Some days, it feels like my wallet has a hole—money just vanishes, especially after stopping for coffee. This often happens about a week after payday, as I prefer using cash for purchases. Overspending hits hard, making me acutely aware of my finances.

I’m sure you’ve felt this way too. To combat this, I’ve developed effective spending habits that I’m excited to share. These tips are practical for anyone, regardless of their budget, and won’t strip away your enjoyment of life.

While I can’t take full credit for these ideas, they’ve worked for me, and I believe they can work for you too. Let’s get started!

1. Automating Your Savings

Automating my savings allows me to save money effortlessly. By having a percentage of my income transferred to savings, I effectively limit my spending.

Most banks promote this feature, and many banking apps make it easy to set up. By scheduling automatic transfers from your checking to your savings account each month, you can safeguard your money from impulsive spending and save for the future.

This strategy acts as a safety net against temptation. Once you set up automatic transfers on payday, you won’t even notice the money is gone. Plus, many banks offer higher interest rates for automatic deposits, helping your savings grow even faster.

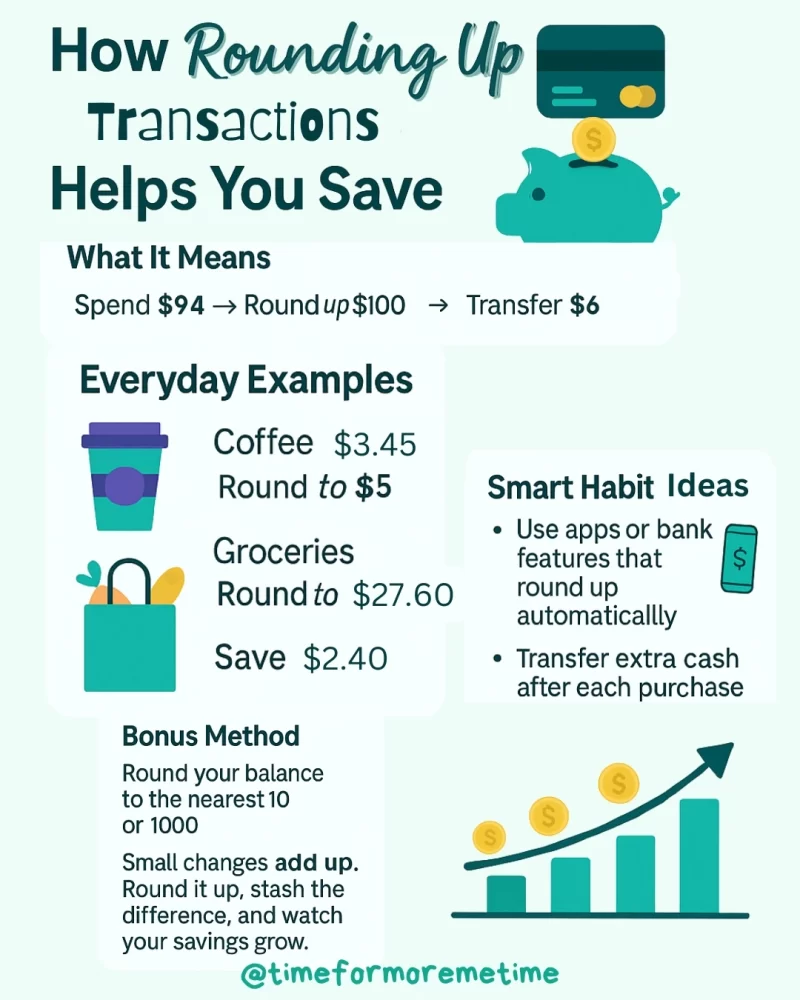

2. Rounding Up Transactions

If you must use your debit card, consider rounding up your transactions to boost your savings. The concept is straightforward: any leftover amount after rounding up goes directly into your savings account. For instance, if you spend $94, round it up to $100, pay the $94, and transfer the remaining $6 to savings.

Imagine how quickly those small contributions from every coffee run or purchase could accumulate! In fact, using a debit card this way might be more effective for building savings than a credit card.

Another strategy is to keep your account balance ending in a neat “0.” For example, if your balance is $3,214, transfer the $4 to savings. If you can, round it down further—move $14 to make it $3,200.

It’s a simple trick, but it can add up quickly!

3. Withdrawing Cash

My personal favorite strategy is withdrawing a set amount of cash for spending. Debit and credit cards provide unlimited access to your money, making it easy to overspend, especially on expensive items you “technically” can afford.

However, when you have only $100 in your pocket, your spending is limited. This forces you to think carefully about each purchase and be more mindful of your budget for the day.

I’m not suggesting you deprive yourself, but this method is an effective way to cut expenses and curb unnecessary spending. It helps you stay in control without feeling overly restricted.

4. Planning Meals

Meal planning can be challenging, especially with a busy schedule or multiple jobs, but it’s worth the effort. While the planning itself is simple, the follow-through—like grocery shopping and cooking—requires commitment.

Meal planning helps you avoid impulse purchases that can quickly increase your grocery bill. It also allows you to stick to a budget and focus on essential items.

Whenever possible, buy staples like rice, pasta, or frozen pizza in bulk; they’re cost-effective and have a long shelf life. Although it may take some extra time and effort, meal planning can lead to significant savings in the long run.

5. Lowering Utility Bills

This tip is for those feeling overwhelmed by expenses. I used this strategy back in 2012, and while it felt extreme at times, it really helped. The key is to minimize your utility costs.

Lowering your utility bills is straightforward. Only keep appliances on in the rooms you’re using, and maximize your refrigerator by storing cold water and essentials to enhance its efficiency. Opt for simple meals that can be cooked on a gas range to reduce electricity use.

If possible, invest in energy-efficient appliances. Look for Energy Star certification to ensure they meet energy-saving standards—doing a bit of research can pay off.

While these changes may not lead to huge savings, they can make a noticeable difference. When you’re trying to save, every little bit counts.

6. Going For Generic Products

In today’s marketing-driven world, many people feel ashamed to choose less expensive, generic products. However, opting for generic or store-brand items is perfectly acceptable. Often, people stick with branded products even when the generic version is 15% cheaper. A Purdue survey found that most people only switch to generic when the price difference reaches around 30%.

It’s important to break the mindset that higher prices equal better quality. If a generic product works just as well or tastes the same, why not save some money? There’s no need to spend more just to showcase a brand, especially if it strains your budget.

I personally stick to a few trusted brands for specific items but choose cheaper options for everything else, as long as the quality is good. Additionally, I use coupons and have several top coupon apps on my phone to maximize savings.

7. Creating A Robust Savings Plan

Creating a strong savings plan is essential for managing your money wisely. Savings isn’t just about setting aside loose change or whatever’s left at the end of the month; it’s about establishing a solid plan for your financial future. With a clear strategy, you can control your spending and make smarter choices.

Start by tracking your spending for a month to identify where your money is going. Once you pinpoint areas of unnecessary spending, cut back on subscriptions, plan meals to avoid impulse buys, and be mindful of utility costs.

Next, set clear savings goals, whether for an emergency fund or a vacation. Specific targets will keep you motivated and focused.

Finally, automate your savings by setting up direct transfers from your checking account to your savings or investment accounts each payday. This way, you prioritize saving for your future.

FAQs

You might still have some questions, so here’s a bit more information to help you out.

How can I avoid the temptation to overspend on credit cards?

To avoid overspending on credit cards, I set a monthly spending limit and, as I mentioned earlier, use cash for everyday purchases to stay mindful of my spending. Automating payments can also help prevent missing due dates. And ultimately, just leave your cards at home—it’s a simple solution to avoid unnecessary temptation.

Should I focus more on saving or paying off debt first?

Debt can be a tricky expense, and I understand it’s hard to decide whether to focus on saving or paying off debt. What I do is pay off high-interest debt first, as the interest can quickly outweigh any growth in savings.

Once the high-interest debt is cleared, I start building my emergency fund, then focus on my long-term savings goals.

How can I balance enjoying life with being financially responsible?

A simple approach is to be frugal and get into frugal living tips, but adjust as you go. Know your limits and what you’re comfortable with, and be honest about what you truly need versus what you just want.

By understanding your needs, you’ll realize what’s worth spending on and what’s not, letting you enjoy life while staying financially responsible.

Conclusion

Saving money doesn’t require sacrificing your quality of life; it’s about spending wisely and setting aside funds for the future. Managing your money effectively is straightforward and relies more on discipline than financial expertise

Most importantly, don’t forget to subscribe to our YouTube channel for actionable advice and inspiration. See you there!

Sources

- Photo: Unsplash: Katt Yukawa