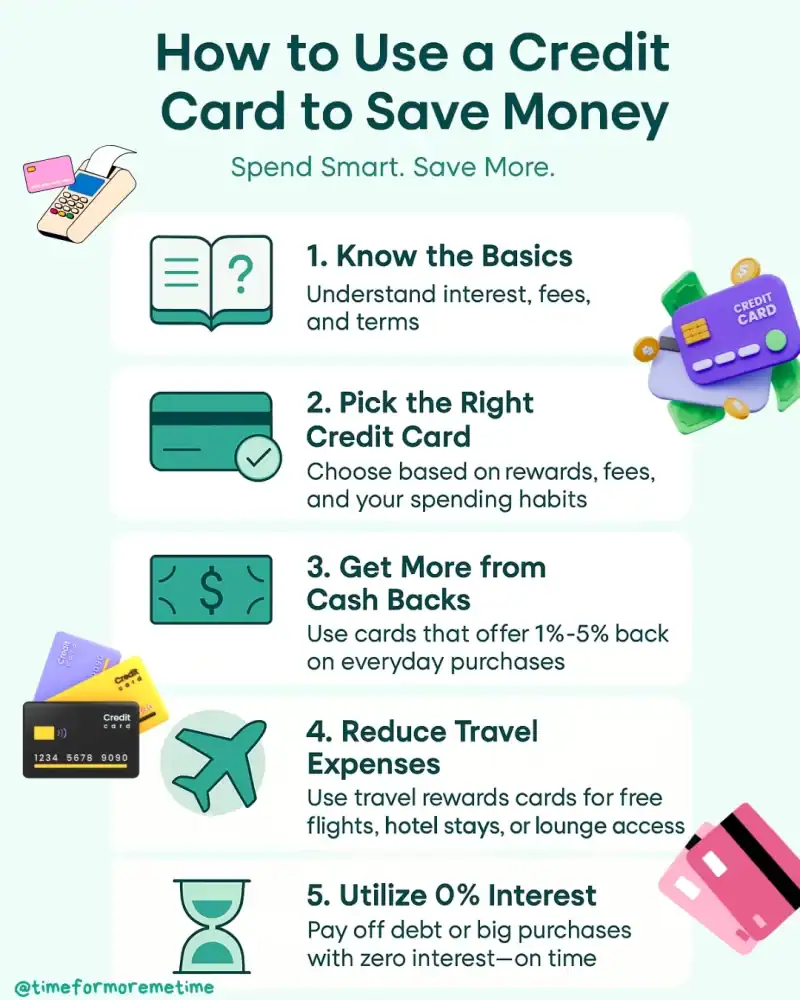

Credit cards often get a bad reputation because of high-interest debt, but they can help you save money if used wisely. This post will explain how you can do that. Let’s get started!

1. Know The Basics

To become a savvy credit card user, it’s essential to understand the basics. A credit card functions as a short-term loan, allowing you to make purchases up to a set credit limit, which you are required to repay—either in full or by making a minimum payment each month.

If you don’t pay your bill in full and on time, you may incur interest and late fees. However, if you pay your bill on time, you can consider it a free interim loan, as you won’t incur any interest charges.

Remember—this is important—credit card “savings” only work if you pay in full each month. If you carry a balance, interest will quickly cancel out any rewards.

And before anything else, know these important terms:

- APR (Annual Percentage Rate): This is the yearly interest on outstanding balances. Comparing cards with different APRs is crucial, as a high APR can significantly increase your total repayment amount.

- Grace Period: This is the time between your statement closing and your payment due date. Paying the full balance during this period usually means you won’t incur interest, provided you had no balance in the previous month.

- Rewards: These perks include cash back, points, or travel miles. Choose a rewards program that aligns with your spending habits to maximize benefits without straining your budget.

- Fees: Be cautious of various fees, such as annual fees, late payment fees, and foreign transaction fees, which can add unnecessary costs.

- Credit Utilization Ratio: This is the percentage of your available credit that you are using. Keeping this ratio below 30% is recommended to maintain a healthy credit score and demonstrate responsible credit management.

Once you understand these terms, you’re on the right path. The next step is to adopt some key practices for handling a credit card effectively.

First, always pay your full statement balance before the grace period ends to avoid interest charges and protect your credit score. I can never stress this enough!

Second, remember that a credit card is different from a debit card. Unlike debit cards, which withdraw funds directly from your bank account, credit cards allow you to borrow money even if you have nothing. So, when using a credit card, spend within your means and pay in full—just monitor responsibly.

Third—to follow up—regularly monitor your spending and account statements. Keeping track of your purchases helps you stay within your budget and quickly identify any unauthorized transactions.

By following these practices, you can use your credit card wisely, maximize its benefits, and maintain a healthy financial profile.

2. Pick The Right Credit Card

Choosing the right credit card is essential, as no single card fits everyone’s needs. Your best option depends on your spending habits and the benefits you value most. Start by familiarizing yourself with the different types of credit cards available:

- Cashback: Earn a percentage back on purchases, typically ranging from 1% to 6%, with higher rates in specific categories.

- Travel Rewards: Accumulate miles or points for flights, hotels, and rental cars.

- Low-Interest: Ideal for those who occasionally carry a balance, these cards feature lower APRs to minimize interest costs.

- Store Cards: Often linked to discounts and rewards at specific retailers, these cards may come with high interest rates, making them especially risky for cardholders who don’t pay in full, as rates can exceed those of general-purpose credit cards. However, they can be beneficial for frequent shoppers at those stores.

- Balance Transfer Cards: These cards let you transfer debt from high-interest credit cards to one with a lower interest rate or a promotional 0% APR for a limited time, helping you save on interest while paying down your debt. Only proceed if the fees, deadlines, and repayment strategy are favorable, as these factors can complicate the process. Always have a clear plan before transferring.

Once you understand the types of cards available, evaluate your regular expenses. If you frequently spend on gas or dining, seek cards with higher cash-back rates in those categories. Travelers should consider cards that offer travel rewards to maximize their benefits.

Next, take advantage of attractive offers often available to new cardholders, such as temporary 0% interest, high rewards rates, or cash bonuses after meeting spending requirements. Keep in mind that these offers are usually temporary.

Finally, check for annual fees to ensure you’re getting enough value from the card. Pay attention to the APR, as high rates can erode your savings if you carry a balance. Also, be aware that reward structures can change, especially with rotating categories.

3. Get More From Cash Backs

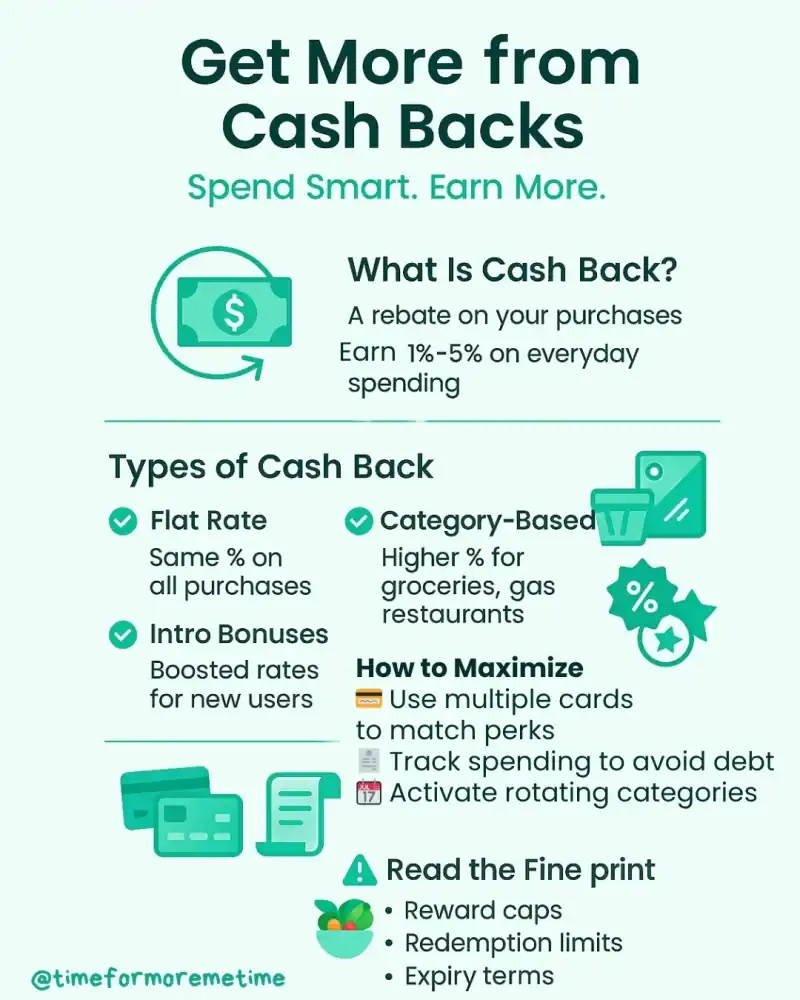

Cash back is a popular feature because it turns everyday spending into rewards, effectively giving you a rebate on purchases. Many credit cards offer cash back ranging from 1% to 5% on common purchases.

Some cards provide bonus cash back based on specific categories, such as restaurants, groceries, and gas stations, often offering higher rates of 3% to 5%. New cardholders may also enjoy increased rates in certain categories during the first few months, but keep in mind that rotating categories typically require activation.

To maximize cash backs, consider using multiple cards. This strategy allows you to match your purchases with specific perks, optimizing your savings. However, be sure to carefully track your purchases and balances to avoid overspending or missing payments.

Note: Be aware that credit card issuers can change or devalue rewards points, impose limits in fine print, or introduce blackout dates after you’ve earned them, significantly reducing their value. Always read the fine print, including expiry terms, minimum spend rules, and change policies. Verify actual redemption options instead of relying solely on advertised point values.

4. Reduce Travel Expenses

You can transform everyday purchases into travel rewards with a good travel rewards credit card. They can allow you to earn free flights, hotel stays, and discounts on extras through travel points.

Start by choosing a travel rewards credit card that offers points on everyday purchases, similar to cash back rewards. As you buy essentials, you’ll accumulate travel points for your next adventure.

Do note that each credit card has its own redemption system. Some allow statement credits for travel expenses, while others provide dedicated portals with options from airlines, hotel chains, and rental car agencies.

Meanwhile, some premium credit cards provide limited travel insurance when you pay for your trip with the card, covering trip cancellations, lost luggage, and medical emergencies abroad. However, coverage varies by card and often comes with limitations. Be sure to read the fine print and review your existing insurance policies to avoid unnecessary costs. If needed, consider purchasing supplemental insurance for additional protection.

And to maximize your travel rewards, consider the following strategies:

- Choose Flexible Rewards Programs: This will prevent you from being tied to a single airline or hotel chain.

- Plan Redemptions Carefully: Strategize to maximize value, especially for premium options or upgrades.

- Be Aware of Blackout Dates: These can limit your redemption options during peak travel times.

Additionally, some travel cards allow you to earn cash back, enabling a hybrid savings strategy that combines both travel rewards and cash back benefits.

5. Utilize 0% Interest

With 0% interest credit card deals, you can borrow money without paying interest for a limited time, similar to a small personal loan. However, it’s essential to carefully review the terms of these offers.

If you have debt on a high-interest credit card, consider transferring that balance to a new 0% interest card. This strategy gives you the opportunity to pay off existing credit card debt without accruing additional interest—but only if the full balance is paid before the promotional period ends. Just be sure to stay on top of your repayment plan, as interest will resume once the promotional period ends.

Using a 0% interest card for significant purchases can enable you to pay over time without incurring extra costs—if you pay off the balance in full before the promotional period ends and avoid any associated fees. In some cases—especially with store cards—interest is deferred, not waived. That means if you don’t pay in full, you could be charged retroactive interest on the entire purchase amount.

While 0% interest offers can be attractive, they also carry the risk of falling into a debt trap. To avoid this, set up auto-payments to prevent late fees and diligently track your spending. Be prepared for payments to increase once the promotional period ends, as you may find yourself with a balance that becomes difficult to manage.

FAQs

Before you reach the conclusion, read my frequently asked questions first!

What is a good credit limit on a credit card for everyday purchases?

A good credit limit depends on your spending habits and your ability to pay off the balance each month. Aim to use less than 30% of your total credit limit, known as your credit utilization rate, as this positively impacts your credit score. A lower utilization rate is better for your score.

Is it a good idea to use a credit card for online purchases?

Yes, using a credit card for online purchases is generally safe, as credit cards offer better fraud protection than debit cards. If unauthorized charges occur, you can usually dispute them. Always shop on secure websites by looking for “https” in the URL and a padlock icon in your browser.

How can I avoid overspending when I use my credit card?

Overspending can be a risk with credit cards. To avoid this, set a budget and stick to it. Treat your credit card like a debit card: if you don’t have the cash to pay for an item now, don’t buy it. Use a budgeting app or your credit card’s online tools to track your spending.

Conclusion

Learning to use a credit card to save money can be challenging. Like any financial tool, credit cards must be handled responsibly. By understanding the terms and selecting a card that fits your spending habits, you can enhance your savings and earn rewards.

If you learned something from this post, consider subscribing to my newsletter. Also, you can follow me in my social media accounts and watch videos from my YouTube channel. See you there!

Sources

- Photos: Unsplash: Blake Wisz