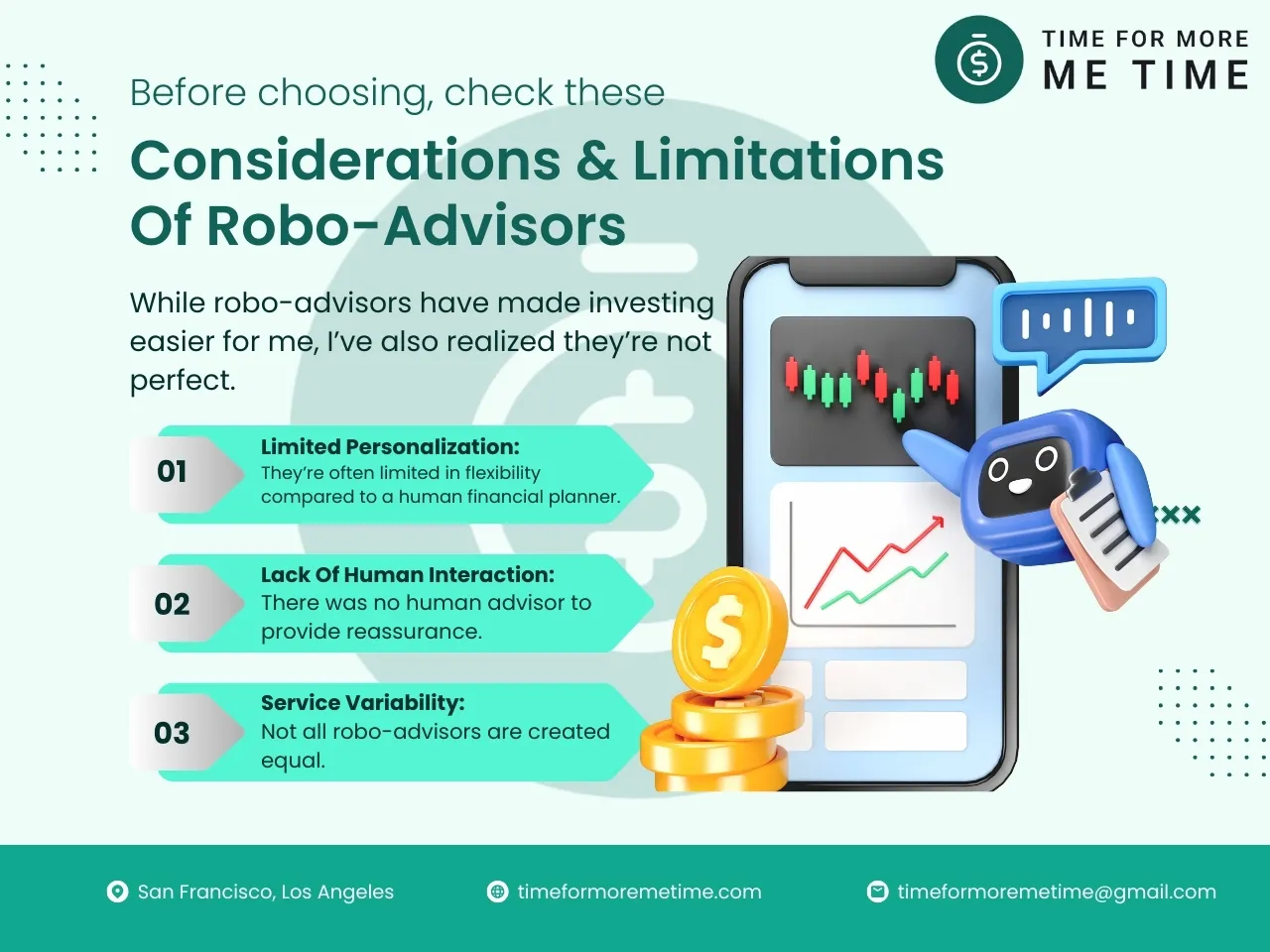

What Are The Considerations And Limitations Of Robo-Advisors

While robo-advisors have made investing easier for me, I’ve also realized they’re not perfect. Before relying entirely on automation, it’s important to understand some of the challenges that come with using these platforms.

Limited Personalization

One of the first things I noticed was that robo-advisors take a standardized approach to investing. When I completed the risk assessment questionnaire, I was impressed by how quickly it recommended a portfolio.

But I also realized it didn’t fully account for some of my unique financial goals.

For example, I wanted to set aside part of my investments for a house down payment while still focusing on long-term retirement growth. My robo-advisor didn’t offer an easy way to manage multiple, distinct goals within the same account.

While some platforms allow goal-based investing, they’re often limited in flexibility compared to a human financial planner who can tailor a strategy to your specific needs.

Additionally, robo-advisors may not be the best fit for those with complex financial situations, such as tax optimization for high-net-worth individuals, estate planning, or business investments.

If your financial needs go beyond basic investing, you may still need professional guidance.

Lack Of Human Interaction

When the stock market dropped unexpectedly, I felt uneasy watching my portfolio lose value. I wanted to talk to someone—a real person—to help me decide whether I should make changes or stay the course.

This experience made me think about the key differences between robo-advisors vs brokers—while robo-advisors offer automated, algorithm-based investing, brokers provide access to human advisors who can offer personalized guidance during market fluctuations.

But with a robo-advisor, there was no human advisor to provide reassurance. If you’re someone who likes to discuss your investments with an expert, this can feel limiting—especially during market downturns when emotions run high.

Some robo-advisors do offer customer support, but it’s typically limited to general inquiries rather than in-depth financial planning. If having direct access to a financial professional is important to you, a robo-advisor might not be enough on its own.

Service Variability

Not all robo-advisors are created equal.

When I started researching, I found that some had lower fees but fewer features, while others offered advanced tax strategies but required higher account minimums.

Typically, many charge around 0.25% annual fee for assets under management. But others have different fee structures.

However, I quickly learned that choosing the right robo-advisor requires more than just looking at fees.

It’s important to compare features, investment options, and long-term benefits to make sure the platform aligns with your financial goals before signing up.

One way to find a reliable option is by exploring top banks offering robo-advisors. That’s because many established financial institutions now provide automated investing services integrated with traditional banking features for a seamless experience.

FAQs

Still have questions? Don’t worry—we’ve got you covered! Here are answers to some common concerns about robo-advisors.

Are robo-advisors safe to use?

Yes, robo-advisors are generally safe to use, as they operate under strict financial regulations. Most are registered with regulatory bodies like the U.S. Securities and Exchange Commission (SEC) or equivalent authorities in other countries.

Additionally, they often provide encryption, two-factor authentication (2FA), and fraud protection to safeguard your personal and financial information.

However, while your funds are typically held with a reputable custodian and protected by Securities Investor Protection Corporation (SIPC) insurance in the U.S., this coverage only protects against broker failure—not market losses.

So, while your robo-advisor is secure, your investments are still subject to risk, just like any other form of investing.

What happens if my robo-advisor goes out of business?

If a robo-advisor shuts down, your investments are not lost. Most platforms do not hold your money directly—they use third-party custodians to store and manage your assets.

In the event of a shutdown, your investments would likely be transferred to another brokerage or returned to you.

So, before choosing a robo-advisor, check its custodial arrangements, regulatory status, and contingency plans to ensure your money is in safe hands.

Do robo-advisors guarantee returns on my investment?

No, like all investment services, robo-advisors cannot guarantee returns. The stock market fluctuates, and while these platforms use data-driven strategies to optimize your portfolio, your investments can still lose value.

What they do offer, however, is risk-adjusted investing—meaning they build portfolios based on your risk tolerance, helping you maximize potential returns while managing downside risks.

Some robo-advisors also provide features like tax-loss harvesting to improve after-tax returns, but there are never any guarantees in investing.

Conclusion

I encouraged you to be one of the projected robo-advisors users that would hit 34.13 million by 2028. There’s a lot, right?

There’s no need to wonder because the best robo-advisors for investing can simplify the process, automate key tasks, and provide low-cost access to professionally managed portfolios.

Thus, beginners or those who prefer a hands-off approach to investing can now confidently grow their money without being blindsided by the complexities of the finance world.

However, it’s just as important to understand their limitations as it is to recognize their benefits. If you need highly personalized advice, reassurance during market downturns, or complex financial planning, a robo-advisor alone might not be enough.

Knowing these trade-offs upfront will help you determine whether they’re the right fit for your financial journey.

Now, I get it—you might be skeptical after hearing all this. That’s completely understandable, especially if you’ve struggled with managing money in the past or if investing feels overwhelming.

Maybe you don’t know how to analyze market trends, pick stocks, or even figure out where to begin. And let’s be honest—the idea of trusting an algorithm with your money can feel both intriguing and intimidating. But here’s my advice: just try it out.

Robo-advisors make investing more accessible and help you see firsthand that it doesn’t have to be complicated. Of course, there’s always risk involved, and yes, you’ll have to pay fees.

But that’s the nature of investing itself—there are no guaranteed returns.

Remember that investing is about understanding how much risk you’re willing to take for the possibility of long-term growth.

If you’re still unsure, start small. Many robo-advisors allow you to begin with as little as $100, making it easy to test the waters without committing too much. If your bank offers a robo-advisor, that might be an even simpler way to get started—just like I did.

Also, if you’re looking for more personal finance tips, don’t forget to subscribe to our YouTube channel for finance-related videos to boost your financial knowledge!

At the end of the day, investing doesn’t have to be confusing or intimidating. Robo-advisors have made it easier than ever to get started, whether you’re a total beginner or someone looking for a more automated investment strategy.

The key is to take that first step—your future self will thank you.

Sources

- Photo: Unplash: Shahram Anhari