Let’s face it: figuring out how to draw up a budget can feel like climbing Everest. Based on personal experience, that happens when we don’t understand our finances. But with the right guidance and tools, you can transform this challenge into a powerful opportunity for financial empowerment.

That’s what Time For More Me Time is all about—ensuring that my journey from living paycheck to paycheck to becoming financially savvy can help others. And it starts with having a solid budget and learning how to draw up a budget effectively!

Step 1: Understanding The Basics Of How To Draw Up A Budget

I learned the hard way that making smart choices with your money requires understanding the basics of personal finance. But you don’t have to go through those hardships with this guide.

Drawing up a budget feels like being in a maze in the dark for some. But it doesn’t have to be.

Personal Vs. Business Budgets

A personal budget and a business budget are cousins, not twins.

Your personal budget revolves around managing daily living expenses—think rent or mortgage payments, groceries, and fun money.

On the other hand, a business budget is all about expansive planning. Budgeting involves predicting income, wisely distributing funds for expansion prospects, and closely monitoring money movement to guarantee enduring stability and financial success.

It’s about balancing what comes into your bank account with what flows out…

It’s important to understand that while both aim at legal and financial wellness, they operate on different scales and principles.

Tracking Your Expenses

Gather your financial statements if you’re wondering how to draw up a budget for a month effectively.

Yes, this means digging through every credit card statement and bank account detail—even that gym membership you forgot about, but it’s still monthly payable.

Your goal? Gaining a clear overview of your take-home pay compared to your expenses is an essential step in drawing up a household or individual money plan.

This exercise allows you to identify areas where you can make cuts (like saying goodbye to that unused gym membership) and highlights where you may need to allocate more funds (like investing in a high-yield savings account).

When you find that your income minus expenses leaves you with extra money each month, you’re making real progress toward those bigger financial goals we all aspire to achieve. This can let you start living beyond your means smartly.

By understanding your financial landscape, you’ll gain the confidence and clarity needed to take charge of your finances and pave the way for a brighter financial future.

Why Traditional Methods Aren’t Enough

Gone are those days when I’ve relied on pen and paper as part of my budgeting methods. Nowadays, I can easily access tools for tracking finances inside my electronic devices.

Your grandma’s envelope system was great for her time. Today? Not so much. We deal with multiple income streams, online subscriptions, and fluctuating expenses.

This is where modern budgeting tools come into play. They track every penny in real-time and adjust your spending as you go.

Leveraging Features Beyond How To Draw Up A Budget

It’s not just about tracking what comes in and goes out anymore.

We’re talking about setting money aside automatically into emergency funds or connecting directly to investment platforms to grow extra cash.

A good tool also educates us on smarter ways to save money without sacrificing essentials like health insurance or child care.

Picking the right app is like choosing a partner for your finances. It should help you understand your money better and adjust when your expenses change. With the right support, reaching your long-term financial goals becomes easier and more achievable.

Step 2: Calculating Your Income And Expenses

Now that you know where and how to track your expenses, calculating your income will be much easier.

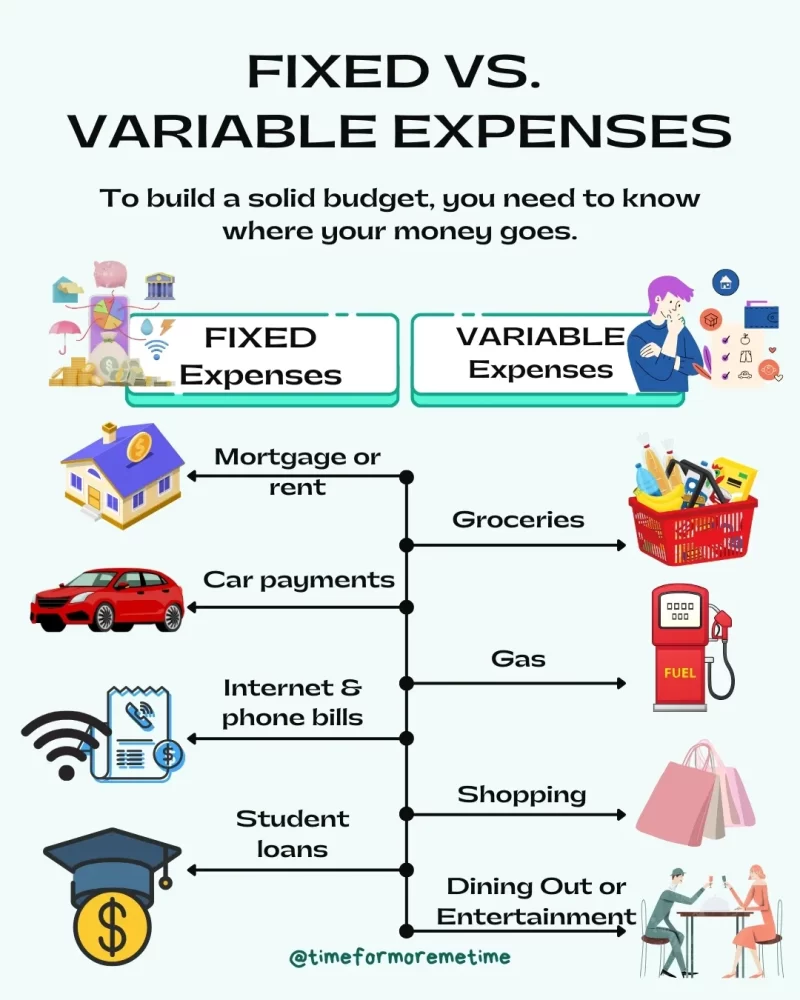

Identifying Fixed Vs. Variable Expenses

Drawing up a budget starts with knowing your money’s ins and outs. First, list every penny you make. This includes not only your take-home pay from the day job but also side hustles, rewards, or any other cash flow.

Next is to lay down your expenses.

They’re answers for seeing where your money goes each month. Regarding that fixed and variable expenses come to the scene.

The trick is to split costs into fixed (like mortgage payments) and variable (like groceries) ones. Fixed costs don’t vary; they’re predictable—like that gym membership you swear you’ll start using next Monday.

Variables? They swing more than a pendulum—gas prices spike, as do the prices of basic commodities.

Subtracting Expenses From Income

Now grab a calculator or use EveryDollar’s budget tool or TaxAct’s Self-Employed Calculator. With such tools, you can get the full picture of your finances.

Subtract total monthly expenses from your net income. The result will tell you if you’re living within your means or not.

If the numbers show more outgoing than incoming, it’s time to cut back—there’s no need for drastic measures like never eating out again, but maybe dial down on nonessential spending.

Saving For Financial Health

If you’ve got some money left over after paying bills, that’s awesome. But hold off on spending it all on fun stuff right away.

Think about saving for things you want in the future or paying off any debts you have instead of having a spending spree now.

Putting your extra money into a savings account that earns a lot of interest can grow it into a nice safety net or emergency fund for the future without you having to do much. Even saving a small amount can get in you to having sinking fund.

It’s like having security in case you plan to take off from work or an emergency happens—you’ll have your weapon. Having enough money for emergencies can stop a bad day from becoming a big financial mess.

Tracking net income against fixed and variable expenses doesn’t just keep finances healthy—it paves the way towards achieving bigger dreams without sacrificing peace of mind today. With the help of the latest tools in cyberspace, you’ll never have any problems tracking.

Step 3: Setting Financial Goals

Financial goals act as your roadmap, reducing financial anxiety along the way. Understanding your destination and creating a strategy to reach it transforms aspirations into achievable objectives.

Defining Your Financial Milestones

Achieving financial success begins by pinpointing your financial objectives.

Think short-term and long-term. Short-term might mean saving for a vacation or paying off a credit card.

Long-term? Think retirement or buying a home.

To start, list what matters most to you—saving for emergencies, clearing debt, or maybe that dream trip next year. This will make it real and doable.

Maintaining Flexibility In Your Budget

Your budget isn’t fixed—it should be flexible when life surprises you (and it definitely will). When unexpected costs arise, be prepared to make changes without ditching your whole plan.

This means sometimes checking on your money situation: Are you not going to the gym anymore? Cancel your membership.

Making extra cash from side jobs? Maybe save more.

It’s okay to change direction if you need to; being flexible helps you stay calm while moving towards your goals steadily.

Evaluating Spending Habits Regularly

If reaching financial freedom seems as complicated as climbing Everest with a blindfold, remember this easy rule: Check often, cut what you don’t need, and keep on track.

By looking at your bills and small expenses, you can find where your money’s going and stop any financial leaks from coming.

And when you see where you’re spending more than you should? You can make smart changes to stay on course and balance having fun now with being secure later.

So, examine your bank statements, credit card bills, and even how much you spend on coffee each day. Understanding where your money goes helps you make better choices and get closer to your savings goals, no matter how life’s winds blow.

Step 4: Managing Debt While Growing Savings

As mentioned, you must pay your debts if you have extra money. But if none and you want to know how to earn extra money, check out the different online platforms. By earning extra money, you can acquire more money for your debts.

Savings Accounts Vs. Emergency Funds

Finding the right balance between paying off debt and saving money might be daunting. On one side, you’ve got savings accounts; on the other, you’re building emergency funds.

Consider your savings account a slow-growing plant that needs consistent watering—your regular deposits. It’s for goals that are not quite at arm’s reach but visible in the process.

Think of emergency funds as your money safety net: you use them only for emergencies. They’re super important because life can be full of surprises.

According to NerdWallet, a good emergency fund should have enough money to cover your living expenses for about three to six months.

Understanding the difference between these funds can help you reach your goal budget and be ready for unexpected events. It also means you can still work on paying off any debts you have.

All About Debt Management Effectively

To start lowering your debts without sacrificing savings growth, consider strategies like the snowball or avalanche methods.

With snowballing, you tackle smaller debts first for quick wins that motivate you toward bigger ones. The avalanche method flips this approach: pay down high-interest debts first to save more over time.

Another strategy involves consolidating credit card balances onto a single card with lower interest rates or into a fixed-rate loan consolidation plan. By streamlining dues into one, you might considerably reduce your interest bill.

Leveraging High-Yield Savings Accounts

Storing money isn’t the end game; it’s about leveraging every penny for bigger aspirations. It’s making every dollar work towards future dreams while managing today’s demands.

If saving feels slow, high-yield savings accounts turn it up a notch. They offer better interest rates than traditional ones, so think of them as turbo-charged piggy banks.

Every cent saved works harder here, but do it right. Some have minimum balance requirements or limited withdrawals.

With discipline, a good plan, and the right tools, you can manage life’s financial ups and downs smoothly.

Step 5: Reviewing Your Budget

Set regular intervals—monthly works well—to review this budget against actual spending using online tools. After this, you can set your spending limit more realistically.

This habit turns reactive adjustments into proactive strategies, keeping issues minimal and stress lower over time. Because, let’s face it, no one enjoys being blindsided by their finances. In the long run, you can save money without compromising anything.

FAQs

What is the 50-30-20 rule of money?

This rule splits your income 50% between needs, 30% between wants, and 20% into savings. It’s simple yet effective.

How should a beginner start a budget?

Begin with tracking your spending for a month. Then, categorize expenses and set realistic goals based on your income.

How do I figure out my budget?

List all sources of income. Deduct monthly expenses from this total to see what’s left for saving or adjusting.

How do you create a personal budget?

Pick a tool or method that suits you best—pen and paper, an app, or Excel. Track every dollar coming in and going out.

Conclusion

Mastering how to draw up a budget plan means understanding your finances inside and out. It’s all about monitoring each penny, crafting achievable objectives, and opting for well-thought-out decisions.

Start by separating wants from needs. Know the difference between fixed expenses like rent or mortgage payments and variable costs such as eating out or gym memberships.

It’s a good idea to set money aside for savings accounts, but remember to tackle debt with money management tools head-on. Remember, balancing both is key to financial health.

Opt for gadgets or apps to help you reach your money goal; they’re pivotal in keeping your expenditures in check and enhancing your savings game.

In the end, it’s all about flexibility—start budgeting and adjusting as you go along without losing sight of what you’re aiming for: Financial freedom and peace of mind.

Know someone who needs a simpler way to create a budget? Share this with them and start transforming your finances!

Sources

- Photo: Unsplash: FIN