Passive income is money you earn without the daily grind of a nine-to-five job. It’s like getting paid while you sleep. Once you set it up and maybe invest a little cash, your bank account can grow effortlessly—whether you’re watching TV or taking time off.

Sounds amazing, right? Personally, I’m still building my passive income streams. Some are doing well and give me a bit of extra cash, but a few still need my constant attention—which is tricky because I don’t have much free time. But hey, that’s a story for another day.

Anyway, with passive income investments, you can wake up to a few bucks added to your account. Over time, those small amounts can turn into hundreds or more. It might sound like a dream, but with the right investments, it’s achievable.

That said, let me remind you of two things: it takes time, and it’s not always easy. Everyone’s journey is different. You might get lucky and hit it big quickly, but your goals and how much risk you’re comfortable with will shape your unique path to financial freedom.

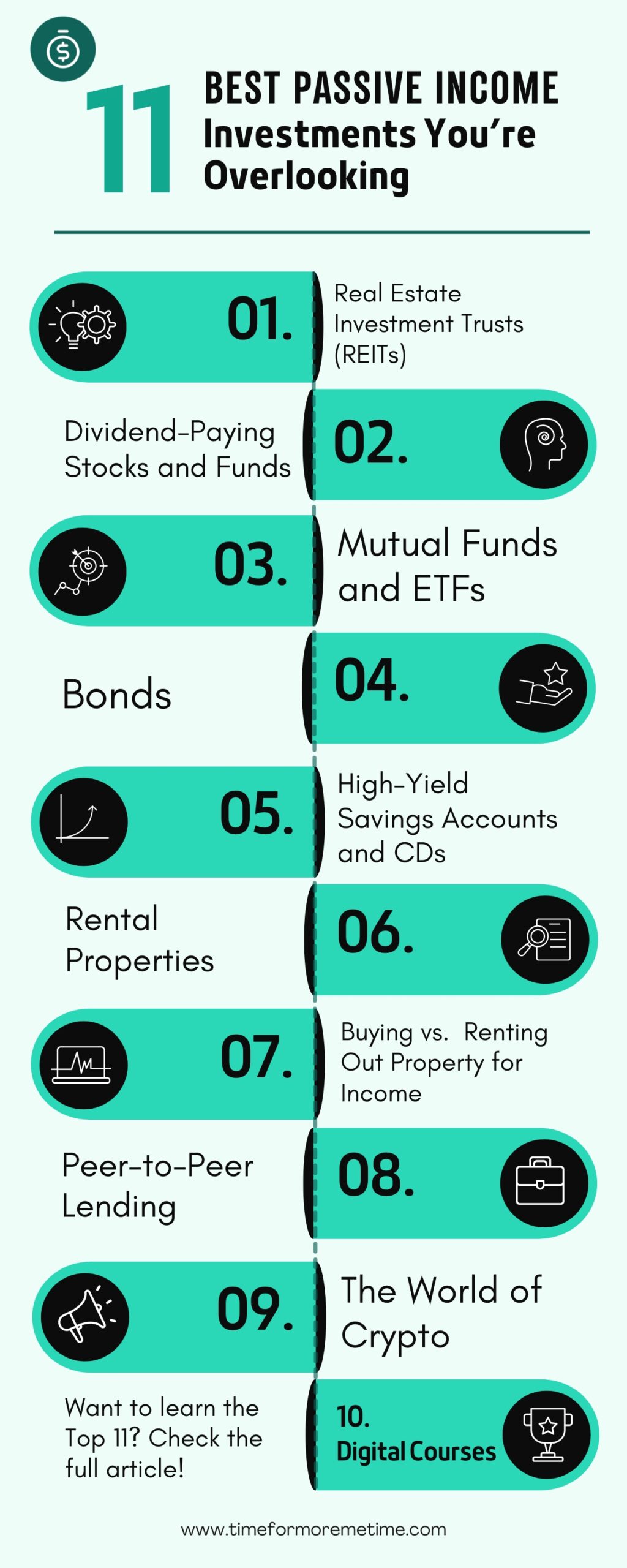

So, now that we’ve set the stage and you understand what passive income is, let’s dive into what you really came for—my recommendations for the best passive income strategies and investments. These options are relatively simple to start and might even include a few you’ve overlooked.

Let’s get started!

1. Real Estate Investment Trusts (REITs)

One of the most popular and profitable passive income investments is Real Estate Investment Trusts (REITs). These are companies that own income-generating properties, such as warehouses, apartments, office buildings, shopping centers, and more.

With REITs, you skip the hassle of owning real estate. Unlike managing a rental property, which involves dealing with maintenance, taxes, legal issues, and tenants, REITs let you invest without the headaches. Essentially, you become a partial owner of these properties and earn dividends from the rental income.

Because REITs own and operate multiple commercial properties, they often offer high dividend yields, even though you’re sharing the earnings with other investors. However, keep in mind that being a REIT investor comes with some costs, such as management fees and administrative expenses.

You can invest in individual REIT stocks or go for a REIT fund to diversify your portfolio while still earning dividends. Either way, investing in REITs is a smart way to tap into the real estate market, enjoying potential returns without the risks and responsibilities of direct property ownership.

2. Dividend Stocks

Dividend stocks are shares in public companies that distribute a portion of their profits to shareholders as dividends. Unlike REITs, which focus on real estate, dividend stocks span various industries. As the company grows and generates more profits, the dividends you receive may increase.

However, not all public companies pay dividends. Many prefer to reinvest their profits into growth and operations. Those that do pay dividends often attract investors seeking steady income, which can make the dividend yields relatively low unless you invest a large amount of money.

Reliable dividend-paying companies, like Coca-Cola, are often referred to as “dividend aristocrats” for consistently paying and increasing dividends over decades. While these companies are stable, their dividend yields are usually modest.

On the other hand, companies offering unusually high dividend yields might signal financial instability. High payouts can be a tactic to attract investors despite weak fundamentals, so it’s essential to research a company’s financial health before investing.

By selecting well-established, financially sound companies, dividend stocks can form a reliable foundation for passive income. Though it may take time to see substantial returns, this approach can help you build long-term wealth with relatively low effort.

3. Mutual Funds And ETFs

Mutual funds and ETFs are an easy way to invest in stocks and other assets without doing all the work yourself. A professional handles the details, so your money can work for you. The key to making passive income with these options is choosing the right funds and a reliable manager.

If you’re unfamiliar, mutual funds are professionally managed investment pools. You contribute money to the fund, and the manager invests it in a mix of assets, such as dividend-paying stocks, bonds, or other securities.

You can earn income from mutual funds in two ways: through dividends or by selling your shares in the fund. If passive income is your goal, focusing on funds that pay regular dividends is the way to go.

ETFs (Exchange-Traded Funds) are another popular option. Similar to mutual funds, ETFs group together a variety of assets. However, unlike mutual funds, ETFs trade on stock exchanges like individual stocks. To generate passive income, you’ll want to choose ETFs that offer dividend payments.

Keep in mind that all investments carry some risk, including the potential for loss. That’s why it’s essential to do thorough research or consult a financial advisor before investing.

In addition to providing income, investing in dividend-paying mutual funds or ETFs is a smart long-term strategy. The investing advantages is not only benefit from regular cash flow but also have the potential to grow your wealth as your investments increase in value over time.

4. Bonds

Next, we have bonds. Unlike stocks, where you own a share in a company, a bond is simply a loan. When you buy a bond, you’re lending money to a company or the government. In return, they pay you interest, which is the profit you earn.

The interest rate is usually set by the borrower—the company or government. For instance, 1-year Treasury bonds currently offer about 5% interest, which is impressive in today’s unpredictable market.

You earn passive income through regular interest payments, typically monthly, semi-annual, or annual. Bonds are generally considered safer than other investments because they’re less affected by market fluctuations.

The amount loaned and the interest rate are fixed, providing stability. This is why many investors use bonds to balance higher-risk investments in their portfolios.

If you’re looking for a reliable way to earn passive income while protecting your money, bonds are a solid choice to consider.

5. High-Yield Savings Accounts And CDs

Another smart way to grow your money with minimal effort is through interest-based passive income. One option is a high-yield savings account. With this, it’s mainly a waiting game to earn small but regular returns.

A high-yield savings account is a solid choice because it offers steady, reliable returns without the risk that comes with other investments. Another option is Certificates of Deposit (CDs). A CD is a type of savings account, but the key difference is that you can’t withdraw the money until the term ends. In exchange, the bank or credit union offers a higher interest rate for your account.

For example, let’s say you’ve saved $25,000 in an emergency fund. By placing it in a high-yield savings account with a 4% APY, you could earn $1,000 in passive income over the next year. No need to do anything; truly a passive move!

I wish I had known about this strategy earlier—it would have provided a safety net while still earning some extra income.

6. Rental Properties

I’m sure you know why many landlords aren’t exactly loved by people. If you don’t, it’s because they get rent money without doing much! Sure, most handle maintenance and other tasks, but many don’t do much at all.

Investing in rental properties is a powerful strategy for making money without the daily grind. You earn rental income while watching your property appreciate over time.

This approach is perfect for those aiming for long-term wealth. Why? Real estate ownership offers cash flow and the potential for big returns—an excellent way to secure your financial future.

Rental properties are a great way to earn passive income. As a landlord, you can set rent prices, choose your tenants, and benefit from your property’s long-term appreciation.

This strategy lets you enjoy immediate cash flow and the possibility of a larger payout when you decide to sell.

Earning $100,000 annually through real estate isn’t just a dream. With smart choices and possibly using property management services, your investments can generate income while you focus on other things.

To enhance your passive income from rental properties, consider these essential tips I’ve gathered from financial advisors:

- Thoroughly Screen Tenants: Choose tenants with good credit and solid references to reduce the risk of missed payments and property damage.

- Scout Attractive Locations: Look for properties in areas that renters will love—not just trendy now but with lasting demand.

- Set Competitive Rent Prices: Research comparable properties in your area to determine the right rent price.

- Maintain Your Property: Keeping your property well-maintained will attract and retain quality tenants.

- Consider Hiring a Property Manager: If you lack the time or expertise to manage the rental yourself, a property manager can handle the details for you.

By trying these strategies, you can increase the chances of maximizing cash flow from your rental properties.

7. Buying And Renting Out Property For Income

Deciding to buy a rental property or rent out your own house? Each approach has pros and cons.

Buying a dedicated rental property allows you to choose a location and property that’s well-suited for attracting tenants. But, you’ve also got to brace yourself for the initial pinch of a down payment and get ready to wear the landlord hat, complete with all its duties.

Meanwhile, renting out your own house can provide passive income without buying another property. But it means you’ll need to find somewhere else to live and be prepared to open your home to tenants.

8. Peer-To-Peer Lending

Peer-to-peer (P2P) lending lets you be the bank. You’ll be lending money to borrowers through platforms like Lending Club and Prosper.

This innovative approach can offer higher interest rates compared to traditional investments, but it comes with added risks, such as loan defaults.

To minimize these risks, focus on high-quality loans and diversify your investments across multiple borrowers. This way, you won’t put all your money into one loan.

It’s vital to meet the income or net worth requirements of your chosen platform, as some may require you to be an accredited investor.

As someone who has navigated financial challenges, I appreciate the potential of P2P lending.

For instance, I want to borrow $10,000 to consolidate debt. If my credit history is good, I can receive a loan from Lending Club.

While P2P lending involves more uncertainty than traditional investments, the potential rewards can be significant. To safeguard your investments, vet borrowers carefully and spread your funds across different loans.

9. Crypto Investing

Cryptocurrencies offer unique opportunities for passive income, but they come with volatility and risk. Before diving in, assess your risk tolerance.

Instead of just buying and holding, consider staking—this allows you to earn rewards by supporting blockchain networks.

When you stake your crypto, you help confirm transactions and, in return, earn more of that cryptocurrency. Popular options for staking include Ethereum, Cardano, Polkadot, and Solana.

Let’s say you buy 10 Ethereum (ETH) at $1,500 each, totaling $15,000. If you stake your ETH in a staking pool, you might earn a reward of 5% per year.

That means you could earn about $750 worth of Ethereum annually, simply for helping the network process transactions!

To get started, hold a minimum amount in a compatible wallet. Then, either join a staking pool or run your own validator node.

Rewards depend on the amount you stake and current rates but remember: if the cryptocurrency’s value drops, your rewards will too. That’s why, always diversify your investments and only stake what you can afford to lose.

10. Digital Courses

Imagine turning your knowledge into cash flow—one of the smartest ways to earn passive income online is by creating digital courses or eBooks.

Think about a subject you know well and are passionate about. Cooking? Marketing? Personal development? Whichever it is, turn them into digital content.

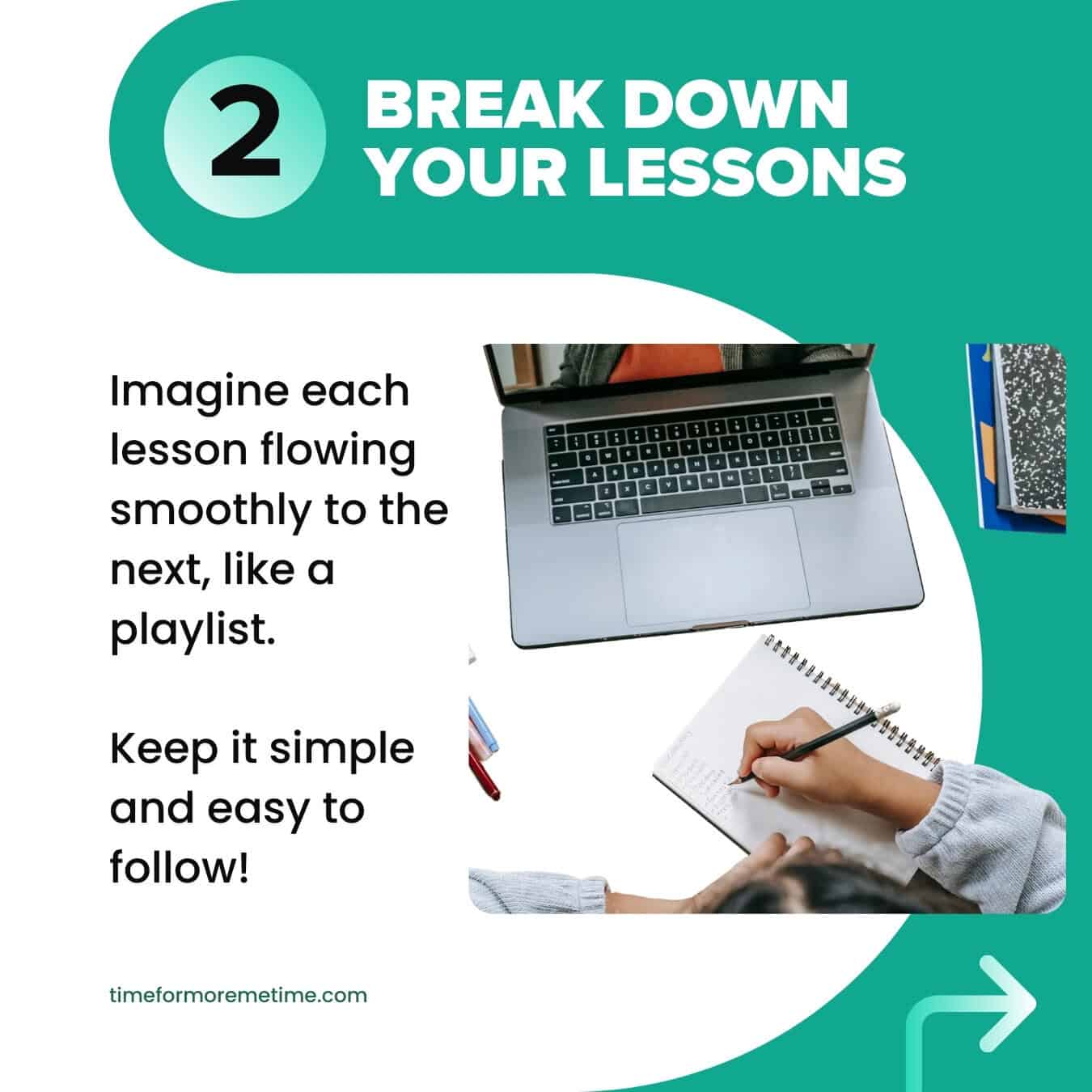

Start by breaking your topic into easy-to-understand lessons. Imagine creating a playlist where each lesson flows seamlessly into the next.

The best? You can deliver content in various formats:

- Videos for visual learners.

- Written lessons for deep dives.

- Worksheets to reinforce understanding.

Feel free to mix and match to cater to different learning styles!

Once your course is ready, you can sell it on your website or through platforms like Udemy and SkillShare. How did it become passive income? You only create the course once, and then it can generate income repeatedly.

I’ve seen how sharing knowledge can transform not just your finances but also help others grow. Try it now, and watch your passive income soar!

11. Content Creation

Another digital content creation option that lets you earn passive income is writing blog posts, articles, or eBooks about anything.

It’s similar to the passive income above, but digital courses provide a more structured and interactive learning experience. Meanwhile, content creation is a broader, more informal way to engage with an audience while sharing any topic.

You’ll attract followers who find your insights useful as you produce valuable content. Once you have a significant number of audience, you can monetize your efforts through:

Ads.

Affiliate marketing.

Selling your own products and services.

To maximize your impact, focus on providing helpful information that solves problems or answers common questions for your audience.

Invest time in creating engaging content that captures attention and resonates with readers. Then, promote your work.

Drawing from my own experience, I’ve seen how consistent, quality content can lead to significant earnings over time. Start sharing what you know, and watch your expertise transform into profit.

FAQs

Need more information? Here’s some more through frequently asked questions about this topic!

What is the most profitable among the best passive income investments?

Real estate often sits pretty at the top of the best passive income investments, thanks to its knack for growing in value and pulling in rent money.

How can I make $1,000, $5,000, or $100,000 a month in passive income?

Diving into dividend stocks or peer-to-peer lending can slowly build you up to an extra grand monthly. Or mix it up with real estate rentals, high-dividend stocks, and maybe some digital product sales online.

To get more, leverage a diversified portfolio across real estate, stock dividends, and business investments. It’s a long game, but it’s doable to earn from the best passive income investments.

Why invest in passive income?

To have a financial cushion in today’s economy, you should invest in passive income. With rising living costs, extra cash flow is more important than ever. After paying off $90,000 in debt, I realized how life-changing it is to have passive income.

For one, you can have extra money through passive income with minimal ongoing effort.

Also, multiple income streams ease financial stress.

Lastly, once set up, you can focus on family, hobbies, or new opportunities.

Conclusion

Generating passive income is within reach for anyone willing to invest wisely. Whether through real estate or stock dividends, many options can help you earn passive income and make your money work for you.

Tailor these strategies to your financial goals and risk tolerance, and remember that success requires research, patience, and resilience.

As I near my 50s, I’m steadily building my passive income. If I had known these passive income streams before, I would have started earlier. But as they say, you can become rich at any age, and financial freedom is a journey!

Ready to take the next step? Watch it on our YouTube channel—don’t forget to subscribe and hit the bell button to get notified!

Sources

- Photo: Unsplash: 金 运