I used to feel stressed by unexpected expenses without an emergency fund. But once I learned to build one, that anxiety disappeared. Now, I can handle car repairs, medical bills, and job loss without financial chaos or relying on credit cards.

Building an emergency fund has been transformative. Start today to protect yourself from financial stress and take control of your future. Let’s get started!

1. Assess Your Personal Finance

Before saving for your emergency fund, assess your financial situation. Gather bank statements, credit card bills, and other documents to track your income and expenses over a month or two. Focus on recurring bills like:

- Rent or mortgage

Auto loans

Credit card bills

Student loans

Utilities

Groceries

Transportation

Also, account for non-essential expenses like daily coffee, forgotten subscriptions, and impulsive purchases, as these can add up quickly.

After tracking your expenses, create a budget outlining your income, fixed expenses, and discretionary spending. This basic strategy can help you cut costs and achieve quick results!

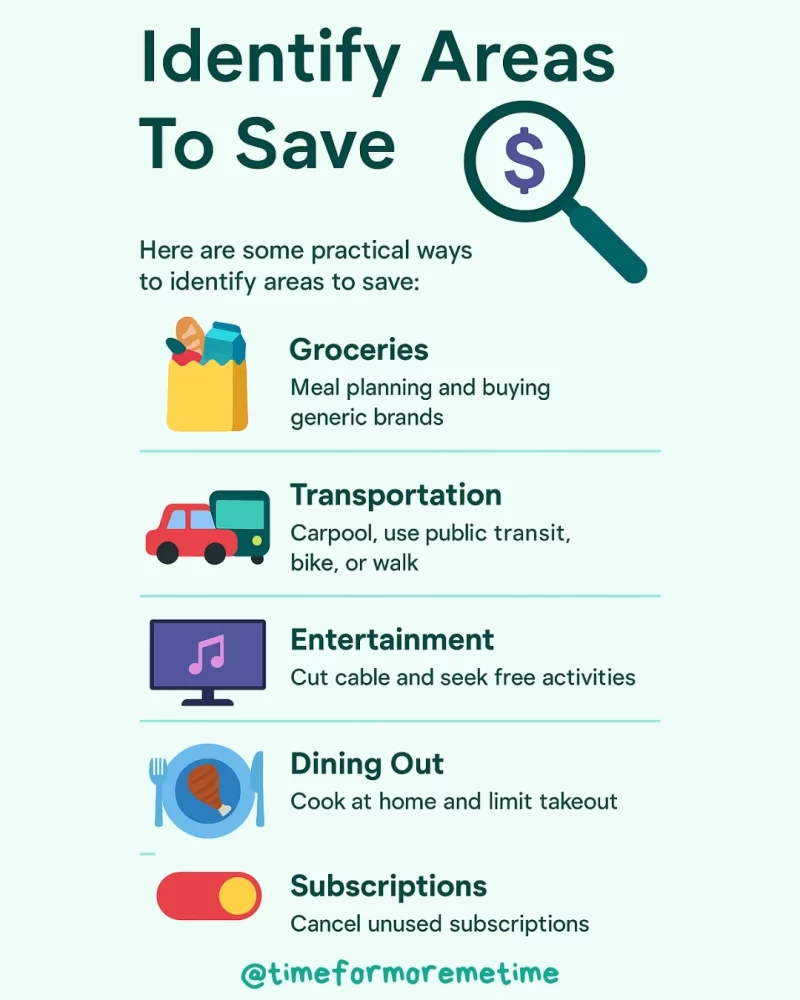

2. Identify Areas To Save

Understanding where your money goes is crucial for finding ways to cut back. Here are some key questions to consider:

- Are there recurring subscriptions you rarely use?

- Can you find more affordable options for groceries or your cell phone plan?

- Are you making purchases just to earn rewards?

You might be surprised by the number of non-essential expenses you have. For example, if you have a gym membership you haven’t used in months, consider switching to home workouts or joining local physical activity events as a more affordable alternative.

Every small saving adds up, and you can also direct unexpected windfalls, like tax refunds or bonuses, straight into your emergency fund.

Here are some practical ways to identify areas to save:

- Groceries: Meal planning, buying generic brands, shopping at discount stores, and using credit card rewards can help reduce grocery costs.

- Transportation: Consider carpooling, using public transit, biking, or walking. These options save money and promote health.

- Entertainment: Cut cable TV, seek free or low-cost entertainment, or use cash gifts from credit card rewards for subscriptions.

- Dining Out: Cooking at home, limiting takeout, and planning meals can significantly reduce dining expenses.

- Subscriptions: Cancel unused subscriptions, explore cheaper alternatives, or limit yourself to one account to minimize these costs.

These things aren’t that difficult to do, right?

3. Choose The Right Savings Account

Selecting the right savings account is crucial for building your emergency fund. Consider both accessibility and growth potential. You need a secure place where your money can grow and be easily accessed in emergencies.

High-yield savings accounts are excellent options, offering security and better interest rates than traditional savings accounts. Money market accounts also provide competitive rates and allow limited check writing.

For example, with a $50,000 initial amount, a traditional savings account with 0.05% interest will let you have an end of year balance of $50,025. Meanwhile, a high-yield with 4.50% interest will let you have $52,250 instead.

The difference is significant: a high-yield account earns $2,250 in interest compared to just $25 with a traditional account. And while it’s wise to keep a small amount of cash at home for minor emergencies, avoid storing large sums due to theft risk. Also, consider consulting a financial advisor to choose the best savings solution for your needs.

4. Make Direct Deposits Automatic

Saving often takes a backseat to other expenses, but in wealth management, your savings should come first—this is known as paying yourself first. To ensure you prioritize saving, set up automatic transfers to your emergency fund.

Automation is key for building your emergency fund. Arrange for automatic transfers from your checking or savings account to your emergency fund every payday. This can be a fixed amount, like $50 or $100, or a percentage of your paycheck. This set it and forget it method ensures consistent savings without the need for manual transfers each month, effectively creating a sinking fund.

5. Monitor And Adjust

After starting your savings, regularly check your progress and make adjustments as needed. Building an emergency fund is a marathon, not a sprint.

Be prepared for fluctuations in your expenses or unexpected windfalls, and adjust your automatic savings accordingly to keep your budget on track. Periodically review your cash flow statement, especially after significant life changes like a new job or salary increase.

This allows you to modify your automated transfers to either accelerate your savings or accommodate changes in income or spending. Regularly monitoring your financial cushion will also motivate you to stay committed to your savings goals.

FAQs

Before I end this post, let me tackle some frequently asked questions first.

What is the best way to create an emergency fund?

Begin by setting a clear savings goal. Next, identify areas where you can cut expenses and set up automatic transfers to a high-yield savings account. Additionally, look for opportunities to increase your income whenever possible.

Is $5,000 enough for an emergency fund?

An amount of $5,000 is a solid starting point for an emergency fund. While it may not cover all individual expenses, it should be sufficient for most common financial emergencies. Remember, starting with any amount is better than having nothing.

How can I build an emergency fund when money is tight?

Start with whatever you can afford, even if it’s a small amount. Over time, these small contributions will add up. As your financial situation improves, gradually increase your savings.

You can also explore additional income streams, such as freelancing or gig economy jobs, to boost your contributions directly to your emergency fund.

Conclusion

Now that you know how to build an emergency fund, it’s time to start. The initial adjustment may be challenging, but it will become satisfying over time. Remember, this isn’t just about saving money; it’s about achieving financial stability and gaining the confidence to handle unexpected situations while making smarter financial choices.

If you find this helpful, be sure to subscribe to our newsletter. Also, follow us on social media and check our videos in our YouTube channel!

Sources

- Photos: Unsplash: Josh Appel