Real estate investment can often seem out of reach for the average investor. Many people struggle to find ways to invest in real estate without the burden of direct property ownership. However, there is a solution that allows individuals to invest in real estate without the complexities of managing properties. This solution is Real Estate Investment Trusts (REITs).

But what are REITs exactly? I’ll explain, so let’s get started!

What Are REITs

REITs are companies that own, manage, or finance properties that generate income, such as apartments, office buildings, and shopping centers. They are a type of investment vehicle, which means they are financial tools that help people invest in different assets.

REITs allow investors to buy shares in a collection of real estate properties. This gives them the benefits of owning real estate without the hassle of managing properties, while also making it easy to invest like they would in the stock market.

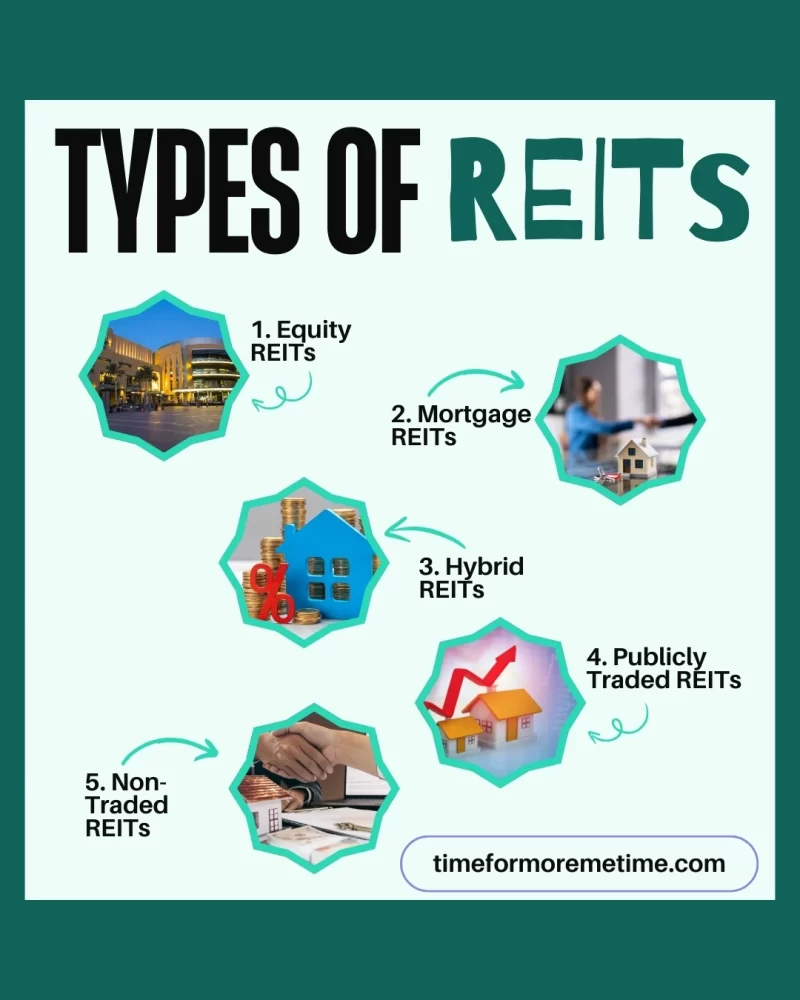

There are several types of REITs, including:

- Equity REITs: These own and operate income-generating real estate, such as apartment buildings and shopping malls.

- Mortgage REITs: These provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities.

- Hybrid REITs: These combine the investment strategies of both equity and mortgage REITs.

- Publicly Traded REITs: These are listed on major stock exchanges and can be bought and sold like stocks.

- Non-Traded REITs: These are not listed on stock exchanges and are typically sold through brokers.

Beginners in investing often choose publicly traded REITs because they are easy to access and can be quickly bought or sold without affecting their price. By the way, this quick buying and selling ability is called high liquidity, which means you can turn the investment into cash easily.

Publicly traded REITs also usually have low minimum investment amounts, making them affordable for new investors. They offer a simple way for beginners to learn about portfolio diversification, as investors can gain exposure to different types of real estate assets without having to buy properties themselves.

Where Can You Invest In REITs

You can invest in REITs through various platforms, including brokerage accounts, retirement accounts, and online investment platforms.

- Brokerage Accounts: These allow you to buy and sell shares of publicly traded REITs. For example, you can open an account with a brokerage firm and purchase shares of a REIT.

- Retirement Accounts: You can invest in REITs through tax-advantaged accounts like IRAs (Individual Retirement Accounts). For instance, you can set up a self-directed IRA and invest in REITs to benefit from tax deferral.

- Online Investment Platforms: They can allow you to invest in non-traded REITs with lower minimum investments. You can create an account, choose a REIT offering, and invest directly through the platform.

Beginners will often start in brokerage accounts because they provide easy access to publicly traded REITs. This accessibility allows new investors to start investing quickly and with lower barriers to entry.

Why Should You Invest In REITs

Investing in REITs can provide a steady income and help diversify your investment portfolio—your collection of different financial assets like stocks, bonds, and real estate.

REITs typically pay dividends, which are payments made to shareholders from the company’s profits. These dividends are usually paid regularly, such as every three months or once a year, allowing investors to earn money without having to sell their shares.

Investing in REITs can be an excellent way to generate passive income. If you don’t invest in REITs, you might miss out on potential profits from the real estate market.

When Is The Best Time To Invest In REITs

The best time to invest in REITs is during market downturns when prices are lower. Investing at these times can lead to higher potential returns as the market recovers. However, if you wait too long to invest, you might miss out on significant gains.

It’s also important to note that rising interest rates can negatively affect REIT performance. To manage this risk, consider diversifying your investments across different types of REITs. This strategy can help you benefit from various market conditions.

A helpful tip for timing your investment is to keep an eye on economic indicators and interest rate trends. By staying informed, you can make smarter investment decisions. Always remember that the timing of your investment in REITs can greatly influence your returns or your profit.

Conclusion

Understanding REITs is important for anyone who wants to invest in real estate without the challenges of owning property directly. By investing in REITs, you can take advantage of the income potential and diversification that real estate offers. Compared to traditional real estate investments, REITs are easier to buy and sell.

If you find this post helpful, please subscribe to our blog, follow us on social media, and watch our YouTube channel for more informative content.

Sources

- Photo: Unsplash: Jakub Żerdzicki