Do you feel like you’re overspending each month? You’re not alone. Embracing frugality is essential.

Being frugal means being intentional with your spending, making wise financial choices for long-term security without sacrificing joy. In a world full of temptations, living frugally is more important than ever.

This guide offers tips for smarter money choices and finding happiness beyond material possessions. Coming from humble beginnings, I’ve always prioritized smart spending. Living below your means requires understanding your priorities, setting realistic financial goals, and controlling your money.

Without further ado, let’s get started!

1. Understanding How You Spend Money

Before you create a detailed plan on how to live below your means and be frugal, you first need to understand where you stand. It’s time for a little financial self-reflection.

Start with identifying all your sources of income: your salary, any side hustle money, or perhaps any rental income coming in. After that, take a close look at your monthly expenses. Here’s a free budgeting worksheet that can be super helpful.

With the budget worksheet, you won’t forget about the sneaky little purchases. People say it’s an easier way to control those frequent smaller purchases on your credit cards that often fly under the radar but add up quickly. With this, you can start with expense-cutting strategies.

2. Eliminating Excess Spending

After reviewing your spending habits, identify areas to cut costs. Scrutinize bank statements, credit card bills, and receipts to uncover hidden spending patterns. Do you really need that daily expensive coffee? Consider brewing at home.

Evaluate your subscriptions—are you using all those streaming services? It might be wise to stick to one or two. Also, think about unused gym memberships; walking, calisthenics, or jogging can be effective alternatives.

This isn’t about being cheap; it’s about being smart with your money. Cutting discretionary expenses frees up cash for savings or paying off debts.

3. Crafting Your Master Budget

Okay, now for the fun part—budgeting. Don’t groan just yet. It’s simpler than you think. Creating a budgeting and financial plan that actually works is all about understanding two things—where your money is coming from and where it’s going.

And since you already did that with step one, you can make choices about how you want to direct your cash flow from your credit cards and savings accounts. Moreover, you can choose from the different ways to budget planning.

One way to have a good budget is to follow the 50-30-20 rule. Basically, it’s a baseline on how you can allocate your after-tax income into three main categories:

With this rule, 50% goes to your essential needs, such as your rent/mortgage, groceries, and utilities.

Then 30% goes towards your wants, such as entertainment, dining out, or travel.

Lastly, the all-important 20% gets stashed away into your savings and debt repayment.

This approach gives you a balanced way to manage your spending. It also helps you build up a safety net—known as an emergency fund—for the future.

4. Utilizing Frugal Budget Approach

After creating your master budget, optimize it with frugal methods. One effective strategy is zero-based budgeting, where you assign every dollar a specific purpose. This increases awareness of your spending habits and reveals savings opportunities. While some may find it restrictive, it can empower those who thrive on structure and help avoid credit card reliance.

Another effective method is the cash envelope system. Although old-school, it’s gaining popularity for good reason. This system allows you to track and control spending in specific categories, like groceries or entertainment. Simply place cash in labeled envelopes; once the cash is gone, you can’t spend more.

For those focused on saving, keep your savings envelope separate from your wallet or online accounts to reduce impulsive spending.

5. Cooking At Home

Restaurant meals add up—fast. One of the simplest ways to live below your means is by mastering the art of cooking delicious, satisfying meals in your own kitchen. Think meal prep Sundays, budget-friendly seasonal recipes, and the joy of experimenting with new flavors—without relying on takeout.

This small shift alone can free up significant cash each month without sacrificing good food. And if you use the right rewards credit card, you can even earn points or cashback on grocery purchases, making your savings go even further.

6. Ditching Impulse Buys

You’re in the checkout line, and bam! Those cleverly placed chocolate bars or that discounted must-have accessory are calling your name. This is the danger zone—where impulse purchases can derail even the most careful budgeting plans. To combat this, try implementing a self-imposed cooling-off period.

When temptation strikes, commit to waiting at least 24 hours before making the purchase. This simple pause gives you time to reassess whether you truly need it, helping you cut unnecessary spending and strengthen your conscious spending habits.

7. Couponing For The Win

Living frugally does not mean sacrificing the things you truly need or love. Whether it’s household essentials or wardrobe upgrades, both online and physical stores offer a treasure trove of deals, sales, coupons, and discounts.

Many websites and apps provide coupons and rewards, from travel perks to credit card cashback and store loyalty programs, helping you save even on big purchases. So, let go of the idea that bargain hunting is only for extreme coupon clippers. Embrace this simple yet powerful strategy to cut costs without lowering your standards. Smart saving is just smart spending.

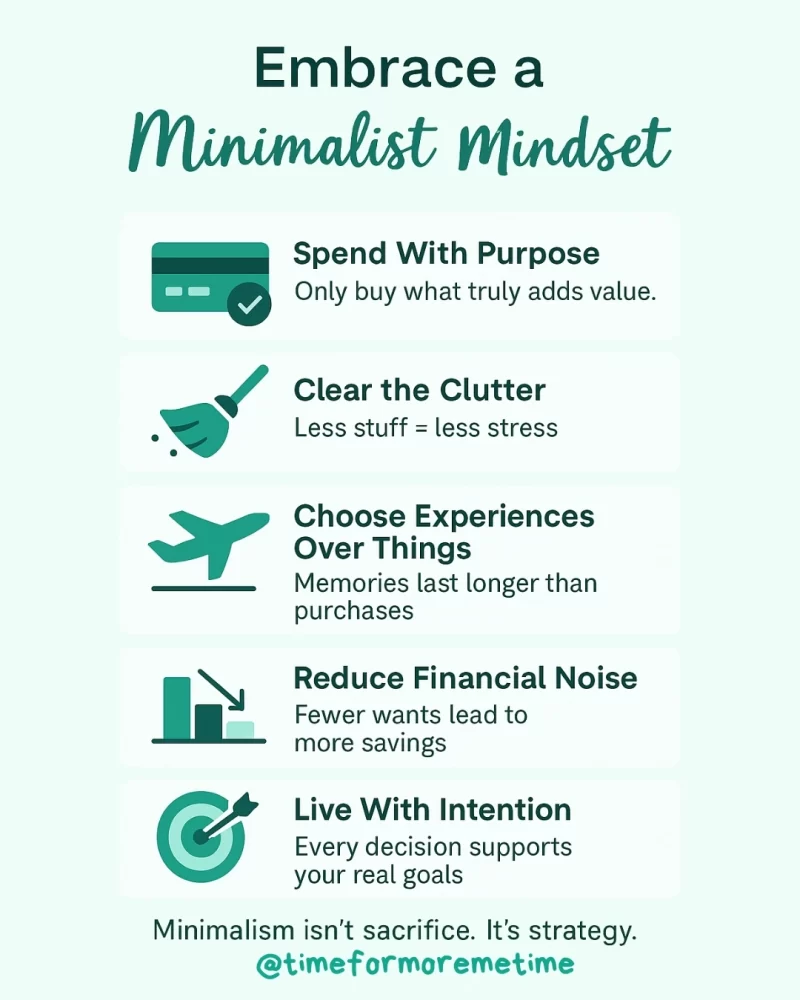

8. Embracing Minimalist Mindset

Stuff costs money. Buying less reduces spending and creates space for what truly enriches your life. A minimalist approach teaches that happiness comes from experiences and meaningful connections, not from cluttered closets.

Consider whether you really need another gadget or trendy shirt, or if that money could be better spent on something valuable, like a weekend trip or learning a new skill. Each time you forgo an unnecessary purchase, you invest in your future.

Living intentionally means asking if a purchase adds real value or just clutters your space and drains your finances. This mindset can lead to more savings and lower credit card bills, making goals like starting a side hustle or taking a dream vacation more attainable.

Living below your means isn’t about deprivation; it’s about prioritizing what truly matters to you.

9. Negotiating Bills

Many service providers, including internet and insurance companies, as well as gyms, are open to negotiation. Don’t hesitate to ask politely for better rates. Even small savings can accumulate over time.

Before renewing any annual contracts, compare prices from competitors, look for bundled packages, or inquire about introductory discounts.

The worst they can say is no, but the potential savings could reduce your monthly bills and free up cash for other priorities. A little effort can lead to significant savings each month.

10. Mastering DIY

Before paying for professional services—whether it’s repairs, beauty treatments, or home improvements—see if there’s a DIY alternative you can try. From simple home fixes to homemade beauty treatments, the world of DIY can save you money while helping you develop valuable skills.

Not only do these skills cut costs and let you create amazing things, but they also build self-sufficiency—and let’s be honest, there’s something incredibly satisfying about doing it yourself. Learning even a few DIY tricks can make your money go further.

11. Having Fun Without Spending

Social media often portrays fun as expensive, making it seem like sticking to a budget means a dull life. However, you can enjoy enriching experiences without spending much.

Consider swapping costly concerts for free outdoor events, dining out for homemade meals with friends, and designer shopping for a capsule wardrobe with fewer, high-quality pieces. By embracing these alternatives, you can create meaningful memories without overspending.

12. Taking Advantage Of Reminders

Maintaining healthy financial habits takes a little daily mindfulness. To stay focused, use visual cues as reminders. Try a photo on your fridge reminding you of your financial goals or a list of frugal recipes on your kitchen noticeboard. These small prompts can help keep you motivated when temptation strikes.

Even a sticky note on your credit card that says, “Do I REALLY need this?” can be enough to stop impulse spending. A simple reminder can have a big impact.

13. Using Credit Cards Wisely

Did you know you can actually use credit cards to your advantage? Yup, you read that right—but it takes discipline.

Think of a credit card as interest-free money for up to 30 days. Use it for necessary expenses like gas or groceries, and if you’re living below your means, you’ll have extra cash to pay it off at the end of the month.

To maximize benefits, pay off the entire balance before it’s due. This allows you to earn rewards—points, miles, or cashback—without incurring interest. However, it’s crucial to pay the balance in full each month; otherwise, interest charges can turn credit cards from helpful to harmful.

14. Avoiding Any Form Of Debt

For those with limited financial resources, debt can be devastating. If you’re committed to living frugally, your primary goal should be to avoid all forms of debt. This includes borrowing from family and friends or running a tab at bars and cafeterias.

While it can be challenging in a capitalist economy where debt is common and often seen as convenient, accumulating debt undermines your financial goals.

However, not all debt is bad or avoidable. Choose wisely; only take on debt that is genuinely useful and won’t jeopardize your financial stability.

15. Readjusting Your Lifestyle As You Go

While the tips I’ve shared are generally effective for everyone, there will be times when you need to be either stricter or more flexible in following them.

The key is to find the right balance. Always remember that the goal is straightforward: live below your means. This doesn’t mean you should stop spending entirely or only spend what you earn. Living below your means means spending wisely enough to allow for savings while still enjoying life.

FAQs

If you still have questions or feel like I haven’t covered everything, this FAQ section might give you the answers you need!

Is living below your means worth it?

Absolutely! Living below your means provides financial stability, reduces stress, increases flexibility, and gives you greater control over your future. It sets you up for financial freedom and long-term prosperity—making it one of the smartest financial decisions you can make.

Over time, these benefits really add up.

How to stop living above your means?

Start by getting brutally honest about where your money is going. Create a budget, cut unnecessary spending, and focus on financial priorities. Learn to find contentment in simpler, non-material things, and always keep your long-term goals in mind.

The key is shifting your mindset from instant gratification to sustainable financial health.

Can I still enjoy life while living below my means?

Definitely! Frugality isn’t about deprivation—it’s about making intentional choices. You can still have fun, travel, and enjoy great experiences by finding creative, budget-friendly alternatives.

Many of life’s best moments don’t come from spending money but from meaningful experiences and strong connections.

Conclusion

Learning to live below your means may seem overwhelming, but you can start today with simple, actionable steps. Taking control of your finances leads to greater stability and freedom, allowing you to break the paycheck-to-paycheck cycle and reduce reliance on credit cards.

For more financial and productivity tips, subscribe to our website, follow us on social media, and check out our YouTube channel. See you there!

Sources

- Photos: Unsplash: Alicia Christin Gerald