Budgeting is one of the biggest challenges on the path to financial freedom. With the rise of technology, I can’t help but ask this question: What are the best budgeting tools?

Earning money from a job is straightforward—you work, complete tasks, and get paid. However, managing that income effectively is where many people struggle. That’s where budgeting apps come in.

In the past, you might have used a notebook or a spreadsheet to track your finances. Now, you can simply download an app and manage everything with a few taps on your phone.

But with so many options available, which one is right for you?

That’s where I come in. I went through my phone’s app store, checked out the top-rated budgeting tools, downloaded them all, and tested them one by one.

To get a clearer picture of their strengths and weaknesses, I also explored each app’s official documentation and user feedback.

To make this list as useful as possible, I focused on apps that offer a free version with unlimited use. Most also have premium upgrades that unlock extra features—some require a subscription, while others have a one-time purchase fee.

With all that said, let’s get started and find the best budgeting app for you!

Note: Keep in mind that these apps are regularly updated by their developers. As a result, some of the features, characteristics, and functionalities mentioned in this list may differ when you check the app yourself.

1. MyMoney

MyMoney is one of the top apps on the Google Play Store, primarily serving as a money manager and budgeting tool. What stands out to me is its intuitive interface and extra features that make it a powerful financial management app, not just a simple budgeting tool.

If you’re willing to invest the time, MyMoney lets you track even the smallest details of your budget and expenses. The more data you input, the more insightful and detailed your financial analysis and budget plan become.

Of course, how much you take advantage of its features is entirely up to you. MyMoney can be as simple as you need for basic budgeting or as comprehensive as you want for in-depth financial tracking.

Who Is MyMoney For: Ideal for those who want the most robust budgeting app that also functions as a passive financial manager.

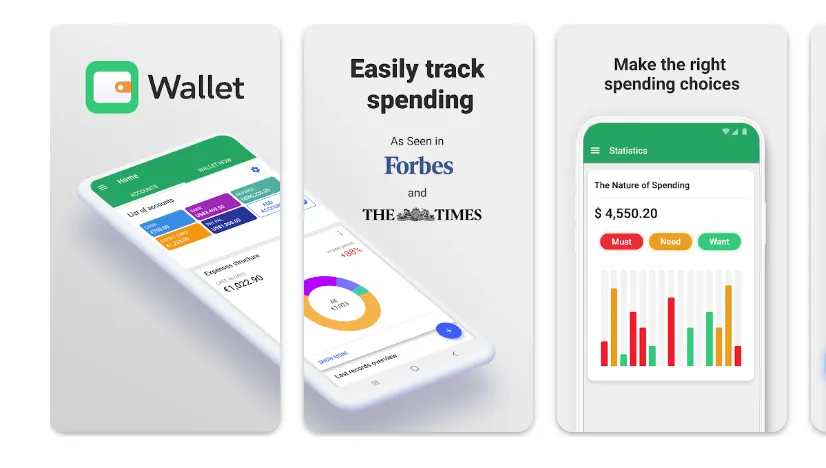

2. Wallet: Budget Expense Tracker

Unlike MyMoney, Wallet: Budget Expense Tracker has a simpler interface. Although simple, it still offers useful features beyond budget planning, such as goal setting, due date reminders, and stock tracking.

You can also connect it to your bank, allowing it to track changes in your accounts automatically.

However, despite its versatility, there are some limitations. For example, it lacks progress tracking for goals and doesn’t support multiple goals within a single account. Still, it remains a solid option for budget planning.

Who Is Wallet: Budget Expense Tracker For: A great alternative to MyMoney for those who prefer a different look and feel.

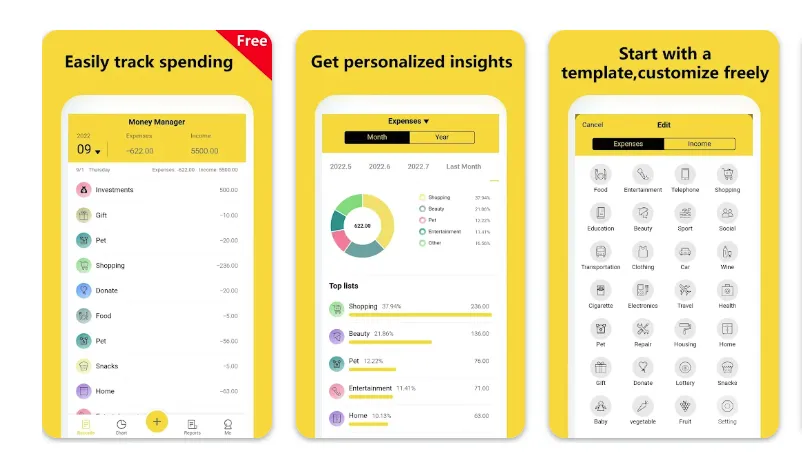

3. Money Tracker-Expense & Budget

If you’re wondering what are the best budgeting tools focused on budget planning, Money Tracker-Expense & Budget might be a good fit. It has a compact design, is easy to use, and feels similar to MyMoney in terms of interface.

And, it includes additional financial features you may find useful.

However, while reviewing the app, I noticed that some users reported a clunky interface. I didn’t experience this issue on my phone, but that might be because I’m using a newer model. It’s possible that the app doesn’t run as smoothly on older devices.

Another drawback is its premium pricing. Instead of a one-time fee, it requires a yearly subscription, which seems quite expensive. Personally, I’d recommend avoiding the paid version.

That said, if you’re sticking to the free version, it works well as a basic budgeting app.

Who Is Money Tracker-Expense & Budget For: Perfect for users who want a simple, compact budgeting app that’s easy to use without a steep learning curve.

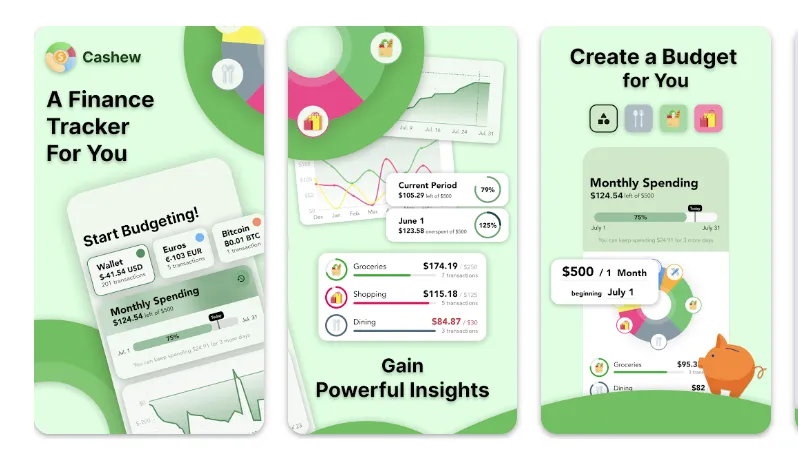

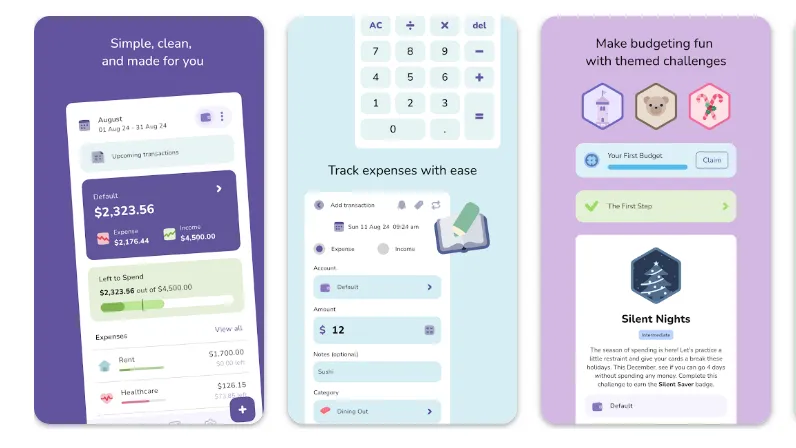

4. Cashew—Expense Budget Tracker

I’m ranking Cashew as my top pick for one simple reason: it doesn’t harvest your data. Unlike the other apps on this list, Cashew doesn’t collect any data from your phone or share information with third parties.

Another major advantage is its seamless integration with spreadsheet programs like Google Sheets. This gives you full control over your data and allows for more in-depth analysis of your spending and budget using a powerful spreadsheet program.

The only downside is that navigating the app can be challenging for those who aren’t tech-savvy. However, if you’re comfortable with technology, Cashew is a great tool that gives you full control over your budget and finances.

Who Is Cashew—Expense Budget Tracker For: Best for privacy-conscious, tech-savvy users who want full control over their budget and financial data without data harvesting.

5. Budgeting App—Spend Tracker

If you’re looking for a simple budgeting and tracking tool—nothing more—Budgeting App—Spend Tracker is the most straightforward option on this list.

It doesn’t come with extra features or fancy add-ons, just basic analytics and budget tracking. Despite being free, it’s completely ad-free, which is a huge plus.

However, its simplicity is both its greatest strength and biggest limitation. Certain features, like setting expenses to automatically recur twice a month, aren’t available.

If you want more advanced financial management, you can upgrade to the premium version, which requires a one-time payment. This unlocks better analytics, such as month-to-month budget comparisons.

Who Is Budgeting App—Spend Tracker For: Designed for those who want a no-frills budgeting tool focused solely on tracking and planning expenses.

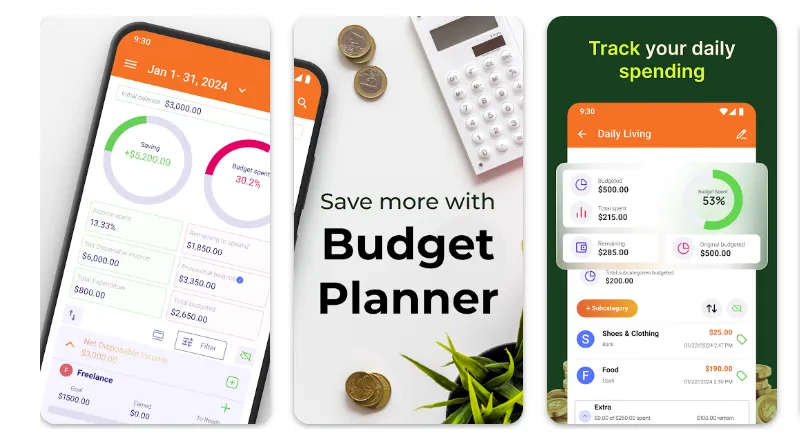

6. Budget Planner—Expense Tracker

I used this app before, and it was pretty decent. It’s one of the older budgeting apps out there, with a clean interface that makes tracking expenses and creating a budget easy.

The best feature was its receipt scanner, which helped simplify expense tracking and financial management.

After switching to a new phone, I forgot to re-download it. When I finally did, I noticed a big change—ads. Now, every two to three actions trigger a pop-up ad, which can be frustrating.

Upgrading to the pro version removes the ads, so if you’re considering this app, make sure it’s the right fit before making a purchase.

Who Is Budget Planner—Expense Tracker For: This app is a good alternative for those looking for a robust budget planner and money manager if you’re willing to or can spend a little extra on the premium version.

Conclusion

And that answers the question: what are the best budgeting tools you can enjoy! I intended to review at least ten, but after checking the next few on the Google Play top list, I found no significant differences between the first six and the following four.

Honestly, the first six apps provide plenty of options and should be more than enough to help with your budgeting. However, if you’d like me to explore more apps, feel free to reach out on my socials!

Or check the other articles that can help you budget and save money! Don’t forget to subscribe to my YouTube channel, too, so you can receive updates on new videos related to making extra money!